Telepharmacy Market Size, Share & Industry Analysis, By Service Type (Patient Counseling, Patient Monitoring, Remote Dispensing [Prescription and Over-the-counter], and Others), By Modality (Store-and-forward (Asynchronous), Real-time (Synchronous), and Remote Patient Monitoring), By End-user (Healthcare Facilities, Homecare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

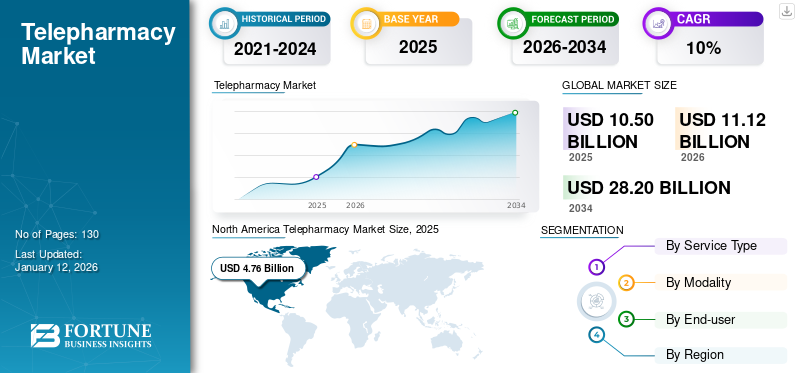

The global telepharmacy market size was valued at USD 10.50 billion in 2025. The market is projected to grow from USD 11.12 billion in 2026 to USD 28.20 billion by 2034, exhibiting a CAGR of 12.34% during the forecast period. North America dominated the telepharmacy market with a market share of 45.35% in 2025.

Telepharmacy is pharmaceutical care through telephonic or online conversations with pharmacists or doctors. It involves the delivery of pharmaceutical care through telecommunications technology, enabling pharmacists to provide services remotely. This method has been enhancing access to pharmaceutical care, especially in underserved or rural areas, and streamlines medication management. The increasing establishment of new players globally and the rising awareness about the benefits and convenience associated with these companies have been fueling the market growth.

- For instance, NeoHomeRx Technologies Ltd. is an Africa-based company involved in remote medicines dispensing in Africa. The company was founded in 2022.

Moreover, the market consists of many small and mid-sized players. Market players such as GoodRx, American Well, and Teladoc Health, Inc. are among the significant players that have been focusing on collaborations and partnerships to enhance their offerings in the market.

Global Telepharmacy Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 10.50 billion

- 2026 Market Size: USD 11.12 billion

- 2034 Forecast Market Size: USD 28.20 billion

- CAGR: 12.34% from 2026–2034

Market Share:

- North America dominated the telepharmacy market with a 45.35% share in 2025, attributed to the strong presence of key players such as GoodRx, Teladoc Health, and CarepathRx, alongside growing awareness of virtual counseling services and supportive digital health infrastructure in the U.S.

- By service type, the Remote Dispensing segment held the largest market share in 2024, driven by the growing preference for receiving prescription and over-the-counter drugs directly at home, with added cost benefits and convenience.

Key Country Highlights:

- Japan:Growth is supported by expanding digital healthcare reforms and high mobile/internet penetration, encouraging the adoption of remote patient care and virtual dispensing solutions.

- United States: The U.S. led the North American market in 2024, fueled by increasing consumer awareness of telepharmacy benefits, government initiatives like the FDA’s "Home as a Healthcare Hub," and partnerships such as GoodRx’s e-commerce rollout and American Well’s platform expansions.

- China: Significant growth potential due to increasing healthcare digitization, high smartphone penetration, and efforts to improve rural healthcare access through virtual platforms.

- Europe: The market benefits from broad digital health adoption, as evidenced by the 2022 WHO Regional Digital Health Action Plan adopted by 53 member states, promoting telehealth integration in mainstream healthcare.

MARKET DYNAMICS

Market Drivers

Increasing Focus of Market Players on New Service Launches to Fuel Market Growth

The growing awareness regarding telepharmacy and various benefits associated with its adoption has been fueling its demand.

- For instance, telepharmacy offers access to healthcare services in rural areas where frequent visits to pharmacists and doctors are difficult. Moreover, these services are very helpful in monitoring and advising the patients where the patients go to the pharmacy, which is quite difficult regularly.

The increasing awareness regarding virtual counseling and remote dispensing has fueled the demand for more efficient counseling and remote drug dispensing services. In order to fulfill this demand, market players have increased their focus on expanding their service offerings for telepharmacy.

- In October 2024, GoodRx announced the rollout of its new e-commerce solution with its partner Opill. With this new solution, direct-to-consumer shopping solutions are available to its customers for medications and health products and get them delivered to their doorstep.

- Similarly, in October 2024, American Well partnered with Hello Heart to expand its portfolio on Amwell Converge, a clinical program platform with the addition of a cardiovascular health risk management solution.

Therefore, the increasing awareness among the population globally about telepharmacy, along with the initiatives by the market players to strengthen its service offerings in this field, has been fueling its penetration globally, thereby positively impacting the telepharmacy market growth.

Market Restraints

Increasing Fraudulent through Telepharmacy Websites to Limit Market Growth

The increasing awareness of the benefits associated with telepharmacy services has fueled the emergence of many small and mid-sized companies. The growing awareness regarding virtual counseling and remote dispensing services has increased the demand for these services. This factor has also increased the risk of fraudulence associated with telepharmacy websites.

Government and regulatory bodies in many countries have observed several cases involving fraudulent cases involving telepharmacy investors and executives who received or paid bribes to obtain fraudulent prescriptions or to sell unapproved fake drugs.

- For instance, in 2023, an investor of the South Bend Specialty Pharmacy ("SBSP") was accused of investing in and aiding a network of pharmacies that distributed unnecessary and overpriced medications.

Moreover, the sale of fake medications over telepharmacy has also been growing significantly across the globe.

- For instance, in July 2024, a telepharmacy company in Iowa, U.S., was accused of selling fake Ozempic to a Michigan, U.S.-based company. This drug is indicated for diabetes and is also used for weight loss.

Such fraudulence associated with these services has been limiting its penetration globally, thereby restricting the market growth.

Market Opportunities

Increasing Government Initiatives on Healthcare Digitalization is Expected to Fuel Penetration of Telepharmacy During Forecast Period

Government and regulatory bodies in many countries, including the U.S., U.K., and India, have been focusing on initiatives for healthcare digitalization.

- In September 2021, Ayushman Bharat Digital Mission (ABDM) was established to revolutionize India's digital healthcare industry to enhance healthcare accessibility, efficiency, and transparency.

- In April 2024, the U.S. Food and Drug Administration (FDA) launched an initiative on Home as a Health Care Hub. This initiative aimed to provide enhanced healthcare facilities to the U.S. population at the convenience of their home with the help of virtual care.

Such initiatives have been growing awareness regarding digital health and telepharmacy and are expected to fuel the market growth during the forecast period.

Market Challenges

Emergence of Many Small and Mid-sized has been Boosting Competition in Market

The telepharmacy market is a highly fragmented market with the presence of many small and mid-sized players. Nevertheless, the emergence of new players with similar or more advanced offerings has been creating significant challenges in the growth of the already present players in the market.

Regulatory and Licensing Issues

Stringent regulations in some countries across the globe and variations in regulations for each country are among the challenges faced by market players in their expansion.

Data Security and Privacy Concerns

Maintaining confidentiality and security of patient information is very critical, especially with the increased use of digital platforms where one shares their medical details. Due to this, sometimes patients restrict themselves from using digital platforms, thereby creating a challenge for market growth.

Technological Barriers

Minimal access to reliable internet and technological infrastructure in certain locations can limit the adoption of digital health services.

Resistance to Change

Some healthcare professionals and patients may be resistant to adopting telepharmacy due to unfamiliarity with or preference for traditional methods.

MARKET TRENDS

Increasing Focus of Market Players on Partnerships to Enhance its Offerings

The market is experiencing significant growth with the emergence of many small and mid-sized companies. This factor has increased competition among the market players. To strengthen its presence, market players have been focusing on strengthening their brand presence by expanding their product portfolio through partnerships and collaborations.

- For instance, in September 2023, American Well and Health Gorilla, a health information network and interoperability solution provider, opened a new capability under Amwell Converge.

- Similarly, in October 2023, American Well partnered with Discovery Health, a health insurance administrator, to introduce digital therapeutic benefits in South Africa, funded by an insurer.

Such strategic initiatives by the market players have enhanced their services' efficiency, fueling their adoption.

Other Trends:

Increasing Focus on Adoption of Advanced Technology Healthcare Facilities

The increasing penetration of advanced technology in healthcare facilities has been fueling the adoption of telepharmacy for pharmacy practice. This helps in enabling remote consultations, medication reviews, and patient education.

Increasing Adoption of Digital Health

The adoption of Artificial Intelligence (AI) and machine learning in drug development and patient care is transforming the pharmacy industry, enhancing efficiency and patient outcomes.

Increasing Awareness Regarding Pharmacy Automation and Robotics

Automation streamlines pharmacy operations, improving dispensing accuracy and allowing pharmacists to focus more on patient care, thereby enhancing the healthcare facility services. Therefore, the increasing awareness regarding pharmacy automation and robotics has been fueling its adoption.

Download Free sample to learn more about this report.

Impact of COVID-19

Increased Focus of Individuals Toward Virtual Consultation Fueled Market's Growth During Pandemic

During the sudden outbreak of the COVID-19 pandemic in 2020, the market experienced significant growth due to the increased preference of the patient population to avoid going outside for pharmacist counseling and drug refills. Patients preferred virtual counseling, monitoring, and remote dispensing of the drug to prevent the spread of the virus.

However, in 2022 and 2023, the growth rate returned to pre-pandemic levels. Moreover, the market is expected to grow at a significant growth rate during the forecast period.

SEGMENTATION ANALYSIS

By Service Type

Remote Dispensing Segment Dominated Market Owing to Increasing Number of Individuals Preferring Drug Refills through Remote Dispensing

The telepharmacy market is segmented by service type into patient counseling, patient monitoring, remote dispensing, and others. The remote dispensing segment is further bifurcated into prescription and over-the-counter.

The remote dispensing segment dominated the market with a share of 56.63% in 2026. The segment's growth is attributed to the increased preference of the patients to receive medicines at the convenience of their homes. This is due to the various advantages associated with drug refilling through telepharmacy, such as the fact that it can offer major discount options that are generally not feasible through offline stores.

- In October 2024, GoodRx announced that QSYMIA capsules were available at low prices in over 70,000 retail pharmacies in the U.S.

The patient counseling segment is expected to grow at the fastest CAGR during the forecast period. Pharmacists can provide education on medications and reminders for on-time administration of the drugs. This results in better clinical outcomes and improved patient satisfaction. These benefits associated with patient counseling are expected to fuel the market growth in the forecast period. The segment held 16.3% of the market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Modality

Various Benefits Associated with Store-and-forward (Asynchronous) is Responsible for Segment's Dominance

The market is segmented based on modality into store-and-forward (asynchronous), real-time (synchronous), and remote patient monitoring.

The store-and-forward (asynchronous) segment dominated the market with share 44.82% in 2026. The store-and-forward service modality offers flexibility to the patients and the pharmacists. Also, it can be used for multiple tasks, such as timely prescription verifications, medication reviews, and chronic disease management. All these benefits associated with store-and-forward (asynchronous) modality are responsible for the segment's dominance. The segment is forecasted to hold 45.0% of the market share in 2025.

The real-time (synchronous) segment is expected to grow at the fastest CAGR during the forecast period. The segment's growth is attributed to the increasing preference of the patients toward virtual counseling with the pharmacists without actually visiting the pharmacy through telephone and video calls. This segment is likely to grow with a considerable CAGR of 10.80% during the forecast period (2025-2032).

By End-user

Increased Transition to Homecare Settings to Contributed to Segment’s Dominance in 2024

The market is segmented into healthcare facilities, homecare, and others based on end-user.

The homecare segment is expected to account for a dominant proportion of the global market during the forecast period due to the rising prevalence of diseases such as diabetes and hormonal imbalance, which requires regular monitoring and a gradual shift toward home care services. This segment is expected to grow with a significant CAGR of 48.29% during the forecast period (2026-2034).

The healthcare facilities segment accounted for a significant proportion of the market in 2024. The segment's dominance is attributed to the increasing focus of the market players on introducing services to improve solutions offered to healthcare facilities. The segment is set to gain 40.5% of the market share in 2025.

- In November 2024, Teladoc Health, Inc. launched its Artificial Intelligence (AI) to enhance its Virtual Sitter solution for patient safety and reduce workforce challenges in hospitals and healthcare systems.

TELEPHARMACY MARKET REGIONAL OUTLOOK

In terms of regions, the global market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Telepharmacy Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In terms of regions, North America dominated the global market and stood at USD 4.39 billion in 2023 and USD 4.56 billion in 2024. The market growth is attributed to the strong presence of market players such as CarepathRx, LOCKE BIO, and American Well, among others.

Furthermore, in North America, the U.S. market dominated in 2024 due to the increasing awareness regarding virtual counseling with pharmacists in the country. The U.S. market is expanding and is set to grow with a valuation of USD 4.15 billion in 2026..

Europe

Europe is the second leading region poised to be worth USD 2.95 billion in 2026, exhibiting a CAGR of 26.38% during the forecast period (2026-2034). The market in this region accounted for a significant share in 2024. The market growth in the region is attributed to the increasing adoption of digital platforms for healthcare services. The U.K. market continues to grow, projected to reach a market value of USD 0.71 billion in 2026.

- For instance, as per the data published by the World Health Organization (WHO) in 2024, in the 72nd session of the WHO Regional Committee for Europe in September 2022, 53 WHO European Region Member States adopted the region's first digital health action plan.

Germany is poised to reach USD 0.71 billion in 2025, while France is estimated to be valued at USD 0.43 billion in the same year.

Asia Pacific

Asia Pacific is the third largest market estimated to reach USD 2.27 billion in 2026. The region is projected to witness the highest growth rate throughout the forecast period. China is estimated to be valued at USD 0.63 billion in 2026. The region’s growth is attributed to the growing technological advancements in digital healthcare services, improving healthcare scenarios, and the high adoption of digital health in the rural population. India is poised to gain USD 0.44 billion in 2025, while Japan is foreseen to grow with a valuation of USD 0.61 billion in 2026.

Latin America and Middle East & Africa

Latin America is the fourth largest market poised to be worth USD 0.57 billion in 2026. The markets of Middle East & Africa and Latin America are projected to witness steady growth prospects throughout the forecast period. The market's growth in the region is attributed to the high unmet population and rising awareness regarding virtual counseling and remote drug dispensing. The GCC market is anticipated to hold USD 0.12 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Emphasis of Companies on Innovative Service Launches to Fuel their Revenue Dominance

Companies, including GoodRx, American Well, and Teladoc Health, Inc., are some of the most important players in this market, with these companies holding a significant global telepharmacy market share in 2024. The established presence of these players in the market is owing to their focus on new service launches to enhance their offerings in the market.

- For instance, in June 2024, GoodRx launched its Prescription Cost Tracker feature, which will help patients in the U.S. monitor out-of-pocket prescription tracking. This would help the customers better understand prescription affordability and price transparency.

Other important companies include HevaHealth, Kranus Health GmbH, and CarepathRx. These companies have been focusing on new offering launches with the aim of strengthening their revenue generation.

- In March 2024, CarepathRx announced the launch of a mobile application, CarepathRx Patient Therapy Mobile (CPTM), aiming to help patients manage their prescriptions effectively through their smartphones.

LIST OF KEY TELEPHARMACY MARKET PLAYERS PROFILED IN THIS REPORT:

- GoodRx (U.S.)

- CarepathRx (U.S.)

- LOCKE BIO (U.S.)

- HevaHealth (Indonesia)

- NeoHomeRx Technologies Ltd. (Nigeria)

- American Well (U.S.)

- Teladoc Health, Inc. (U.S.)

- eleClinic GmbH (Germany)

- Kranus Health GmbH (Germany)

- MedKitDoc (Germany)

- Medley Medical Solutions Pvt. Ltd (India)

- Cardinal Health (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2024– GoodRx announced the availability of menopause availability programs through Pfizer. This development would help to increase GoodRx's reach in delivering crucial medications for women at affordable prices.

- August 2024– Heva Health introduced itself as a telehealth The company is involved in providing treatment plans and medicine to its patients.

- July 2024– CarepathRx, a pharmacy solutions company, was recognized as one of the top workplaces in healthcare in the U.S. This helped the company strengthen its brand presence in the market.

- February 2024– American Well announced its partnership with Amplar Health. This partnership aims to expand its hybrid and digital care programs in Australia.

- September 2023– OSF Healthcare System, an integrated health system, reduced the rates of anxiety and depression by 50% in the U.S. with the help of the Amwell platform.

REPORT COVERAGE

The global telepharmacy market research report provides a detailed competitive landscape and market insights. It also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. Additionally, it focuses on key points, such as new solution launches in the market. Furthermore, it covers regional analysis of different market segments, profiles of key market players, market trends, and the impact of COVID-19 on the market. It consists of quantitative and qualitative insights that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.34% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type

By Modality

By End-user

By Region North America (By Service Type, Modality, End-user, and Country)

Europe (By Service Type, Modality, End-user, and Country/Sub-region)

Asia Pacific (By Service Type, Modality, End-user, and Country/Sub-region)

Latin America (By Service Type, Modality, End-user, and Country/Sub-region)

|

Frequently Asked Questions

The global telepharmacy market size was valued at USD 10.50 billion in 2025. The market is projected to grow from USD 11.12 billion in 2026 to USD 28.20 billion by 2034, exhibiting a CAGR of 12.34% during the forecast period.

In 2026, the North American market value stood at USD 5.02 billion.

The market is predicted to exhibit a CAGR of 12.34% during the forecast period of 2026-2034.

By service type, the remote dispensing segment led the market.

The increasing focus of the market players on new service launches has been fueling the market growth.

GoodRx, American Well, and Teladoc Health, Inc. are the top players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us