Steel Fiber Market Size, Share & Industry Analysis, By Type (Hooked-End, Crimped, Straight, and Others), By Application (Industrial Floors, Pavements, Tunneling, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

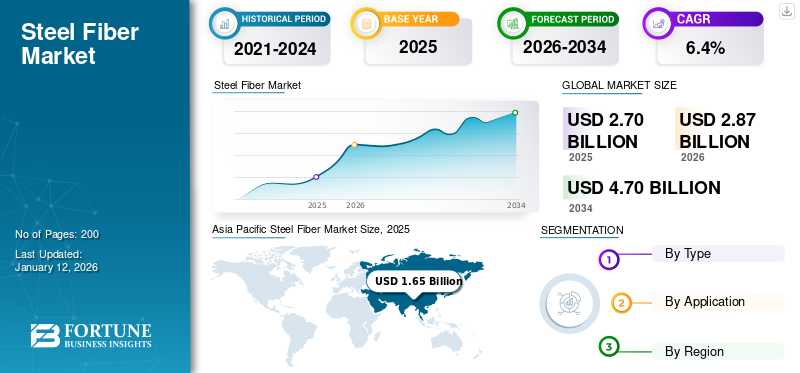

The global steel fiber market size was valued at USD 2.7 billion in 2025. The market is projected to grow from USD 2.87 billion in 2026 to USD 4.7 billion by 2034, exhibiting a CAGR of 6.40% during the forecast period. Asia-specific dominated the global market with a share of 61% in 2025.

Steel fibers are short, discrete lengths of steel with various shapes and aspect ratios that are mixed into concrete to enhance its performance. When uniformly distributed, they act as reinforcement, improving the material’s tensile strength, ductility, crack resistance, and impact durability, making concrete suitable for demanding applications such as industrial floors, tunnels, pavements, and precast elements. The market growth is closely tied to global construction activity, urban development, and the adoption of fiber-reinforced concrete as an alternative to conventional reinforcement methods.

Furthermore, the market encompasses several major players with Bekaert, ArcelorMittal, Nippon Seisen Co., Ltd., Fibrometals, and Green Steel Group at the forefront. Broad portfolio with innovative product launch, and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Construction & Infrastructure Expansion to Propel Market Growth

The global construction industry is undergoing rapid expansion, particularly in emerging economies across Asia Pacific, the Middle East, and Africa. Mega projects such as airport runways, metro systems, industrial complexes, and large-scale housing developments are fueling demand for high-performance construction materials. Steel fibers are increasingly preferred in these projects as they improve crack resistance, enhance impact strength, and extend the service life of concrete.

- For instance, industrial flooring in logistics hubs and warehouses often employs steel fiber-reinforced concrete (SFRC) to handle heavy machinery and forklift traffic.

- In tunnels and underground structures, fibers reduce spalling and improve fire resistance, which is critical for long-term durability and safety.

- According to the Global Infrastructure Hub, annual global infrastructure investment needs are projected to surpass $3.7 trillion by 2035, which directly supports the product's growth potential in high-durability construction solutions.

MARKET RESTRAINTS

Price Volatility for Steel Feedstock to Restrict Market Expansion

One of the biggest restraints for the market is the volatility of raw material prices, particularly steel wire rod, which is the primary feedstock. Steel prices are influenced by global supply-demand imbalances, energy costs, and geopolitical tensions.

- Since they are used in large volumes for flooring, pavements, and precast elements, even a 5-10% swing in steel prices can significantly impact project economics.

- The inability to fully pass on these costs to end users creates uncertainty for suppliers and may hinder adoption in projects with tight budgets.

MARKET OPPORTUNITIES

Urbanization & Transport Projects to Create Lucrative Growth Opportunities

The rapid pace of urbanization and transport infrastructure development is expected to create significant opportunities in the market. With 68% of the world’s population expected to live in urban areas by 2050 (UN forecast), there is growing demand for durable pavements, bridges, ports, and repair works.

- Heavy-duty pavements in container yards and port facilities are increasingly using SFRC, which provides better load-bearing capacity and wear resistance than plain concrete.

- Steel fibers are also proving valuable insights in rehabilitation projects, where they are applied in thin overlays to strengthen existing pavements and extend their service life.

- For example, China’s Belt and Road Initiative (BRI) has triggered large-scale highway and port construction projects across Asia and Africa, many of which incorporate advanced concrete reinforcement technologies, including steel fibers.

Additionally, the push for sustainable construction is boosting the role of SFRC, as it reduces the volume of traditional reinforcement required and optimizes material usage.

STEEL FIBER MARKET TRENDS

Shift to Fiber-Reinforced Concrete (FRC) is one of the Significant Market Trends

The move toward fiber-reinforced concrete is one of the most significant trends reshaping the market. While traditional reinforcement with steel rebar remains dominant, fibers are gaining ground in select applications due to their ability to be mixed directly into concrete. This allows faster placement and reduces the need for extensive rebar installation. Lifecycle cost savings are also an advantage since SFRC structures often exhibit reduced maintenance needs compared to conventionally reinforced concrete.

- For instance, in European transport infrastructure, SFRC has been adopted in tram and light rail slab tracks, where reduced cracking and higher fatigue resistance are crucial. Similarly, in India, contractors for airport taxiways have begun incorporating the product to minimize joint failures and increase pavement lifespan.

MARKET CHALLENGES

Fragmented Supply Base and Quality Issues to Hamper Market Growth

The market is characterized by a highly fragmented supply base, with numerous regional manufacturers offering fibers of varying shapes, lengths, and aspect ratios. Unlike steel rebar, which has well-established global standards, such as ASTM, EN, and IS codes, steel fiber standards are still evolving and not uniformly applied across regions.

For instance, in India and parts of the Middle East, large infrastructure contractors have reported variability in fiber performance from local suppliers, pushing them to import from established global brands at higher costs, reducing the competitiveness of local markets.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

High Demand for Hooked-end Contributed to Segmental Growth

On the basis of the segmentation of type, the market is classified into hooked-end, crimped, straight, and others.

The hooked-end segment held the largest steel fiber market share 58.89% in 2026 and is expected to experience substantial growth, driven by rising demand. Their unique geometry ensures strong mechanical anchorage within the concrete mix, resulting in superior pull-out resistance, enhanced load transfer, and effective crack control, making them a preferred choice for heavy-duty applications. Industries increasingly adopt hooked-end fibers for industrial flooring, tunnel linings, airport pavements, and precast segments, where long service life and resistance to structural stresses are critical.

The growth of the crimped segment is driven by its cost-effectiveness and ease of mixing, particularly in markets where price sensitivity is a deciding factor. Their wavy, crimped shape allows for better dispersion in concrete, reducing clumping and ensuring more uniform reinforcement. These fibers are commonly used in thin overlays, road repairs, tunnel rehabilitation, and sprayed concrete (shotcrete), offering adequate crack control without the higher costs associated with premium fiber types. As construction activities grow in developing economies, crimped fibers are finding a broader role in mid-strength concrete applications, especially where budgets are tight but performance improvements are still necessary.

The straight segment is projected to experience significant growth in the coming years. It is finding a niche in specialized and high-performance concrete applications. Its main strength lies in providing excellent tensile properties, making it suitable for high-performance concrete (HPC) and ultra-high-performance concrete (UHPC) mixes. These fibers are used in military structures, blast-resistant facilities, and advanced precast elements, where the need for extreme durability outweighs cost considerations.

By Application

To know how our report can help streamline your business, Speak to Analyst

Industrial Floors Segment to grow with Fastest CAGR during Forecast Period

Based on application, the market is segmented into industrial floors, pavements, tunneling, and others.

The industrial floors segment dominates the market, driven by the need for enhanced durability and reduced maintenance costs. Heavy machinery, forklifts, and constant traffic in warehouses and manufacturing units place significant stress on concrete surfaces. Steel fibers improve load-bearing capacity, control crack formation, and extend service life, making them an attractive alternative to traditional reinforcement methods. Additionally, their ability to shorten construction time and reduce the requirement for joint spacing further encourages adoption in industrial floors. Furthermore, the segment is set to hold a 37.28% share in 2026.

The pavements segment is also experiencing favorable growth over the projected period. In pavement construction, the product is gaining popularity due to its role in increasing flexural strength and fatigue resistance. Roads, highways, and airport runways face high traffic loads and frequent thermal cycles, which can lead to cracking and deterioration. Steel-based fibers distribute stresses more evenly and provide long-term resilience against wear and tear. Growing investments in infrastructure modernization, coupled with the need for sustainable and cost-efficient pavement solutions, are pushing contractors and governments toward SFRC. In addition, pavements applications are projected to grow at a CAGR of 6.2% during the study period.

Steel Fiber Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Steel Fiber Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific held the dominant share in 2025, valued at USD 1.65 billion, and also took the leading share in 2026 with USD 1.76 billion. The factors fostering the dominance of the region include rapid urbanization and mega-infrastructure projects. China and India are heavily investing in highways, airports, and metro rail networks, where the product is increasingly used for durability and speed of construction. Rapid industrialization and the establishment of new manufacturing hubs are also boosting the use of steel-based fibers in industrial flooring. Growing awareness about cost efficiency and structural resilience further accelerates adoption across this region. In 2026, the China market is estimated to reach USD 1.04 billion.

- China is one of the largest and fastest-growing markets, supported by rapid urbanization and continuous infrastructure expansion. Massive investments in metro rail systems, underground transportation corridors, and hydroelectric tunneling projects are significantly increasing the use of steel fibers in shotcrete applications.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is anticipated to witness a notable growth in the coming years. During the forecast period, the European region is projected to record a growth rate of 5.8%, which is the second highest amongst all the regions, and touch the valuation of USD 0.49 billion in 2025. Major metro rail and cross-border tunnel projects are driving the adoption of steel-based fibers in shotcrete applications. The region’s emphasis on reducing lifecycle costs and promoting green construction solutions also supports steel fibers, as they minimize material usage compared to conventional reinforcement. Backed by these factors, countries including the U.K. are expected to record the valuation of USD 0.09 billion, Germany to record USD 0.08 billion, and France to record USD 0.08 billion in 2026.

North America

After Europe, the market in North America is estimated to reach USD 0.37 billion in 2025 and secure the position of the third-largest region in the market. The rise of e-commerce is increasing the demand for durable industrial floors that can withstand heavy equipment and high throughput. Additionally, government spending on highway upgrades and airport expansions, along with stringent standards for concrete performance, supports the use of SFRC in pavements and transport infrastructure. In 2026, the U.S. market is estimated to reach USD 0.33 billion.

Latin America and Middle East & Africa

Over the forecast period, the Latin America and the Middle East & Africa regions would witness a moderate steel fiber market growth. The Latin America market in 2025 is set to record USD 0.06 billion in its valuation. The growth of the market is driven by ongoing infrastructure modernization and the push for durable construction solutions in challenging climates. In the Middle East & Africa, GCC is set to attain the value of USD 0.06 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Product Innovation R&D and Sustainability Initiatives are Essential Aspects for Growth of Companies Operating in Market

Large players leverage scale, R&D, and sustainability initiatives to maintain a competitive edge, while regional companies capitalize on cost efficiency and proximity to local infrastructure projects. Some of the key market players include Bekaert, ArcelorMittal, Nippon Seisen Co., Ltd., Fibrometals, and Green Steel Group. Product innovation, including new fiber geometries and eco-friendly materials, remains a critical strategy as customers demand higher performance and lower lifecycle costs. Increasingly, partnerships and expansions in the Asia Pacific are shaping competition, given the region’s booming infrastructure development.

LIST OF KEY STEEL FIBER COMPANIES PROFILED

- Bekaert (Belgium)

- ArcelorMittal (Luxembourg)

- Nippon Seisen Co., Ltd. (Japan)

- Fibrometals (Romania)

- Green Steel Group (Spain)

- Spajic (Serbia)

- Jiangsu Shagang Group (China)

- Zhejiang Boen Metal Products Co., Ltd. (China)

- Hunan Sunshine Steel Fiber Co., Ltd. (China)

- Yuthian Zhitai Steel Fiber Manufacturing Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- June 2025: ArcelorMittal completed the acquisition of Nippon Steel’s 50% stake in the AM/NS Calvert facility (Alabama, USA), renaming it “ArcelorMittal Calvert.” The site is being upgraded with investments, including a new electric-arc furnace (EAF) capable of producing lower-CO₂ steel.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.4% from 2026-2034 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By Type, Application, and Region |

|

By Type |

· Hooked-End · Crimped · Straight · Others |

|

By Application |

· Industrial Floors · Pavements · Tunneling · Others |

|

By Region |

· North America (By Type, Application, and Country) o U.S. o Canada · Europe (By Type, Application, and Country/Sub-region) o Germany o France o U.K. o Italy o Rest of Europe · Asia Pacific (By Type, Application, and Country/Sub-region) o China o India o Japan o South Korea o Rest of Asia Pacific · Latin America (By Type, Application, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Type, Application, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

The global steel fiber market size is projected to grow from $2.87 billion in 2026 to $4.7 billion by 2034.

In 2025, the market value stood at USD 1.65 billion.

The market is expected to exhibit a CAGR of 6.4% during the forecast period.

The hooked-end segment led the market by type.

The key factors driving the market are the rising demand for durable industrial floors, urbanization, and growing awareness about cost efficiency and structural resilience.

Bekaert, ArcelorMittal, Nippon Seisen Co., Ltd., Fibrometals, and Green Steel Group are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

The ongoing infrastructure modernization and the push for durable construction solutions in challenging climates are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us