Stomach Cancer Treatment Market Size, Share & Industry Analysis, By Drug Type (Programmed Cell Death Protein 1 (PD-1) Inhibitors, Human Epidermal Growth Factor Receptor (HER2) Antagonists, and Others), By Disease Indication (Gastric Adenocarcinoma, Gastrointestinal Stromal Tumor (GIST)), By Route of Administration (Oral and Parenteral) By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

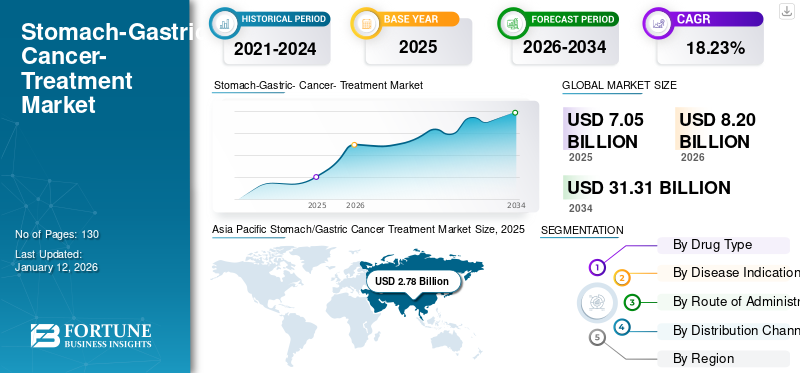

The global stomach cancer treatment market size was valued at USD 7.05 billion in 2025 and is projected to grow from USD 8.2 billion in 2026 to USD 31.31 billion by 2034, exhibiting a CAGR of 18.23% during the forecast period. Asia Pacific dominated the global market with a share of 39.38% in 2025.

Stomach cancer is the fifth most common cancer in the world. According to Cancer Research U.K., 6,697 gastric carcinoma cases are diagnosed each year. Stomach cancers are classified into three types. Gastric Adenocarcinoma is the most common type of stomach cancer and accounts for 90%-95% of stomach cancer cases. Gastrointestinal Stromal Tumor (GIST) and Gastric Neuroendocrine Tumors (gNET) are rare in nature. Rising incidence of cancer cases and limited drugs as first-line treatment are the major factors that have encouraged many pharmaceutical giants to conduct research for the development of novel drugs.

This has also paved the way for many significant strategic collaborations between pharmaceutical companies. For example, in March 2019, AstraZeneca entered into a development and commercialization agreement with Daiichi Sankyo, Inc., for trastuzumab deruxtecan, an antibody-drug conjugate under investigation for gastric carcinoma. As a result, the stomach cancer treatment market is receiving a lot a traction. In addition to this, active government support is also expected to boost the market.

Download Free sample to learn more about this report.

Programmed Cell Death Protein 1 (PD-1) inhibitors are considered to be the rising star in the market. Owing to the positive and effective results of PD-1 blocking antibody, they are actively being adopted for the treatment of gastric carcinoma. Apart from this, the launch of biosimilars of trastuzumab and the rapid adoption of biosimilars in oncology is booming the market for gastric cancer treatment.

Stomach Cancer Treatment Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 7.05 billion

- 2026 Market Size: USD 8.2 billion

- 2034 Forecast Market Size: USD 31.31 billion

- CAGR: 18.23% from 2026–2034

Market Share:

- Asia Pacific dominated the stomach cancer treatment market with a 39.38% share in 2025, driven by the high incidence of gastric cancer in countries like Japan, China, and India, along with the rapid adoption of PD-1 inhibitors and targeted therapies.

- By drug type, PD-1 inhibitors are expected to witness remarkable growth during the forecast period, supported by increased research, regulatory approvals (e.g., Keytruda), and positive treatment outcomes in gastric carcinoma patients.

Key Country Highlights:

- Japan: High stomach cancer incidence (115,546 cases in 2018), strong adoption of PD-1 inhibitors, and favorable reimbursement policies are driving market demand.

- United States: Rising prevalence of gastric cancer (estimated 27,510 new cases in 2019), strategic collaborations, and FDA approvals for PD-1 inhibitors such as Keytruda are fueling growth.

- China: Largest stomach cancer burden globally (456,124 cases in 2018), with increasing investment in novel therapies, government healthcare initiatives, and rapid uptake of targeted drugs.

- Europe: Growth supported by product launches, strategic collaborations (e.g., Boehringer Ingelheim & PureTech Health), and favorable healthcare reimbursement for targeted gastric cancer therapies.

MARKET DRIVERS

“Rising Prevalence of Gastric Cancer to Fuel the Market”

Stomach cancer is emerging as a leading cause of death across the world. According to WHO, the incident cases of stomach cancer are estimated to increase from 1.03 million in 2018 to 1.24 million by 2025. This increasing prevalence of gastric carcinoma is expected to boost the demand for gastric cancer treatment during the forecast period and become one of the leading stomach cancer treatment market trends.

Furthermore, the rapid adoption of advanced diagnostic tools for the early detection of stomach cancer is raising the patient population. This is anticipated to favor the stomach cancer drugs market growth during the forecast period

“Presence of Potential Pipeline Candidates to Boost the Market”

Many pharmaceutical companies are actively investing in the research and development of novel drugs for the treatment of stomach cancer. Many potential candidates are in their end stages of development and are projected to give a tremendous boost to the market after their launch. For example, in November 2019, Pfizer and EMD Serono, Inc. announced positive results from their phase III clinical study on avelumab for the treatment of advanced gastric cancer. In addition to this, various biosimilars of trastuzumab are either entering the market or are under development. This, coupled with an increasing preference for biosimilars for cancer treatment, is poised to surge the market.

On the contrary, high cost of the drugs and stomach cancer treatment side effects are the major factors that are expected to hinder the stomach cancer therapeutics market.

SEGMENTATION

By Drug Type Analysis

“PD-1 Inhibitors Segment to Witness Remarkable Growth”

On the basis of drug type, the market can be segmented into Programmed Cell Death Protein 1 (PD-1) inhibitors, Human Epidermal Growth Factor Receptor (HER2) antagonists, Vascular Endothelial Growth Factor Receptor (VEGFR) antagonists, and others. The PD-1 inhibitors segment is estimated to account for the maximum portion of the market with a share of 62.56% in 2026. owing to the increased research on PD-1 inhibitors and new product approvals. In September 2017, Keytruda received FDA approval for the treatment of stomach cancer. This is anticipated to accelerate the growth of the PD-1 inhibitors segment.

To know how our report can help streamline your business, Speak to Analyst

The presence of potential pipeline candidates and the green signal from the government for biosimilars of trastuzumab are expected to drive the growth of the HER2 antagonists segment during 2024-2032. The VEGFR antagonists segment is projected to expand owing to the rising prevalence of stomach cancer, new product launches, and favorable health reimbursement. The prominent use of Lonsurf, fluorouracil, capecitabine, and other chemo drugs as the first line of treatment for gastric carcinoma are the primary reasons responsible for the growth of the others segment. Stomach cancer treatment chemotherapy is a widely preferred option in developing countries which is positively impacting the others segment.

By Disease Indication Analysis

“Gastric Adenocarcinoma Segment to Dominate the Market”

Based on disease indication, the stomach cancer treatment market can be segmented into gastric adenocarcinoma, gastrointestinal stromal tumors (GIST), and gastric Neuroendocrine Tumors (gNET). The gastric adenocarcinoma segment is likely to dominate the market with a share of 74.26% in 2026. throughout the forecast period owing to the rising prevalence of gastric adenocarcinoma and rapid adoption of targeted therapy and immuno-checkpoint inhibitors for the treatment of gastric adenocarcinoma. Potential pipeline candidates and the growing trend of research collaborations are expected to favor the expansion of gastrointestinal stromal tumors and gastric neuroendocrine tumors segments.

By Route of Administration Analysis

“Parenteral Segment to Register the Maximum CAGR”

On the basis of route of administration, the market can be segmented into oral and parenteral is anticipated to hold a dominant market share of 85.36% in 2026.. Favorable reimbursement and the presence of more intravenous drugs for treating stomach cancer are poised to surge the parenteral segment. On the other hand, convenience with oral drugs and increasing sales of Lonsurf and Afinitor are likely to propel the demand for oral drugs.

By Distribution Channel Analysis

“Strong Government Support to Favor the Hospital Pharmacy Segment”

In terms of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. Strong government support for cancer treatment through establishment of government-aided hospitals and pharmacy and favorable reimbursement are the major factors attributable to the expansion of the hospital pharmacy segment is projected to lead the market with a 57.80% share.. The retail pharmacy segment is anticipated to grow owing to the increasing number of cancer treatment centers, rising prevalence of stomach cancer, and increasing patient pool. The online pharmacy segment is projected to witness remarkable growth during the forecast period owing to the rapid adoption of online stores for purchasing drugs and rising focus of pharmaceutical companies to strengthen their distribution networks.

REGIONAL ANALYSIS

Asia Pacific Stomach/Gastric Cancer Treatment Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific, with a revenue of USD 2.78 billion in 2025, accounted for the major portion of the stomach cancer treatment market share. The region is estimated to dominate the market throughout the forecast period. Primary factors attributed to the dominant share of Asia Pacific are the rising cases of gastric cancer especially in Japan, China and India and the rapid adoption of PD-1 inhibitors. According to WHO, the number of incident cases for stomach cancer in Japan and China was 115,546 and 456,124 respectively in 2018. This rising incidence along with new product launches are anticipated to augment the market for gastric cancer treatment in Asia. The Japan market is projected to reach USD 0.58 billion by 2026, the China market is projected to reach USD 1.67 billion by 2026, and the India market is projected to reach USD 0.39 billion by 2026.

North America

Strategic collaborations between major pharmaceutical companies, increased R&D spending, and rapid adoption of targeted therapy and immunotherapy are expected to foster the demand for gastric carcinoma drugs in North America. According to the American Society of Clinical Oncology, 27,510 people are estimated to be diagnosed with stomach cancer in 2019 in the U.S. This is likely to fuel the market for stomach cancer drugs in North America. The U.S. market is projected to reach USD 1.4 billion by 2026.

Europe

In Europe, the market is estimated to flourish owing to new product launches, favorable health reimbursement, and active government support. In April 2019, Boehringer Ingelheim, a Germany-based company, collaborated with PureTech Health, to help the company to apply PureTech’s lymphatic targeting platform to the company immuno-oncology candidate for gastric cancer. As a result, the drug can be administrated directly to the gut lymphatics. The expected launch of such drugs that can be directly administered to the site is anticipated to fuel the market in Europe. In Latin America and the Middle East & Africa, the demand for gastric carcinoma treatment is projected to boost owing to the improving health infrastructure, unmet patient needs, and the launch of new products. The UK market is projected to reach USD 0.44 billion by 2026, while the Germany market is projected to reach USD 0.5 billion by 2026.

INDUSTRY KEY PLAYERS

“Merck & Co., Inc. and F. Hoffmann-La Roche Ltd. to Lead the Market”

In terms of stomach cancer treatment market revenue, Merck & Co., Inc. and F. Hoffmann-La Roche Ltd. accounted for the leading position. Approval of Keytruda for gastric cancer in 2017 in the U.S. and Japan increased demand for the drug and this rendered Merck with the maximum share of the market in 2018. On the other hand, Roche accounted for the second position in the market owing to the rising demand for Roche’s blockbuster drug Herceptin for gastric cancer and also prominent use of Xeloda for chemo treatment.

List Of Key Companies Covered:

- Ipsen Pharma

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Bayer AG

- Celltrion Inc.

- TAIHO PHARMACEUTICAL CO., LTD.

- Jiangsu Hengrui Medicine Co., Ltd.

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Merck announced that the Phase 3 KEYNOTE-859 trial met its primary endpoint of overall survival in patients with HER2-negative gastric or gastroesophageal junction (GEJ) adenocarcinoma.

- November 2024: The FDA approved KEYTRUDA® (pembrolizumab) in combination with chemotherapy as a first-line treatment for adults with locally advanced unresectable or metastatic HER2-negative gastric or GEJ adenocarcinoma.

- May 2024: Bristol-Myers Squibb announced a 10-year strategy, ASPIRE, to expand access to its innovative treatments, including Opdivo, in low- and middle-income countries.

- July 2024: Taiho Pharmaceutical exercised an option for an exclusive license to Quemliclustat in Japan and certain territories in Asia. While this agent is under investigation for various cancers, specific applications to stomach cancer were not detailed.

REPORT COVERAGE

Stomach cancer is among the most commonly occurring cancer in the world especially in Asia. Owing to its rising prevalence and increasing patient pool, many pharmaceutical companies are making significant investments in the development of novel therapies. Presence of promising pipeline candidates and rapid uptake of targeted and immune therapy is boosting the market.

The stomach cancer treatment market report offers an in-depth analysis of the market. It further provides details on the prevalence of stomach cancer for key countries, regulatory and reimbursement scenario for key countries, new product launches, and key industry developments such as mergers, acquisitions, and partnerships. Information on drivers, opportunities, threats, and restraints of the market can further help stakeholders to gain valuable insights into the market. The report offers a detailed competitive landscape by presenting information on key players, along with their strategies, in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Drug Type

|

|

By Disease Indication

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

The value of the global stomach cancer/gastric cancer treatment market was USD7.05 billion in 2025.

Fortune Business Insights says that the stomach cancer/gastric cancer treatment market is projected to reach USD 31.31 billion by 2034.

The value of Asia Pacific stomach cancer/gastric cancer treatment market was USD 2.78 billion in 2025.

The stomach cancer/gastric cancer treatment market is projected to grow at a CAGR of 18.23% during the forecast period (2026-2034).

Programmed Cell Death Protein 1 (PD-1) inhibitors segment is the leading segment in this market during the forecast period.

Rising prevalence of stomach cancer is the key factor driving the stomach cancer/gastric cancer treatment market.

Merck & Co., Inc. and F. Hoffmann-La Roche Ltd are the top players in the market.

Asia-Pacific is expected to hold the highest market share in the market.

Adoption of Programmed Cell Death Protein 1 (PD-1) inhibitors and research on developing biosimilars of trastuzumab are the key trends of the stomach cancer/gastric cancer treatment market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us