Specialty Carbon Black Market Size, Share & Industry Analysis, By Grade (Conductive Carbon Black, Fiber Carbon Black, Food Contact Carbon Black, and Other Grades), By Application (Plastics, Printing Inks, Paints & Coatings, Electronics, Packaging, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

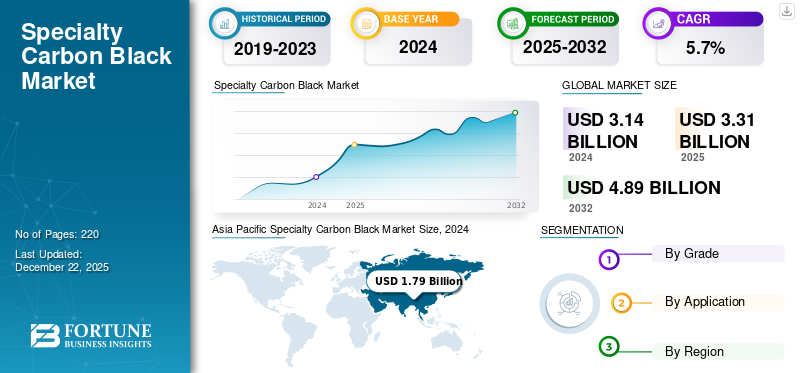

The global specialty carbon black market size was valued at USD 3.32 billion in 2025. The market is projected to grow from USD 3.5 billion in 2026 to USD 5.46 billion by 2034, exhibiting a CAGR of 5.7% during the forecast period. The Asia Pacific dominated the specialty carbon black market, accounting for a 57% market share in 2025.

Specialty carbon black consists of engineered carbon particles with accurately controlled surface area, particle size, structure, and chemistry, manufactured through controlled thermal decomposition of hydrocarbons. Unlike commodity carbon black, these high-performance variants deliver specific functionality in complex applications, including conductive polymers, UV-resistant coatings, and specialized inks. Their distinctive properties, such as high purity, precise particle morphology, and tailored surface chemistry, enable critical performance enhancements in products ranging from high-voltage cables to automotive finishes. The growing demand for high-performance plastics and coatings in the automotive, electronics, and packaging sectors is driving the specialty carbon black market.

Birla Carbon, Cabot Corporation, Imerys, Orion Engineered Carbon, and Continental Carbon Company are a few key players operating in the market.

SPECIALTY CARBON BLACK MARKET TRENDS

Growing Consumer Demand for Eco-Friendly Products to Shift Manufacturers' Focus toward Green Production Methods

Increasing environmental regulations and growing consumer awareness about carbon footprints are compelling specialty carbon black manufacturers to shift from traditional petroleum-based feedstock to sustainable alternatives such as recovered carbon black from tire pyrolysis and bio-based materials from renewable biomass. This shift toward green production methods drives significant market growth as businesses invest in cleaner technologies to meet regulatory compliance and satisfy environmentally conscious customers who demand products with reduced environmental impact. Consequently, the market is experiencing an accelerated innovation in sustainable manufacturing processes, creating new revenue streams while helping end-user industries achieve their sustainability and carbon neutrality goals.

MARKET DYNAMICS

MARKET DRIVERS

Growing Plastic Engineering Applications to Fuel Product Demand

The plastics industry drives the market growth through increased technical requirements in engineering polymers. Manufacturers require precisely calibrated conductive grades to manage electrostatic discharge in sensitive electronic components and packaging materials. Simultaneously, UV-stabilized plastics for outdoor applications depend on specialty carbon blacks with optimized particle size distribution to prevent degradation from solar radiation, extending product lifespans in construction, agriculture, and automotive surfaces.

MARKET RESTRAINTS

Stringent Environmental Regulations Constrain Traditional Carbon Black Production Methods

Environmental and regulatory pressures significantly restrict the market expansion through multiple mechanisms. Increasingly strict air emission standards limit the traditional carbon black production methods that release particulate matter, NOx, and sulfur compounds. Simultaneously, workplace exposure regulations impose substantial compliance costs on producers and processors alike. Carbon-intensive production methods face rising carbon taxes and emissions trading schemes in key markets, while regulatory classification concerns regarding potential carcinogenicity create formulation challenges for consumer-facing applications.

Download Free sample to learn more about this report.

MARKET OPPORTUNITIES

New High-Performance Applications in Electric Vehicles to Boost Market Growth

Increasing demand for electric vehicles creates substantial opportunities for specialty carbon black through specialized performance requirements. EV battery systems require high-purity conductive grades for electrode formulations and conductive packaging materials that prevent static discharge around sensitive components. Simultaneously, lightweight composite body panels incorporating UV-stabilized specialty carbon blacks protect against solar degradation while maintaining dimensional stability. The expansion of charging infrastructure further drives the demand for weather-resistant, electrically conductive polymers in charging stations and connection systems.

MARKET CHALLENGES

Expensive Raw Materials and Complex Manufacturing Processes to Hinder Market Growth

High production costs from expensive feedstock, energy-intensive manufacturing processes, and specialized equipment needs constrain market expansion by making the product less price-competitive than other alternatives. This cost barrier particularly affects small-scale manufacturers and price-sensitive end-user industries, reducing overall market penetration and limiting their adoption in emerging applications.

Segmentation Analysis

By Grade

Growth in Electronics and Electric Vehicle Production Accelerated Demand for Conductive Carbon Black Grade

Based on grade, the market is segmented into conductive carbon black, fiber carbon black, food contact carbon black, and other grades.

The conductive carbon black segment held the dominant specialty carbon black market share. This grade features carefully engineered morphology and surface chemistry to convey precise electrical conductivity in polymers, coatings, and battery applications. The growth in electronics manufacturing and expanding electric vehicle production has accelerated demand for conductive grades that provide consistent and reliable performance in increasingly sensitive components. North American and European manufacturers focus on ultra-high purity variants for premium applications, while Asian producers have rapidly expanded their capacity to serve rising regional electronics manufacturing.

Fiber carbon black is characterized by specialized particles designed to reinforce rubber and polymer systems without compromising processability. This grade exhibits distinctive morphological properties that enhance tensile strength and abrasion resistance in demanding applications such as high-performance tires, industrial belting, and specialized hoses. The growing emphasis on fuel efficiency in transportation has driven demand for reinforcing grades that contribute to lower rolling resistance in tire applications while maintaining durability standards.

By Application

Technical Requirements Compatibility in Plastic Formulations to Boost the Segmental Growth

Based on application, the market is segmented into plastics, printing inks, paints & coatings, electronics, packaging, and others.

Plastic applications represent the largest end-use segment, spanning conductive compounds for electronics housings, UV-stabilized automotive components, and color-critical consumer products. This segment demonstrates strong growth, particularly in Asia Pacific, where electronics and automotive components manufacturing continue to expand. Technical requirements continue to evolve toward lower loading levels that maintain performance while minimizing the impact on mechanical properties and processing characteristics.

Printing inks use carbon black products with stringent color strength, undertone control, and dispersibility requirements. Digital printing applications have created new opportunities for ultra-fine grades with precisely controlled particle size distributions and surface properties. This segment shows strong regional variation, with applications concentrated in North America and Europe, while volume growth is driven by increasing packaging and commercial printing operations in Asia Pacific.

Paints & coatings utilize specialty carbon blacks for UV protection, jetness (deep black color), and conductivity in specialized industrial finishes. Automotive refinish applications represent a demanding subsegment requiring exceptional dispersibility and color stability. Environmental regulations limiting solvent content have driven reformulation toward waterborne systems, creating technical challenges for carbon black dispersion that are addressed with the help of specialty grades.

Specialty Carbon Black Market Regional Outlook

The market is categorized by geography into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Specialty Carbon Black Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 1.9 billion in 2025 and USD 2.01 billion in 2026. The largest and fastest-growing regional market, at approximately 57% of global consumption. China dominates regional consumption with its massive manufacturing base spanning electronics, automotive components, and consumer goods. The region demonstrates significant variation in technical requirements, with Japan and South Korea focused on premium grades for advanced electronics, while developing markets prioritize cost-effective solutions for growing industrial applications. Regional production capacity has expanded rapidly, transforming the global supply landscape and escalating price competition across all grade categories.

North America

North America is characterized by a mature market with a strong emphasis on high-performance applications in automotive, electronics, and advanced materials. The region’s consumption is heavily weighted toward premium grades, commanding significant prices, with particular strength in conductive applications for electronics and transportation. Regulatory factors significantly influence the regional market, with strict environmental controls on manufacturing processes and growing scrutiny of carbon black in consumer-facing applications driving technical innovation and sustainability edges.

In the U.S., rising adoption of electric vehicles and high-end electronics is boosting demand for specialty carbon black in conductive and insulation applications. Additionally, growth in infrastructure and packaging industries is driving its use in advanced polymers and coatings.

Europe

Stringent regulatory requirements and a strong focus on environmental performance distinguish the European market. The region leads in developing food-contact grades meeting rigorous EU standards while driving innovation in low-PAH formulations for consumer applications. The European automotive sector is particularly important for specialty blacks used in high-performance compounding applications. However, economic uncertainties and manufacturing shifts toward Eastern Europe and Asia have created challenging market dynamics for established producers.

Latin America

Latin America, with Brazil and Mexico, represents the largest consumption centers. The region's automotive manufacturing sector drives significant demand for specialty carbon blacks in plastic components and rubber applications, while packaging applications are expected to grow as regional consumer economies develop. Limited local production capacity results in significant import dependence on premium grades, though basic specialty grades are increasingly produced within the region to serve the growing industrial applications.

Middle East & Africa

Middle East & Africa represent the smallest but one of the fastest-growing regions. The region’s specialty carbon black market growth is closely tied to developing plastic and polymer processing industries, particularly in manufacturing hubs across Saudi Arabia, UAE, and South Africa. While currently focusing on more basic specialty grades, the region showcases increasing sophistication in material requirements as manufacturing capabilities advance. Strategic investments in petrochemical integration create the potential for expanded regional production capacity, leveraging feedstock advantages.

COMPETITIVE LANDSCAPE

Key Industry Players

Sustainability Push and Evolving End-Use Demands to Surge Company’s Market Share

Leading players, including Birla Carbon, Cabot Corporation, Imerys, Orion Engineered Carbon, and Continental Carbon Company, drive growth in the market by launching advanced and sustainable products. Innovations are focused on enhancing battery performance, lightweight materials, and eco-friendly solutions. Companies are expanding production facilities to meet demand in the automotive, energy, and electronics sectors, aligning with sustainability trends.

LIST OF KEY SPECIALTY CARBON BLACK COMPANIES PROFILED

- Cabot Corporation (U.S.)

- Birla Carbon (U.S.)

- Mitsubishi Chemical Group Corporation. (Japan)

- Continental Carbon Company (U.S.)

- Tokai Carbon Co., Ltd. (Japan)

- International CSRC Investment Holdings Co., Ltd (China)

- Imerys (France)

- Zaozhuang Jiarun Chemical Co., Ltd. (China)

- Orion Engineered Carbons GmbH (Germany)

- Beilum Carbon Chemical Limited (China)

KEY INDUSTRY DEVELOPMENTS

- April 2025 – Birla Carbon announced to showcase advanced, sustainable carbon-based solutions at Chinaplas 2025, targeting high-performance applications in plastics, electronics, cables, and fibers. These innovations aim to enhance product durability, aesthetics, and conductivity.

- February 2025 – Birla Carbon declared to introduce its latest battery-grade conductive carbon black, Conductex, at InterBattery in Seoul. Produced at its South Korean plant, it is designed for energy-intensive applications.

- October 2024 – Birla Carbon inaugurated its first Asia Post Treatment (APT) plant in India. This advanced facility enhances the company’s specialty carbon black capabilities, offering improved flexibility, efficiency, and precision.

- May 2024 – Cabot Corporation launched two new REPLASBLAK universal circular black masterbatches, reUN5285 and reUN5290. These products, powered by EVOLVE sustainable solutions, offer high-gloss, high-jetness pigmentation.

- March 2024 – Cabot Corporation introduced PROPEL E8, an engineered reinforcing carbon black designed to enhance tread durability and reduce rolling resistance in electric vehicles and high-performance tires.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, grades, and applications. Also, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.7% from 2026-2034 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Segmentation

|

By Grade

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.32 billion in 2025 and is projected to reach USD 5.46 billion by 2034.

In 2025, the market value stood at USD 1.9 billion.

The market is expected to exhibit a CAGR of 5.7% during the forecast period of 2026-2034.

The conductive carbon black segment led the market by grade in 2025.

The key factor driving the market is the growing plastic engineering applications.

Birla Carbon, Cabot Corporation, Imerys, Orion Engineered Carbon, and Continental Carbon Company are the top players in the market.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us