Small Scale Battery Energy Storage Market Size, Share & Industry Analysis, By Battery Type (Lithium-Ion (Li-Ion), Lead Acid, Flow Batteries, and Others), By Capacity (Less than 100 kWh, 100-500 kWh, 500-1,000 kWh, and 1,000-2,000 kWh), By Connection Type (Grid-Connected and Off-Grid), By End-User (Residential, Commercial, Industrial, and Utility Scale), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

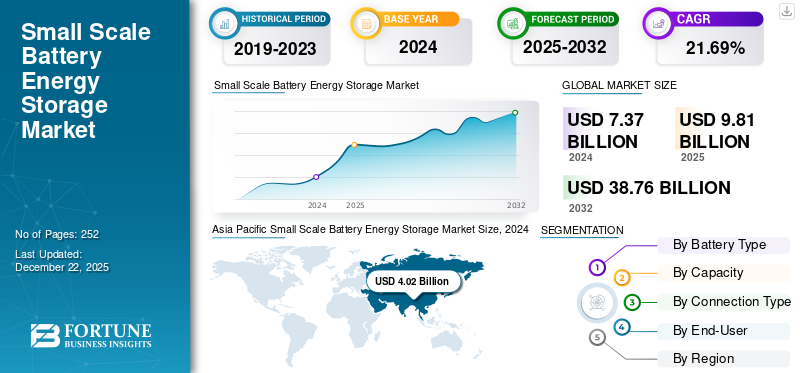

The global small scale battery energy storage market size was valued at USD 7.37 billion in 2024. The market is projected to grow from USD 9.81 billion in 2025 and expected to reach USD 38.76 billion by 2032, exhibiting a CAGR of 21.69% during the forecast period.

The market is growing due to technological, economic, and regulatory factors. Solar panels generate electricity and stores energy only during the day. Batteries store excess solar energy at night or during cloudy weather, ensuring continuous power availability. The global energy transitions are accelerating the growth of small-scale battery energy storage, enabling greater renewable integration and decentralized energy solutions

Without a battery, excess solar energy is sent to the grid. With storage, users can consume more energy, reducing reliance on the grid and saving money. Stored solar energy can be used during peak electricity pricing hours, helping users avoid high tariffs.

The share of battery technologies is growing due to rising solar adoption, lower battery costs, growing need for backup power, supportive government incentives, and the shift toward smarter, decentralized energy systems. Small scale battery energy storage systems are essential for storing surplus energy and ensuring a continuous power supply, and this factor will increase market share. Lithium ion batteries in the small-scale battery energy storage market are witnessing strong growth, driven by their high energy density, longer lifespan, and declining costs.

GE, ABB, and Samsung have a global reach, advanced manufacturing facilities, and established supply chains, allowing them to scale production and serve diverse markets efficiently. These companies continuously invest in battery technology, energy management software, and modular energy storage systems tailored for homes and small businesses.

MARKET DYNAMICS

MARKET DRIVERS

Rising Adoption of Rooftop Solar to Drive Market Growth

The rising adoption of rooftop solar is expected to drive the growth of the small scale battery energy storage market, as it enables users to store surplus solar energy, enhance energy independence, and reduce reliance on the grid. Solar panels generate electricity only during the day. Battery store excess solar power at night or during cloudy conditions, ensuring availability of round-the-clock power. The integration of small-scale battery energy storage with renewable sources such as solar and wind is set to drive market growth.

In May 2025, General Electric Vernova Inc., declared the inauguration of two major updates to its utility-scale Flexinverter program. Both developments constitute crucial steps in improving energy efficiency, lowering project costs, and assisting in the transformation for a more sustainable global energy infrastructure.

MARKET RESTRAINTS

High Initial Costs to Hinder Market Growth

High initial cost is expected to hinder the growth of the small scale battery energy storage market. Despite long-term savings and supportive policies, the capital expenditure for batteries, inverters, and installation remains prohibitively expensive for many residential and small commercial users. The return on investment takes several years, making it less attractive for consumers who seek quicker savings.

MARKET OPPORTUNITIES

Growing Focus on Energy Resilience to Drive the Market Expansion

The growing emphasis on energy resilience is expected to drive the small scale battery energy storage market growth. Natural disasters, extreme weather events, and aging infrastructure are causing more frequent blackouts, pushing homeowners and small businesses to seek backup power solutions. As solar and wind energy become more common, batteries are required to store excess power during non-generation hours, enhancing grid stability.

In June 2022, U.S. conglomerate General Electric (GE) aimed to threefold its solar and battery energy storage manufacturing capacity at its newly started Renewable Hybrids factory in India to 9GW per annum by the end of 2022.

Small Scale Battery Energy Storage Market Trends

Increased Adoption of Batteries in Urban Areas to Drive the Market

Urban areas often face grid congestion and occasionally outages, prompting households and small businesses to adopt energy backup solutions. Compact battery systems are ideal for urban homes and apartments with limited space. City governments promote decentralized energy systems, and incentives/subsidies make small-scale storage more accessible. Urban consumers are early adopters of smart home technologies, and battery storage complements energy management systems.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Battery Type

Lithium-Ion Battery Segment Dominates Due to its High Energy Density and Long Lifespan

By battery type, the market covers Lithium-Ion (Li-Ion), lead acid, flow batteries, and others.

Lithium-ion batteries (Li-Ion) are the dominating segment in the small scale battery energy storage market. This growth is driven by its high energy density, long cycle life, and rapidly declining costs. Mass production and technological advancements reduce prices, making small-scale systems more affordable.

Lead acid batteries is the second largest segment in the market. Lead acid batteries are cheaper than lithium-ion alternatives, making them attractive to small dealers and budget conscious consumers, especially in residential and rural applications.

By Capacity

Growing Rooftop in Residential & Commercial Sector to Lead the 100-500 kWh Growth

By capacity, the market is segmented into less than 100 kWh, 100-500 kWh, 500-1,000 kWh, and 1,000-2,000 kWh.

The 100-500 kWh holds the largest small scale battery energy storage market share. Many rooftop solar systems are paired with 100-500 kWh batteries to store excess energy and ensure self-sufficiency. This segment balances energy needs and affordability, making it attractive for end-users in both developed and emerging markets.

500-1,000 kWh is the second largest segment in the market. This range is suitable for small factories, warehouses, hospitals, and schools, which need reliable backup and load shifting. It also supports peak shaving, reducing electricity costs during high demand periods.

By Connection Type

Advanced Utility and VPP Models to Foster Grid-connected Segment Share

By connection type, the market is segmented into grid-connected and off-grid.

Grid-connected segment is leading the market. Utilities and aggregators are building virtual power plants, pooling household batteries to sell energy and grid services. Owners earning additional income are further incentivizing grid-connected setups.

Off-grid is the second largest segment in the market. Households and small businesses in off-grid areas are increasingly using solar PV with batteries for 24/7 power, especially in places with frequent grid outages or no grid at all.

By End-User

Growing Demand for Energy Independence to Fuel Residential Segment Growth

By end-user, the market is segmented into residential, commercial, industrial, and utility scale.

The residential segment dominates the market due to widespread solar integration, policy support, affordability improvements, and the growing need for energy resilience and autonomy.

Commercial is the second dominating segment in the market. Many commercial facilities are installing solar panels. Small scale battery systems allow them to store excess solar energy and use it later, increasing self-consumption and reducing grid reliance.

SMALL SCALE BATTERY ENERGY STORAGE MARKET REGIONAL OUTLOOK

The market has been analyzed regionally in to North America, Europe, Asia Pacific, and Rest of World. Among them Asia Pacific is the leading region in the market.

North America

Asia Pacific Small Scale Battery Energy Storage Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is a prominent region in the small scale battery energy storage market. Many homeowners pair rooftop solar with battery systems to store excess solar power and use it during the night or grid outages. In California, over 70% of new solar systems are installed with batteries. Across North America, around 1 in 3 new home solar installations include a battery.

Extreme weather events such as hurricanes, wildfires, heat waves, and aging grid infrastructure have caused frequent power outages. Batteries provide reliable backup power, making them attractive for homes and businesses. The North America market is experiencing steady, technology-driven growth, fueled by increasing renewable energy adoption, supportive policy frameworks, and rising demand for grid resilience.

U.S.

More U.S. homes and businesses are installing solar panels. Pairing them with batteries allow users to store excess solar energy and use it during night or grid outages, increasing self-sufficiency. Power outages caused by storms, wildfires, or aging gird infrastructure are leading Americans to seek backup solutions such as batteries. The U.S. small-scale battery energy storage market is witnessing robust growth, driven by expanding solar installations, favorable incentives, and the push for energy independence.

Europe

Europe is growing at a significant rate in the market. A surge in residential and commercial solar PV systems drives demand for solar storage setups. Countries including Germany, Italy, Spain, and Austria are leading in residential solar battery installations. In Germany alone, over 700,000 home batteries were installed by 2023, with nearly 80% of new solar systems paired with batteries. The Russia-Ukraine war triggered energy insecurity across Europe. The Europe market is advancing rapidly, supported by strong renewable energy integration targets, supportive regulations, and rising residential and commercial adoption.

Asia Pacific

Asia Pacific is the leading region in the market. Countries such as Australia, Japan, India, South Korea, and China are witnessing massive rooftop solar adoption. Households and small businesses are increasingly pairing PV with battery storage to maximize solar energy use and reduce grid reliance. For example, in Australia, ~ 30% of households have solar, and nearly 1 in 3 new solar systems now include a battery. In many parts of Asia (especially rural or island regions), an unreliable electricity supply pushes consumers toward backup power solutions. The Asia Pacific small-scale battery energy storage market is experiencing rapid expansion, propelled by surging renewable energy deployment, urbanization, and government-led clean energy initiatives.

Rest of the World

Rest of the world small scale battery energy storage market is anticipated to grow at a significant rate in the coming years. Countries such as Brazil, Chile, Mexico, and Argentina are witnessing a rapid rise in rooftop solar installations for homes and small businesses. Many regions in Latin America experience frequent blackouts, voltage fluctuations, or poor grid coverage, especially in rural and off-grid areas. Home and small business batteries offer critical reliability and backup power. In Peru, Bolivia, Colombia, and Central America, small-scale solar battery systems are used to electrify off-grid areas.

Furthermore, South Africa, Kenya, Nigeria, Egypt, UAE, and Saudi Arabia are leading this trend. Over 600 million people in sub-Saharan Africa still lack access to electricity. Governments and NGOs are deploying solar battery microgrids and standalone systems to off-grid regions. The Rest of the World small-scale battery energy storage market is growing steadily, driven by increasing electrification efforts, renewable energy projects, and the need for off-grid power solutions in emerging economies

COMPETITIVE LANDSCAPE

Key Industry Players

Vendors are Introducing Advanced Battery Technologies to Drive Market Expansion

In May 2025, ABB declared the introduction of its modern Battery Energy Storage Systems-as-a-Service (BESS-as-a-Service), a resilient, zero-CapEx solution created to increase the shift to resilient, clean, and economical energy. It is the first in the extent of next-generation service models being expanded to separate fencing to clean technology adoption, and encourage industry transformation to net zero.

List of Key Small Scale Battery Energy Storage Companies Profiled

- ABB (Switzerland)

- General Electric (U.S.)

- Hitachi Chemical Co., Ltd. (Japan)

- Samsung (South Korea)

- Siemens Energy (Germany)

- Total (France)

- LG Energy Solution (South Korea)

- Fluence (U.S.)

- Narada (China)

- VRB Energy (Canada)

- Kokam (U.K.)

- EVE Energy Co., Ltd. (China)

- Black & Veatch (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In June 2025, Chinese lithium-ion battery manufacturer EVE Energy announced that it is moving forward with the second phase of its facility in Malaysia to produce energy storage batteries, following the commissioning of phase one for cylindrical batteries. According to EVE, the company plans to invest 8.654bn yuan ($120.8mn), and phase two has a designed capacity of 10-15 GWh/yr of energy storage batteries.

- In February 2025, Black & Veatch, a global leader in evaluative human infrastructure solutions, was preferred by two U.K.-based companies as the Owner’s Engineer (OE) and Technical Advisor (TA) on Battery Energy Storage Solution (BESS) projects that will supply up to 200MWh.

- In February 2025, Fluence declared a new AC-based modular battery storage platform for release in the fourth quarter of this year. Amalgamating smart performance, predictive servicing, top standards levels, and a future-ready modular design, Smartstack addresses crucial industry challenges brought on by outstanding growth and demand involving performance, transportation logistics constraints, and land use.

- In April 2023, Portland General Electric, the utility serving Portland, Oregon, declared that it is prospecting the second-largest battery storage deployment in the U.S., at 400 MW of power. This project is important because it decreases the demand for power plants that burn fossil fuels, which contribute to global warming.

- In August 2021, South Korean lithium-ion battery system manufacturer Kokam signed an agreement with Electricité de Tahiti to supply 15 MW/10.4 MWh battery energy storage system (BESS). Electricité de Tahiti (EDT), a subsidiary of ENGIE, will attain the country's first effective Synchronous Generator to displace the utility's spinning reserve diesel generators. The move works to decarbonize and build up the grid while permitting more sustainable energy.

REPORT COVERAGE

The report provides a detailed analysis of the small scale battery energy storage market. It focuses on key aspects such as leading companies, product processes, competitive landscape, and leading small scale battery energy storage sources. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 21.69% from 2025 to 2032 |

|

Unit |

Value (USD Billion), Volume (MW) |

|

Segmentation |

By Battery Type

|

|

By Capacity

|

|

|

By Connection Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 7.37 billion in 2024.

In 2024, the Asia Pacific market value stood at USD 4.02 billion.

The market is expected to exhibit a CAGR of 21.69% during the forecast period.

The residential segment is leading the market by end-user.

Rising adoption of rooftop solar drives the market growth.

Some of the top major players in the market are General Electric, ABB, Samsung, and others.

Asia Pacific dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us