Sun Care Products Market Size, Share & Industry Analysis, By Product Type (Sun-protection, After-sun, and Tanning), By Form (Lotion, Spray, Stick, and Others), By SPF (0-29, 30-50, and >50), By Distribution Channel (Hypermarkets & Supermarkets, Pharmacy Stores, Online Channels, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

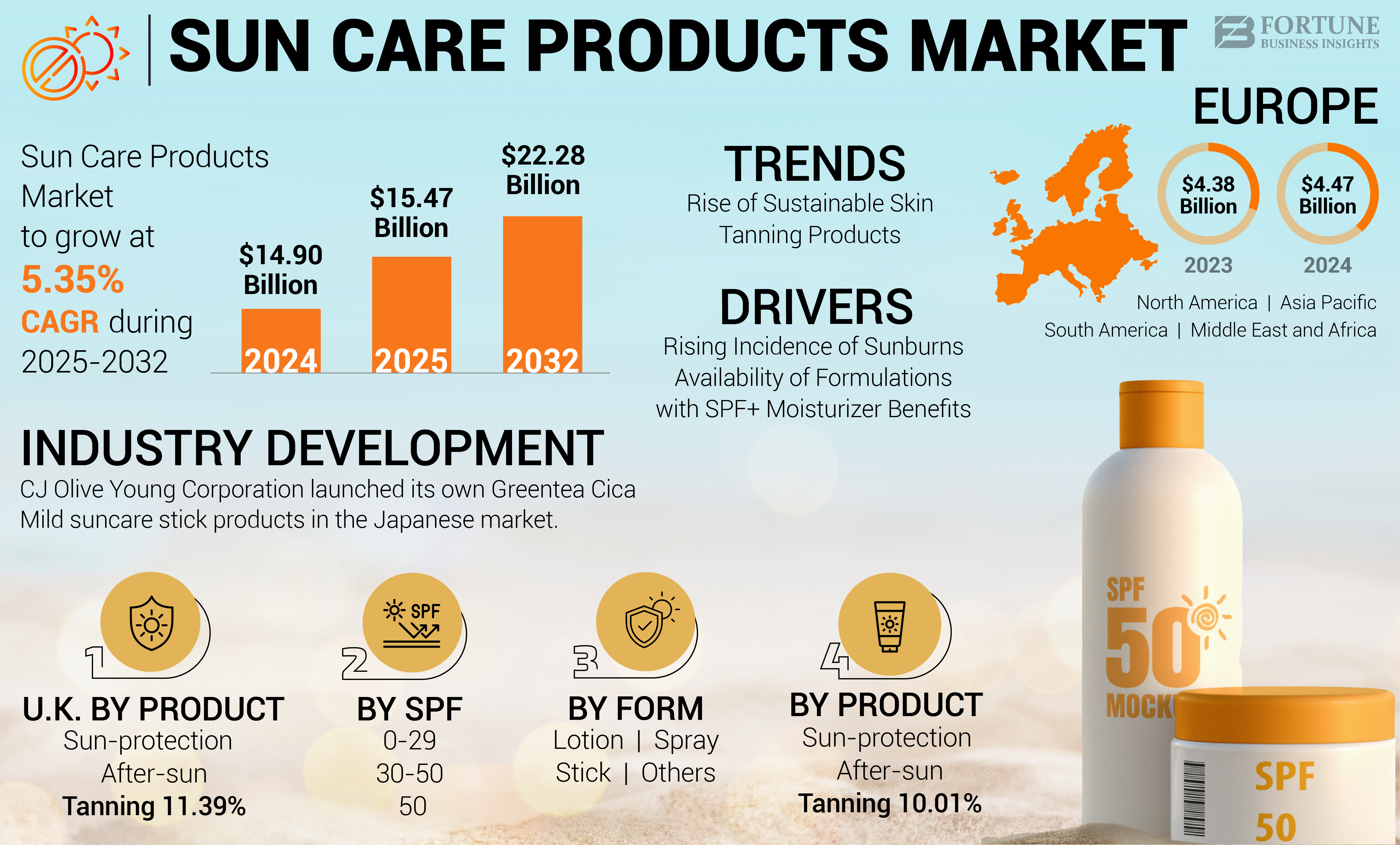

The global sun care products market size was valued at USD 14.90 billion in 2024. The market is projected to grow from USD 15.47 billion in 2025 to USD 22.28 billion by 2032, exhibiting a CAGR of 5.35% during the forecast period. Europe dominated the sun care products market with a market share of 30.% in 2024.

Incidents with sunrays with UVA I, UVA II, and UVB radiation on the skin surface often lead to severe melanomas. As per the SkinCancer Organization’s U.K. study conducted in 2023, 5,420 men and 2,570 women died because of melanomas caused by sun radiation in the U.K. Therefore, consumers are largely demanding sun care items with a higher value of SPF, as well as mineral-only sunscreens, which are primarily responsible for the burgeoning growth of the global sun care market.

The tourism and hospitality sector holds a significant market for sun care products, which experienced a downturn due to travel restrictions and decreased consumer confidence in travel. This led to a decline in demand for sun care products typically used by tourists and travelers visiting beach destinations and resorts. For instance, Edgewell Personal Care Corporation, the owner of the popular Banana Boat sun care brand, reported about a 30% decline in organic net sales in its ‘Sun Care’ segment during the third fiscal quarter that ended on 30th June 2020.

However, despite the decline in outdoor activities, there was an increased focus on health and wellness during the COVID-19 pandemic. Consumers became more conscious of the importance of skincare and sun protection for overall health. This led to continued demand for sun care products during outdoor activities, such as walking, jogging, or gardening.

Global Sun Care Products Industry Landscape Overview

Market Size & Forecast:

- 2024 Market Size: USD 14.90 billion

- 2025 Market Size: USD 15.47 billion

- 2032 Forecast Market Size: USD 22.28 billion

- CAGR: 5.35% from 2025–2032

Market Share:

- Europe dominated the sun care products market with a 30% share in 2024, driven by high seasonal usage during holidays and summer, coupled with awareness campaigns on sun protection due to high cancer rates across the region.

- By product type, sun-protection products held the dominant share, driven by frequent reapplication needs and rising concerns over sunburn and skin aging. Lotion/cream form remains the largest segment due to its conventional usage and widespread acceptance.

Key Country Highlights:

- United Kingdom: Rising melanoma-related deaths and strong consumer demand for SPF-rich and mineral-only sunscreens are boosting product adoption.

- Australia: Annual campaigns like ‘National Skin Cancer Action Week’ and high UV exposure levels are driving sun care awareness and sales.

- United States: Demand for multi-functional products like moisturizers with SPF and makeup with sun protection is rising. Vegan and mineral-based launches (e.g., Love Sun Body) are also expanding market share.

- Saudi Arabia: Product usage is growing, especially among high-income groups, with awareness improving steadily in the Middle East & Africa region.

- Southeast Asia: Strong growth is supported by increased beach tourism and tropical climate exposure, with over 580,000 international tourists visiting the region in early 2022.

Sun Care Products Market Trends

Rise of Sustainable Skin Tanning Products to Augment Market Growth

Shifting consumer trends toward luxury cosmetic items will increase the demand for premium-quality sun care products, driving market growth. Additionally, shifting consumer preference towards self-tanning items made up of coconut oil, argan oil, and other natural ingredients will offer newer business growth opportunities for the key companies in the sustainable tanning product segment. For instance, from June 2020 to January 2022, EVERYDAY HUMANS, an eco-conscious tanning & other skincare products maker, reported a 300% jump in its overall sales of skincare products. Furthermore, the growing popularity of at-home professional tanning services among households will accelerate the global product consumption rate.

Download Free sample to learn more about this report.

Sun Care Products Market Growth Factors

Rising Incidence of Sunburns to Surge Awareness of Sun Care Products

The body’s skin, when exposed to the high intensity of sunlight for a prolonged period of time, can undergo sunburns, skin aging, and cancers. The growing skin-related concerns due to UV exposure are fueling the consumption of anti-aging sun care items. Moreover, initiatives taken by cancer care organizations for increasing sun care awareness will boost the demand for the products. For instance, the Cancer Council along with the Australasian College of Dermatologists organizes a ‘National Skin Cancer Action Week’ from 17th to 23rd November every year. The Australian population is encouraged to follow measures for skin protection from the sun through this event and it also makes them aware of early skin cancer detection. Therefore, the increasing necessity to protect the skin from sunburns will lead to higher usage of sun care items.

Availability of Formulations with SPF+ Moisturizer Benefits to Push Product Demand

Sun care products with SPF and moisturizer offer all-day protection against sun damage and dehydration. The moisturizing ingredients help keep the skin hydrated throughout the day, while the SPF protects against harmful UV rays, reducing the risk of sunburn, premature aging, and skin cancer. Therefore, women are widely seeking products that are multi-functional, such as a skin whitener equipped with sun protection, a moisturizer with sun protection, and others. As per the ‘2020 RealSelf Sun Safety Report,’ about 56% of the surveyed individuals stated to use moisturizers having SPF benefits in 2020 increased from 51% in 2019, wherein, 1 in 3 surveyed adults in the U.S. make use of makeup products having SPF ingredients.

Players in the personal care market are also developing products that can cater to changing consumer preferences. For instance, in the first week of August 2020, Love Sun Body brand launched its vegan ‘Moisturizing Mineral Face Sunscreen’ with SPF 30. The product is formulated with moisturizing ingredients such as raspberry seed oil and sunflower oil which are 100% naturally originated ingredients. Therefore, the provision of added benefits along with SPF is likely to drive sun care product sales.

RESTRAINING FACTORS

Seasonal Product Requirement and Ban on Toxic Ingredients to Limit Market Growth

Greater product demand is exhibited in holidays and summer periods. However, people are less likely to purchase these products in other seasons, which is set to limit the market expansion. Moreover, numerous ingredients are proving to be hazardous to the environment such as oxybenzone or octinoxate. The government of Hawaii, the U.S., has planned to ban the sale of sun care items containing these ingredients without a prescription from healthcare providers from January 2021.

Furthermore, the U.S. FDA has imposed several restrictions on the use of ingredients in sun-protection products that may pose a challenge to manufacturers in terms of maintaining a balance between innovative formulation and competitive pricing. Therefore, strict product formulation rules are expected to limit the sun care products market growth.

Sun Care Products Market Segmentation Analysis

By Product Type Analysis

Need for Frequent Product Re-application to Make the Sun-protection Segment Dominant

The global sun care products market analysis can be conducted based on various product types such as sun-protection, after-sun, and tanning. The sun-protection segment holds the leading market share. Sun-protection products are applied to the exposed body parts just before going into the sunlight. The American Academy of Dermatology states that the product has to be reapplied on the skin after every 2 hours when the user is outdoors, to avoid further cell damage of the skin. Also, the need for re-application has prominently resulted in greater product usage and therefore has supported higher revenue generation from the segment.

On the other hand, increasing awareness is being showcased among consumers regarding the harmful effects of the indoor tanning process with the use of an artificial source of UV exposure such as a sunbed, sunlamp, and tanning booth. This factor has immensely promoted the use of tanning sunscreen products that provide sunless tanned skin without the need for UV exposure.

To know how our report can help streamline your business, Speak to Analyst

By Form Analysis

Lotion/Cream Segment to Hold Largest Share Owing to Conventional Nature

Based on product form, the market is segmented as lotion/cream, sprays, stick/roll-on, and others (gels, masks, etc.). The lotion/cream segment holds a major share as it is considered to be the traditional form of skincare product.

However, spray type sun care items are growing significantly owing to the usage convenience, wherein colored roll-on products are gaining attention from the younger generation. For instance, CTK, a color cosmetics and body care products maker is offering body eliminators and stick formula-based sun care products in the U.S.

By SPF Analysis

0-29 SPF Segment to Remain at Forefront Backed by Cost-effectiveness of These Products

Based on SPF, the market is segmented as 0-29, 30-50, and >50. Users prefer higher SPF products for times when high-intensity UV light is expected. However, the increasing value of SPF further surges the concentration of ingredients that filters sunrays, eventually raising the product cost.

Moreover, as reported by the National Cancer Institute, SPF 15 is also enough for protection from the sun. Therefore, for daily use, where limited sun exposure is expected, consumers prefer to use lower SPF products. Several after-sun and tanning products are also offered in the non-SPF or zero SPF variants due to the growing consumer demand. Therefore, a significant sun care products market share is accounted for by the 0-29 SPF segment due to a broader application range.

By Distribution Channel Analysis

Easier Bulk Purchasing at Hypermarkets/Supermarkets to Help the Segment Grow

Based on the distribution channel, the market is segmented as hypermarkets/supermarkets, pharmacies, online, and others. The hypermarkets/supermarkets segment is expected to be the leading segment as users often prefer buying all the necessary grocery items in one place in bulk. Bulk purchasing also allows customers to avail of benefits such as discounts. However, COVID-19 has changed consumer habits and shifted their preference towards online buying which is expected to fuel the growth of the online segment. This factor has led to a growing number of online sales on e-commerce sites to boost product purchases. For instance, in May 2020, Dermstore, an online beauty products retailer, offered a discount of about 20% on essential beauty products used in summer including sunscreens and self-tanner under its Summer Sale 2020.

REGIONAL INSIGHTS

Europe Sun Care Products Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in Europe stood at USD 4.47 billion in 2024. The region holds a significant market share due to the greater product usage in holidays and the summer season. For instance, within the second week of April 2021, High Street Pharmacy, a British health and beauty retailer, reported a 300% spike in the sales of self-tanning products due to the Isle of Paradise, St. Tropez, and Bondi Sands brands’ collaboration with the Boots Limited U.K., an online pharmacy retailer in the U.K.

Furthermore, as per the study conducted by World Cancer Research Fund International (WCRF), in 2020, the cancer rate was highest in Denmark, followed by a few European countries such as Belgium, Hungary, France, Netherlands, Norway, and Slovenia. Therefore, several campaigns and awareness programs are being conducted in Europe to reduce the occurrence of skin cancer by adopting sun-protection measures that will aid in market growth.

Tropical countries such as India and Southeast Asian nations, as well as subtropical conditions in Australia and New Zealand have greatly supported the sun care products consumption in Asia Pacific as these areas are significantly exposed to the sun. Moreover, a surge in traveling and beachside tourism activities, as well as the growing popularity of sunbathing is likely to increase product sales in the region. As per the data presented by HospitalityNet Organisation, in January and February 2022, Southeast Asia welcomed more than 580,000 international visitors in the region, 102% up over the previous year.

To know how our report can help streamline your business, Speak to Analyst

Similarly, the demand for the product is increasing from other tropical countries such as Brazil, Peru, and Colombia in South America and Mexico in North America. Geographical condition is one of the reasons for the increasing awareness regarding sunscreens in these countries. Moreover, the growing disposable income and rising cancer awareness among the population will foster sun care product demand in these regions.

The Middle East and Africa held a comparatively lower share of the market owing to the presence of several lower-income countries. However, product penetration is likely to increase in the forecast period along with greater product-related awareness. For instance, as per the research titled, ‘Sunscreen Use among a Population of Saudi University Students’ published in 2020 by the Journal of Dermatology Research and Practice, about 51% of the surveyed students in Saudi Arabia used sunscreen, wherein a majority of them were from high-income families. Therefore, growing product consumption in countries such as UAE, Saudi Arabia as well as South Africa is expected to expand the market in the region.

Key Industry Players

Innovations by Raw Material Suppliers to Offer Competitive Advantage

The market is fragmented and characterized by major multi-national players such as Beiersdorf AG, Edgewell Personal Care, and Johnson and Johnson, as well as several local players. Companies have been constantly developing innovative ingredients that offer advanced sun protection properties. These ingredients may include novel UV filters, antioxidants, and photo stabilizers that improve the efficacy of sun care formulations in blocking harmful UV rays and protecting the skin from sun damage. Besides, the focus on safe, green, and highly active ingredients by manufacturers is likely to increase the competition between players. Suppliers of active ingredients or UV filters such as BASF and Galaxy Surfactants would play a vital role in the supply chain of sun care products. In May 2023, BASF SE, a global chemical company featured Tinomax CC, an optimizing sunscreen formulation that provides particle shaping and lengthy UV protection with SPF and UVA to improve skin greasiness. Therefore, highly efficient UV filters and eco-friendly ingredients are being explored by the manufacturers to gain consumers’ attention.

LIST OF TOP SUN CARE PRODUCTS COMPANIES PROFILED:

- The Edgewell Personal Care Company (U.S.)

- L’Oréal S.A. (France)

- Shiseido Co. Ltd. (Japan)

- Beiersdorf AG (Germany)

- Johnson & Johnson Services Inc. (U.S.)

- Unilever Plc. (U.K.)

- The Procter & Gamble Company (U.S.)

- Natura & Co. (Brazil)

- The Estee Lauder Companies Inc. (U.S.)

- Kao Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- May 2023 - CJ Olive Young Corporation, a South Korean health and beauty products store launched its own Greentea Cica Mild suncare stick products in the Japanese market. The product is available at Plaza, the Japanese lifestyle store.

- June 2022 – POPxo expanded its product offerings by launching POPxo Sun care range through the campaign ekdoteenapplysunscreen in India.

- September 2020 – KOKOSTAR, a Korean brand released a new Sunscreen Capsule Mask with SPF 50+ containing sunblock serum and sunscreen oil. The mask is vegan and formulated with biodegradable ingredients.

- August 2020 – Lotus Herbals, an Indian cosmetic maker acquired organic skincare company Vedicare Ayurveda Pvt. Ltd. to expand its range of organic sun protection, makeup, and skincare products.

- March 2020 – Ergodyne launched its new brand ‘Krew’d’ and entered the sunscreen market. The product range includes SPF 50 broad-spectrum and water-resistant sunscreens in lotion, spray, as well as sticks formats.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as competitive landscape, distribution channels, and leading product types & forms. Besides this, the report of the global market outlooks insights into the various market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several other factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.35% during 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Form

|

|

|

By SPF

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 14.90 billion in 2024 and is projected to reach USD 22.28 billion by 2032.

In 2024, the Europe market value stood at USD 4.47 billion.

Registering a CAGR of 5.35%, the global market is forecasted to grow during 2025-2032.

The sun-protection segment is the leading segment based on product type.

The prevalence of sunburns and skin cancer due to intense sun rays is a key factor driving the market.

Beiersdorf AG, Edgewell Personal Care, and Johson & Johnson are a few major players in the global market.

Europe dominated the market in terms of share in 2024.

The development of a broad-spectrum high SPF, mineral-only, and eco-friendly sunscreens are expected to drive the adoption of sun care products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us