Telepathology Market Size, Share & Industry Analysis, By Offering (Products and Services), By Type (Static, Dynamic, and Hybrid), By Application (Diagnosis, Consultation, and Others), By End User (Hospitals & Clinics, Diagnostic Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

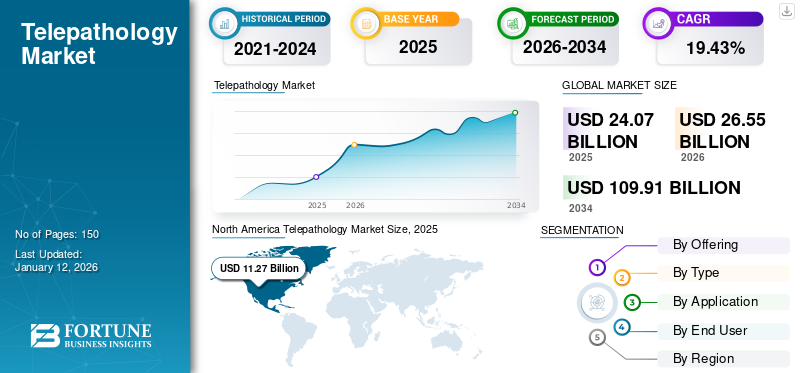

The global telepathology market size was valued at USD 24.07 billion in 2025. The market is projected to grow from USD 26.55 billion in 2026 to USD 109.91 billion by 2034, exhibiting a CAGR of 19.43% during the forecast period. North America dominated the telepathology market with a market share of 46.83% in 2025.

Telepathology is the practice of pathology using telecommunication technology to send pathology images (e.g., slides) for remote evaluation by pathologists. It facilitates quicker diagnosis and improves access to specialized pathologists, especially in rural or underserved areas. This field has experienced significant growth in recent years, driven by technological advancements, the increasing adoption of telemedicine, and the need for efficient diagnostic services. This is a one of the rapidly growing segments of the telemedicine market.

The increasing prevalence of chronic diseases and the need to reduce turnaround time for critical diagnoses are some of the other factors boosting the growth of the market.

- For instance, in February 2025, Charles River Laboratories International, Inc. collaborated with Deciphex, a frontrunner in AI-driven digital pathology, with an aim to enhance innovative image management solutions and develop advanced artificial intelligence tools for toxicologic pathology. The partnership aims to establish a comprehensive workflow for image management, distribution, and archiving, improving efficiency, accuracy, and scalability in pathology processes.

Some of the leading players in the market include OptraScan, CompuMed, Inc., Diagnostic Instruments, Inc., and UCLA Health. These companies are emphasizing on the introduction of advanced products & services and collaboration & partnerships to strengthen their market presence.

Telepathology Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 24.07 billion

- 2026 Market Size: USD 26.55 billion

- 2034 Forecast Market Size: USD 109.91 billion

- CAGR: 19.43% from 2026 to 2034

Market Share:

- Leading Region: North America dominated the telepathology market with a 46.83% share in 2025. This dominance is attributed to advanced healthcare infrastructure, early adoption of digital pathology solutions, and presence of key market players.

- By application, Disease Diagnosis accounted for the largest share of the market in 2024, propelled by growing demand for rapid, accurate pathology services in oncology, infectious diseases, and chronic illness management across healthcare institutions globally.

Key Country Highlights:

- United States: The U.S. held the major share of the North American telepathology market in 2024. The country is a pioneer in adopting innovative pathology technologies, frequently the first to launch new telepathology products and services. Strong investments in healthcare IT infrastructure further support growth.

- Europe: Europe is the second-largest market globally. Growth is driven by healthcare modernization and supportive government initiatives promoting telepathology since the late 1980s. Active regional promotion and gradual digital transformation underpin the steady adoption.

- Asia Pacific: The Asia Pacific market is projected to grow robustly due to increasing telecommunication infrastructure and digital health adoption. For example, China’s National Cloud-Based Telepathology System facilitates remote pathology consultations via a large-scale cloud platform.

- Latin America & Middle East & Africa: These regions are anticipated to see considerable market growth, supported by improving digital infrastructure and expanding access to telepathology services.

MARKET DYNAMICS

MARKET DRIVERS

Advancements in Digital Imaging/Pathology to Drive Market Growth

One of the key factors driving market growth is the advancements in digital pathology. These technological advancements provide enhanced diagnostic accuracy, efficiency, and workflow optimization, which in turn are accelerating the adoption of digital pathology solutions. As a result, industry players are increasingly focusing on integrating high-resolution imaging products into their service offerings. The combined effect of these factors is anticipated to drive overall market growth.

Along with that, the growing prevalence of chronic diseases has contributed to increased demand for the remote interpretation of image-rich pathology data, such as tissue and cell samples, across distant locations. This trend further drives the telepathology market growth.

- For instance, according to the World Health Organization (WHO) data, cancer is the leading cause of death accounting for nearly one in six deaths in 2020.

MARKET RESTRAINTS

Dearth of Skilled Professionals to Limit Market Expansion

One of the key factors that limit the adoption of these products and services is the lack of skilled professionals, especially in developing countries. The less availability of skilled personnel and the high costs of maintaining compliance are considered to be some of the key factors affecting these services. Along with that, adapting to new digital systems requires time and effort, which can be challenging for busy professionals, limiting market growth.

MARKET OPPORTUNITIES

Integration of Telepathology in Clinical Trials to Positively Impact Market Growth

Integration of telepathology in clinical trials facilitates remote pathology reviews, thereby expediting drug development processes. It offers several advantages such as access to expert opinions with reduced timelines, centralized review, and faster turnaround times, in turn enhancing diagnostic accuracy and trial efficiency. It supports enhanced data collection and the analysis of large data sets, which are crucial for understanding disease mechanisms and the development of new innovative therapies. This benefit creates an opportunity for industry players to expand in this growing market.

MARKET CHALLENGES

Privacy and Security Concerns:

The use of digital platforms for telepathology presents challenges related to data privacy and security, which can hinder its adoption. Since it involves handling personal health information, patients may be reluctant to share their information due to data privacy concerns. This results in lesser usage of these services and highlights the critical need for stringent data protection measures to ensure patient trust and regulatory compliance.

Limited Infrastructure and Connectivity:

Limited infrastructure and connectivity hinder telepathology adoption in remote and underdeveloped areas. Due to the lack of required digital infrastructure in under-developed countries, healthcare providers are not keen on adopting advanced products. Some pathologists may be reluctant to transition from traditional practices to telepathology solutions, further slowing adoption rates.

TELEPATHOLOGY MARKET TRENDS

Integration of Artificial Intelligence (AI) is a Prominent Market Trend

Integrating artificial intelligence and machine learning is one of the prominent trends in the market. These technologies enhance diagnostic accuracy and efficiency through advanced image analysis. AI-based pathological algorithms play an important role, especially in disease diagnosis, anomaly detection, and patient outcome prediction. The role of AI in telepathology is poised for continued expansion.

- PathAI, Inc. is a U.S.-based company that offers AI-based comprehensive precision pathology solutions, contributing to the advancement of the telepathology landscape.

Download Free sample to learn more about this report.

Telepathology Segmentation Analysis

By Offering

Services Segment Led due to High Usage of Telepathology Services

Based on offering, the market is divided into products and services.

The services segment captured a significant share of the global market in 2024 and held a dominating position throughout the study period. Key factors including the high number of healthcare systems such as hospitals & clinics using telepathology services along with the presence of new entrants in the market with advanced service offerings have contributed to segment growth.

The products segment is expected to witness substantial growth in the study period due to the increasing new product approvals.

- For instance, in January 2025, F. Hoffman – La Roche Ltd. received the U.S. FDA approval for its whole slide imaging system.

By Type

Static Segment Led due to its Advantages

In terms of type, the market is classified into static, dynamic, and hybrid.

The static segment accounted for a notable share of the global market attributed to the advantages offered by this type of system. The segment is anticipated to dominate the global market over the study period. Key benefits include cost-effectiveness and ease of operation, as these systems need minimal specialized software and equipment, making them practical for many healthcare settings.

- In August 2022, Diagnexia, Deciphex’s tele-pathology care provider signed a strategic collaboration with Saudi Ajal Medical Laboratories to offer expert consultation pathology service in the country.

The dynamic and hybrid segments are expected to witness steady growth in the forecast period due to the increased adoption of these systems among end-users.

- In Norway, a well-documented, sustainable, and dynamic-robotic telepathology program is currently available. Dynamic robotic telepathology and WSI are being used in the new class of imaging system called the WSI-enhanced dynamic robotic telepathology system.

By Application

Increasing Utilization of Advanced Technologies Boosted Growth of Consultation Segment

On the basis of application, the market is divided into diagnosis, consultation, and others.

The consultation segment accounted for the largest share of the market in 2024. Teleconsultations leverage advanced technology to enable remote review and diagnosis of digital pathology, helping to overcome geographical barriers and ensuring increased access to specialized expertise.

The diagnosis segment is anticipated to hold a considerable share of the market. The growing use of telepathology for accurate and timely disease identification has been a major driver of the segment growth.

By End User

Hospitals & Clinics Dominated due to Increasing Usage of Digital Technologies

Based on end user, the market is segmented into hospitals & clinics, diagnostic laboratories, and others.

The hospitals & clinics segment held a significant telepathology market share in 2024 and is projected to hold its dominating position during the forecast period. Growth in the number of hospitals & clinics adopting telecommunication technologies for pathology consultations and various initiatives undertaken by healthcare facilities has been a key driver of the segment growth.

- For instance, in October 2022, Diagnexia was selected as a service provider for The Countess of Chester Hospital National Framework Agreement for telepathology.

The diagnostic laboratories segment is projected to grow considerably in the coming years owing to the increasing usage of this technology for remote consultations.

Telepathology Market Regional Outlook

By geography, the market is studied across Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Telepathology Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held a dominant position in the global market, accounting for around 46.83% share and a revenue generation of USD 11.27 billion in 2025. The regional dominance can be attributed to the region’s advanced healthcare infrastructure and the early adoption of digital pathology solutions compared to other regions.

U.S.

The U.S. captured the major share of the market in North America in 2024. Known for its high adaptability to technological advancements, the country continues to lead in the adoption of innovative solutions. Additionally, it has been the first market for the launch of new products and services by the majority of the large companies.

Europe

Europe represents the second-largest market across the globe. The region has experienced steady growth due to healthcare modernization and supportive government initiatives. The implementation of telepathology in Europe started in the late 1980s and since then it is constantly growing.

- For instance, as per the study published in the diagnostic pathology journal in 2020, the adoption of telepathology is increasing due to active promotion across the region.

Asia Pacific

The market in the Asia Pacific region is projected to witness strong growth during the forecast period, driven by the increasing usage of telecommunication services in pathology.

- The Chinese National Cloud-Based Telepathology System has been operating in the country for more than 4 years. This system is designed to facilitate telepathology consultations by enabling pathologists to access and review digital Whole-Slide Images (WSIs) remotely. It is a cloud-based infrastructure to manage and store large volumes of WSI data.

Latin America and the Middle East & Africa

The Latin America and Middle East & Africa are expected to witness considerable growth in the coming years due to the increasing access to required digital infrastructure.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Focus on Collaborations and Partnerships to Boost their Market Share

The global market is witnessing strong growth with a significant number of companies operating in this field. The key players such as OptraScan, UCLA Health, CompuMed, Inc., and Leica Biosystems Nussloch GmbH held a substantial portion of the global market in 2024. These companies focus on various strategic initiatives such as collaborations, regional expansion, and acquisitions to strengthen their market positions.

- For instance, in April 2024, UCLA Health and PreciseDx collaborated to enhance AI-enabled predictions and risk mitigation for triple-negative breast cancer recurrence.

Additionally, Krsnaa Diagnostics Ltd. and Diagnostic Instruments Tribun Health are among the other prominent players in the market. These companies are focusing on receiving significant investments to boost their share in the market.

This market operates in a dynamic environment influenced by various factors such as technological advancements, regulatory policies, market competition, and shifting healthcare priorities. Continuous innovation, strategic collaborations, and partnerships among industry players are essential for sustained growth and market expansion.

In conclusion, the market is poised for substantial growth, driven by technological advancements and the increasing need for efficient diagnostic solutions. Addressing challenges such as data security and infrastructure limitations will be crucial for the widespread adoption and success of these services globally.

LIST OF KEY TELEPATHOLOGY COMPANIES PROFILED

- Krsnaa Diagnostics Ltd. (India)

- OptraScan (U.S.)

- CompuMed, Inc. (U.S.)

- Diagnostic Instruments, Inc. (U.S.)

- UCLA Health (U.S.)

- Grundium Ltd (Finland)

- Leica Biosystems Nussloch GmbH (Germany)

- Medica Reporting Ltd. (U.K.)

- Specialist Direct LLC. (U.S.)

- Tribun Health (France)

KEY INDUSTRY DEVELOPMENTS

- February 2025: PathAI, Inc. introduced a new AI-powered tool, PathAssist Derm to advance dermatology research.

- November 2024: Deep Bio collaborated with PathAI, Inc. to enhance AI-powered innovations in digital pathology.

- February 2024: F.Hoffmann-La Roche partnered with PathAi, Inc. for the development of an AI-powered digital pathology algorithm

- September 2022: Krsnaa Diagnostics set up a tele-pathology reporting center in Pune, India by using SigTuple AI100.

- August 2020: Motic Digital Pathology announced the launch of a telepathology program at a global level.

REPORT COVERAGE

The global telepathology market analysis provides market size and forecast by all the segments included in the report. The report provides information on market dynamics and trends, driving the market in the forecast period. It offers information on key industry developments, new product and service launches, and details on partnerships, mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 19.43% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Offering

|

|

By Type

|

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 24.07 billion in 2025 and is projected to reach USD 109.91 billion by 2034.

In 2025, the market value stood at USD 11.27 billion.

The market is expected to exhibit a CAGR of 46.83% during the forecast period of 2026-2034.

The services segment led the market by offering.

The key factors driving the market are the shifting focus toward the use of digital pathology and integration of Artificial Intelligence (AI) and machine learning in telepathology.

OptraScan, CompuMed, Inc., Diagnostic Instruments, Inc., and UCLA Health are some of the top players in the market.

North America dominated the market in 2025 and held the largest share.

Advancements in digital pathology, and increasing need remote diagnostic services are some of the factors that are expected to favor the service adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us