Solvent-borne Wood Coatings Market Size, Share & Industry Analysis, By Product (Polyurethane, Acrylic, and Others), By Application (Furniture, Cabinets, Sliding, Flooring & Decking, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

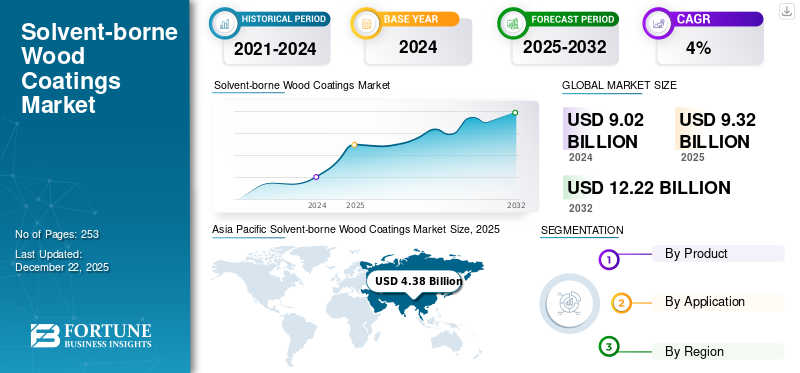

The global solvent-borne wood coatings market size was valued at USD 9.32 billion in 2025 and is projected to grow from USD 9.63 billion in 2026 to USD 13.23 billion by 2034, exhibiting a CAGR of 4% during the forecast period. Asia Pacific dominated the solvent-borne wood coatings market with a market share of 47% in 2025.

Solvent-borne wood coatings are protective layers composed primarily of organic solvents. These coatings are applied to wood surfaces to enhance durability, aesthetics, and resistance to environmental factors such as moisture and weathering. They are also referred to as solvent-based coatings. These coatings play a pivotal role in the protection and aesthetic enhancement of wood products across various industries, including furniture, cabinetry, flooring, and construction. These coatings utilize organic solvents to dissolve resins and additives, offering advantages such as superior durability, faster drying times, and enhanced resistance to environmental factors compared to water-borne alternatives. Akzo Nobel N.V., The Sherwin-Williams Company, PPG Industries, Inc., RPM International Inc., and Sirca S.p.A. are key players operating in the industry.

Global Solvent-borne Wood Coatings Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 9.32 billion

- 2026 Market Size: USD 9.63 billion

- 2034 Forecast Market Size: USD 13.23 billion

- CAGR: 4% from 2026–2034

Market Share:

- Asia Pacific dominated the solvent-borne wood coatings market with a 47% share in 2025, driven by rising construction activity, booming furniture and cabinetry production, and rapid urbanization across China, India, and Southeast Asia.

Key Country Highlights:

- China: China led the Asia Pacific market in 2024, fueled by large-scale construction, growing furniture exports, and urbanization aligned with the country’s continued development under the Belt and Road Initiative.

- United States: The U.S. solvent-borne coatings market generated USD 1.28 billion in 2026, supported by a robust furniture and residential construction sector. Despite strict VOC regulations, demand continues due to superior aesthetic and protective performance.

- Germany: A key market in Europe with a focus on renovations and sustainable wood finishing solutions. The demand is supported by the strong domestic furniture industry and stringent quality standards.

- Saudi Arabia: The Vision 2030 initiative and major infrastructure investments are fueling demand for high-performance wood coatings in residential and commercial construction, positioning the country as a major player in the Middle East & Africa region.

Solvent-borne Wood Coatings Market Trends

Technological Innovations in High-Performance Resins to Foster Global Market Growth

The solvent-borne wood coatings industry is undergoing significant technological advancements, particularly in the development of high-performance resins. These innovations aim to enhance adhesion, durability, and resistance to environmental factors, meeting the stringent demands of industries such as automotive, aerospace, and industrial manufacturing. Below is a detailed explanation of these advancements and their implications.

Manufacturers are investing in research to develop resins that improve adhesion to wood surfaces, even under challenging conditions. This is crucial for applications in industries such as automotive and aerospace, where coatings must endure extreme mechanical stress and environmental exposure.

Moreover, the incorporation of nanomaterials such as nanosilica, nanoclay, and nanotitanium into resin formulations has significantly improved the mechanical properties of coatings. These materials enhance hardness, stiffness, and thermal stability while also providing superior water resistance.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Growing Consumer Preference for Superior Aesthetics to Drive Continued Product Demand

The growing consumer preference for premium wood finishes is significantly propelling the solvent-borne wood coating market forward. Consumers and commercial clients increasingly seek wood products that display exceptional aesthetic appeal, including depth, clarity, and richness of color that solvent-borne coatings consistently deliver. These coatings provide superior grain enhancement and visual depth that water-based alternatives often struggle to match.

Professional woodworkers and manufacturers continue to specify solvent-borne coatings for projects where appearance is vital. The consistent performance and predictable application characteristics allow for repeatable, high-quality results in production environments. Additionally, solvent-borne finishes often require fewer coats to achieve desired results, making them efficient for achieving premium finishes in professional settings.

While environmental considerations have driven innovation in water-based alternatives, manufacturers have responded by developing high-performance solvent-borne coating formulations with reduced Volatile Organic Compounds (VOCs) content. These next-generation products maintain superior finish quality while addressing environmental concerns, ensuring continued demand in markets where appearance and durability cannot be compromised.

Surging Construction & Renovation Activities to Fuel Demand for Solvent-Borne Wood Coatings

The global surge in construction activities and renovation projects has become a significant catalyst for the solvent-borne wood coating market. As urban development accelerates across emerging economies and renovation trends gain momentum in established markets, the demand for reliable wood protection solutions has intensified. Solvent-borne coatings, with their established track record of performance, continue to be specified for many of these projects despite environmental considerations.

Residential construction particularly drives this demand, with homeowners seeking durable finishes for flooring, cabinetry, and architectural woodwork. The housing market recovery in many regions has directly translated to increased consumption of traditional solvent-based stains, varnishes, and lacquers that contractors trust for consistent results. Additionally, the growing trend of custom home building has created a demand for premium wood finishes that showcase natural wood beauty.

Market Restraints

Regulatory Constraints and Technical Alternatives to Restrict Market Growth

Environmental regulations have emerged as a primary constraint to the market's growth potential. Across developed economies, increasingly stringent VOC emission limits imposed by agencies such as the EPA in the U.S. and the European Chemicals Agency have forced manufacturers to reformulate traditional products significantly. These regulations often establish maximum VOC content thresholds that many conventional solvent-borne formulations cannot meet without substantial modification. Compliance necessitates costly investment in research and development, reformulation, and production process changes, directly impacting profit margins and pricing structures. In regions such as California, where SCAQMD regulations are particularly restrictive, manufacturers face a fragmented regulatory landscape requiring multiple formulations for different markets.

Market Opportunities

Demand for Premium Furniture, Exterior Durability, and Eco-Innovation to Act as a Market Opportunity

The premium furniture sector continues to fuel demand for solvent-borne wood coatings, creating significant market opportunities. Consumers investing in high-end furniture expect flawless finishes with depth, clarity, and a luxurious appearance that only solvent-based formulations consistently deliver. This aesthetic superiority drives manufacturers to maintain solvent technologies in their premium product lines, particularly for luxury residential and commercial applications where appearance is paramount.

Technological advancements in low-VOC solvent formulations represent perhaps the most promising opportunity. Innovative manufacturers are creating hybrid systems and reformulated products that maintain the performance advantages of traditional solvent coatings while significantly reducing environmental impact. These advancements allow companies to meet increasingly stringent regulations while preserving the application properties and finish quality that professionals prefer, effectively future-proofing solvent technology in an environmentally conscious market.

Market Challenges

Volatility in Raw Material Prices to Act as a Challenge for the Market

The volatility in raw material prices significantly impacts the wood coatings industry, particularly solvent-borne wood coatings, due to their reliance on petrochemical-derived components such as resins, solvents, pigments, and additives. These fluctuations affect production costs, profit margins, and market competitiveness. Raw materials account for more than half of the total production costs in the coatings industry. A surge in prices for components such as acetone or n-butyl acetate can significantly inflate production expenses. Moreover, when raw material costs rise sharply, companies either absorb these costs or increase product prices—both of which are expected to erode profitability.

Impact of COVID-19

The COVID-19 pandemic initially delivered a significant blow to the market in early 2020. Manufacturing disruptions, supply chain complications, and construction project delays created immediate demand contraction across most regions. Production facilities faced operational challenges from workforce restrictions and safety protocols, while raw material shortages drove price volatility for key components. Residential renovation emerged as an unexpected bright spot during lockdown periods, as homebound consumers invested in DIY projects and home improvements. This partially offsets losses from the commercial and industrial sectors. Professional contractor activity slowed dramatically during peak restriction periods but demonstrated resilience through adaptation to new safety protocols.

By mid-2021, the market had entered recovery mode, driven by pent-up demand in commercial construction and surging housing markets globally. Supply chain challenges persisted longer than anticipated, with some specialty raw materials facing extended availability issues through 2022. Manufacturers responded by reformulating products to utilize available materials and implementing more robust inventory management practices. The pandemic accelerated several pre-existing trends, including digital color selection tools, contactless distribution models, and a preference for durable, low-maintenance finishes. The market has now largely recovered to pre-pandemic levels, though with notable shifts in distribution channels and customer engagement models that appear permanent.

Segmentation Analysis

By Product

Polyurethane Segment Held the Key Market Share Owing to High Demand from the Road Construction Industry

By product, the market is segmented into polyurethane, acrylic, and others.

The polyurethane segment held the prime solvent-borne wood coatings market with a share of 62.41% in 2026, owing to the high demand from the construction industry. Polyurethane coatings are highly versatile and offer superior performance characteristics, including excellent durability, chemical resistance, and moisture protection.

The acrylic segment is expected to show significant growth during the forecast period due to its good flexibility and soft finish. Acrylic coatings are versatile and can be formulated to achieve various finishes. Others segment is expected to grow considerably by 2032.

By Application

To know how our report can help streamline your business, Speak to Analyst

Furniture Segment Held Significant Share Due to Increasing Demand

In terms of application, the market is segmented into furniture, cabinets, sliding, flooring & decking, and others.

The furniture application segment dominated the market with a share of 72.27% in 2026 and is expected to continue its dominance with the fastest growth rate during the forecast period. Furniture manufacturing is one of the largest markets for solvent-borne wood coatings. These coatings provide a high gloss finish and are preferred for their durability and resistance to wear and tear. Polyurethane coatings are particularly popular in furniture due to their versatility and ability to protect wood surfaces effectively.

Cabinets are expected to be the second fastest-growing segment. Increasing preference for wooden cabinets due to their aesthetic appeal is expected to drive the growth.

The flooring & decking segment is anticipated to grow considerably by the end of the forecast period, owing to its durability and longevity.

Solvent-borne Wood Coatings Market Regional Outlook

The global market has been segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Solvent-borne Wood Coatings Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific is the largest and fastest-growing market for solvent-borne wood coatings, driven by rising construction activities and growing demand from the furniture and cabinet sectors. The region generated a value of USD 4.53 billion in 2026.

China dominated the Asia Pacific wood coatings market due to its large construction sector and expanding furniture industry. China's continuous urbanization and government initiatives surge the demand for wood coatings in residential and commercial sectors, further driving the solvent-borne wood coatings market growth. China market is valued at USD 2.64 billion by 2026

India is the fastest-growing market in the Asia Pacific region, driven by government investments in the residential sector and the growth of the furniture industry. The country's wood coatings market is experiencing rapid expansion driven by increasing investments in residential and commercial sectors, along with strategic government initiatives. India market is valued at USD 0.93 billion by 2026. The Japan market is valued at USD 0.25 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America’s market dynamics are influenced by technological advancements, environmental regulations, and consumer preferences for durable and aesthetically pleasing wood finishes. The U.S. is a leading market for solvent-borne wood coatings in North America. The country's robust construction and furniture sectors drive the demand for these coatings.

The market in North America is characterized by its diverse dynamics across the U.S. and Canada. While the U.S. leads in terms of market size, generating a value of USD 1.28 billion in 2026 and technological innovation, Canada offers growing opportunities driven by industrial expansion and consumer demand for sustainable products.

Europe

Europe holds a substantial market share as well, with steady demand for renovations and new construction. The market in Europe is a vital segment of the construction and infrastructure. Germany is a significant market for wood coatings in Europe, driven by its robust construction and furniture industries. The U.K., France, and other European countries also present opportunities, though they face stricter environmental regulations, which may influence the adoption of various coating technologies. The UK market is valued at USD 0.35 billion by 2026, while the Germany market is valued at USD 0.43 billion by 2026.

Latin America

The market in Latin America is characterized by its diverse dynamics across Brazil, Mexico, Argentina, and Chile. While these coatings face challenges from environmental regulations and competition from more sustainable alternatives, technological advancements and innovations in formulations are expected to support their ongoing demand. As the market evolves, the balance between performance and sustainability will remain a key factor in shaping the future of solvent-borne wood coatings in Latin America.

Middle East & Africa

The market in the Middle East & Africa is characterized by its diverse dynamics across GCC, South Africa, and others. GCC is a significant market for wood coatings in the Middle East & Africa region, driven by its robust construction sector. Saudi Arabia's wood coatings market is substantial, with a strong emphasis on high-performance coatings. The market is expected to grow steadily, driven by infrastructure development and the need for sustainable products. The country's Vision 2030 initiative aims to diversify its economy and invest heavily in infrastructure projects, which fuels the demand for wood coatings. Similarly expanding construction and furniture industries in African countries on account of urbanization is further supporting the market growth.

Competitive Landscape

Key Industry Players

Key Players Adopted Acquisition Strategy to Gain Market Share

Akzo Nobel N.V., The Sherwin-Williams Company, PPG Industries, Inc., RPM International Inc., and Sirca S.p.A. are the top 5 players operating in the industry. To enhance their competitive position and mitigate the risks posed by new entrants, manufacturers are aggressively expanding their operations. The market is characterized by intense competition among both international and regional players, who leverage their extensive distribution networks, regulatory expertise, and supplier relationships to gain an edge. Furthermore, companies are engaging in strategic collaborations, including contract signings, acquisitions, and partnerships with other industry leaders to broaden their market reach and strengthen their presence. The global market is fairly consolidated, with the top 5 players accounting for around 60% of the market share.

Key Market Players in the Solvent-borne Wood Coatings Market

To know how our report can help streamline your business, Speak to Analyst

LIST OF KEY SOLVENT-BORNE WOOD COATING COMPANIES PROFILED:

- Akzo Nobel N.V. (Netherlands)

- The Sherwin-Williams Company (U.S.)

- Tikkurila (Finland)

- Sirca S.p.A. (Italy)

- Heubach GmbH (Germany)

- PPG Industries, Inc. (U.S.)

- Kansai Nerolac Paints (India)

- RPM International Inc (U.S.)

- Renner Italia S.p.A (Italy)

- Ceramic Industrial Co (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025 – Akzo Nobel launched RUBBOL WF 3350, a 20% bio-based wood coating, ensuring durability and sustainability. The company is expanding bio-based content across products, including paints for KIA’s EV9 and Dulux Anndru in China.

- October 2024 – RPM International Inc. acquired France-based TMPC, a manufacturer of outdoor design products, integrating it into its Fibergrate Structure business. TPMC’s product offerings, including adjustable and fixed pedestals and accessories for flooring pedestals and accessories for flooring and roofing applications.

- June 2024 – PPG launched TOMORROW INCLUDED, a sustainability marketing concept for its Architectural Coating in EMEA. It highlights environmentally-friendly benefits such as durability, energy savings, and recyclability across brands such as TIKKURILA and JOHNSTONE’S. This aligns with PPG’s 2030 sustainability goals, reinforcing its commitment to sustainable innovation and customer guidance.

- October 2023 – Sherwin-Williams acquired Germany-based SIC Holding, including Oskar Nolte GmbH and Klumpp Coatings GmbH, strengthening its position in industrial wood coatings. The deal expands its global reach with innovative foil, radiation-cured, and water-based coatings.

- December 2022 – Sherwin-Williams completed the acquisition of Industria Chimica Adriatica S.p.A. (ICA), an Italian company specializing in industrial wood coatings for products such as kitchen cabinets and furniture. This acquisition aims to enhance the company’s wood coating portfolio and expand its presence in Europe and other markets.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, products, and end-use industries. Additionally, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors contributing to the market's growth in recent years.

This report includes historical data & forecasts revenue growth at global, regional, and country levels, and analyzes the industry's latest market dynamics and opportunities.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

CAGR (2025-2032) |

CAGR of 4% from 2026 to 2034 |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 9.32 billion in 2025 and is projected to reach USD 13.23 billion by 2034.

In 2025, the Asia Pacific market size stood at USD 4.38 billion.

Growing at a CAGR of 4%, the market will exhibit steady growth during the forecast period (2026-2034).

The furniture application led the market in 2026.

The growing demand for superior aesthetics is a key factor driving market growth.

Akzo Nobel N.V., The Sherwin-Williams Company, PPG Industries, Inc., RPM International Inc., and Sirca S.p.A. are major players operating in the industry.

Asia Pacific dominated the market in 2026.

Demand for premium furniture, exterior durability, and eco-innovation to boost the adoption of products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us