Smart Factory Market Size, Share & Industry Analysis, By Technology (Digital Twin, Industrial IoT, Industrial Robots, and Others), By Solutions (Industrial 3D Printers, Programmable Logic Controller (PLC), Product Lifecycle Management (PLM), Manufacturing Execution System (MES), Robotic Process Automation (RPA), Supervisory Control And Data Acquisition (SCADA), and Others), By Industry (Discrete Industry and Process Industry), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

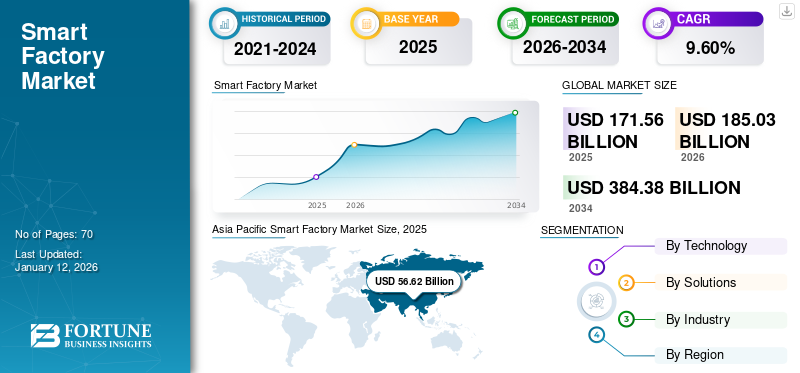

The global smart factory market size was valued at USD 171.56 billion in 2025 and is projected to grow from USD 185.03 billion in 2026 to USD 384.38 billion by 2034, exhibiting a CAGR of 9.60% during the forecast period. The Asia Pacific dominated global market with a share of 33.00% in 2025.

A smart factory is an intelligent manufacturing ecosystem encompassing various connected technologies, such as digital twin, industrial IoT, robotics, and other automated products. Unlike traditional manufacturing facilities, these facilities integrate various solutions into a connected ecosystem. Multiple trends, including AI-driven operations, high-speed connectivity, and digital twins, drive the global growth of the smart factory market. Within the smart manufacturing ecosystem, the adoption of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), Industrial Internet of Things (IIoT), and Robotics has supported the increasing adoption of smart factory solutions among prime manufacturers such as Samsung, Airbus, Unilever, and others. Some use cases are Unilever, which adopted smart factory principles by incorporating AI-driven production analytics that improve production efficiency and reduce waste for sustainability practices.

Global smart factory players such as Siemens, Honeywell, and ABB are coping with the shifting trend by offering more flexible smart manufacturing and industrial solutions. These technologies enable real-time optimization, predictive maintenance, and seamless integration across various production-linked operations.

IMPACT OF GENERATIVE AI ON THE MARKET

AI Agents in Industrial Automation Shaping New Manufacturing Dynamics

AI technology backed by industry-led data is critical for customization and productivity growth. Manufacturing facilities and equipment leverage AI's analytics power by actively using the data collected through IIoT. This data helps machine and equipment manufacturers train automated machines and expand their process efficiency by optimizing time and improving a product's production lifecycle. In the near term, artificial intelligence AI and machine learning will shape manufacturing dynamics, led by enhanced decision-making and real-time analytics, significantly reducing business costs and time.

- For instance, in May 2025, Siemens introduced AI agents to its Xcelerator platform, aiming to increase productivity by 50% for industries. The AI architecture features a complex orchestrator that can independently execute a complete industrial workflow.

SMART FACTORY MARKET TRENDS

Leveraging Data and Robotics for Process Efficiency is a Key Market Trend

Download Free sample to learn more about this report.

Modern manufacturing emphasizes AI's importance in eliminating material wastage in production processes. For these, businesses are using data collected through IIoT to improve productivity in manufacturing operations by customizing and expanding machine capabilities and process efficiency through AI and ML integration. Further, small and medium-sized enterprises have a rising demand for industrial robots to automate complex machining and production operations. These advancements positively expand the smart factory market share over the forecast period.

- For instance, in June 2024, Regal Rexnord launched an intelligent decision-making and predictive maintenance solution in industrial engineering. The platform is designed to build and automate multiple Regal Rexnord condition monitoring systems into a unified architecture with the latest technologies.

MARKET DYNAMICS

Market Drivers

Integration of Modern Technology, Digital Twins, to Drive Market Growth

Original Equipment Manufacturers (OEM) and the In-house technology group in the manufacturing facility are actively integrating modern technology, such as digital twins, to test every new technology virtually and minimize the implementation risk. Digital twins help adopt dynamic digital models that connect building systems, which can monitor and optimize resources. For the digital twin growth platform, such as Autodesk tandem software, it helps optimize the asset lifecycle, schedule minimal downtime, and mitigate risk. These capabilities drive the smart factory market growth progressively during the forecast period.

- For instance, in January 2025, SPX Flow collaborated with Siemens to implement cutting-edge digital twin technology at Chicago's (Manufacturing x Digital) center. This technology is further enhanced by 5G connectivity and modular production using software with an associated digital twin.

Market Restraints

Lack of Skilled Workforce and Huge Capital Infusion Hinders Market

The market demands a skilled workforce that can easily incorporate automated machines with smart manufacturing solutions. This implementation needs precision and expertise to link modern technology to a traditional machine upgrade. Further, the capital infusion required for the upgrade is relatively higher than that of traditional industry 4.0 solutions, making the market less lucrative. All these factors collectively create a gap and hinder the growth of the smart factory market.

Market Opportunities

Lucrative Opportunities in No-Code Intelligent Automation Support Growth

Intelligent automation solutions are creating lucrative opportunities for the smart factory, especially in product engineering, quality control, and predictive maintenance. Manufacturers use diverse solutions such as no-code software to make data-backed intelligence and process improvement feasible. These solutions provide a deep drill-down analysis at required granularity into the intelligent factory data silos, make analytics, and train ML models for quality control assessment. Intelligent automation offers multiple benefits by connecting physical assets to the IT world and enabling manufacturers to leverage analytics to improve production efficiency.

- For instance, in November 2024, Rockwell Automation Inc., a global industrial automation and digital transformation leader, introduced FactoryTalk Analytics VisionAI. This cutting-edge inspection technology leverages AI and ML to revolutionize quality control. This no-code solution allows quality personnel to easily train AI models and deploy across production lines without machine vision expertise.

SEGMENTATION ANALYSIS

By Technology

Proliferated Industrial IoT Usage in Manufacturing Analytics Strengthens Market

By technology segment, the market is divided into digital twin, industrial IoT, industrial robots, and others (machine vision, etc.).

Across different technologies, the industrial IoT segment dominates the market with a share of 42.31% in 2026, driven by AI sensors coupled with IIoT. Businesses leverage the data collected on various parameters, including temperature, light, pressure, and others, through various physical assets. IIoT combines advancements that benefit manufacturers by estimating the present state of machines and enhancing their performance. It further helps businesses predict future failures in flexibility and quality.

The digital twin technology segment has the highest CAGR, backed by the active investment by key manufacturers that can detect anomalies and irregularities in production operations in real time to gain a holistic view of overall equipment effectiveness.

Industrial robots and machine vision technology are a steadily growing segment driven by the active integration of industrial robotics and machine vision systems capable of handling complex operations and major payloads to enhance productivity and flexibility.

By Solutions

Growing MES adoption for Operational Excellence Drives Growth

By solution type segment, the market is classified into industrial 3D printers, programmable logic controller (PLC), product lifecycle management (PLM), manufacturing execution system (MES), robotic process automation (RPA), supervisory control and data acquisition (SCADA), and others (energy management solutions, etc.).

The Manufacturing Execution System (MES) segment dominates the global market with contribution of 19.78% globally in 2026, led by the active adoption of solutions in the manufacturing ecosystem that balance modern analytics and Industry 4.0. IoT sensors embedded in machines and production equipment generate real-time data insights and enhanced production capabilities with connected IoT physical systems.

Industrial 3D printer solutions are the highest CAGR segment, driven by the dynamic investment across 3d printing solutions capable of supporting additive manufacturing of medical devices, autoparts, and other 3d printed products.

PLM and SCADA are steadily growing solutions backed by the growing demand for IIoT products and projects. PLC, RPA, and other solutions are significantly expanding market presence fueled by the remote monitoring, sustainability, and robotics demand.

Global Smart Factory Market Share, By Solutions, 2026

To get more information on the regional analysis of this market, Download Free sample

By Industry

Integrating Advanced Technologies for Optimization to Drive Discrete Industry Dominance

Industry segment is classified into discrete and process industry.

The discrete industry segment is driven by high investment with a share of 58.71% in 2026, by prime end users in integrating advanced technologies into various sub-industries, including automotive, marine & transportation, semiconductor & electronics, and others. Implementing IIoT, digital twin, and advanced analytics reduced 50% of the time spent on marketing and a 15% increase in throughput in process lines. Prime solution providers such as Siemens offer smart automotive factory solutions in their Xcelerator portfolio that help solve operational challenges to scale and future expansions.

The process industry is a steadily growing segment backed by the demand from major processing industries such as pharmaceuticals, mining, chemicals, and others.

SMART FACTORY MARKET REGIONAL OUTLOOK

Asia Pacific

Asia Pacific Smart Factory Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific leads the regional market with a 33% share, driven by the region's dynamic growth and industrialization. Asia Pacific dominated the global market in 2025, with a market size of USD 56.62 billion. Major industries and manufacturing units are expanding their presence in this region to meet the active demand of the world’s largest consumer base. Countries in the Asia Pacific, such as China, India, and Southeast Asia, are key economies attracting foreign direct investment (FDI) for manufacturing. These FDIs help businesses improve process optimization using advanced RPA products and active PLM management. The Japan market is projected to reach USD 15.19 billion by 2026, and the India market is projected to reach USD 11.05 billion by 2026.

China is the biggest market in the Asia Pacific region, and its dominance is due to its industrial and manufacturing base. The country adopts and integrates advanced technologies such as IIoT and robotics to improve the MES solution process, pushing the industry's dynamic growth. The China market is projected to reach USD 24.19 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

Progressive-led policies and a groomed manufacturing sector through trade policies and supporting manufacturing bills, including the big beautiful bill, drive the North American smart factory demand. Today, U.S. manufacturing constitutes 8-12% of the region's GDP, with major manufacturing investments in advanced technologies such as MES, PLM, and SCADA. These technologies leverage advanced analytics and ML-trained software that minimizes operational challenges. The U.S. market is projected to reach USD 40.06 billion by 2026.

Europe

Europe's growing market benefits from a dynamic industrial sector driven by AI, ML, and Industry 4.0 adoption. This shift is pushing toward advanced, precise engineering in automotive and manufacturing, with the energy sector's growth supporting this development. The UK market is projected to reach USD 6.76 billion by 2026, and the Germany market is projected to reach USD 10.48 billion by 2026.

Latin America

The Latin American market is slowly evolving as the region's manufacturing and mining sectors pick up, backed by rising investment in processing facilities. In Brazil and Argentina, the demand is especially fueled by the dominant mining industry and the growing focus on efficiency and renewable energy infrastructure.

Middle East and Africa

The Middle East & Africa market is expanding moderately. Traditional automation remains in demand in the oil industry, while investors focus on mining and EPC projects. South Africa's investments in the smart factory market include AI integration, IIoT, and analytics that significantly boost regional growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leveraging AI Capabilities in Solutions Portfolio Benefits Companies

Smart Factory companies invest heavily in integrating automated AI tools and ML techniques to generate meaningful insight and improve industry process automation. AI in manufacturing offers a decisive competitive advantage that implements industry 4.0 technologies to transform production through analyzing vast data and leveraging AI to execute daily routine tasks and solve bottlenecks in the production process.

- For instance, in May 2025, Siemens announced the expansion of its industrial AI offerings with advanced AI agents that work seamlessly across different industrial copilot ecosystems. This technology is a fundamental shift from traditional AI responding bots to independent AI agents that execute entire industrial processes.

With the help of the Industrial Internet of Things, large amounts of data from machines, equipment, and production lines can be processed through AI algorithms that can quickly process and analyze data. Government supportive policies, and rising investment in AI technology to further boost the market for AI in industrial applications. For instance, according to the National Association of Software and Service Companies (NASSCOM) report, digital technologies are estimated to account for 40% of the total manufacturing expenditure by 2025 in India in comparison to 20% in 2021.

Long List of Companies Studied (including but not limited to)

- ABB Ltd. (Switzerland)

- Siemens AG (Germany)

- Schneider Electric SE (France)

- Emerson Electric Co. (U.S.)

- General Electric (U.S.)

- Honeywell International, Inc. (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Rockwell Automation, Inc. (U.S.)

- Fanuc Corporation (Japan)

- SAP (Germany)

- Endress + Hauser (Switzerland)

- Fujitsu (Japan)

- Yokogawa Electric Corporation (Japan)

- Tata Technologies (India)

- Samsung (South Korea)

- NEC Corporation (Japan)

- Omron Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- July 2025: Siemens acquired ebm-papst's Industrial Drive Technology (IDT) division to expand its factory automation and digitalization portfolio. This strategic addition will open up new markets for conveyor and autonomous transport, creating opportunities for Siemens in intelligent battery-powered drive solutions.

- April 2025: Rockwell Automation and AWS collaborate to streamline the digital transformation of manufacturing companies. By combining Rockwell operation technology with AWS cloud services, manufacturers are equipped with scalable, flexible, and secure cloud solutions that help optimize asset performance, increase operational capability, and deliver actionable insights.

- March 2025: Siemens acquires Altair Engineering Inc. to strengthen the position of Siemens' industry software portfolio and further enhance digital twin offerings. The addition of Altair will enhance comprehensive digital twin simulation for product development for businesses of any size.

- March 2025: Siemens expands industrial Copilot with new generative AI-powered maintenance offering. The AI-based assistant empowers customers with SCL code generation for PLC while minimizing errors and reducing the need for specialized knowledge. The generative AI solution extends capabilities and supports every predictive maintenance cycle stage with the Senseye predictive maintenance tool.

- March 2025: Siemens announced an extended collaboration with Microsoft to simplify information and operational technology integration. The customer benefits from Siemens' industrial edge and Azure IoT, which enable seamless data flow and AI and digital twin-powered solutions to improve machine performance.

REPORT COVERAGE

The smart factory report includes detailed segmentation and analysis of the market. It focuses on key aspects such as leading companies, solutions, and industries. It also offers insights into market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

By Solutions

By Industry

By Region

|

|

Companies Profiled in the Report |

ABB Ltd. (Switzerland), Siemens AG (Germany), Schneider Electric SE (France), Emerson Electric Co. (U.S.), General Electric (U.S.), Honeywell International, Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Robert Bosch GmbH (Germany), Rockwell Automation, Inc. (U.S.), and Fanuc Corporation (Japan) |

Frequently Asked Questions

The market is projected to reach USD 384.38 billion by 2034.

In 2025, the market was valued at USD 171.56 billion.

The market is projected to grow at a CAGR of 9.60% during the forecast period.

The industrial IoT is the leading technology segment in the market.

Focus on digital twin adoption, minimize implementation risk, and drive optimization and market growth.

The top players in the market include ABB Ltd., Siemens AG, Schneider Electric SE, Emerson Electric Co., General Electric, Honeywell International, Inc., Mitsubishi Electric Corporation, Robert Bosch GmbH, Rockwell Automation, Inc., and Fanuc Corporation.

The Asia Pacific region is expected to hold the highest market share.

The discrete industry is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us