Sepsis Diagnostics Market Size, Share & Industry Analysis, By Product Type (Instruments and Reagents & Consumables), By Technology (Microbiology, Molecular Diagnostics, Immunoassays, and Others), By Method (Conventional and Automated), By Test Type (Laboratory Tests and Point-of-Care Tests), By Pathogen (Bacterial, Fungal, and Others), By End User (Hospitals & Clinics, Diagnostic Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

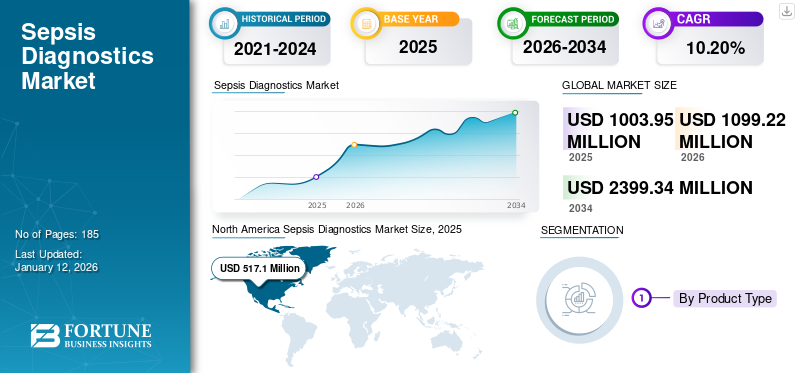

The global sepsis diagnostics market size was valued at USD 1,003.95 million in 2025 and is projected to grow from USD 1,099.22 million in 2026 to USD 2,399.34 million by 2034, exhibiting a CAGR of 10.20% during the forecast period (2026-2034). North America dominated the sepsis diagnostics market with a market share of 51.50% in 2025. Moreover, the U.S. sepsis diagnostics market size is projected to grow significantly, reaching an estimated value of USD 950.5 million by 2032, driven by an increase in the number of cases and frequency of sepsis cases.

Sepsis is considered a life-threatening condition when the body's response to an infection damages its own tissues. Infection with bacteria is one of the most common causes. Also, other infections, such as viral and fungal infections, can lead to this disease. There are three stages of the disease, sepsis, severe sepsis, and septic shock. The rising prevalence of this disease globally and favorable reimbursement support for hospital admissions strongly contribute to the market growth. For instance, according to World Health Organization (WHO) estimates of 2020, this disease affected an estimated 49.0 million people and caused 11.0 million deaths globally in 2017. Various awareness programs are promoting diagnostics adoption among the patient population. In addition, numerous strategic initiatives to launch new products and technological advancements are expected to favor the global market growth in the near future.

In 2020, the COVID-19 pandemic had a slightly positive impact on the market of sepsis diagnostics due to the increased incidence of this disease among COVID-19-positive patients. Moreover, the number of patient visits and company revenue returned to their pre-pandemic growth levels in 2021, and these trends are expected to enable the market to attain stable growth during 2025-2032.

Sepsis Diagnostics Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1,003.95 million

- 2026 Market Size: USD 1,099.22 million

- 2034 Forecast Market Size: USD 2,399.34 million

- CAGR: 10.20% from 2026–2034

Market Share:

- North America dominated the sepsis diagnostics market with a 51.50% share in 2025, driven by high sepsis incidence rates, favorable reimbursement scenarios, and rapid adoption of advanced diagnostics, particularly in the U.S.

- By Product Type, Reagents & Consumables held the largest market share in 2024 due to their widespread usage in diagnostic procedures and recurring demand across laboratories and hospitals.

Key Country Highlights:

- United States: The U.S. market is projected to reach USD 950.5 million by 2032, fueled by a high burden of sepsis cases (~1.7 million annually), government-funded awareness programs, and strong healthcare infrastructure supporting early diagnostics and advanced POC testing.

- Japan: Growth is supported by revised Japan-specific Clinical Practice Guidelines (J-SSCG 2021) that emphasize timely diagnosis and treatment. Rising awareness and adoption of updated diagnostic protocols contribute to increased utilization of sepsis diagnostics.

- China: Demand is driven by increasing healthcare investments, growing prevalence of sepsis, and adoption of automated diagnostic technologies. Government initiatives and clinical infrastructure improvements are further boosting diagnostic penetration.

- Europe: Growth is supported by the rising number of diagnostic procedures, availability of skilled professionals, and regulatory approvals such as CE marking for advanced molecular diagnostic instruments. Countries like Germany, France, and the U.K. are leading in technology adoption.

Sepsis Diagnostics Market Trends

Rising Adoption of Rapid Diagnostic or Point-of-Care Techniques for Early Diagnosis Propels Market Expansion

The global market has witnessed a prominent trend of increased focus on the development of rapid diagnostic or point-of-care techniques by key companies. These rapid diagnostic or point-of-care techniques have significantly improved the speed of sepsis diagnostics, standardization, and efficacy. These techniques have several advantages over manual methods, including the demonstration of rapid and reliable results. An additional benefit of these techniques is that they require limited healthcare personnel and can overcome the shortage of skilled healthcare professionals for diagnostic services. Such a scenario has increased the emphasis of prominent players on the development of rapid diagnostic or point-of-care techniques and is expected to be instrumental in the market's growth. In November 2023, Inflammatix completed the technical development of its point-of-care TriVerity Acute Infection and Sepsis Test System. It also received the U.S. FDA’s breakthrough device designation for that system, which will help it accelerate its commercialization in the US. The firm hopes to launch the test in the fourth quarter of 2024. Robust focus by key players to launch new products with advanced technologies, such as rapid diagnostics or POC techniques, favors market growth.

Download Free sample to learn more about this report.

Sepsis Diagnostics Market Growth Factors

Rising Incidence of Sepsis Globally Contributes to the Market Growth

In the last few decades the global incidence has increased at an exponential rate. This disease can be caused by any infection, setting off a chain of events that leads to organ failure and tissue damage. For instance, according to the data published by the U.S. Centers for Disease Control and Prevention (CDC), about 1.7 million adults in the U.S. develop sepsis, and about 350,000 adults who develop sepsis die during their hospitalization or are discharged to hospice care. Factors such as the increasing number of these cases led to a strong demand for effective diagnostic measures.

Furthermore, hospitalized or recently hospitalized patients are generally more susceptible to infections, which eventually lead to this disease. According to data published by the Centers for Disease Control and Prevention (CDC) in August 2022, around 1 in 3 people who die in a hospital had this condition during their hospitalization. Factors such as the rising incidence among hospitalized patients have increased the demand for these diagnostic procedures. Hence, the abovementioned factors drive the global market during the forecast period.

Improvement in Awareness in Emerging Countries to Boost Diagnostic Procedures

The rising number of cases of this condition poses an economic and healthcare burden, especially in developing countries. Numerous government and non-government bodies are working toward the dissemination of awareness among the population regarding this disease. These programs generally consist of screening for this condition, education, measurement of sepsis bundle performance, improved patient outcomes through the adoption of advanced diagnostics, and a protocol for treatment. For instance, according to an article published by Springer Nature Switzerland AG in October 2021, the development of such programs and guidelines helps to improve adherence to these bundles and reduces mortality in patients with these conditions.

One of the most prominent organizations is the Global Sepsis Alliance, which has partnered with various organizations from various regions, including Latin America and Africa, to raise awareness regarding this condition. Furthermore, the World Health Organization (WHO) partnered with 52 countries and implemented the Global Maternal Sepsis Study and Campaign (GLOSS). It aims to assess the burden and management of maternal sepsis and raise healthcare workers' awareness of this issue. Thus, an increase in various government organizations' and foundations' initiatives for raising awareness and gaining support is anticipated to augment the global market growth of sepsis diagnostics.

RESTRAINING FACTORS

Diagnostic Devices Cost is Prohibitively Expensive, Limiting Market Growth Prospects

This condition is considered difficult to diagnose immediately. Generally, a single diagnostic test for this condition does not yet exist, and healthcare professionals use a combination of tests and immediate and worrisome clinical signs. The burden and costs associated with the disease restrain the growth of the global market during the forecast period. For instance, according to an article published by the Multidisciplinary Digital Publishing Institute (MDPI) in 2020, it has been estimated that the cost of this disease is around USD 9.24 billion per year, including direct hospital and indirect costs in the U.K. Such factors can hinder the adoption of these devices in the forecast period.

Additionally, the cost burden associated with the disease is growing due to the increasing fixed costs in an emerging nation. According to prices published by DNA Labs India, the SEPSIS PANEL Test for one time can cost up to USD 53.8 (INR 3,978.0) in India. This creates a cost burden for the patients. The high cost of diagnosing and treating sepsis makes it unlikely that more patients will seek sepsis diagnosis in the next few years.

Sepsis Diagnostics Market Segmentation Analysis

By Product Type Analysis

Robust Usage for Diagnostic Procedures to Enable the Reagents & Consumables Segment to Dominate the Market

By product type, the market is classified into reagents & consumables, and instruments.

The reagents & consumables segment held a dominant proportion of the global sepsis diagnostics market share of 77.22% in 2026. Moreover, reagents & consumables are largely utilized in diagnostic procedures, which contributes to the segment’s growth prospects.

The instruments segment is projected to witness growth prospects in the market. Increasing technological advancements in these products and improvements in healthcare infrastructure are projected to propel the segment's growth in the forecast period. Also, the increased focus of key players on strategic initiatives such as new product introductions is likely to augment the segment's growth. For instance, in August 2024, Cytovale commercially launched the IntelliSep sepsis test in the U.S. The test aids in the rapid diagnosis of sepsis for adult patients with signs and symptoms of the infection, providing results in under 10 minutes.

To know how our report can help streamline your business, Speak to Analyst

By Technology Analysis

Robust Utilization of Microbiology Technology Favors its Dominance

Based on technology, the market is classified into microbiology, molecular diagnostics, immunoassays, and others.

The microbiology segment dominated in terms of market share of 58.85% in 2026. Most hospitals use blood cultures and other types of microbiological tests. Robust utilization of microbial testing due to its cost-effectiveness is the primary factor attributable to the segment’s growth. The molecular diagnostics segment is projected to hold the third-largest market position. The fact that molecular diagnostic solutions are more sensitive, specific, and less time-consuming is projected to propel the segment's growth during the forecast period.

The immunoassays segment is projected to account for the second-largest market position due to the engagement of key players in R&D initiatives to advance immunoassay technology for this disease. As per an article published by the Royal Society of Chemistry in 2021, an advanced one-step immunoassay enables quick and accurate diagnosis of this disease by measuring the Procalcitonin Test (PCT) concentration in patient sera. Such positive results from studies are propelling the segment’s growth. The other segment exhibits a lower CAGR, and it includes diagnostics such as flow cytometers and fluorescence detection technology.

By Method Analysis

Increased Adoption of Automated Systems due to their High Sensitivity and Specificity Led to their Market Dominance

By method, the market is segmented into conventional and automated.

The automated segment held the largest share of 93.26% in 2026 due to its high efficacy and specificity in detecting various pathogens. Additionally, increasing R&D efforts by prominent and emerging companies to launch new products are expected to boost the segment’s growth prospects. In December 2020, an article published in SelectScience noted the development of an automated test called the AutoSepT by the company Molzym GmbH & Co. KG and the research institute Fraunhofer IZI-BB, which enables fast pathogen detection directly from samples in less than five hours. Such new product launches have increased the adoption of these diagnostics. Therefore, these factors accelerate the segment’s growth in the market.

The conventional segment held a limited market share in 2024. However, as conventional diagnostic methods are more cost-effective than other alternative devices, they are commonly utilized in low-income settings, especially in emerging nations.

By Test Type Analysis

Rising Cases among Hospitalized Patients Contribute to Laboratory Tests Segment’s Dominance

Based on test type, the market is divided into laboratory tests and point-of-care tests.

The laboratory tests segment dominated the global market in 2024. The increasing number of incidences in hospitalized patients due to Hospital Acquired Infections (HAIs) and improvements in healthcare facilities, specifically in developing countries, is anticipated to contribute to the expansion of the laboratory testing segment. Also, the fact that diagnosis is mostly made in laboratories contributes to the segment’s growth.

The CAGR for the point-of-care test segment was expected to reach its peak in 2024. The focus of prominent players to launch products and the specific benefits of POC in diagnosis are the primary reasons for the prominent share of the point-of-care tests segment. According to an article published by Science Direct in 2021, a model was developed in Ireland to study the economic and clinical value of the rapid point-of-care test in the detection of this condition. It was found that the POC method is cost-effective for diagnosis. Such benefits of POC devices are expected to drive the segment’s growth.

By Pathogen Analysis

Increasing Bacterial Infections Favors the Bacterial Dominance

Based on pathogens, the market is segmented into bacterial, fungal, and others.

The bacterial segment is projected to generate the highest global market share. Increasing cases of this disease due to bacterial infections and advanced launches for detecting diseases caused by this pathogen are expected to boost the segment’s growth. In 2021, the National Library of Medicine published an article stating that bacterial infections are the most common cause of this disease. This vital factor contributes to the segment’s growth.

The fungal segment accounts for the second largest segment and is expected to grow at a substantial CAGR in the forecast period. People with weak immune systems are more likely to encounter this disease through fungal infections, which contribute to segmental growth. The other segment is anticipated to grow at a lower CAGR. In November 2023, Siemens Healthineers collaborated with Janus-I Science and Louis Stokes Cleveland Veterans Affairs Medical Center (VAMC) to develop a new diagnostic tool using next-generation sequencing. It rapidly detects sepsis within six hours of a blood draw, identifies a range of bacteria and fungi, and provides information about their likely resistance to certain antibiotics.

By End User Analysis

Highest Patient Admissions at Hospitals & Clinics Led to the Segment’s Dominance

By end user, the market is divided into diagnostic centers, hospitals & clinics, and others.

The hospitals & clinics segment dominates the market and is projected to grow as these patients are usually treated in Intensive Care Units (ICU) due to their severity; thus, most diagnostic tests are carried out in hospitals only. This factor is anticipated to contribute to the growth of this segment. According to an article published by the Regents of the University of Minnesota in 2020, this disease is the leading cause of death in hospitals, with an estimated mortality rate of 26.7% in hospital patients and 42.6% in ICU patients treated. The rising number of HAIs also contributes to the segment’s growth.

The diagnostic centers segment occupied the second-largest market share in 2024. Strategic initiatives by global players to enhance the adoption of diagnostic services will contribute to its expansion. In January 2022, Siemens Healthcare GmbH partnered with American Hospital Dubai to provide advanced diagnostic imaging and lab diagnostic equipment solutions. The others segment accounted for the lowest market share in 2024.

REGIONAL INSIGHTS

The global market is segmented by region into Europe, North America, Asia Pacific, and the Rest of the World.

North America Sepsis Diagnostics Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North American

The North American market size was valued at USD 517.1 million in 2025. The region is projected to lead the global market during the forecast period. The region’s market dominance is due to the substantial demand for these products due to the robust incidence of this condition, the rapid adoption of advanced diagnostics, and favorable reimbursement policies. The U.S. market is projected to reach USD 521.6 billion by 2026.

Europe

The Europe market is anticipated to be the second leading region in 2024. The growth is due to the increasing number of diagnostic procedures and the rising number of skilled professionals. Moreover, regulatory approvals, such as the CE mark for advanced diagnostic instruments, contribute to the region’s growth prospects. The UK market is projected to reach USD 47.7 billion by 2026, while the Germany market is projected to reach USD 73.7 billion by 2026.

Asia Pacific

The Asia Pacific market is expected to develop significantly during the forecast period. Increasing awareness among the population, the development of clinical guidelines to improve care for this disease, and the launches of new products in the market favor the segment's growth. The Japanese Clinical Practice Guidelines for Management of Sepsis and Septic Shock (J-SSCG 2016), for example, were revised and released in August 2021, according to an article published by BioMed Central Ltd. This led to new Japan-specific clinical practice guidelines for this condition. The goal of these guidelines is to train medical staff to make appropriate decisions to improve the care of this disease. Such guidelines improve the adoption rate of these diagnostics, and also the treatment facilities, thus contributing to the segment’s growth. Furthermore, the rest of the world, which comprises Latin America, the Middle East, and Africa, is expected to witness growth prospects due to the increased focus of organizations such as the World Health Organization (WHO) and the Sepsis Alliance on raising awareness. The Japan market is projected to reach USD 54.3 billion by 2026, the China market is projected to reach USD 65.7 billion by 2026, and the India market is projected to reach USD 22.2 billion by 2026.

List of Key Companies in the Sepsis Diagnostics Market

Significant Product Portfolio and Market Presence of bioMérieux SA and Danaher Led to their Strong Market Position

In terms of the competitive landscape, the global market depicts a fairly fragmented structure, with some significant players accounting for strong market shares. Some of the topmost players in the market include bioMérieux SA, Thermo Fisher Scientific Inc., Danaher, and BD (Becton, Dickinson, and Company), owing to their diversified diagnostic portfolios and established geographical presence. For instance, advanced product launches for this disease are some of the prominent driving factors that have led bioMérieux SA to capture a maximum market share. Danaher, through its subsidiary, Beckman Coulter, is also one of the leading market players. For instance, in August 2020, Beckman Coulter (Danaher) received the CE Mark for its product, the DxH 900 hematology analyzer, which the U.S. FDA classifies as an ‘Early Sepsis Indicator’.

Emerging sepsis diagnostics players include Luminex Corporation, Bruker, T2 Biosystems, Inc., and others. These players have generated strong sales and have also focused on geographical expansion through territory-exclusive distribution agreements. This is anticipated to strengthen the aforementioned companies' market position. For instance, in February 2022, T2 Biosystems, Inc. executed territory-exclusive distribution agreements in Norway, Finland, and Turkey. As per the agreement, T2 Biosystems sold T2Dx Instruments, T2Bacteria, T2Candida, and T2Resistance Panels through these distributors. In November and October 2021, it executed a territory-exclusive distribution agreement in Taiwan, Singapore, and South Korea. Such strategic initiatives are expected to strengthen the market share of sepsis diagnostics players in the forecast period.

LIST OF KEY COMPANIES PROFILED:

- T2 Biosystems, Inc. (U.S.)

- Danaher (U.S.)

- Abbott (U.S.)

- bioMérieux SA (France)

- Thermo Fisher Scientific Inc. (U.S.)

- Luminex Corporation (DiaSorin S.p.A.) (U.S.)

- BD (Becton, Dickinson, and Company) (U.S.)

- Bruker (U.S.)

- Siemens Healthcare GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: The University of Oxford partnered with Danaher Corporation to develop a new test to enable precision medicine care for sepsis.

- November 2023: Oxford Nanopore Technologies collaborated with Day Zero Diagnostics to develop an end-to-end diagnostic solution for bloodstream infections.

- May 2022: bioMérieux SA received approval from Health Canada for BIOFIRE Blood Culture Identification 2 (BCID2) Panel. It is a rapid molecular diagnostic of bloodstream infection.

- May 2022: DiaSorin S.p.A. and Thermo Fisher Scientific’s part, B•R•A•H•M•S GmbH, partnered to commercialize and develop the new LIAISON B•R•A•H•M•S MR-proADM immunodiagnostic test. The assay aided in sepsis diagnostics, kidney disease, lower tract respiratory infections, septic shock, and urinary tract infections.

- October 2021: Prenosis, Inc. expanded its existing partnership with F. Hoffmann-La Roche Ltd to improve and expedite the clinical recognition of sepsis through advanced precision diagnostics. This partnership expanded its core NOSIS dataset and worked to obtain the U.S. FDA clearance for the Prenosis Sepsis Immunoscore and the Roche Elecsys IL-6 Assay.

- May 2021: Danaher collaborated with Sepsis Alliance to support the Sepsis Alliance Clinical Community and expanded the agreement to other educational programs, including the Sepsis Alliance Summit and Sepsis Alliance Institute Continuum of Care webinars.

- January 2021: Bruker received the U.S. FDA clearance and launched the MBT Sepsityper Kit U.S. IVD for rapid microbial identification of more than 425 microorganisms from positive blood cultures on the MALDI Biotyper CA System.

REPORT COVERAGE

The global sepsis diagnostics market research report comprises a detailed market analysis. The global market is segmented by product type, technology, method, test type, pathogen, end user, and geography. The report highlights the critical aspects of the market such as market dynamics, key industry developments, new product launches, technological advancements, regulatory and reimbursement scenarios, prominent market players, and COVID-19 impact. Also, the report includes insights into the global sepsis diagnostics market trends and industry dynamics that favor the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.20% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product Type

|

|

By Technology

|

|

|

By Method

|

|

|

By Test Type

|

|

|

By Pathogen

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 1,099.22 million in 2026 and is projected to reach USD 2,399.34 million by 2034.

The global market is projected to record a CAGR of 10.20% during the forecast period of 2026-2034.

The North America market value stood at USD 517.1 million in 2025.

The reagents & consumables segment is the leading segment of this market.

The rise in demand for these diagnostic procedures due to rising incidence, technological advancements, and new product launches is driving global market growth.

bioMerieux SA, Thermo Fisher Scientific Inc., Danaher, and T2 Biosystems, Inc. are some of the prominent market players.

North America dominated the sepsis diagnostics market with a market share of 51.50% in 2025.

Increased government initiatives to raise awareness and favorable reimbursement policies are significant factors contributing to the adoption in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us