Telecardiology Market Size, Share & Industry Analysis, By Offering (Products and Services), By Application (Remote Patient Monitoring, Teleconsultation, and Others), By Modality (Store-And-Forward (Asynchronous), Real-Time (Synchronous), and Others), By End User (Healthcare Facilities, Homecare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

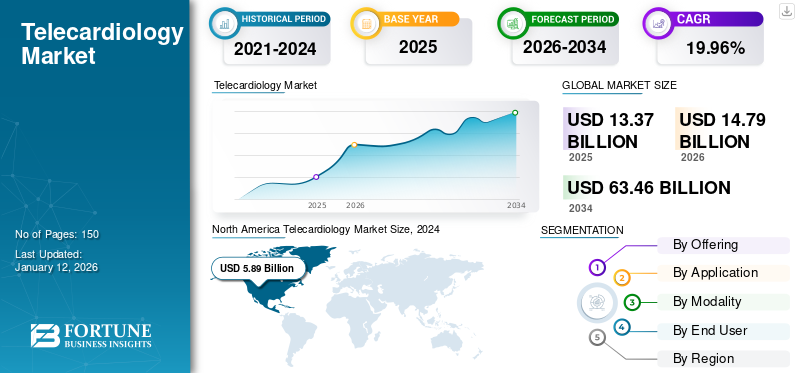

The global telecardiology market size was valued at USD 13.37 billion in 2025. The market is projected to grow from USD 14.79 billion in 2025 to USD 63.46 billion by 2034, exhibiting a CAGR of 19.96% during the forecast period. North America dominated the telecardiology market with a market share of 11.68% in 2025.

The telecardiology market focuses on the use of telecommunications and information technology to remotely monitor, diagnose, and manage cardiovascular diseases (CVDs). The market has been experiencing significant growth, driven by the growing prevalence of CVDs, technological advancements in healthcare IT, and the demand for accessible healthcare services. Cardiovascular diseases are a leading cause of mortality globally, leading to a higher demand for these services. Additionally, the growing global population aging results in a higher incidence of chronic diseases such as heart ailments and greater reliance on telecardiology for remote care. Furthermore, advancements in healthcare IT such as cloud computing, artificial intelligence (AI), and machine learning are revolutionizing this space by improving diagnostic accuracy, boosting quality of life, and enabling timely interventions.

- For instance, as per the data published by the CDC in October 2024, every year, an estimated 805,000 individuals in the U.S. have a heart attack, with 605,000 of them suffering for the first time.

- As per an article published by the Heart Research Institute (HRI) in 2022, a heart attack is the leading cause of hospitalization in Australia, with an average of 19 lives every day.

- An estimated 430,000 Australians have had a heart attack at some point in their lives, and every year, 57,000 Australians suffer a heart attack.

Some of the leading players in the market include CompuMed, Inc., Eagle Telemedicine, and Access TeleCare, LLC. These players focus on collaborations and partnerships to maintain their market presence.

Global Telecardiology Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 13.37 billion

- 2026 Market Size: USD 14.79 billion

- 2034 Forecast Market Size: USD 63.46 billion

- CAGR: 19.96% from 2026–2034

Market Share:

- Region: North America dominated the market with a 11.68% share in 2025. This leadership is driven by the region's advanced healthcare infrastructure and early adoption of digital cardiology solutions.

- By Offering: The services segment held the largest market share in 2024. The segment's growth is attributed to a significant number of healthcare providers adopting these services and increasing usage by the patient population, particularly in remote areas.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan's market is driven by an increasing prevalence of cardiovascular diseases and a growing number of government initiatives to improve healthcare access through digital technologies.

- United States: The market is fueled by a high incidence of cardiovascular events, with an estimated 805,000 heart attacks occurring annually. The market is also supported by a growing demand for remote care and a shortage of cardiologists, which is projected to increase by 18% annually through 2025.

- China: Growth is propelled by a large and aging population, which increases the prevalence of chronic heart conditions. The market is also benefiting from government initiatives to expand digital health services to improve access in rural and underserved areas.

- Europe: The market is advanced by the increasing adoption of telemedicine services by healthcare providers in countries such as France. Strategic partnerships between AI-driven diagnostic companies and medical centers are enhancing service offerings and driving market growth.

MARKET DYNAMICS

MARKET DRIVERS

Technological Advancements Coupled With Shortage of Cardiologists to Drive Market Growth

Technological advancements in the delivery of cardiology services to patients are one of the key factors driving the market growth. These advancements include portable diagnostic devices for easier data collection from a distance, improvements in telecommunication infrastructure, and advancements in mobile health apps. These advanced devices offer enhanced efficiency, improved diagnostic accuracy, and faster turnaround time, leading to increasing adoption of these products & services among healthcare providers as well as patients. Mobile apps facilitating teleconsultations and real-time monitoring are becoming highly popular for managing heart conditions. Devices, including smartwatches with ECG functionality, enable continuous health monitoring, which is changing the landscape of telecardiology. These factors collectively are anticipated to drive the market growth. Additionally, shortage of cardiologists is another factor that aids in increasing the usage of these products & services.

- According to a Health Affairs report, the demand for cardiologists will increase by 18% annually through 2025. This also addresses the shortage of cardiologists by enabling expert interpretation of ECGs and remote monitoring of heart conditions. This allows for timely diagnosis and efficient management and can potentially reduce unnecessary hospital visits.

MARKET RESTRAINTS

Digital Literacy and Socio-Cultural Barriers to Limit the Market Expansion

Patients, particularly older adults and those in rural areas, have limited digital literacy and difficulty using technology. This is one of the prominent factors limiting the adoption of telecardiology. The poor availability of digital infrastructure and the cost of advanced technologies are considered some of the most important factors affecting the services leveraged by patients across the world.

- As per the World Bank Group's Digital Progress and Trends Report 2023, in 2022, only one in four individuals in middle-income countries had internet access.

Furthermore, some individuals may prefer in-person consultations and may be hesitant to use telemedicine for medical advice. Additionally, many patients are not fully aware of the benefits of these services, which affects adoption rates, particularly in rural and underserved areas. This also hampers the telecardiology market growth to a certain extent.

MARKET OPPORTUNITIES

Expansion of Telecardiology in Low & Middle-Income Countries is expected to Create Lucrative Opportunities for Market Growth

Low and middle-income countries often struggle with a shortage of cardiologists and specialized facilities, particularly in rural areas. Thus, the expansion of these solutions in these countries is anticipated to offer growth opportunities for the operating players. This would be aimed at addressing limited access to specialists and improving cardiovascular care in limited resource areas. This expansion is driven by cost-effectiveness and technological advancements (such as portable diagnostic devices). Policymakers are also advocating for the inclusion of telecardiology in national healthcare systems to promote equitable access.

- For instance, according to an article published in BMJ Journals in January 2025, the Telehealth Network of Minas Gerais (TNMG) was established in 2005 and provides telecardiology support to 1,320 municipalities and 14 out of the 27 states in Brazil. It is a large-scale Brazilian public telehealth service.

TELECARDIOLOGY MARKET TRENDS

Integration of Artificial Intelligence (AI) is One of the Prominent Telecardiology Market Trends

The future of telecardiology is anticipated to be profitable with constant advancements in digital health technologies. Integration of machine learning and artificial intelligence has further enhanced remote diagnostics, in turn improving the accuracy of detecting cardiac abnormalities. These technologies help in quicker diagnosis, timely intervention, along continuous patient management from a distance. Advanced AI-based algorithms used in these solutions efficiently analyze both echocardiograms & ECGs and detect heart conditions. AI is enhancing diagnostic capabilities in this space by analyzing ECG readings and other cardiovascular data for accurate diagnoses.

- For instance, Tricog Health is a Singapore based company that offers AI-based comprehensive solutions for telecardiology.

MARKET CHALLENGES

Technological and Infrastructure Limitations Hampers the Market Growth

Telecardiology requires reliable internet connectivity and access to necessary devices such as smartphones, computers, and others. This can be a significant barrier in rural or underserved areas where infrastructure is limited. This, in turn, limits the overall market growth. Additionally, issues related to insufficient bandwidth also affect image quality and the ability to transmit real-time data, hindering effective diagnosis and treatment. Some other challenges in the market include the integration of existing systems cost of installation, among others.

Other Challenges

Some of the other challenges in the market include patient data security & privacy and regulatory and compliance barriers. The storage and transmission of sensitive health data require robust security measures to protect against breaches and unauthorized access.

Download Free sample to learn more about this report.

Segmentation Analysis

By Offering

High Usage of Telecardiology Services Enhanced the Services Segment Growth

In terms of offering, the market segmentation is into products and services.

The services segment captured a leading portion of the global market in 2024. Factors contributing to the dominance of the segment include a significant number of healthcare providers adopting these services along with increasing usage by the patient population, especially in remote areas. Telecardiology can provide real-time consultations for cardiologists working in rural hospitals, allowing them to access the expertise of specialists at larger facilities.

On the other hand, the products segment, which includes monitoring devices, is expected to witness substantial growth in the study period. Increasing new product approvals is one of the major factors driving the market growth.

- For instance, in June 2021, eDevice SA, a company involved in remote patient monitoring solutions & telemedicine, acquired the commercialization rights for the TwoCan PulseTM telecardiology monitoring system from Boston Scientific.

By Application

Increasing Number of Teleconsultations Boosted Segmental Dominance

On the basis of application, the market is divided into remote patient monitoring, teleconsultations, and others.

The teleconsultation segment accounted for a largest share of the market in 2024. Telecardiology provides a platform for general practitioners to consult with cardiologists about patient cases. Additionally, teleconsultations leverage advanced technology to review and remotely provide diagnosis and treatment of heart disease. It further aids in increasing access to expertise for the population residing in remote areas.

The remote patient monitoring segment is anticipated to grow with a considerable CAGR over the study period. It can be used to monitor patients with implanted cardiac devices (pacemakers, defibrillators) or chronic heart failure. Increasing the use of remote monitoring solutions for patients with chronic heart conditions improves management and timely intervention. Thus, increasing usage for monitoring patients from outside the hospital settings supports segmental growth.

By Modality

Growing Adoption of Store-And-Forward (Asynchronous) Service by Healthcare Facilities Boosted the Segment Growth

In terms of modality, the market is divided into store-and-forward (asynchronous), real-time (synchronous), and others.

The store-and-forward (asynchronous) segment held a highest share of the market in 2024. This can be attributed to the increasing number of teleconsultations for cardiac-related issues, which use asynchronous modes of service delivery. Here, the medical records of the patient are stored on devices and are later used for further disease management. It also includes second opinions, chronic condition management from a distance, collaboration with other healthcare providers, and others.

On the other hand, the real-time (synchronous) segment is anticipated to witness notable growth in the near future. Key factors augmenting the segment growth include increasing incidences of emergency hospital visits due to cardiac issues, coupled with increasing cases of accidents and trauma.

By End User

Growing Adoption of Digital Technologies by Healthcare Facilities to Boost Market Growth

Based on end-users, the market is segmented into healthcare facilities, homecare, and others.

The healthcare facilities segment captured a largest telecardiology market share in 2024. The increasing number of hospitals introducing remote cardiology services, coupled with the advantages offered by these services to fill the gaps between healthcare providers and patients, have majorly driven segment growth.

- For instance, in December 2024, Vandalia Health’s Webster Memorial Hospital introduced a new telecardiology service in collaboration with Vandalia Health’s Mon Health Heart & Vascular Center. This is aimed at improving cardiac care in rural areas.

On the other hand, the homecare segment is projected to grow at a sustainable rate in the coming years, owing to the increasing usage of this technology for remote patient monitoring and consultations.

Telecardiology Market Regional Outlook

By geography, the market is segmented into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Telecardiology Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held a dominating position in the global market with a significant share and a revenue generation of USD 6.92 billion in 2026. The regional dominance can be attributed to advanced healthcare infrastructure and early adoption of digital cardiology solutions compared to other regions.

U.S.

The U.S. captured the major share of the North America market in 2024. The country is considered to be highly adaptive to technological advancements. This is one of the key factors that has driven the market growth. Also, the country has been the first market to the launch of new products & services by the majority of the large companies.

Europe

Europe is the second-largest market for telecardiology. The region is anticipated to witness notable growth in the coming years. The adoption of these products & services is constantly growing in the region. This can be attributed to the increasing adoption of telemedicine services by healthcare providers in the region.

- For instance, in September 2021, Cardiology, a company operating in artificial intelligence (AI) cardiology diagnostics, partnered with cardiologists at three medical centers in France. This was aimed at enhancing service offerings in the country.

Asia Pacific

The Asia Pacific region is expected to grow with the fastest CAGR during the forecast period. The rising prevalence of cardiovascular diseases and the increasing number of government initiatives undertaken are anticipated to boost the market growth over the forecast period. Additionally, the presence of a vast patient pool and the increasing demand for effective emergency solutions, especially in rural areas, are some of the key factors driving the market growth in the region.

- For instance, in March 2022, the Telecardiology unit of the Gauri Healthy Heart Project was launched as a part of the Corporate Social Responsibility (CSR) initiative of AstraZeneca and implemented by Umeed Foundation in collaboration with GauriKaul Heart Centre and Mata Saraswati Pustakalya.

Lain America and Middle East & Africa

The market in the Latin America and Middle East & Africa regions is expected to witness relatively slower growth in the coming years. The growing adoption of telemedicine in various medical specialties, coupled with expanding access to the required digital infrastructure, is expected to supplement the market growth in these regions. Also, increased investment in healthcare technologies and rising CVD rates are further contributing to growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Strong Emphasis on Collaboration & Partnerships by Key Companies Resulted in their Market Dominance

The global marketspace is anticipated to witness significant growth in the near future with an increasing number of companies operating in this space. Some of the prominent players include Access TeleCare, LLC, and CompuMed, Inc., among others. These companies focus on various strategic initiatives such as collaborations, regional expansion, and acquisitions to strengthen their market positions.

- For instance, in March 2024, Access Telecare, in collaboration with UT Southwestern Medical Center, initiated two projects with an aim to improve the care of patients with heart failure in rural communities.

Other notable players in the global market include Tricog Health, CompuMed Inc., AmplifyMD, and Eagle Telemedicine. Apart from these players, the market also comprises various small & emerging players that offer telecardiology services & products.

LIST OF KEY TELECARDIOLOGY COMPANIES PROFILED

- Access TeleCare, LLC (U.S.)

- Tricog Health (Singapore)

- CompuMed, Inc. (U.S.)

- AmplifyMD (U.S.)

- Eagle Telemedicine (U.S.)

- National Diagnostic Imaging (U.S.)

- Koninklijke Philips N.V. (U.S.)

TRADE PROTECTIONISM

Trade protectionism can affect the telecardiology market by introducing tariffs and trade barriers that can increase healthcare costs and limit access to essential technologies. Regulatory differences across countries create challenges in market entry and international expansion, particularly for telecardiology companies that need to meet varying standards in different regions.

KEY INDUSTRY DEVELOPMENTS

- March 2025: ECU Health launched a new telecardiology clinic in the Chowan area to expand access in remote areas.

- December 2024: DocGo Inc. partnered with SHL Telemedicine for the integration of the SmartHeart portable 12-lead ECG device across the mobile healthcare units by DoCGo.

- April 2022: BIOTRONIK launched a new mobile app update for cardiac device patients. It is designed to acilitate exchange with clinical staff and patinets.

- June 2021: Twin County Regional Healthcare, in partnership with Access Physicians, a multispecialty telemedicine physician group, introduced telecardiology services to its hospital.

- December 2020: Coala Life, a Swedish company, launched Coala Connect Rx, a new telecardiology service in the U.S. This service is offered in collaboration with cardiologists in the U.S. and is covered by many healthcare plans in the country.

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. The market forecast includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on regional analysis, key industry developments, new product & service launches, and details on partnerships, mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.96% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Offering

|

|

By Application

|

|

|

By Modality

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 14.79 billion in 2026 and is projected to reach USD 63.46 billion by 2034.

In 2025, the market value stood at USD 6.28 billion.

The market is expected to exhibit a CAGR of 19.96% during the forecast period.

The services segment led the market by offering.

The key factors driving the market include the shifting focus toward the use of digital cardiology solutions and the increasing prevalence of cardiovascular diseases.

CompuMed, Inc., Eagle Telemedicine, and Access TeleCare, LLC are some of the major players in the market.

North America dominated the market in 2025.

Advancements in digital solutions and the increasing need for remote cardiology services are some of the factors that are expected to favor the service adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us