South Korea Cloud Computing Market Size, Share & Analysis, By Type (Public Cloud, Private Cloud and Hybrid Cloud), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS) and Software as a Service (SaaS)), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods and Retail, Healthcare, Manufacturing and Others) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

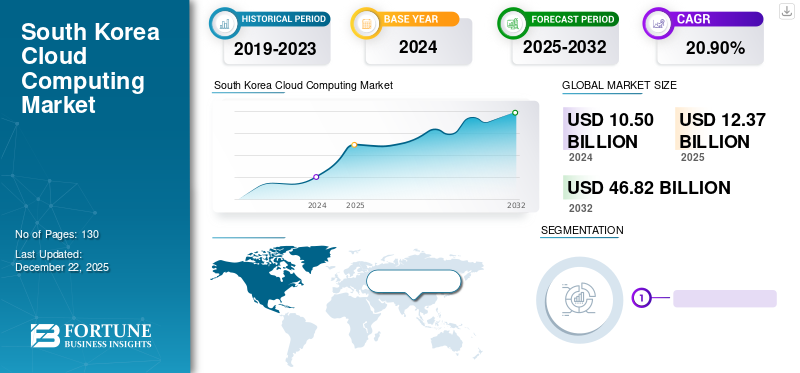

The South Korea Cloud Computing market size was valued at 10.50 billion in 2024. The market is projected to grow from USD 12.37 billion in 2025 to USD 46.82 billion by 2032, exhibiting a CAGR of 20.90% during the forecast period.

South Korea’s cloud computing market is emerging as a crucial part of the country’s digital future. This growth stems from a tech-savvy population and strong demand from businesses for modernization. Instead of just following global trends, South Korean organizations are developing their own cloud strategies. They focus on performance, control, and trust. The market features a mix of local innovation and international collaboration. Cloud technologies are essential for smart city development, digital healthcare, and AI deployment.

- In June 2024, The South Korean Ministry of Science and ICT announced an investment of USD 121.9 million to boost the local cloud computing industry.The funding will support the development of advanced cloud services, the transition of traditional software to SaaS models, and the growth of SaaS startups.

South Korea Cloud Computing Market Trends

Industry Specific Solutions to be the Key Driver for Market Growth

Industry specific cloud solutions are gaining traction in South Korea, as sectors including government, healthcare, and education adopt custom cloud services to address their specific regulatory and operational needs. These tailored solutions improve security, increase efficiency, and support innovations such as telemedicine and remote learning. This focused approach not only fosters digital transformation within each sector but also supports national goals by ensuring compliance and encouraging adoption across vital industries.

Key takeaways· The South Korea Cloud Computing Market is projected to be worth USD 46.82 billion in 2032. · By type segmentation, public cloud contributed for around 55.3% of the South Korea Cloud Computing Market share in 2024. · By service segmentation, Infrastructure as a Service (IaaS) is projected to grow at a CAGR of 22.2% in the forecast period. · By enterprise type segmentation, Large Enterprises accounted for around 50.70% of the market in 2024. |

South Korea Cloud Computing Growth Factors

Growing Demand for AI and Big Data Analytics to Boost Market Growth

South Korea focuses heavily on artificial intelligence innovation and data-driven decision-making. This is a key factor in the growth of cloud computing in the country. As businesses and South Korean government agencies depend more on analytics and machine learning to gain insights, improve efficiency, and create new services, they need strong computing power and large storage options. Cloud platforms offer the suitable environment for these needs. They provide scalable and flexible resources that can manage large amounts of data and complex processing tasks without requiring a large upfront investment in physical infrastructure. These factors collectively contribute to the South Korea Cloud Computing Market growth.

- According to the report published by the OECD Digital Policy Committee (DPC), South Korea leads the OECD in digital technology adoption, ranking first in IoT at 53%, Big Data at 40%, and AI at 28%, while securing fifth place in cloud computing with a 70% adoption rate. This reflects the country’s rapid embrace of advanced technologies across industries.

South Korea Cloud Computing Market Restraints

Strict Data Sovereignty and Residency Laws Limit Market Growth

One major limitation in South Korea’s cloud computing market is the strict data sovereignty and residency laws. These rules greatly affect how cloud services are set up and managed. For example, the K-ISMS certification requires cloud service providers to follow tough standards for data protection, infrastructure security, and risk management. Moreover, companies in sensitive sectors such as finance, healthcare, or government must keep specific types of data storage within the country. This requirement restricts their ability to fully take advantage of global cloud infrastructure.

South Korea Cloud Computing Market Segmentation Analysis

By Type

Based on type, the market is divided into public, private, and hybrid clouds.

In South Korea’s cloud computing market, public cloud holds a majority share due to its scalability, ease of deployment, and cost efficiency. This makes it a popular choice for businesses looking to expand digitally. At the same time, hybrid cloud models are expected to grow with the highest CAGR as companies try to balance cloud flexibility with data control. With increasing focus on data privacy and specific compliance needs, many South Korean companies are adopting hybrid environments. These companies emphasize on keeping important workloads on-premises while still enjoying the benefits of cloud flexibility and innovation.

By Service

Based on service, the market is bifurcated into infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

In South Korea’s cloud computing market, Software as a Service (SaaS) is expected to hold a major share. Businesses are focusing on ready-to-use applications that improve workflows and lower IT costs. Its easy integration and user-friendly nature make it attractive for both small to medium enterprises (SMEs) and large companies. At the same time, Infrastructure as a Service (IaaS) is expected to grow with the highest CAGR. Organizations are investing into customizable and on-demand infrastructure to handle high-performance computing, data analysis, and changing digital workloads.

By Enterprise Type

Based on enterprise type, the market is segmented into Large Enterprises and SMEs.

In South Korea, large companies have been early leaders in adopting cloud technology. They use modern cloud platforms to scale operations, improve system integration, and drive digital innovation across various industries. As cloud systems develop, small and medium-sized enterprises (SMEs) are also adopting the services. They are attracted by the cost-effectiveness, flexibility, and user-friendliness of today's cloud solutions. This increasing involvement from SMEs is expanding the market, positioning cloud technology as a key part of digital transformation for businesses of all sizes in the country.

By Industry

Based on industry, the market is segmented into BFSI, IT and Telecommunication, Government, Consumer Goods and Retail, Healthcare, Manufacturing, and Others.

The IT and Telecommunication segment leads the market. Cloud adoption in South Korea is driven by changes in specific industries. Sectors such as IT and telecom use cloud infrastructure to handle high-speed connectivity, better analytics, and service automation. At the same time, healthcare is experiencing significant changes. Digital health projects and AI-based medical tools are increasing the demand for scalable, secure cloud environments. As industries see the benefits of cloud technology, companies have started to accept it. This trend is speeding up cloud integration across the country and strengthening its role in essential business functions.

List of Key Companies in the South Korea Cloud Computing Market

Key players leading the South Korean cloud computing market are Samsung SDS, LG CNS, NHH Cloud, and KT Cloud. They leverage their higher understanding of local business needs to offer specialized cloud services. Samsung SDS and LG CNS mainly serve large corporations and government organizations. They focus on secure cloud adoption and digital transformation initiatives.

In contrast, NHH Cloud supports startups and small to medium enterprises by providing affordable and scalable cloud solutions. KT Cloud serves a wide range of industries with reliable and flexible cloud infrastructure. Together, these companies drive the growth of South Korea cloud computing market by focusing on data security, regulatory compliance, and customized services for different sectors.

LIST OF KEY COMPANIES STUDIED

- Samsung CDS (South Korea)

- LG CNS (South Korea)

- NHH Cloud Corporation (South Korea)

- KT Cloud (South Korea)

- NAVER Cloud Corporation (South Korea)

- SK Inc (South Korea)

- Posco DX (South Korea)

- Lotte Innovate Company (South Korea)

- Cloocus Corporation (South Korea)

- Solbox (South Korea)

- Zenlayer, Inc. (South Korea)

KEY INDUSTRY DEVELOPMENTS

June 2025: Alibaba Cloud announced the launch of its second data center in South Korea by the end of June 2025, following the first center launched in 2022. This move supports the growing demand for cloud computing and AI services, especially for generative AI applications.

June 2025: SK Group has partnered with Amazon Web Services (AWS) to build a new AI Zone data center in Ulsan, South Korea, with operations expected to begin in 2027. This 15-year strategic partnership aims to strengthen South Korea’s AI infrastructure by offering local access to AWS’s advanced AI and cloud technologies.

REPORT COVERAGE

This report provides a comprehensive analysis of South Korea’s cloud computing market, examining key trends such as the growing adoption of hybrid and multi-cloud infrastructures, the evolving regulatory landscape around data protection, and sector-specific uptake across finance, healthcare, and manufacturing. It also explores strategic collaborations among industry players, government-led digital initiatives, and the development of innovative cloud-based services. The report offers insights into market size, growth forecasts, competitive dynamics, and the role of cloud technology in accelerating digital transformation across the country

[zApoalJEkd]

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 20.90% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Public Cloud · Private Cloud · Hybrid Cloud |

|

By Service · Infrastructure as a Service (IaaS) · Platform as a Service (PaaS) · Software as a Service (SaaS) |

|

|

By Enterprise Type · SMEs · Large Enterprises |

|

|

By Industry · BFSI · IT and Telecommunications · Government · Consumer Goods and Retail · Healthcare · Manufacturing · Others |

Frequently Asked Questions

Fortune Business Insights says that the South Korea cloud computing market was worth USD 10.50 billion in 2024.

The market is expected to exhibit a CAGR of 20.90% during the forecast period of 2025-2032.

By industry, the IT and Telecommunications industry is set to lead the market.

Samsung CDS, LG CNS, NHH Corporation and KT Cloud are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us