Tax Management Software Market Size, Share & Industry Analysis, By Deployment (On-Premise and Cloud), By Enterprise Type (Large Enterprises and SMEs), By Vertical (BFSI, IT & Telecommunication, Healthcare, Retail, Manufacturing, Energy and Utilities, Hospitality, and Others), and Regional Forecast, 2026– 2034

KEY MARKET INSIGHTS

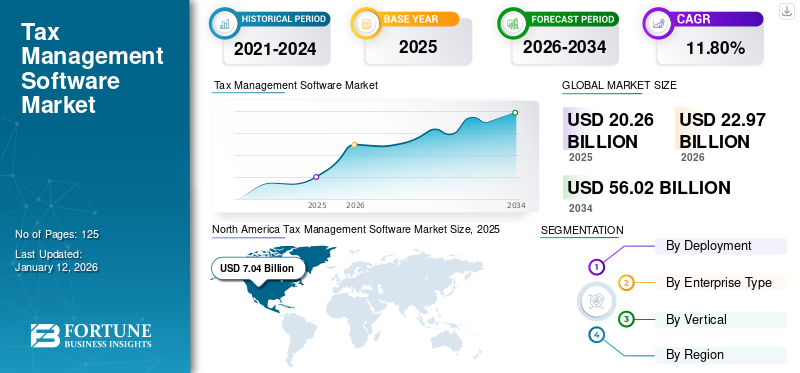

The global tax management software market size was valued at USD 20.26 billion in 2025. The market is projected to grow from USD 22.97 billion in 2026 to USD 56.02 billion by 2034, exhibiting a CAGR of 11.80% during the forecast period. North America dominated the global market with a share of 34.70% in 2025. Additionally, the U.S. tax management software market is predicted to grow significantly, reaching an estimated value of USD 9.51 billion by 2032.

The tax management software market growth is primarily driven by the increasing volume of financial transaction data collected by companies. This has propelled the adoption of technologically advanced platforms to create and manage audit reports, tax returns, and payments. Several companies and fintech firms are emphasizing on simplifying tax compliance with automation. Thus, the demand for the software has been on the forefront. In addition, the complex nature of the existing taxation system and digital payments growing at a larger scale have created ample opportunities for key vendors to expand their product portfolio.

Key vendors in the tax management market are heavily investing in research & development activities to develop cloud-based solutions that enable organizations to configure tax rates, perform tax accounting, and generate tax reports in a single platform.

The COVID-19 pandemic had an extraordinary impact on economies across the globe, with governments taking various measures to help their citizens and businesses. According to H&R Block, 28% of small and medium enterprises were confident of understanding the implications of tax management software after the pandemic. Besides, seven out of 10 SMEs stated that in-house tax assistance was more important for their businesses.

During the pandemic, the surge in e-commerce business enhanced online sales, which enabled real-time transactions across the globe. This increased the use of digital financial services, which is expected to boost the adoption of tax management software during the forecast period.

Tax Management Software Market Trends

Adoption of Advanced Technologies to Focus on Enforcement and Taxpayer Compliance for Efficient Customer-Centric Services

Although the tax ecosystem may be slow to digitalize, the modern value is gradually being taken up by the tax authorities to pursue more real-time reporting and offer efficient services to their customers. These days, tax authorities are at different maturities by digitizing interactions to give taxpayers with more useful and personalized services.

In the era of the consumer-centric world, tax authorities around the globe are adopting more recent tax legislations and demand greater transparency by sharing and easily exchanging information between tax authorities and taxpayers. For example, many European regulators, followed by Latin America, are shifting toward Standard Audit File for Tax (SAF-T) protocols. Similarly, web-based tax systems, equipped with applications of Machine Learning (ML) and Artificial Intelligence (AI) are being replaced with spreadsheets, which minimize manual input, data transformation, and speed the tax filing processes. The rising usage of tax management software helps to simplify the tax management process, enhance the accuracy of tax calculation, and eliminate complex and routine tasks by reducing manual work.

Since most of the tax authorities have started using advanced analytics, there has been complexity associated with digitization of the taxation process. The adoption of advanced technologies in tax management reduces complexity by helping taxpayers to apply for tax registration online, e-filing of tax returns, and e-processing of returns and refunds by tax authorities in minimal time. Thus, the emergence of new technologies and businesses adopting digital strategy has led to the growth of the global market.

Download Free sample to learn more about this report.

Tax Management Software Market Growth Factors

Need for Automated Solution to Manage Large Transactional Data to Drive the Market Growth

With constant globalization and the proliferation of e-business, there is an ongoing demand for platforms that permit companies to conduct business across countries, trade zones, and multiple channels of intercommunication. As digitization progresses, corporate tax and IT departments are looking to meet more partners to meet their specific customer needs. Tax software helps businesses improve reporting and management of ever-changing transaction tax laws and regulations. The software processes and manages compliance reports and allows one to meet tax return deadlines with minimal manual effort without unnecessary hassle.

Furthermore, the constantly evolving taxation eco-system intensifies the burden for implementing successful strategies for evaluating, collecting, and processing the data, which is usually hard to obtain from standard financial reporting. This has facilitated the growth of the global market.

A tax software helps financial institutions and businesses to analyze the massive amount of data collected by monetary transactions and help businesses with decision making. Tax and customs authorities are collecting data from Goods and Service Tax (GST) and Value Added Tax (VAT) payers through their financial transactions. Additionally, tax administrations are electronically processing and analyzing financial data collected from indirect tax. The software enables tax administrators to use data extracted from taxpayers’ systems to carry out VAT/GST audits. The adoption of data analytics solutions to upgrade the eVAT/GST compliance is considered to be an emerging driver for the market.

Growing Emphasis on Centralized Taxation System for Economic Development to Aid Product Demand

Well-functioning tax systems lead to strong, sustainable, and effective economic development. Taxation provides governments with the resources they need to develop infrastructure, alleviate poverty, and deliver public services in a highly efficient and timely manner. It also helps ensure economic reliability and sustainability to foster growth. In terms of transparency and fairness, the tax architecture is also closely related to internal and global investment decisions.

Furthermore, efficient tax administration helps governments and businesses to be registered formally, thereby expanding the general taxation and increased tax revenues. Modernization of the infrastructure and the implementation of a single tax administration system have made tax officials and taxpayers more operative. Similarly, the rising number of trade activities and growing usage of tax and accounting laws for continuously monitoring business activities enhance the demand for tax management software with increased customer engagement.

Tax software assists organizations and taxpayers with a better understanding of complex taxation systems. This would enable them to monitor their business and finance activities and provide alerts about tax payments. As a result, the need for timely tax filings with the help of tax software is driving the market.

RESTRAINING FACTORS

Increasing Reliance on Digital Communication and E-payment Methods Creating Data Security Concerns May Hamper Industry Growth

There are several possible vulnerabilities present in electronic communication methods. These vulnerabilities include sensitive information sharing, data and security breaches, identity theft, and other platforms of cyberattacks. Nevertheless, due to the useful and fragile nature of the information, the danger in tax administration is severe. Sensitive data is often stored in areas outside banking such as on-cloud and databases, which enables cybercriminals, including the filing of fraudulent tax returns to subvert valuable company data and to use it to enter unlawful trading. Similarly, cybercriminals also target tax professionals as they have details including client names, addresses, dates-of-birth, and access to bank accounts. This might impede the tax software market growth during the forecast period.

Human errors trigger many of the data breaches. Therefore, policymakers should combine that dependency on digital communication with a concerted effort to inform citizens on the key risks and safeguards.

Tax Management Software Market Segmentation Analysis

By Deployment Analysis

On-premises Segment to Aid the Market Growth Driven by Numerous Benefits

Based on deployment, the market is segmented into cloud and on-premise.

The on-premise segment is expected to hold the largest market share 57.35% in 2026. On-premise deployment of tax software enables organizations and financial firms to gain control over their integrations and provide various benefits such as scalability, functionality, and high data security.

The cloud-based software approach helps tax authorities and businesses minimize expenses while offering highly versatile and efficient access to IT approaches through the Cloud Service Provider (CSP) network. Enterprises, therefore, tend to use cloud platforms to improve mobility and decentralize data storage and computing. Cloud-based tax solutions deliver accurate tax reports with a hosted tax decision engine. Also, these solutions enable companies to get a comprehensive insight into innovations, patterns, and preferences. The concept is used to implement organizational and tax decisions effectively based on analytical results.

By Enterprise Type Analysis

Rising Product Adoption among Large Enterprises to Propel Segmental Growth in Near Future

Based on enterprise type, the market is segmented into SMEs and large enterprises.

The large enterprises segment is projected to hold the largest share 57.36% in 2026. owing to the growing digital transformation among companies and the ubiquitous adoption of tax platforms. An increasing number of large enterprises is shifting toward tax management solutions to manage taxes and regulate compliance responsibilities. The growing usage of tax management software across large enterprises brings automation in tax and accounting processes to ensure the accuracy of financial operations. This factor also helps to boost the productivity of business operations.

Tax management is an inevitable aspect of running a small business and it can be a struggle for any small business owner to deal with taxes. Small and medium-sized enterprises, which contribute to economic growth and employment, have significant modest tax rates. SMEs need tax software to manage their tax filings and financial transactions as they are offered loans at lower interest rates than usual. Therefore, the need for tax software among SMEs is likely to rise during the forecast period. In Brazil, a monetary framework designed to simplify tax collection for micro and small businesses was developed by the government.

By Vertical Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Implementation of Tax Management Software to Boost BFSI Segment Growth

Based on vertical, the market is segmented into BFSI, IT & telecommunication healthcare, retail, manufacturing, energy and utilities, hospitality and others.

The BFSI sector is anticipated to hold the largest share 25.28% in 2026. and grow with the highest CAGR over the forecast period. The BFSI segment has shown great reluctance in its transition to adopt tax software. The explosive growth of banking data collected through various channels, such as mobile banking, digital wallets, and chatbots, has resulted in a demand for tax software. Government regulations in the BFSI sector are complex. Therefore, businesses are leaning toward advanced technologies to provide a more value-added and strategic role for the organizations.

The manufacturing sector follows a dynamic taxation mechanism, ranging from decreases in exports and increased infrastructure investment. Some indirect fiscal regulations have led to considerable enforcement and administrative expenses and conflicts over classification and evaluation. Therefore, manufacturers need to adopt tax management software to tackle continuously varying markets. The software enables manufacturers to increase working capital and amend supply chain management. For example, Onesource Determination, a tax software provided by Thomson Reuters, is majorly used by manufacturers to validate the vendor-charged tax with procure-to-pay software and helps to accrue correct use tax on inventory movements.

REGIONAL INSIGHTS

Geographically, the global market is segmented across five major regions, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. They are further categorized into countries.

North America Tax Management Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 7.04 billion in 2025 and USD 7.87 billion in 2026. North America holds the highest tax management software market share as the region has witnessed tremendous growth in the adoption of tax software due to continuous changes and regulations in the regional taxation system. The complexity of the tax system, along with the differences in tax and labor laws in the region, creates an excellent opportunity for software developers and large vendors to invest in the market. Software vendors in the region have started integrating with third-party developers to develop API-based software to smoothen the taxation system. Subsequently, businesses in North America leverage advanced technologies and channels to sustain in the market and upgrade at an exponential growth rate. This is having a profound impact on the taxation environment and product adoption in North America. The U.S. market is projected to reach USD 5.16 billion by 2026.

Asia Pacific

The Asia Pacific market is projected to grow with a moderate growth rate in the coming years. Governments in this region will continue to be driven to protect their tax base, tax reforms, and the frequency of tax audits will be in the spotlight. This will facilitate the need for robust solutions that handle tax reports. Therefore, the demand for tax management software is expected to boost in the region. The continuously evolving taxation environment has also made it essential that tax authorities and payers in Asia Pacific keep themselves informed about factors affecting the company’s tax obligations. The Japan market is projected to reach USD 1.15 billion by 2026, the China market is projected to reach USD 1.57 billion by 2026, and the India market is projected to reach USD 1.49 billion by 2026.

The tax forum in Asia Pacific has become the best opportunity for tax software vendors to expand their consumer base in the region. For many countries, growth for Asia Pacific has moderated, making it increasingly necessary for tax policies to appeal to enterprises. However, there is likely to be more regular and vigorous fiscal audits by tax administrations to produce more significant revenues. Thus, the demand for this software is expected to increase over the forecast period.

The Middle East & Africa as well as Latin America regions are estimated to witness steady growth over the study period. This expansion is mainly due to the increased adoption of tax software among SMEs and large enterprises to handle tax filings and financial transactions.

Key Industry Players

Avalara, Inc., Thomson Reuters, and Wolters Kluwer Emphasize on Expanding Product Portfolio to Strengthen Market Position

The competitive landscape of the market is moderately fragmented with the presence of well-known brands, along with some regional and local players. The prominent players in the global market, such as Wolters Kluwer N.V., Sailotech, Vertex, Inc., Avalara, Inc., and TaxSlayer LLC, are introducing advanced solutions with an integrated data analytics platform. Besides this, the companies are heavily investing in R&D to produce new creative products in collaboration with research institutes. Tax management solution providers are concentrating on mergers and acquisitions of smaller and emerging technology companies, which expand their offerings and product range to gain more significant market share.

List of Top Tax Management Software Companies

- Avalara, Inc. (U.S.)

- Thomson Reuters Corporation (Canada)

- Wolters Kluwer N.V. (U.S.)

- Intuit, Inc. (U.S.)

- Vertex, Inc. (U.S.)

- SAP SE (Germany)

- HRB Digital LLC. (U.S.)

- TaxSlayer LLC. (U.S.)

- Sailotech Pvt Ltd. (U.S.)

- Sovos Compliance, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2023 – Tax System, a tax compliance software provider in the U.K. and Ireland acquired TaxModel, a Dutch-based tax technology provider to expand their product suite to serve their customers present across the globe.

- February 2023 - Intuit Turbotax partnered with Asure Software Inc., a small business HR and payroll solution provider. The partnership would streamline the employee's tax filing process by reducing errors, saving time, and accelerating tax refunds.

- February 2023 - Avalara, Inc., a leading player in cloud-based tax management software, introduced a new automated property tax compliance solution named “Avalara Property Tax’’ for businesses and accountants, which helps to manage property tax compliance by reducing errors via automation.

- January 2023 - Thomson Reuters acquired a U.S.-based tax software company Sureprep LLC for USD 500 million. The acquisition aimed to deliver end-to-end tax automated and connected workflow solutions to the companies' mutual customers.

- August 2022 - Intuit Accountants launched Intuit Tax Advisor tool to provide tax advisory services to clients to save their time and help to develop personalized tax plans to enable growth for clients and their firms.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 11.80% from 2026 to 2034 |

|

Segmentation |

By Deployment

By Enterprise Type

By Vertical

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 20.26 billion in 2025.

The market is likely to grow at a CAGR of 11.80% over the forecast period (2026-2034).

The cloud segment is the leading segment in the market.

Wolters Kluwer N.V., SAP SE, Thomson Reuters, Intuit Inc., and Sovos Compliance, LLC are some of the leading players in the global market.

The rising need for automated solution for the management of large transactional data is expected to drive the market growth.

By vertical, the BSFI segment is expected to lead the global market share during the forecast period.

The U.S. dominated the market in 2025.

By 2034, the market size is expected to reach USD 56.02 billion.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us