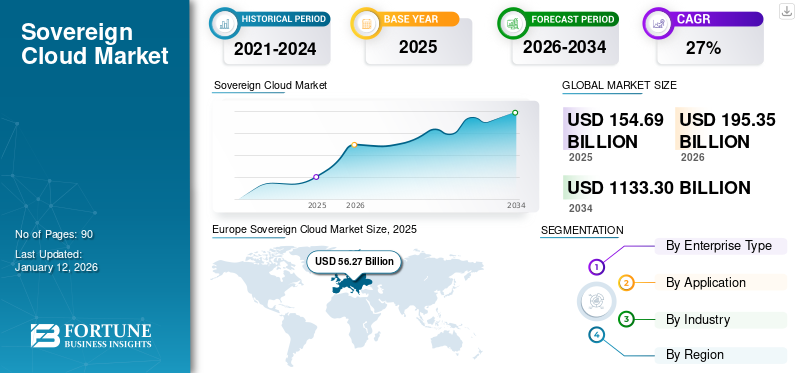

Sovereign Cloud Market Size, Share & Industry Analysis, By Enterprise Type (SMEs and Large Enterprises), By Application (Data Sovereignty, Operational Sovereignty, and Digital Sovereignty), By Industry (BFSI, Healthcare, Government & Public Sector, Manufacturing, and Others), and Regional Forecast, 2026 – 2034

SOVEREIGN CLOUD MARKET SIZE AND FUTURE OUTLOOK

The global sovereign cloud market size was valued at USD 154.69 billion in 2025. The market is projected to grow from USD 195.35 billion in 2026 to USD 1133.3 billion by 2034, exhibiting a CAGR of 24.6% during the forecast period. Europe dominated the market with a share of 23.00% in 2025.

Sovereign cloud is a type of cloud computing solution that meets specific data sovereignty and regulatory requirements by ensuring that the data is stored, processed, and managed within a particular geographic region or country. Unlike public clouds, sovereign clouds are designed to keep data under the jurisdiction and governance of the local government or a designated trusted partner, which is essential for industries and governments with stringent privacy, security, and compliance needs. The market is poised for significant growth during the forecast period. More countries are implementing data protection and residency laws, driving the demand for cloud sovereignty solutions that align with these regulatory compliances. For example, Europe’s General Data Protection Regulation (GDPR) has inspired similar laws in Asia Pacific and the Americas, and stricter policies are being developed in regions, such as South America and the Middle East & Africa. Major companies are employing strategies, such as collaborations, product launches, and geographic expansion to capture market opportunities.

Moreover, key players operating in the market, such as Microsoft Corporation, Oracle Corporation, VMware, Inc. (Broadcom), SAP SE, Clever Cloud, OVH SAS, Cloudian, and others are engaging in partnership and collaboration strategies. Collaborating with government agencies, local cloud providers, and enterprises to ensure compliance with regional data protection laws is a key approach. Market players are engaging in partnerships with governments and local providers, such as in Germany (Microsoft Cloud Deutschland), to deliver compliant sovereign cloud solutions.

The COVID-19 pandemic had a significant positive impact on the market. The outbreak highlighted the critical need for secure and compliant cloud solutions as businesses and governments dealt with sensitive data, particularly in sectors, such as healthcare, finance, and education. The pandemic accelerated the adoption of digital technologies across industries, with organizations shifting to cloud-based solutions for remote work, collaboration, and service delivery. As part of this transformation, businesses sought secure, localized cloud environments to comply with regional regulations, driving sovereign cloud adoption.

IMPACT OF GENERATIVE AI

Increasing Demand for AI-powered Sovereign Cloud Optimization to Aid Market Growth

Generative AI can improve threat detection and bolster cybersecurity within sovereign clouds by identifying vulnerabilities and responding to threats in real-time. AI models help optimize storage allocation, workload distribution, and energy consumption in sovereign cloud data centers, improving operational efficiency. Furthermore, gen AI can assist in categorizing and tagging data to ensure it adheres to localization requirements, reducing manual oversight.

Moreover, generative AI models rely on vast amounts of sensitive and localized data for fine-tuning and operation. Cloud sovereignty provides secure environments where data can be stored and processed in compliance with regional sovereignty laws, driving demand for their adoption.

MARKET DYNAMICS

Market Drivers

Increase in Demand for Data Protection and Transparency from Consumers to Drive Market Growth

As data breaches, privacy scandals, and unauthorized data-sharing incidents make headlines, consumers are becoming increasingly aware of how their personal data can be exploited. This awareness is prompting them to favor organizations that prioritize data protection, particularly those utilizing secure and transparent data management solutions like sovereign clouds. Regulations, such as the General Data Protection Regulation (GDPR) in Europe, the Central Consumer Protection Authority (CCPA) in the U.S., and other regional data protection laws underscore the importance of consumer rights, including the “right to be forgotten” and data portability. These clouds support these regulations by ensuring that the data remains within specific jurisdictions and is managed according to local laws, giving consumers peace of mind that their sensitive information is protected. For instance,

- In October 2023, Amazon Web Services, Inc., launched the AWS European Sovereign Cloud, which was developed to assist public sector customers in Europe. This cloud solution is located and operated within Europe.

Moreover, consumers expect companies to be transparent about their data handling practices, including who has access to their information, where it is stored, and how it is used. Sovereign Cloud Providers (SCPs) facilitate transparency by giving organizations enhanced control and visibility into their data management practices. This allows them to meet consumer expectations and build trust, which further drives the market’s growth.

Market Restraints

High Infrastructure Costs and Scalability Limitations May Hinder Market Growth

Setting up sovereign cloud environments often requires substantial upfront investments in data centers, compliance technologies, and cybersecurity measures. These costs can be prohibitive for smaller organizations and regional governments. The cloud sovereignty infrastructure must be regularly maintained and updated to comply with evolving regulations and protect against cyber threats, thereby adding operational expenses. Moreover, traditional public cloud providers offer highly scalable environments with vast resources that may be challenging for cloud sovereignty to match. This can be particularly restrictive for businesses needing to scale rapidly. Organizations using a mix of sovereign and public clouds may face difficulties in creating seamless integrations due to data residency and compliance restrictions, limiting flexibility. These factors are expected to hinder the sovereign cloud market growth.

Market Opportunities

Rise in Cloud-based Digital Transformation to Create Lucrative Opportunities for Market Players

The ongoing shift to cloud-based infrastructure for digital transformation provides an opportunity for sovereign cloud providers to cater to organizations concerned about data security and localization. Cloud sovereignty offers solutions that align with these goals, particularly in industries, such as manufacturing, retail, and education.

Moreover, the growing adoption of hybrid and multi-cloud strategies presents opportunities for sovereign clouds to act as compliant components within these infrastructures. Organizations can use cloud sovereignty for sensitive workloads while utilizing public or private clouds for less critical applications. These factors will collectively create significant opportunities for growth in the market in the coming years.

Market Trends

Rise of Sovereign Cloud Adoption in Public Sector to Ensure Market Growth

Governments across the globe, particularly in Europe, North America, and Asia Pacific, are actively adopting sovereign cloud solutions for critical public services. This includes services related to healthcare, law enforcement, and education, where sensitive data needs to be securely stored and processed within the country. Public sector entities are increasingly partnering with cloud providers to meet stringent data privacy regulations, control local data, and better manage government-owned data systems. Governments are partnering with leading cloud providers to develop and deploy cloud sovereignty solutions, ensuring adherence to national security and data privacy mandates. For instance,

- In Europe, initiatives like the GAIA-X association, which is a project to develop a high-performance, secure, and trustworthy data infrastructure for Europe, promote the development of a safe and interoperable cloud sovereignty infrastructure.

- Also, in Asia Pacific, countries, such as India and Japan are fostering collaborations for localized sovereign cloud development.

These factors represent some of the key trends fueling the market’s growth.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Enterprise Type

Surge in Need for Advanced Security Requirements Fueled Demand for Sovereign Cloud Solution in Large Enterprises

Based on enterprise type, the market is bifurcated into SMEs and large enterprises.

The large enterprises segment captured the largest market share of 68.15% in 2026, as they face complex cybersecurity challenges due to their scale, global operations, and the volume of sensitive data they handle. Cloud sovereignty provides zero-trust security frameworks, encryption, and data isolation to meet these requirements. Furthermore, large enterprises often collaborate with sovereign cloud providers as cloud offers customized solutions which align with their global and local operational needs.

The SMEs segment is expected to record a noteworthy CAGR in the coming years as they are being increasingly targeted by cyberattacks due to their lack of sophisticated in-house security teams. Cloud sovereignty offers managed security services, reducing vulnerability while meeting local data protection laws. SMEs are increasingly adopting this cloud service to enhance customer trust by ensuring that sensitive data, such as personal or financial information is stored and processed locally.

By Application

Increasing Trust and Transparency among Users Propeled Adoption of Data Sovereignty

Based on application, the market is divided into data sovereignty, operational sovereignty, and digital sovereignty.

The data sovereignty segment captured the largest market share in 2025 and is anticipated to continue its dominance by registering the highest CAGR during the forecast period. Users feel secure knowing that their data is managed according to local laws and not transferred across borders without consent. Businesses adhering to strict data sovereignty principles are perceived as trustworthy, attracting more clients. This factor showcases that the importance of data sovereignty is growing with the rise of regulations and need for transparency. The segment is expected to capture 53.79% of the market share in 2026.

The digital sovereignty segment is projected to record a prominent CAGR of 26.20% during the forecast period (2026-2034), as it ensures that digital systems, such as cloud infrastructure and communication networks, are protected under the national jurisdiction. Also, it limits reliance on foreign technologies that may have vulnerabilities or backdoors. Moreover, digital sovereignty strengthens a country’s position in the global tech ecosystem by fostering indigenous technological capabilities.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Rise in E-Governance Initiatives Fueled Adoption of Sovereign Cloud Solution In Government Industry

Based on industry, the market is categorized into BFSI, healthcare, government & public sector, manufacturing, and others (energy & utilities).

The government & public sector segment captured the largest market share in 2025. Increasing adoption of digital platforms for public services, such as tax systems, healthcare portals, and smart city projects, requires a secure and compliant cloud infrastructure. Furthermore, cloud sovereignty reduces reliance on foreign cloud providers, mitigating risks of unauthorized data access and foreign surveillance. This segment is likely to gain 38.28% of the market share in 2026.

The healthcare sector is anticipated to record the highest CAGR of 30.13% during the forecast period (2026-2034). Cloud sovereignty provides advanced encryption and secure data storage to protect sensitive patient information from breaches and unauthorized access. Moreover, the rise of telemedicine and digital health platforms requires secure and scalable cloud solutions for real-time patient data processing.

SOVEREIGN CLOUD MARKET REGIONAL OUTOOK

With respect to region, the market covers North America, Europe, Asia Pacific, and the rest of the world.

Europe

Europe Sovereign Cloud Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe held the largest sovereign cloud market share with a valuation of USD 56.27 billion in 2025 and USD 69.38 billion in 2026. European countries are prioritizing data sovereignty to reduce reliance on foreign cloud providers and protect sensitive data from international surveillance. The U.K. market is estimated to reach a market value of USD 13.72 billion in 2026. The regional governments are promoting the use of local cloud service providers to foster regional economic growth and create jobs. Moreover, hospitals and research institutions leverage public cloud services to store and process sensitive patient data while ensuring compliance with local regulations. For instance,

- In February 2022, Arvato Systems and SAP SE invested in Delos Cloud, a new German company. This company will offer a sovereign cloud infrastructure for the public sector in Germany. Through this investment, the company aims to boost digital transformation in the country.

These factors play a vital role in driving the market’s growth in the region. Germany is likely to hold USD 13.21 billion in 2026, while France is expected to gain USD 9.13 billion in the same year.

The U.K. sovereign cloud market is expected to grow at a significant pace during the forecast period. The U.K. government has adopted cloud sovereignty solutions for secure data handling in healthcare e.g., National Health Service (NHS) digital services, law enforcement, and public administration. In addition, the government encourages the use of cloud sovereignty solutions for public services and sensitive data management to strengthen national security.

North America

North America is the second largest market, expected to hit USD 57.5 billion in 2026, exhibiting a CAGR of 26.1% during the forecast period. In North America, the market is growing at a prominent pace owing to the increasing need for secure data storage, compliance with stringent regulations, and a growing emphasis on data sovereignty across critical industries. The U.S. regulations, such as the Federal Risk and Authorization Management Program (FedRAMP) and Cybersecurity Maturity Model Certification (CMMC), mandate the use of a secure and compliant cloud infrastructure for handling sensitive government and defense data. In addition, Canadian government initiatives encourage the adoption of sovereign cloud to secure critical public sector data and foster local cloud infrastructure development. For instance,

- In April 2024, IBM Corporation announced plans to design a novel Cloud Multizone Region in Quebec, Canada to meet data sovereignty needs. Through this, the company aims to help clients harness generative AI with a secured enterprise cloud platform.

The U.S. government and enterprises seek to mitigate risks associated with foreign data access or breaches by leveraging a government cloud infrastructures. Moreover, concerns over data security and protection have driven U.S. organizations to prioritize cloud sovereignty solutions that guarantee that the data remains under the U.S. jurisdiction. Furthermore the presence of a large number of key market players across the country plays an important role in fueling the market growth. The U.S. market is set to gain USD 40.57 billion in 2026.

Asia Pacific

Asia Pacific is the third largest market expected to reach a valuation of USD 54.92 billion in 2026, as nations prioritize data sovereignty and digital transformation initiatives. China is set to be valued at USD 12.53 billion in 2026. Countries in the region are leveraging cloud sovereignty solutions to localize data storage and processing, thereby ensuring compliance with regional laws and addressing geopolitical concerns. The rapid adoption of cloud technologies in sectors, such as government, healthcare, and finance will drive the need for a secure and compliant cloud sovereign infrastructure across the region. For instance,

- In October 2024, Oracle Corporation engaged in a collaboration with NTT Data Japan to reinforce sovereign cloud capabilities in Japan. Through this collaboration, NTT Data Japan would be able to provide its customers with access to the latest AI capabilities and 150+ Oracle Cloud Infrastructure (OCI) services.

India is expected to hit USD 9.09 billion in 2026, while France is anticipated to reach USD 8.51 billion in the same year.

Rest of the World

The rest of the world is is the fourth largest market expected to hit USD 11.36 billion in 2026. Countries in the MEA region are enacting data protection laws that require data to be stored and processed locally. Sovereign cloud adoption is driven by smart city initiatives, government modernization programs, and the need for secure e-governance. Furthermore, South American governments aim to reduce reliance on foreign cloud providers to ensure national data security and protection against cyber threats.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Market Players Are Focusing On Partnership and Acquisition Strategies to Expand Their Cloud Services Globally

Key players are focusing on expanding their global presence by offering industry-specific services. They are focusing on collaborations and acquisitions with regional and local players to maintain their dominance across regions. They are also launching new solutions to increase their consumer base. An increase in R&D investments for product innovations is enhancing the market’s expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

List of Companies Studied:

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Alphabet, Inc. (Google LLC) (U.S.)

- OVH SAS (France)

- VMware, Inc. (Broadcom) (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Clever Cloud (France)

- Cloudian (U.S.)

- SAP SE (Germany)

- Tietoevry (Finland)

- T-Systems International GmbH (Germany)

- Accenture (Ireland)

- TATA Consultancy Services Limited (India)

- Orange Business (France)

- Rackspace Technology (U.S.)

- Salesforce (U.S.)

- Red Hat (U.S.)

- Reply (Italy)

…and more

KEY INDUSTRY DEVELOPMENTS:

November 2024: SAP SE announced the availability of its Sovereign Cloud capabilities in the U.K. It will provide secure cloud solutions to meet the needs of critical national infrastructure, public sector organizations, and regulated industries across the country.

November 2024: NSI Group engaged in a collaboration with IBM Corporation. Through this collaboration, the company launched a cloud sovereignty solution to help businesses with AI ready-to-use AI solutions.

November 2024: IBM Corporation unveiled Watsonx on IBM Cloud in Australia and New Zealand. This launch will help the company enhance the cloud infrastructure in the region.

July 2023: OVH Cloud engaged in a strategic partnership with Unisys, a global technology group. Through this collaboration, the company aims to offer a data-sovereign cloud infrastructure to public sector customers in Europe.

January 2023: Scaleway and Clever Cloud engaged in a partnership to offer cloud sovereignty and PaaS (Platform-as-a-Service) solutions to customers across Europe.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Many companies invest heavily in continuous innovation to enhance the security, efficiency, and customization of cloud sovereignty solutions. The key market players include IBM Corporation, Oracle Corporation, VMware, Inc. (Broadcom), SAP SE, Clever Cloud, OVH SAS, and Cloudian, among others. These players are focusing on making recurring investments in research and development activities to launch new solutions. For instance,

- IBM Corporation provides advanced security solutions, including AI-driven threat detection, for its cloud sovereignty offerings to enhance data privacy.

- VMware Inc. developed the VMware Sovereign Cloud Framework to provide security, compliance, and sovereignty controls for hybrid cloud environments.

These factors are expected to create a lucrative opportunity for the market’s growth.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 24.6% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Enterprise Type

By Application

By Industry

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 9.09 billion by 2034.

In 2025, the market was valued at USD 154.69 billion.

The market is projected to record a CAGR of 24.60% during the forecast period.

By application, the data sovereignty segment leads the market.

Increase in the demand for data protection and transparency from consumers is driving the market’s growth.

Microsoft Corporation, IBM Corporation, Oracle Corporation, Alphabet, Inc. (Google LLC), OVH SAS, VMware, Inc. (Broadcom), Hewlett Packard Enterprise Development LP, Amazon Web Services, Inc., Clever Cloud, and Cloudian are the top players in the market.

Europe is expected to hold the highest market share.

By industry, the healthcare segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us