Table-top Ultrasound Equipment Market Size, Share & Industry Analysis, By Type (2D, 3D, and Others), By Application (Gynecology, Cardiology, Urology, and Others), By End-user (Hospitals, Specialty Clinics, Diagnostic Imaging Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

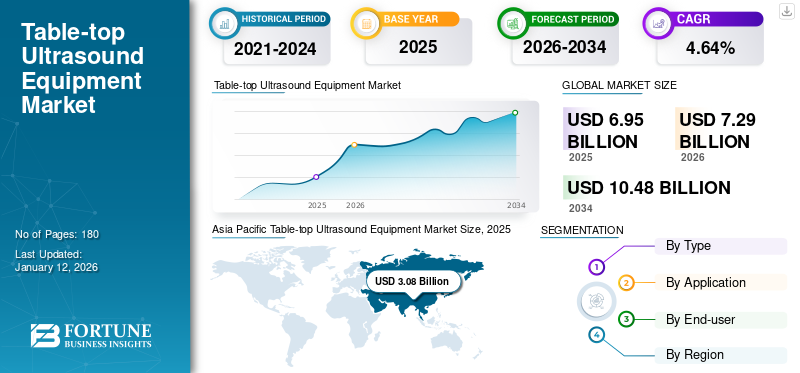

The global table-top ultrasound equipment market size was valued at USD 6.95 billion in 2025. The market is projected to grow from USD 7.29 billion in 2026 to USD 10.48 billion by 2034, exhibiting a CAGR of 4.64% during the forecast period. Asia Pacific dominated the ultrasound equipment market with a market share of 44.29% in 2025.

Table-top ultrasound equipment are stationary products that are used for a wide range of medical imaging procedures, primarily for diagnosis and monitoring of internal organs, tissues, and blood vessels among patients. The market is driven by the increasing prevalence of acute and chronic conditions such as cardiovascular conditions, urological conditions, and others, resulting in an increasing diagnosis rate among the patient population. This, coupled with the rising number of key players such as Siemens Healthineers AG, GE Healthcare, and others focusing on research and development activities to develop and introduce novel products, is anticipated to support their increasing global market share.

- According to 2024 statistics published by the Collective Minds, about 3.6 billion diagnostic procedures are performed every year globally.

Table-top Ultrasound Equipment Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 6.95 billion

- 2026 Market Size: USD 7.29 billion

- 2034 Forecast Market Size: USD 10.48 billion

- CAGR: 4.64% from 2026–2034

Market Share:

- Asia Pacific dominated the table-top ultrasound equipment market with a 44.29% share in 2025, fueled by the rising geriatric population, growing prevalence of chronic diseases, and expanding access to healthcare services across China, India, and Southeast Asia.

- By type, 3D table-top ultrasound equipment is expected to retain the largest market share in 2025, supported by the superior image quality and growing demand for advanced diagnostics in cardiovascular and gynecological conditions.

Key Country Highlights:

- Japan: Demand is driven by the need for high-resolution diagnostic imaging in an aging population, as well as technological innovation by domestic manufacturers like Canon Medical and Fujifilm.

- United States: Rising prevalence of chronic conditions, favorable reimbursement policies, and continuous innovation (e.g., AI integration by GE Healthcare) support strong adoption across hospitals and imaging centers.

- China: With over 297 million people aged 60 and above, and government efforts to expand healthcare access, the country is a major contributor to regional demand, supported by local manufacturers like Mindray.

- Europe: Growth is supported by high healthcare spending, increasing awareness of early disease detection, and rising installed base of advanced diagnostic equipment across hospitals and clinics.

MARKET DYNAMICS

MARKET DRIVERS

Growing Prevalence of Acute and Chronic Disorders to Boost the Demand in the Market

The increasing prevalence of acute and chronic conditions, such as cancer, cardiovascular diseases, and gynecological conditions, among others, is resulting in growing patient admissions for diagnosis and treatment globally. The growing geriatric population is another factor responsible for the increasing number of patient admissions in the healthcare setting globally.

- According to 2024 data published by the American Cancer Society, it was reported that about 2.0 million new cancer cases are expected to be diagnosed in 2024 in the U.S.

- According to the 2024 statistics published by The People’s Republic of China, about 297 million adults aged 60 and above are living in China.

The increasing number of patient admissions is resulting in growing diagnosis procedures among patients, further supporting the increasing demand for novel ultrasound equipment in the market. This, along with increasing benefits of table-top ultrasound equipment such as the provision of high-quality and detailed images for various medical applications, is one of the additional factors contributing to increasing demand for these devices in the market.

Additionally, increasing adoption and demand are resulting in a growing focus of prominent players toward research and development activities to develop and introduce innovative products, further supporting the global table-top ultrasound equipment market growth.

MARKET RESTRAINTS

High Cost Associated with Table-top Ultrasound Equipment to Limit Market Growth

There is an increasing demand for ultrasound imaging equipment, such as table-top ultrasound devices, in healthcare settings. However, one of the crucial factors that hinders the adoption of these products is the high cost associated with them. The direct cost involved in the purchase and implementation of ultrasound imaging equipment is very high, owing to the inclusion of development costs, service costs, and distributors’ margins. With the growing technological advancements in this product among the prominent players, the prices for these products are increasing owing to the initial manufacturing cost of the novel products with advanced technologies, which is anticipated to limit the market growth significantly, especially in emerging countries.

- For instance, according to the 2025 data published by FUJIFILM Sonosite, Inc., the price of a new table-top ultrasound equipment ranges from USD 50,000 to over USD 150,000.

Therefore, the high costs associated with these ultrasound scanners are expected to hamper the adoption rate among the population globally.

MARKET OPPORTUNITIES

Increasing Medical Applications Pertaining to Ultrasound Imaging Present Lucrative Opportunity

The ultrasound imaging technique has gained extensive acceptance in various fields of medicine. There is an increasing adoption of these devices among medical professionals due to the wide variety of medical applications associated with the products. For instance, table-top ultrasound equipment provides the ability to accurately assess the biological response to disease treatment in patients over time. This is mainly attributable to the fact that table-top ultrasound devices offer an enhanced image quality for diagnosis, thereby enabling medical professionals to make an efficient and accurate analysis of any ailment.

The use of this diagnostic imaging technique continues to grow, allowing the study of more and more body parts.

Moreover, imaging procedures have also become much faster due to the integration of advanced technology with this equipment. Point-of-care ultrasound systems (POCUS) enable faster and more accurate assessments by enabling quick detection and diagnosis among the patient population. POCUS has expanded into the subspecialties, most notably in critical care, emergency medicine, internal medicine, and anesthesia. Thus, growing benefits have shifted the preference toward point-of-care ultrasound systems, thereby expected to augment the adoption rate and global table-top ultrasound equipment market size.

- According to 2023 data published by GE Healthcare, POCUS has shown a specificity of 98% to 100% in Abdominal Aortic Aneurysms (AAA), a surgical emergency among patients.

MARKET CHALLENGES

Development of Regulated Market for Refurbished Equipment to Hamper Market Growth

There is a growing focus on research and development activities among key players, resulting in the introduction of advanced imaging devices such as table-top ultrasound equipment and others at a comparatively reduced cost. However, the demand for these products is limited, particularly from developing countries such as China, Poland, India, and others. The limited demand for these products is due to the emergence of a regulated and established market for refurbished medical devices in these nations. The domestic and international key players have emerged and are firmly expanding their portfolio in the growing industry of refurbished medical equipment.

The market for refurbished medical devices is highly concentrated on capital equipment, owing to their high costs, such as ultrasound imaging equipment, including table-top. These products have a typical life cycle of 5-7 years and are later decommissioned, which often creates a replacement market for new equipment.

This huge price difference, along with strategic initiatives implemented by the prominent players offering post-sales services, has been instrumental in the rapid development of the refurbished devices market worldwide.

- For instance, according to the 2022 data published by Ultrasound Solutions Corp., the average cost of a refurbished ultrasound scanner ranges from USD 5,000.0 to USD 15,000.0.

Other Prominent Challenges

- Skilled Workforce Shortage: The global shortage of trained sonographers and radiologists creates inefficiencies in healthcare systems, slowing diagnostic processes and limiting the use of advanced ultrasound systems. This shortage is a critical barrier to scaling ultrasound equipment adoption, especially in underserved regions.

- Infrastructure Deficits: In low-resource areas, insufficient healthcare infrastructure hinders the deployment of ultrasound equipment. Lack of maintenance expertise, funding, and technical support also contributes to reduced system effectiveness in these regions.

TABLE-TOP ULTRASOUND EQUIPMENT MARKET TRENDS

Increasing Technological Advancements in Imaging Equipment is a Prominent Trend

There has been a shifting preference toward technologically advanced systems, including table-top ultrasound scanners and others. Traditional scanners can be cumbersome and often require specialized training to operate, but with the advent of technology in the recent era, advanced models are being utilized.

- For instance, in February 2024, FUJIFILM Corporation launched the advanced endoscopic ultrasound machine ALOKA ARIETTA 850 with advanced capabilities such as enhanced detection quality in India.

The integration of technology in these table-top ultrasound equipment is crucial in the diagnosis of chronic conditions such as pancreatic cancers, stomach cancer, oesophageal and rectal early cancers, and others. Along with this, technological advancement in these devices offers improved image quality, enhanced diagnostic accuracy, and improved patient outcomes among patients across various medical fields.

Additionally, there is a growing preference for novel systems due to certain benefits, including telemedicine capability, streamlined storage/retrieval, advanced post-processing options, accurate results, and others.

The advantages mentioned above associated with these advanced machines have caused the shift from traditional to modern systems.

Download Free sample to learn more about this report.

Other Prominent Trends

3D/4D Imaging: The adoption of 3D/4D ultrasound imaging is transforming clinical practices in areas such as obstetrics, cardiology, and musculoskeletal diagnostics. These imaging modalities allow for better visualization of anatomical structures, providing more detailed insights for accurate diagnoses, especially in prenatal care.

Trade Protectionism & Regulatory Impact

The trade tensions among countries such as the U.S. and China have significantly impacted the ultrasound equipment market by raising tariffs on medical-grade components such as sensors and transducers, increasing overall manufacturing costs. Companies that rely on global supply chains for parts and materials face increased risks of supply chain disruption.

In addition, regional regulatory frameworks such as the EU Medical Device Regulation (MDR) require extensive testing and certification processes for devices, which increases costs and delays market entry for new products.

Segmentation Analysis

By Type

Increasing Adoption of 3D Table-top Ultrasound Equipment Drives Segmental Growth

Based on type, the market is classified into 2D, 3D, and others.

The 3D segment dominated the market in 2024. Increasing prevalence of cardiovascular conditions and gynecological conditions, rising per capita healthcare expenditure, growing awareness toward early diagnosis of diseases, and rapidly growing installed base per million populations for these ultrasound imaging scanners are some of the major factors that are expected to contribute to the segmental growth in the market.

- For instance, according to 2023 statistics published by Springer Nature, it was reported that there are about 190,000 ultrasound machines installed in China.

On the other hand, the 2D and others segment is expected to grow with a considerable CAGR during the forecast period. The growth is owing to increasing demand for these products among healthcare professionals, further resulting in the growing focus of key players towards R&D activities to launch innovative products in the market.

By Application

Increasing Prevalence of Gynecological Conditions to Boost the Growth in the Gynecology Segment

Based on application, the market is segmented into cardiology, gynecology, urology, and others.

The gynecology segment dominated the market in 2024. The increasing prevalence of gynecological conditions such as pelvic cancer, ovarian cysts, ectopic pregnancy, and others, along with the ability of advanced equipment to provide in-depth imaging and other factors, is likely to contribute to the rising adoption rate of these systems in the market.

- For instance, according to 2025 data published by the National Center for Biotechnology Information (NCBI), an estimated 1.0% - 2.0% of pregnancies are affected among females in the U.S.

Additionally, the cardiology segment is expected to grow with a considerable CAGR during the forecast period. The growth is due to increasing technological advancements, along with research and development activities for cardiovascular applications, which are leading to the increasing adoption of these systems in the market.

On the other hand, the urology and others segments are expected to grow during the study period. The growth is primarily owing to the growing prevalence of various types of cancer, such as lung cancer and prostate cancer, and the rising diagnosis rate among patients. This has resulted in key players focusing on R&D activities to launch novel devices, thus supporting the segmental growth.

By End-user

Growing Number of Diagnostic Imaging Centers to Boost Segment’s Growth

Among end-user, the market is divided into hospitals, specialty clinics, diagnostic imaging centers, and others.

The diagnostic imaging centers segment is likely to grow with a considerable CAGR during the study period. The growth is owing to distinct factors, such as the shift in patient preference toward diagnostic centers owing to benefits including easy accessibility, patient convenience, shorter waiting time, and others. This, coupled with the growing number of diagnostic imaging centers providing imaging scans with advanced technology, is anticipated to support the segmental growth in the market.

- For instance, according to the 2023 data published by Definitive Healthcare, there are about 19,000 imaging centers in the U.S.

Moreover, the hospitals segment is also expected to grow during the study period. The growth is owing to adequate reimbursement policies pertaining to cancer care that support patients with improved access to highly efficient imaging systems in hospitals, resulting in the growing adoption rate and demand for advanced products in these healthcare settings.

Table-top Ultrasound Equipment Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Table-top Ultrasound Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific region dominated the market and generated revenues of USD 3.08 billion in 2025. The increasing geriatric population, growing prevalence of various acute and chronic conditions, and increasing government initiatives to improve healthcare access and maternal care are some of the vital factors that are expected to boost the growth of the market. Additionally, increasing demand for advanced products, especially in India, China, and Southeast Asia, and the growing number of prominent players focusing on the development and introduction of innovative ultrasound equipment are likely to support the growth of the market in the region.

- For instance, according to 2023 data published by China’s government, approximately 297 million people in China are aged 60 and above. Thus, the growing geriatric population is resulting in an increasing diagnosis rate, further contributing to the increasing ultrasound scans among the patient population.

Europe

Europe is expected to grow with a considerable rate during the forecast period. The growth is owing to the increasing geriatric population and growing demand for advanced diagnostic solutions, further supporting the growing number of installed bases for table-top ultrasound scanners and others in both healthcare settings. Furthermore, an increasing per capita healthcare expenditure in European countries, coupled with initiatives among governmental organizations to support the growing awareness for early diagnosis of various medical conditions, is likely to support the adoption of these products in the market.

- For instance, according to 2021 statistics published by the Statistisches Bundesamt, the per capita healthcare expenditure is USD 6,167.7 in Germany.

North America

The growing prevalence of various conditions, such as cardiovascular conditions, urological conditions, high healthcare spending, advanced technology adoption, favorable reimbursement policies, and a growing number of key players focusing on acquisitions and mergers, are some of the factors supporting the growth of the market.

- In July 2024, GE Healthcare acquired clinical artificial intelligence from Intelligent Ultrasound Group PLC, with an aim to incorporate these solutions across the ultrasound portfolio, strengthening its capabilities that help workflows and enhance ease-of-use for the benefit of clinicians and patients.

U.S.

The growing prevalence of acute and chronic conditions, including cancer, cardiology disorders, gynecological disorders, among others, and technological advancements in table-top ultrasound scanners are some of the crucial factors responsible for the rising demand for these systems. This, along with the growing number of key players focusing on the establishment of new R&D centers, is also expected to support the growth of the market in the country.

Latin America

Increasing emphasis on the development of healthcare infrastructure, growing healthcare spending, rising awareness about the advantages of early diagnosis of chronic conditions, and growing government focus on increasing healthcare access are some of the vital factors contributing to the growth of the market in the region.

- For instance, according to 2023 data published by the National Center for Biotechnology Information (NCBI), Brazil’s healthcare spending increased from 8.3% of GDP in 2010 to 9.2% of GDP in 2018.

Middle East & Africa

The Middle East & Africa is expected to witness considerable growth during the forecast period. The growth is due to the growing number of healthcare facilities, coupled with increasing R&D activities to introduce novel products in the market. Furthermore, an increasing number of key players focusing on the expansion of their geographical presence in Middle East countries is likely to support the growth of the market.

- For instance, according to 2025 statistics published by International Citizen Insurance (ICI), there are approximately 600 hospitals in South Africa.

COMPETITIVE LANDSCAPE

Key Industry Players

Increasing New Product Launches by Key Players Resulted in Their Dominating Positions

The global market is consolidated with players such as GE Healthcare, Siemens Healthineers AG, and Koninklijke Philips N.V., accounting for a significant share of the market.

GE Healthcare is one of the dominant players operating in the industry. The growth is primarily due to distinct factors, including an increasing focus on R&D activities to launch advanced products, a strong focus on widening its distribution network, and acquisitions and collaborations among other players in the market.

- In October 2024, GE Healthcare launched the easy-to-use Versana Premier, a multi-purpose ultrasound system, with an aim to widen its product portfolio.

On the other hand, Siemens Healthcare AG is also growing in the market owing to the company’s increased focus on expanding its presence in emerging countries, including Poland, Brazil, and others. The rising focus on increasing their brand presence by attending conferences, recognition awards, and others among players such as Koninklijke Philips N.V., and others, is expected to support the global table-top ultrasound equipment market share.

LIST OF KEY TABLE-TOP ULTRASOUND EQUIPMENT COMPANIES PROFILED

- GE Healthcare (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- FUJIFILM Corporation (Japan)

- SAMSUNG (U.S.)

- Esaote SPA (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2024: Esaote Group, one of the leading innovators in medical imaging, expanded its production capacity with the establishment of a new ultrasound manufacturing facility in India.

- September 2024: SAMSUNG launched the Premium OB/GYN ultrasound system “HERA Z20” at the International Society of Ultrasound in Obstetrics & Gynecology (ISUOG) World Congress 2024 with an aim to strengthen its product portfolio.

- August 2024: Koninklijke Philips N.V. partnered with Carilion Clinic in order to expand quality cardiac care with the latest cardiology innovations in the U.S. This helped the company in strengthening its presence globally.

- July 2024: Koninklijke Philips N.V. launched its next-generation artificial intelligence-enabled cardiovascular ultrasound platform with an aim to speed up cardiac ultrasound analysis with proven AI technology and reduce the burden on echocardiography labs.

- October 2023: SAMSUNG showcased artificial intelligence-based automatic measurement and diagnostic solutions at the International Society of Ultrasound in Obstetrics & Gynecology (ISUOG). This helped the company to increase its brand presence.

REPORT COVERAGE

The global table-top ultrasound equipment market report provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends that are expected to drive the market during the forecast period. It offers information on the prevalence of chronic disorders in key regions/countries, key industry developments, new product launches, and details on partnerships, mergers & acquisitions. It covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.64% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 6.95 billion in 2025 and is projected to record a valuation of USD 10.48 billion by 2034.

In 2025, the market value stood at USD 3.08 billion.

The market is expected to exhibit a CAGR of 4.64% during the forecast period.

The 3D segment led the market by type.

The key factors driving the market are the growing prevalence of chronic disorders, growing development in healthcare infrastructure, and the rising number of product launches.

Siemens Healthineers AG, GE Healthcare, and Koninklijke Philips N.V., are the top players in the market.

Asia Pacific dominated the market with a share of 44.29% in 2025.

Increased awareness of early diagnosis, the launch of technologically advanced products, and a surge in the demand for these products in developing nations are some of the factors that are likely to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us