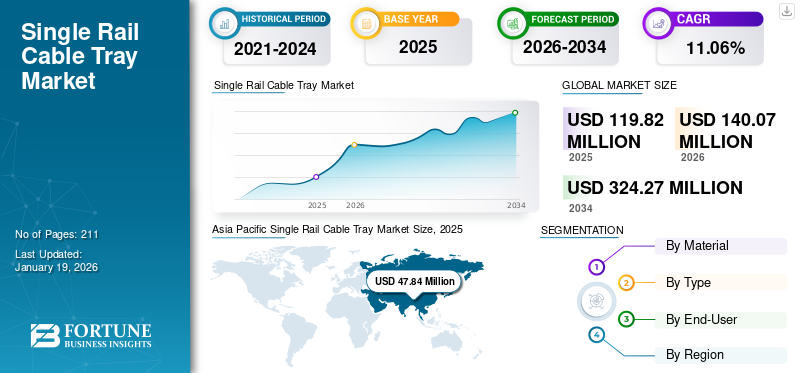

Single Rail Cable Tray Market Size, Share & Industry Analysis, By Material (Aluminium, Steel, FRP/GRP, and Others), By Type (Ladder, Channel/Bottom, and Wire Mesh), By End-User (Power, Construction, Manufacturing, IT and Telecom, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global single rail cable tray market size was valued at USD 87.64 million in 2025. It is projected to be worth USD 140.07 million in 2026 and reach USD 324.27 million by 2034, exhibiting a CAGR of 11.06% during the forecast period. Asia Pacific dominated the needle free injectors market with a market share of 32.37% in 2025.

The single rail cable tray market is growing primarily due to an increasing demand for flexible, space-saving, and easy-to-install cable management solutions. Single rail trays allow for quick laying and removal of cabling and avoiding wasted time and labor. With increased use in data centers, IT facilities, and telecommunication, where cables are often required to change places, the demand for single rail cable trays is surging.

As more industries are opting for flexible, compact, and easy-to-install cable management solutions instead of the traditional ladder or perforated trays, the demand for single rail cable is on rise. Industries and construction projects are increasingly looking for durable, long-lasting, and low-maintenance cable management solutions. Single-rail cable tray meets the modem construction and industrial demand for flexible, efficient, and esthetic cable management. Single rail cable tray market is growing due to industrial, infrastructure, and power projects that can accommodate indoor and outdoor applications under harsh conditions.

KDM Steel and Atkore International are the major vendors in the market. KDM Steel has an impressive selection of single rail cable trays made from various materials such as stainless steel, galvanized steel, FRP, mesh, and plastic, serving a wide array of industries. Atkore International specializes in providing comprehensive cable management systems, featuring cutting-edge single rail and center-supported tray solutions. The global construction industry is rapidly expanding, especially in emerging economies such as China, India, Brazil, and others, due to urbanization, rising disposable income, and infrastructure projects. There is increased demand for the single-rail cable tray segment due to the need of modern industries and construction projects to space-saving and efficient and cost-effective cable management systems.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of Data Centers and Telecom Networks to Drive Market Growth

Data centers and telecom networks are growing rapidly due to cloud computing, 5G's arrival, and huge data being transferred. This growth is also driving a need for better cable management. Single rail cable trays are popular in these fields as they are simple to set up, occupy less space, and can handle lots of cables, making them effective for current IT and telecom setups.

- In May 2024, ABB and Niedax Group collaborated to create a joint venture. It integrated ABB's Installation Products Division and Niedax Group's North American cable tray businesses. This new venture will target electrical contractors, distributors, and system integrators in the U.S., Canada, and Mexico. Both companies will have equal ownership.

MARKET RESTRAINTS

Higher Initial Cost Compared to Conventional Trays to Restrain Market Growth

Single rail cable trays usually cost more initially compared to regular ladder or perforated ones as they are made uniquely and need certain materials such as aluminum alloy, stainless steel, fiberglass-reinforced plastic and others. This higher price discourages adoption in markets where saving money is key, especially for smaller projects. Contractors and users often pick cheaper options instead of thinking about how well things will work in the long run.

MARKET OPPORTUNITIES

Growth of Smart Buildings And Commercial Infrastructure Creates an Opportunity for Market Growth

The increase in smart buildings, new office spaces, and tech centers is offering opportunities for the market. These building projects demand cable systems and are efficient, do not occupy much space, and are easy to handle. Single rail cable tray has a simple design, can be routed in different directions, and can be put together quickly. This helps meet the demand for well-ordered cable solutions that can grow with the increase in needs of business buildings.

In August 2025, Enlight Metals Pvt. Ltd., one of the top metal aggregators in Pune, entered the cable tray aggregation business, continuing to expand from raw material supplier to complete solutions provider for steel. This is a key step in their long-term vision to provide project-ready components to industries and infrastructure projects in India.

Single Rail Cable Tray Market Trends

Increasing Demand in Emerging Economies to Drive Market Growth

Rapid urbanization, infrastructure development, and industrial growth in developing countries across the Asia Pacific and Middle East & Africa are increasing the need for advanced cable management systems. In developing markets, single rail cable trays are growing due to their space-saving, ease of installation, and reduced maintenance costs in the long run. The number of projects related to smart city, renewable energy, telecommunication, and data center investments from government and private entities will see a significant uptick in the use of the single rail trays, contributing to overall growth in the market.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Material

Lightweight, Corrosion-Resistant, And Durable Properties of Aluminium Drives the Segment Growth

By material the market is segmented into aluminium, steel, FRP/GRP, and Others.

Aluminium is the dominating segment in the market. It provides an effective balance of strength, lightweight, and corrosion-resistant properties, which make it very useful across industries.

The steel segment is the second largest segment in the market. Steel is also the fastest growing segment in the single rail cable tray market due to its durable strength, load-bearing capacity, and price competitiveness, making it suitable for heavy-duty industrial applications.

By Type

High Strength, Excellent Ventilation, and Flexibility Properties of Ladder Drives Segment Growth

The market is segmented by type into ladder, channel/bottom, and wire mesh.

Ladder is the dominating segment with largest single rail cable tray market share due to its structural strength, more suitable cable support, and versatility when compared to other designs.

Channel/bottom is the second dominating segment in the market. These are prevalent due to its maximizing protection, routing, and connectivity for sensitive and smaller cables, especially in commercial and IT environments.

By End-User

Increasing Electricity Demand Drives Power Segment Growth

The market is segmented by end-user into power, construction, manufacturing, IT and Telecom, and others.

The power segment dominates the market. This is attributed to the rising electricity demand and the expansion of energy infrastructure.

Construction is the second-dominating segment in the market. The construction segment in the market is on the rise, buoyed by rapid infrastructure development and increasing growth in demand for effective cable management in modern buildings.

REGIONAL ANALYSIS

The market has been analyzed geographically by North America, Europe, Asia Pacific, Latin America, the Middle East & Africa.

Asia Pacific

Asia Pacific Single Rail Cable Tray Market Size, 2025 (USD Million) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 47.84 billion in 2025 and USD 57.96 billion in 2026. The market is experiencing tremendous growth as major countries, including China, India, Japan, and South Korea, are undergoing rapid urbanization, infrastructure development, and industrial growth. Demand for single rail cable trays is being fueled by large investments in telecommunications and data centers as the faster communications (5G) go live and internet penetration increases. Thus all these factors collectively drive Asia Pacific single rail cable tray market growth.

North America

There is an upward growth in the North America market with the rapid increase in data centers, telecom networks, and smart building projects in the U.S. and Canada. Increase in expenditures associated with cloud computing, 5G infrastructure, and industrial automation are also driving demand for enhancing the efficiency of cable management. Single rail trays are often preferred for their space-saving traits, fast installation, and simplified cable maintenance. A market from a regional perspective also has a strong emphasis on updating commercial infrastructure and adopting renewable energy projects.

U.S.

The market in the U.S. is swiftly increasing in size due to the demand caused by data center construction, the rollout of 5G networks, and smart commercial infrastructure projects. The U.S. is a global leader in cloud service providers, IT companies, and telecom operators, and all of such companies require flexible cabling solutions that provide and manage cable systems under high-density installations.

Europe

The Europe market is expanding with the increasing growth of smart buildings, renewable energy projects, and industrial automation. Countries such as Germany, the U.K., and France are spending considerable amounts of money on upgraded commercial infrastructure and modernization with a push for digital transformation, which requires compact and efficient cable management systems. As sustainability initiatives and green building programs are expanding the development and specification of commercial building products, there is a focus on using lightweight, corrosion-resistant single rail trays made out of aluminum and FRP.

Latin America

The Latin America market is growing due to increasing investments in infrastructure, telecom networks, and renewable energy projects in Brazil, Mexico, and Chile. The increased demand for data centers and cloud services, as well as the deployment of 5G networks, are increasing the utilization of modern modular cable management systems that occupy less space.

Middle East & Africa

The market in the Middle East & Africa region is experiencing growth due to large-scale infrastructure projects, oil & gas expansion, and the development of data centers and telecom networks. Countries such as the UAE, Saudi Arabia, and South Africa are investing heavily in smart cities, commercial complexes, and renewable energy projects requiring advanced and space-efficient cable management systems.

COMPETITIVE LANDSCAPE

Key Industry Players

Vendors are Innovating New Cable Tray Products with Enhanced Designs and Materials to Improve Efficiency

Vendors such as Aeron Composite Pvt. Ltd., Atkore International, Niedax Group, Panduit Corporation, and others continue to innovate new products with innovative designs and materials to meet the increasing need for lightweight, corrosion-resistant, and space-saving cable management solutions. Panduit Corporation has been actively contributing to the advancement of single rail cable tray solutions by focusing on designs that combine strength, flexibility, and ease of installation. The company emphasizes lightweight yet durable structures that provide efficient support for cables in data centers, industrial plants, and commercial facilities. Panduit’s single rail trays are engineered to optimize space usage and simplify cable routing, making them suitable for environments with frequent changes or expansions. Additionally, their solutions are designed with quick-mounting features and corrosion-resistant materials, ensuring long-term reliability and reduced maintenance costs.

- In January 2024, Panduit Corporation, a worldwide leader in networking and electrical infrastructure solutions, announced the introduction of its next generation of cable management solutions, the Wire Basket Cable Tray Routing System, an innovative offering designed to route and manage copper data cables, fiber optic, or power cables in data center, connected building, and industrial environments.

Some of the Key Companies Profiled in the Report

- Star Manufacturing Industries (India)

- Aeron Composite Pvt. Ltd. (India)

- Sinewy Composite Products (India)

- KDM Steel (China)

- Atkore International (U.S.)

- Niedax Group (Germany)

- Eaton B-Line (USA)

- Legrand Cablofil (France)

- Electro Poles Products Pvt. Ltd. (India)

- Super Fab Inc. (India)

- MP Husky (U.S.)

- Alphatek Engineering Limited (Bangladesh)

- Lionet Cable Trays Co. (China)

KEY INDUSTRY DEVELOPMENTS

- In August 2025, Enlight Metals, a major metal aggregator, entered the cable tray aggregation sector and moved closer to its goal of evolving from a provider of raw materials to a full steel solutions provider. This move enables the company to become a bigger player in supplying project-ready finished components to industries and infrastructure projects throughout India.

- In March 2024, Legrand purchased the New Zealand cable management company, Mechanical Support Systems (MSS). MSS delivers services including cable containment manufacture, supply, installation, design, and bespoke fabrication. Legrand announced that the acquisition combines MSS's cable management solutions with the purchaser's current power, emergency lighting, structured cabling, and wiring product range, allowing the combined organization to deliver "end-to-end solutions" across the commercial, infrastructure, and data center sectors.

- In January 2024, with the new chainflex cable CF33.UL, igus launched the world's first motor cable for energy chains and cable trays, with both UL certification and an exciting four-year functional guarantee in the energy chain. The purpose of the new CF33.UL is to simply run the cable from energy chain to cable tray without any connector in between. The CF33.UL also complements the chainflex range with a shielded PVC motor cable.

- In September 2023, Chemi Tech Group, a market leader in solar solutions, expanded its product range with the launch of Fiber Reinforced Plastic (FRP) Cable Trays. This decision demonstrates the company's vision for innovation in solar solutions, and to provide the complete range of solar components, including panels, inverters, structures for Aluminium Solar module mounting, and FRP Cable Trays.

- In September 2022, PFLITSCH chose ABB to design a unique combined offer of cable assemblies, cable glands, accessories, and specialized protection systems that complement high and low voltage wiring to suit customers in automation, e-mobility, food and beverage, infrastructure, OEM machinery, robotics, and transport.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service processes, competitive landscape, and the leading single rail cable tray market. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.06% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Material

|

|

By Type

|

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 119.82 million in 2025.

In 2025, the Asia Pacific market value stood at USD 47.84 million.

The market is expected to exhibit a CAGR of 11.06% during the forecast period of 2026-2034.

The power segment led the market by end-user.

Expansion of Data Centers and Telecom Networks to drive market growth

Some of the top major players in the market are Aeron Composite Pvt. Ltd., Atkore International, Niedax Group and others.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us