Staffing Agency Software Market Size, Share & Industry Analysis, By Deployment Model (Cloud and On-premise), By Enterprise Type (Small and Medium-sized Enterprises and Large Enterprises), By End-user (BFSI, Retail & Consumer Goods, IT & Telecommunications, Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

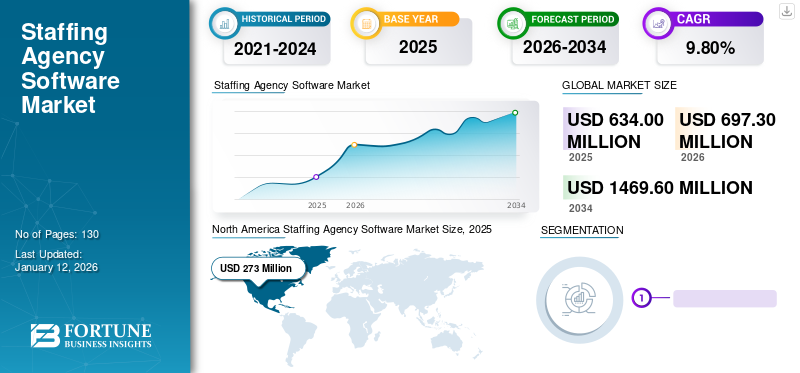

The global staffing agency software market size was valued at USD 634 million in 2025 and is projected to grow from USD 697.3 million in 2026 to USD 1469.6 million by 2036, exhibiting a CAGR of 9.80% during the forecast period. North America dominated the global staffing agency software market with a share of 43.10% in 2025.

Staffing agency software is used by staffing firms to source, recruit, and track candidates throughout the recruitment process. Further, staffing agencies hire candidates across three categories, including temp-to-hire, contract employment or short-term hire, and long-term staffing. The software provides outstanding characteristics, such as adaptability and scalability, which help in tracking the candidates, thereby contributing to the market growth.

One of the major factors propelling the market growth is the demand for a staffing agency in small and medium-sized organizations. Increasing technological developments as well as digitization in emerging countries is another factor boosting the staffing agency software market growth. For instance, in February 2022, Bullhorn, a leader in staffing and recruiting software businesses, announced the launch of Bullhorn Ventures, a corporate venture capital resource, that invests and partners with high-potential, new companies dedicated to helping staffing and recruiting firms progress operational efficiency and boost top-line growth. Initially, Bullhorn Ventures invested USD 20 million of its own money.

COVID-19 IMPACT

Pandemic Led to Notable Uptick in AI and Cloud Implementation in Staffing Agency Solutions

In 2020, companies and their employees faced unprecedented challenges as they shifted to online and work from home practices. The year was extremely challenging for recruitment agencies.

- As per the Global Recruitment Insights and Data, 2022, two out of five agencies reported year-on-year revenue losses in 2020, which hampered the demand for staffing agency software amid the pandemic.

In response to the pandemic, staffing agencies adopted virtual recruitment practices to maintain business continuity.

- As per the COVID-19 Impact Survey, staffing agencies focused on investment and utilization of recruitment technologies such as candidate sourcing, application tracking, resume harvesting, and others. Further, it stated that agencies leverage tools for communicating and relationship-building with candidates, clients, and teams.

Furthermore, most of the players are providing AI-powered platforms for smoother recruitment processes done by staffing agencies, HRs, and others. For instance,

- Skillate, an AI recruiting platform, is a refined analyzing engine that streamlines and speeds the hiring process. It delivers intelligent hiring services powered by artificial intelligence (AI), people analytics, and better applicant experiences. The platform also allows organizations to hide personal information about candidates to make fair hiring judgments.

Hence, the adoption of AI and cloud in staffing agency software is expected to propel market growth during the forecast period.

LATEST TRENDS

Download Free sample to learn more about this report.

Rising Adoption of Cloud-based Solutions in Staffing Agencies

Software as a Service (SaaS) and cloud-based software has been gradually increasing in popularity, and this trend is expected to continue. This deployment strategy is both economical and scalable, giving enterprises of all sizes opportunities and flexibility. Furthermore, it is accessible whenever and wherever consumers have an internet connection, which boosts the need for digital and social media recruiting.

- For instance, AkkenCloud is a cloud-based system that gives enterprises comprehensive access to their information anywhere, at any time. Accessing the same information in real-time from anywhere across the globe increases communication with organizations while giving maximum control and security.

SaaS solutions allow for immediate upgrades, ensuring that all of the staff have access to the most up-to-date technology. This fosters higher levels of performance and production, allowing a company to stay ahead of the competition. In addition, as compared to on-premise systems, SaaS solutions give a greater level of security.

- For instance, AkkenCloud unifies applicant tracking, customer relationship management, human resource management, reporting, email, and more, removing the need for a substantial upfront investment in several software packages and months of installation time.

Hence, cloud-based solutions are likely to propel the market growth during the forecast period.

DRIVING FACTORS

Enhancement of Existing Products by Unified Technologies to Boost the Market Growth

Organizations are primarily concerned with providing creative, efficient, and cost-effective work and project-based solutions. For instance, Oracle Fusion Cloud Human Capital Management and Oracle Fusion Cloud ERP were introduced. Oracle Fusion Cloud Human Capital Management is an excellent tool for managing activities such as talent management, workforce management, and payroll. Oracle Cloud ERP is aiding the finance and procurement teams in identifying underlying profitability drivers, improving working capital utilization, and controlling company costs.

- In December 2021, Oorwin, an AI-powered platform, announced its integration with a widely known job board, Naukri.com. The integration with Oorwin's ATS permits recruiters to post positions on Naukri directly from the Oorwin's website. It makes the process easier for recruiters to hire people quickly and simply. Additionally, this integration also provides recruiters with the specifics of the positions that are advertised from the dashboard itself. The recruiters can automatically extract resumes from applicants that are applied on Naukri into Oorwin for particular jobs that are advertised on Oorwin, owing to this update.

Therefore, enhancements in the existing products by integrating technologies, such as AI, are likely to propel the market growth.

RESTRAINING FACTORS

Technical Limitations to Impede the Market Growth

Some organizations, such as Amazon, have demonstrated preconceptions that are reinforced through hiring tools. The screening engine was shown to favor phrases commonly used by male candidates, resulting in unintended inequity that made it more difficult for female applicants to qualify. Biases may be increased by technology since recruitment software programs must be customized by a person.

Since staffing agency software adheres to predetermined criteria, individuals who think outside the box may be excluded from consideration for reasons unrelated to their abilities or fit. For instance, a candidate who would have been great for the organization based on "soft" talents such as communication and creativity might get neglected as they might lack certain qualifications or sufficient experience to compete with other applicants.

Due to formatting difficulties, certain resumes may be overlooked by recruitment software. While recruiters are unaware of the problem, this might disqualify highly competent candidates from consideration or change the way their CV is seen. It's critical to ensure that a system exists to double-check the software frequently to ensure that technical challenges do not hinder recruiting.

Although the software can help to speed up and simplify many aspects of the hiring process, it should not be used to make final decisions or take complete control of the process.

Hence, the aforementioned factors may hinder the market growth.

SEGMENTATION

By Deployment Model Analysis

Surging Applications in Various Sectors to Fuel Cloud-based Solutions Adoption

Based on deployment model, the market is categorized into cloud and on-premise.

The cloud segment is projected to dominate the market with a share of 68.81% in 2026.The increasing adoption of cloud technologies in industries is surging the demand for cloud-based staffing agency software. For instance,

- In December 2021, CEIPAL Corp partnered with CloudCall, a cloud-based software provider, to expand CEIPAL’s customer relationship management software capabilities. The collaboration of CEIPAL with CloudCall would be providing access to communication technology to staffing professionals to engage with candidates while hiring.

Also, this technology provides an efficient and rapid process to source, recruit, and track candidates throughout the recruitment process that improves optimization and capacity to compete. The growth of on-premises is lowering as only a few large enterprises with maximum spending capacity are investing in this technology.

By Enterprise Type Analysis

Availability of Operation Optimization at Lower Cost to Fuel Adoption by Large Enterprises

Based on enterprise type, the market is divided into small and medium-sized enterprises and large enterprises.

The large enterprises segment is expected to lead the market, accounting for 74.00% of the total market share in 2026. Large enterprises were early users of the software and are likely to account for the majority of revenue during the forecast period. The software provides major businesses with effective recruitment solutions and services.

Small and medium-sized enterprises segment is expected to showcase the highest CAGR during the forecast period owing to low cost and excellent capabilities. By reducing unnecessary stages, the software improves the staffing experience and speeds up the recruitment process. The software is being used by SMEs with a few employees to improve their decision-making capabilities. As a result, demand for this software from small and medium-sized businesses is predicted to rise, assisting the market growth.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

IT & Telecommunications Segment to Grow at a Higher CAGR Due to Fast-paced and Technical Nature of the Field

As technology becomes an essential part of a firm's success, the demand for quality IT & telecommunications professionals has grown significantly. By applying staffing agency solutions in IT & telecom agencies, organizations can streamline their hiring process while attracting top technical talent. Due to the fast-paced and highly technical nature of the field, the IT & telecommunications segment will grow at a higher growth rate during the forecast period. Furthermore, by increasing their group of qualified job applicants, businesses can cut hiring costs, streamline the IT recruiting process, and enhance candidate quality. For instance,

- In July 2022, Bullhorn announced that it acquired SourceBreaker, a Bullhorn Marketplace partner, and a rapidly growing provider of market search and matching solutions. The intuitive solutions of SourceBreaker make it easier for recruiters to find the finest talent in inner and outer databases. The acquisition has further enhanced Bullhorn's talent engagement solutions across the entire candidate lifecycle, from recruitment to onboarding, engagement, and redeployment.

REGIONAL INSIGHTS

North America Staffing Agency Software Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Geographically, the market is studied across five key regions, North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further categorized into countries.

North America

North America is anticipated to lead the staffing agency software market share. High penetration of advanced technologies such as cloud, AI, and others is boosting the growth of software in North America. Cloud-based solutions offer robust processing and ease of accessing the software for organizations, thereby fueling the market. The U.S. market is projected to reach USD 194.9 billion by 2026.

Similarly, the growing adoption of cloud solutions by SMEs would propel the market growth. Prominent players in this industry, such as Bullhorn, Zoho Corporation Pvt. Ltd., Avionte, CEIPAL Corp, and others, are focusing on acquisitions and product launches, thereby propelling the market growth in the region. For instance,

- January 2022 - Bullhorn announced that it acquired Able, a Bullhorn Marketplace partner and the supplier of leading candidate engagement and onboarding solutions. With this acquisition, Bullhorn has made its most significant investment to help staffing agencies around the world modernize their business in a time of continuous digitization.

Asia Pacific

The Japan market is projected to reach USD 24 billion by 2026, the China market is projected to reach USD 32.3 billion by 2026, and the India market is projected to reach USD 36.6 billion by 2026. The market in Asia Pacific is highly fragmented, owing to an increasing number of players, whose major focus is to expand their geographical presence by offering customized services to clients across developing nations worldwide.

- According to the Asian Development Bank (ADB) Institute survey, the unemployment rate increased by 20% across the globe in 2020 due to the COVID-19 pandemic. Further, as per the survey, Asia Pacific lost 8% of working hours in 2020. The growing government initiatives and increasing support for businesses are expected to create new job opportunities among enterprises.

Europe

Europe is likely to have a dominant position in the market. In terms of expanding investments and finances, the region's staffing industry is the second largest. Players in the market are focusing on expanding their geographical presence by offering customized services to clients across nations worldwide. The UK market is projected to reach USD 48.5 billion by 2026, while the Germany market is projected to reach USD 52.9 billion by 2026.

- In July 2021, Avionté introduced Avionté+, a collaboration initiative designed to streamline the Tech Stacks of staffing firms. The Avionté+ platform enables quick deployment and excellent compatibility between Avionté software over and 60 pre-integrated technology partners and third-party partners.

The Middle East & Africa is expected to have a substantial growth rate owing to the rising focus on enhancing the staffing industry. Saudi Arabia, the UAE, and Qatar are investing in advanced technologies such as AI and the Internet of Things (IoT) to improve their recruitment system. South America is anticipated to showcase steady growth with increasing research and development for staffing agency software in the region.

KEY INDUSTRY PLAYERS

Key Players Emphasize Advanced Solutions to Strengthen their Positions

Key players are focusing on Research & Development (R&D) activities to develop a comprehensive range of staffing agency software offering to meet the customer's and organization's needs. The launch of advanced software assists players to sustain their business competence. The enhancement and expansion of the existing product portfolio uplift the position of vendors in the market. Market players are focused on development of the software based on emerging technologies such as cloud, AI, and others. Companies are focusing on developing cloud-based, mobile-friendly staffing agency software, with the growing consumer demand for automated and flexible software.

April 2022 – AkkenCloud partnered with Sense, an engagement and communication solution provider. Through this partnership, recruiting and staffing agencies can leverage both platforms efficiently and increase retention rate.

August 2021 – PCRecruiter integrated with Integration Platform (IPaaS), Zapier. Through this integration, PCRecruiter customers can customize workflows and automate tasks. The combination would allow customers to create links between applications of Zapier and PCRecruiter.

List of the Key Companies Profiled:

- Zoho Corporation Pvt. Ltd. (India)

- Ramco Systems Ltd (India)

- Bullhorn, Inc (U.S.)

- Avionté (India)

- CEIPAL Corp (U.S.)

- Main Sequence Technology, Inc. (U.S.)

- Vincere (U.K.)

- AkkenCloud (U.S.)

- JobDiva (U.S.)

- JobAdder (Australia)

KEY INDUSTRY DEVELOPMENTS:

- March 2023 – Avionté launched Avionté 24/7 ONBOARD, a broad, mobile-supported onboarding solution, that allows employees to perform all tasks from their smartphones while providing real-time updates to recruiting staff through the AviontéBold onboarding platform.

- November 2022 – AkkenCloud released the integration with Hubspot, a leader in inbound marketing. To eliminate duplicate records and incomplete data, this integration enabled them to streamline their customer relations management system, applicant tracking system as well as marketing platform.

- September 2022 – Essential StaffCARE (ESC) announced its partnership with AkkenCloud to provide an integrated affordable medical benefits platform solution. ESC offers products curated to work together, delivering the coverage required by the Affordable Care Act at low cost for employers to ensure that compliance is maintained.

- July 2022 – Bullhorn launched the Bullhorn Talent Platform to help companies build deeper connections throughout their entire recruitment process. The talent involved in this end-to-end solution is engaged at any stage of the employment lifecycle, from job application through recruitment and redeployment.

- April 2022 – Avionté introduced an improved approach to background checks. In the AviontéBOLD platform, clients are now able to submit a single or multiple requests from one provider with just a few steps. Avionté has made the background screening process within AviontéBOLD even simpler for recruiters by implementing self-service integration setup.

REPORT COVERAGE

The global staffing agency software market research report includes prominent regions to get a better understanding of the market. Furthermore, the report provides insights into the most recent industry and market trends as well as an analysis of technologies that are being adopted at a quick rate on a global scale. It also emphasizes some of the growth-stimulating restrictions and elements, allowing the reader to obtain a thorough understanding of the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 9.80% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Deployment Model, Enterprise Type, End-user, and Region |

|

By Deployment Model |

|

|

By Enterprise Type |

|

|

By End-User |

|

|

By Region |

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market is projected to reach USD 1469.6 million by 2034.

In 2025, the market stood at USD 634 million.

The market is projected to grow at a CAGR of 9.80% during the forecast period (2026-2034).

By deployment model, the cloud segment is likely to lead the market.

Rising advancement in digital technologies by staffing agencies is expected to fuel the market.

Zoho Corporation Pvt. Ltd., Ramco Systems Ltd, Bullhorn, Inc, Avionté, CEIPAL Corp, Main Sequence Technology, Inc, Vincere, AkkenCloud, JobDiva, and JobAdder are the top players in the market.

North America is expected to hold the highest market share over the forecast period.

By enterprise type, the small and medium-sized enterprises segment is expected to grow with the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us