Tetracyclines Market Size, Share & Industry Analysis By Generation (First Generation, Second Generation, and Third Generation), By Application (Respiratory Infections, Gastrointestinal Tract Infections, Skin Infections, and Others), By Route of Administration (Oral, Parenteral, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

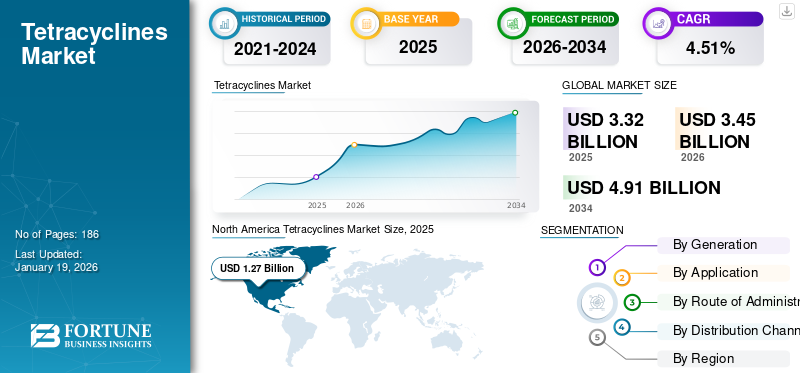

The global tetracyclines market size was valued at USD 3.32 billion in 2025. The market is projected to grow from USD 3.45 billion in 2026 to USD 4.91 billion in 2034, exhibiting a CAGR of 4.51% during the forecast period. North America dominated the tetracyclines market with a market share of 38.27% in 2025.

Tetracyclines are a class of medications that are used to manage and treat various bacterial infections. These are protein synthesis inhibitor antibiotics and are considered to be broad-spectrum. There are three generations of tetracycline such as naturally occurring (tetracycline, chlortetracycline, demeclocycline, and oxytetracycline), semi-synthetic (rolitetracycline, lymecycline, methacycline, doxycycline, rolitetracycline, and minocycline), and a class of newer tetracyclines that includes sarecycline, omadacycline, and eravacycline. These drugs can treat a variety of bacterial infections such as syphilis, rickettsial infections, amebiasis, brucellosis, chlamydial infections, and pelvic inflammatory disease, and diseases associated with Mycoplasma pneumoniae, Staphylococcus aureus, and others.

Furthermore, the global tetracyclines market is witnessing an upward growth trajectory due to the rising prevalence of these bacterial infections, and increasing development of novel tetracyclines with limited antimicrobial resistance. Moreover, the increasing approval for generic drug launches is anticipated to bolster product adoption and market growth.

- For instance, in April 2024, Lupin, with the U.S. FDA approval, announced the launch of the first generic version of Oracea (Doxycycline Capsules, 40 mg) in the U.S.

Moreover, major players in the market, such as Pfizer Inc., Teva Pharmaceuticals Industries Ltd., and Lupin, with branded and generic product offerings, are maintaining their market share. Strategic activities and research and development activities are propelling the companies’ shares in the market.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Prevalence of Infectious Diseases to Drive the Market Growth

The rising prevalence of bacterial infections, such as respiratory tract infections, such as pneumonia, skin and soft tissue infections, such as acne and rosacea, and sexually transmitted infections, such as Chlamydia and syphilis, and others, is driving the market growth.

Different generations of tetracyclines are used to treat a variety of these bacterial infections. The rising cases of these diseases increases the prescription, bolstering the market growth.

- For instance, in November 2024, as per data published by the WHO, in 2020, an estimated 128.5 million new infections with Chlamydia trachomatis were reported worldwide among adults aged 15 to 49 years.

- Similarly, as per the National Rosacea Society, an estimated more than 16.0 million Americans and more than 415.0 million worldwide are suffering from rosacea.

A larger number of cases associated with bacterial infections boost product demand, driving the global tetracyclines market growth.

MARKET RESTRAINTS

Product Recall due to Manufacturing Defects to Restrict the Market Growth

Product recalls, especially due to manufacturing defects, are a key factor restraining the market growth due to significant damage to a pharmaceutical company's reputation and erosion of public trust in their products. Substantial financial costs, erosion of consumer trust and potential lawsuits, and regulatory penalties are all these factors that lead to losses and impact companies' profitability.

- In February 2023, the WHO issued a medical product alert for Tetracycline Hydrochloride Ophthalmic Ointment USP 1% from Galentic Pharma (India) Pvt. Ltd. Samples detected with various quality defects, including particles in the ointment, nozzle, and cap, as well as spots and splotches on the inner foil lining, and phase separation. These issues varied by batch and procurer. The manufacturer initiated a voluntary recall for several batches, according to the WHO.

- Similarly, in April 2020, the U.S. Food and Drug Administration announced that Avet Pharmaceuticals Inc. voluntarily recalled its Tetracycline HCl Capsules USP, 250 mg and 500 mg. The recall was initiated due to dissolution issues of the drug; the lower dissolution resulted in less tetracycline in the body to combat infection, and it may hamper the geriatric, immune-compromised patients and patients with severe infections.

Such incidences may impose stricter regulatory standards on manufacturers and more rigorous inspection protocols for tetracycline products, potentially leading to delays in product launches and hindering market expansion.

MARKET OPPORTUNITIES

Rising Focus on Developing and Launching Novel Products to Cater to Unmet Needs

There has been an increase in microbial resistance to the available drugs and the presence of individual treatment options for diseases such as Rosacea. This has shifted the focus of key pharmaceutical companies to develop and launch new drugs for effective treatment, pushing market growth during the forecast period.

Rosacea is a chronic, relapsing, inflammatory skin condition with symptoms such as deep facial redness, acne-like inflammatory lesions (papules and pustules). The number of individuals worldwide suffering from this disease has lowered their self-confidence and self-esteem. However, for the treatment of these diseases, the only FDA-approved oral treatment was Oracea (doxycycline, 40 mg). Thus, many key companies are focused on developing superior products for the treatment of rosacea in the minimum possible dosage.

- For instance, in March 2024, Journey Medical Corporation received U.S. FDA approval for Emrosi (Minocycline Hydrochloride Extended Release Capsules, 40 mg), for the treatment of inflammatory lesions of rosacea in adults. As demonstrated in clinical trials, this drug has delivered superior clinical outcomes for rosacea when compared to Oracea and placebo, while maintaining a comparable safety profile.

Such developments are expected to increase the demand for effective products, propelling market growth.

MARKET CHALLENGES

Adverse Effects Associated with Tetracycline to Challenge the Market Growth

Adverse drug effects associated with tetracyclines are challenging the market growth. The common effects associated with the drug usage are Nausea, vomiting, diarrhea, photosensitivity, skin rashes, and others.

Furthermore, the irreversible ADRs include teeth discoloration, blurred vision, severe allergic reactions, and others. Such adverse effects associated with the long-term usage may restrict its adoption and challenge the market growth.

Moreover, many government bodies are issuing alerts for the usage of tetracycline to avoid the adverse effects associated with it.

- For instance, in October 2024, the Indian Pharmacopoeia Commission (IPC) issued an alert about the potential adverse reactions of Tetracycline can cause skin reactions when used for treating various infections such as malaria, typhus, respiratory infections, tick fever, and cholera. Such events hamper the product image and market growth.

TETRACYCLINES MARKET TRENDS

Use of Tetracycline Antibiotics as Anti-Cancer Agents Identified as a Key Market Trend

Increasing research and development by academic institutes and research centers to identify the usage of available antibiotics for oncological applications is acting as a prominent global tetracyclines market trend. Currently, these antibiotics have been used to treat patients with infectious diseases for many years; these old drugs may point the way to new immunotherapies for cancer patients who currently have few treatment options.

- For instance, in April 2024, the University of Osaka, Japan researchers discovered that certain tetracycline antibiotics, such as minocycline, can stimulate the immune system to identify cancer cells. Minocycline enhanced the antitumor activity of T lymphocytes by targeting galactin-1, which helps cancer cells to hide from the immune system. Thus, targeting galectin-1 to no longer stop the T lymphocytes from reaching and attacking tumors. Thus, tetracycline treatment allows the immune system to target and destroy the cancer cells effectively.

This mechanism offers a potential new avenue for cancer treatment, particularly for patients who do not respond to current immunotherapies.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Generation

Third Generation Leads Due To Its Ability To Overcome Common Resistance Mechanisms

Based on generation, the global market is segmented into first, second, and third.

The third generation segment held the most significant market share in 2024. The growth of the segment is driven by the increasing adoption of third-generation tetracyclines, primarily due to its enhanced activity against antibiotic resistant bacteria and ability to overcome common resistance mechanisms. Additionally, increasing approvals and product launches of third-generation drugs to propel the segment’s growth.

- For instance, in June 2021, Almirall, S.A. received U.S. Food and Drug Administration (FDA) approval for the production of Seysara (sarecycline) at the Barcelona, Spain, production site. Seysara is used for the treatment of inflammatory lesions of nonnodular acne vulgaris.

The second generation segment is anticipated to hold a significant CAGR during the forecast period. The segment's growth is due to the increase prevalence of bacterial and atypical organism infections and the strong activity of second generation drugs against gram-positive and gram-negative bacteria, as well as organisms such as Chlamydia, Mycoplasma, and Rickettsia. Such advantages are poised to boost the segment’s growth. Additionally, the launch of generic second-generation products are expected to increase the adoption of these solutions.

- For instance, in February 2018, Teva Pharmaceutical Industries Ltd., launched two strengths of a generic version of Solodyn 1 (minocycline HCl). These are formulations such as extended release tablets, available in the U.S. in two strengths, i.e., 65 and 115 mg.

On the other hand, the first-generation drugs segment is expected to grow at a moderate compound annual growth rate during the forecast period. Compared to other generation drugs, antibiotic resistance and side effects associated with the first-generation drugs limit their adoption and segment growth.

By Application

Rising Cases of Skin Infections to Augment Segment Growth

Based on application, this market is classified as gastrointestinal tract infections, skin infections, respiratory infections, and others.

The skin infections segment held a dominant market share in 2024. The increasing cases of skin and soft infections (SSTIs), including acute bacterial skin and skin structure infections (ABSSSIs), bacterial skin infections such as acne vulgaris, boosted the demand for adequate treatment, driving the segment growth. Moreover, increasing approval for novel antibiotics for the treatment of skin infections is poised to boost the segment growth.

- For instance, in December 2021, Zai Lab announced the approval of New Drug Application (NDA) by the China National Medical Products Administration (NMPA) for NUZYRA (omadacycline). It is given in oral and parenteral routes for the treatment of acute bacterial skin and skin structure infections (ABSSSI) and community-acquired bacterial pneumonia (CABP).

The gastrointestinal tract infections segment held a substantial market share and is expected to grow during the forecast period. The growth of the segment is driven by the strategic activities of key players to offer new-aged tetracycline for abdominal infection treatment.

- For instance, in November 2024, Everest Medicines presented the data on eravacycline (XERAVA) at the Los Angeles, California, at IDWeek 2024. The presentation showcases the broad and consistent antimicrobial activity of eravacycline for the treatment of complicated intra-abdominal infections caused by both Gram-negative and Gram-positive bacteria. Such evidence supports the adoption of the drug and segment growth.

The respiratory infections segment grow at a moderate CAGR during the forecast period. This is due to the rising prevalence of community-acquired and hospital-acquired respiratory infections and increased demand for prominent treatment options with lesser chances of resistance. Leading companies are focusing on proving the efficacy of available drugs for severe community-acquired bacterial pneumonia increased the customer base, impelling segment growth.

- For instance, in July 2024, Paratek Pharmaceuticals, Inc., announced positive results from a global Phase 3 post-marketing study (OPTIC-2) that evaluated the efficacy and safety of NUZYRA (omadacycline) for treating moderate to severe community-acquired bacterial pneumonia (CABP). The study compared omadacycline to moxifloxacin and states that omadacycline was generally safe and well-tolerated. Such studies boost the adoption and segment growth.

By Route of Administration

Launch of Generic Oral Drugs to Bolster Segment’s Growth in the Market

The global market is classified as oral, parenteral, and others on the basis of the route of administration.

The oral segment is expected to hold a dominant global tetracyclines market share in 2024. The growth of the segment is driven by ease of administration without requiring medical supervision, better bioavailability, and convenience to follow the treatment regimen, making them a preferred choice.

Additionally, new product launches of oral drugs by key players are expected to boost the segment growth.

- For instance, in March 2023, Endo International plc launched a generic version of Allergan's Pylera (bismuth subcitrate potassium, metronidazole, tetracycline hydrochloride) capsules (140 mg, 125 mg and 125 mg) in the U.S. This combination drugs is used for the treatment of patients with duodenal ulcer disease and Helicobacter pylori infection.

The parenteral segment is expected to grow at a moderate CAGR during the forecast period. The increasing demand for rapid action in severe infections and product approvals by regional regulatory bodies to bolster segment growth.

The other routes of administration segment is expected to grow at a slower CAGR during the forecast period. The rising number of product recalls associated with ophthalmic solutions is lowering the pace of segment growth.

By Distribution Channel

Rising Prescription Numbers to Boost Retail Pharmacy Segment

Based on distribution channel, the global market is divided into online pharmacy, retail pharmacy, and hospital pharmacy.

The retail pharmacy segment held a dominant share of the market in 2024. The rising number of outpatient antibiotic prescriptions dispensed from retail pharmacies is a major factor influencing segment growth.

- For instance, in 2022, as per data published by the CDC for Outpatient Antibiotic Prescriptions in the U.S., around 27.1 million prescriptions of tetracycline were dispensed in the U.S.

The hospital pharmacy segment is anticipated to witness significant growth during the forecast period. The rise in patients seeking care for infectious diseases in hospitals is boosting the distribution of related products through hospital pharmacies.

- For instance, in 2022, as per data published by the CDC, the Physician Assistants and Nurse Practitioners prescribed 84.4 million prescriptions in the U.S.

The online pharmacy segment is likely to grow at the highest CAGR during the forecast period. Increasing preference for doorstep delivery, convenience, and prescription refilling are the factors boosting segment growth.

TETRACYCLINES MARKET REGIONAL OUTLOOK

Based on region, the global market can be segmented such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America

North America Tetracyclines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is anticipated to dominate the market and accounted for a market value of USD 1.27 billion in 2025 and USD 1.32 billion in 2026. The increasing number of cases with bacterial infections, the presence of advanced healthcare infrastructure, with prominent guidelines for adequate and careful usage of antibiotics, is fueling the region’s growth.

The region comprises key players with expanded research and development facilities. In contrast, the strong presence of key players with advanced research and development facilities propels the region's market growth.

U.S.

In the North America region, the U.S. dominated the market in 2024. The rising prevalence of diseases, increasing activities to boost to reduce resistance and significant focus of key generic players to launch a generic version of tetracycline in the country are driving the market growth in the country.

- For instance, in May 2024, Dr. Reddy’s Laboratories Ltd. announced the launch of ORACEA (doxycycline, USP) Capsules, 40 mg generic version in the U.S.

Europe

The Europe region is expected to witness significant growth. Robust product offerings by key players in the region are expected to boost the product adoption and market growth.

- For instance, in September 2021, PAION AG, the Specialty Pharma Company, launched XERAVA(R) (eravacycline). It announced commercial availability in the Netherlands for ordering and delivering to customers through direct sales. Such scenarios boost the customer base and demand for products, influencing regional market growth.

Asia Pacific

The Asia Pacific market is expected to grow at the highest CAGR over the forecast period. A strong presence of regional players, offering readily available and cost-effective generic drugs to a large patient base, is driving significant growth.

- For instance, in August 2022, Everest Medicines announced the approval of a New Drug Application for Xerava (eravacycline) by the Taiwan Food and Drug Administration (TFDA). Xerava is intravenously administered to treat complicated intra-abdominal infections (cIAI). This approval marks the successful commercialization of novel anti-infective products in the region.

Latin America & Middle East & Africa

The market in Latin America and the Middle East & and Africa is projected to grow at a moderate CAGR during 2025-2032. The market expansion is expected to be fueled by the increased establishment of new healthcare facilities and increasing efforts to raise public awareness of various bacterial infections and the appropriate use of antibiotics.

- For instance, in April 2022, Abu Dhabi's Sheikh Shakhbout Medical City (SSMC) launched a prominent point-of-care antimicrobial management tool to increase medical awareness in the Middle East.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Pfizer Inc., Abbott, with Strong Product Offerings, to Maintain their Position in the Market

The market holds a semi-fragmented structure with larger number of key players holding maximum share. Large pharmaceutical companies are securing a significant market share in 2024, driven by their extensive product portfolios and strategic investments in research and development. These companies are leveraging collaborations and acquisitions to further enhance their global presence and competitive advantage.

Other key players that hold a substantial market share are Paratek Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Journey Medical Corporation, Inc., Dr. Reddy’s Laboratories Ltd., and Lupin. Companies are depicting a focus on research and development and the launch of generic products with regulatory approvals to increase their market share during the forecast period.

LIST OF KEY COMPANIES PROFILED

- Pfizer Inc. (U.S.)

- Abbott (U.S.)

- Lupin (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Everest Medicines (China)

- Paratek Pharmaceuticals, Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sun Pharmaceutical Industries Ltd. (India)

- Journey Medical Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2023: Bausch Health Companies Inc. (OraPharma) collaborated with World Series Champion and 3-time American League MVP to launch a national awareness campaign about the prevalence and impact of gum disease. The program aimed to increase the adoption of ARESTIN with scaling and root planing (SRP) to treat adult periodontitis.

- January 2023- Zai Lab Limited announced that the National Reimbursement Drug List (NRDL) includes NUZYRA (omadacycline) for the treatment of adults with community-acquired bacterial pneumonia (CABP) and ABSSSI.

- January 2023- Meitheal Pharmaceuticals announced the launch of Tigecycline injection in 50 mg per vial and in 10 ml per single-dose vial in the U.S.

- January 2021- La Jolla Pharmaceutical Company entered into a licensing agreement with PAION AG for the sale of GIAPREZA (angiotensin II) and XERAVA (eravacycline) in the European Economic Area, the U.K., and Switzerland.

- February 2019- Breckenridge Pharmaceutical, Inc., launched Tetracycline 250mg and 500mg capsules.

REPORT COVERAGE

The research report provides a detailed market analysis. This market report focuses on the prevalence of key diseases by key countries, new product launches, and pipeline analysis. Furthermore, it includes key industry developments, mergers, acquisitions, and partnerships by key players. In addition, the report offers a detailed analysis of market drivers, restraints, opportunities, and market trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.51% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Generation

|

|

By Application

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 3.45 billion in 2026 and is projected to reach USD 4.91 billion by 2034.

In 2025, the market value in North America stood at USD 1.27 billion.

Registering a CAGR of 4.51%, the market will exhibit steady growth over the forecast period (2026-2034).

The rising burden of infectious diseases is a major factor driving the market growth.

Pfizer Inc., Abbott, and Lupin are some of the major players in the global market.

North America dominated the tetracyclines market with a market share of 38.27% in 2025.

The increasing use of tetracyclines for new indications around the globe are expected to drive the growth and adoption of the products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us