Traction Inverter Market Size, Share & Industry Analysis, By Technology (IGBTs and MOSFETs), By Vehicle Type (Two Wheeler, Passenger Cars, Commercial Vehicles, and Train), By Propulsion Type (Battery Electric Vehicle (BEV) and Hybrid Electric Vehicle (HEV)), By Voltage (Up to 200V, 201 to 900V and Above 901V), and Regional Forecast, 2026-2034

TRACTION INVERTER MARKET SIZE AND FUTURE OUTLOOK

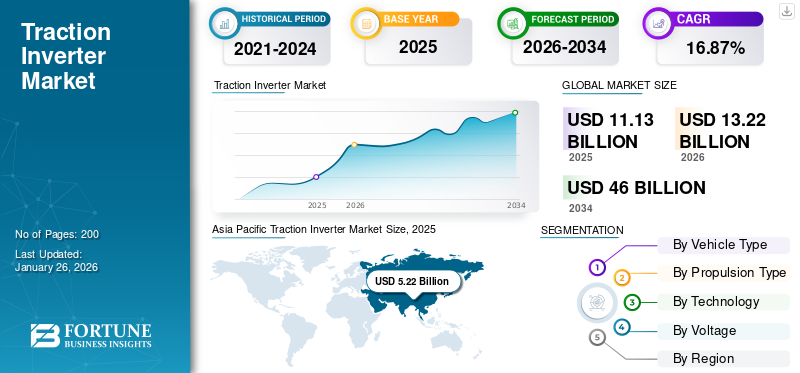

The global traction inverter market size was valued at USD 11.13 billion in 2025. The market is projected to grow from USD 13.22 billion in 2026 to USD 46.00 billion by 2034, exhibiting a CAGR of 16.87% during the forecast period. Asia Pacific dominated the global market with a share of 46.88% in 2025.

A traction inverter is a crucial power electronic device in electric and hybrid vehicles, responsible for converting direct current (DC) from the battery into alternating current (AC) to drive the electric motor. This conversion is essential for the efficient operation of the motor, allowing for precise control of speed and torque. It also plays a vital role in energy management, facilitating regenerative braking by converting kinetic energy back into electrical energy for recharging the battery.

The global market growth is experiencing a significant rise due to the increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs). As automakers focus on enhancing vehicle performance and efficiency, inverters are evolving with advanced technologies, improving their power density and thermal management. Regulatory pressures for reduced emissions and the transition toward sustainable transportation solutions further fuel the demand for high-efficiency inverters. Additionally, innovations in semiconductor materials and integration techniques are contributing to the development of more compact and effective systems.

The COVID-19 pandemic had a notable impact on the global market share. Initially, manufacturing disruptions and supply chain challenges hindered production capabilities, leading to delays in vehicle launches and reduced demand. However, as economies began to recover, there was a renewed focus on green technologies, including electric vehicles EVs, which spurred investments in EV infrastructure and production. The pandemic also accelerated the shift toward digitalization in automotive operations, prompting manufacturers to adopt more advanced technologies in inverters to meet evolving consumer demands for efficiency and sustainability.

TRACTION INVERTER MARKET TRENDS

Growing Shift Toward Adoption of Silicon Carbide is a Latest Trend in the Market

The latest trend in the global market is characterized by significant advancements in power electronics, particularly the adoption of wide-bandgap semiconductors such as silicon carbide (SiC) and gallium nitride (GaN). These materials enhance the efficiency and performance of inverters, enabling them to handle higher voltages and temperatures while reducing energy losses. Manufacturers are increasingly integrating these technologies into their products to meet the growing demands for electric vehicles (EVs) and hybrid electric vehicles (HEVs). For instance, companies such as Texas Instruments are pushing the boundaries of inverter capabilities by utilizing microcontrollers with real-time control features, which improve switching performance and reliability. This innovation enhances vehicle performance and contributes to lighter and more efficient motors, setting a new standard in the automotive sector.

Additionally, the integration of vehicle-to-grid (V2G) technology is gaining traction, allowing EVs to interact with the power grid and contribute to energy management systems. This trend is supported by government incentives aimed at promoting sustainable transportation solutions. As automakers continue to focus on electrification, partnerships between manufacturers and technology firms are becoming more common, facilitating the development of advanced inverters that cater to evolving market needs. Overall, these trends signify a shift toward more efficient, reliable, and sustainable solutions in the market as it adapt to the increasing popularity of electric mobility.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for BEVs and HEVs to Drive Market Growth

A major driving factor for the global traction inverter market is the accelerating demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs). This surge is largely influenced by stringent government regulations aimed at reducing carbon emissions and promoting sustainable transportation. For example, in 2023, the European Union implemented new regulations requiring car manufacturers to significantly lower their fleet emissions, which has led to increased investments in EV technology and infrastructure. Major passenger cars commercial vehicles manufacturers, such as Ford and Volkswagen, are committing substantial resources to electrification strategies, including the development of advanced inverters that enhance vehicle performance and efficiency.

Additionally, advancements in power electronics technology are playing a crucial role in this market’s growth. The adoption of wide-bandgap semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN), is enabling the production of more efficient and compact inverters. Companies such Tesla are leveraging these technologies to improve the energy density and thermal performance of their electric drivetrains, thus enhancing overall vehicle range and performance.

Moreover, the expansion of charging infrastructure is vital for supporting the growing EV market. Governments worldwide are investing heavily in charging networks to alleviate range anxiety among consumers. For instance, the U.S. government announced a significant investment plan to expand its EV charging network as part of its commitment to clean energy initiatives. This holistic approach—combining regulatory support, technological innovation, and infrastructure development is driving the popularity of product as it aligns with global sustainability goals.

MARKET RESTRAINTS

High Manufacturing and Installation Cost Associated with Such Inverters to Hamper Market Growth

A crucial restraining factor for the traction inverter market growth is the high manufacturing and installation costs associated with these systems. The complexity of such inverters, which involves advanced power electronics and materials, significantly contributes to their overall expense. For instance, the integration of wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN) enhances efficiency but also raises production costs due to their intricate manufacturing processes. Companies such as Tesla and General Motors are investing heavily in research and development to reduce these costs. Still, the financial burden remains a significant barrier to the widespread adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs).

Moreover, limited access to raw materials poses another challenge. The demand for key components, such as rare earth metals used in magnets for electric motors, is increasing, leading to supply chain constraints. This issue has prompted manufacturers to seek alternative materials or recycling methods to mitigate costs and ensure a steady supply. For example, Ford has announced initiatives aimed at securing sustainable sources for battery materials, which could indirectly support inverter production.

Additionally, charging infrastructure remains underdeveloped in many regions, limiting the potential market for EVs equipped with such inverters. Governments are recognizing this gap; for instance, the U.S. Department of Energy has launched programs aimed at expanding charging networks across urban and rural areas. These initiatives are crucial for fostering an environment where inverters can be more widely utilized.

SEGMENTATION ANALYSIS

By Technology

MOSFET Segment Leads Owing to Rising Investments by Key Players

In terms of technology, the market primarily is divided into Insulated Gate Bipolar Transistor (IGBT) and Metal-Oxide Semiconductor Field-Effect Transistor (MOSFET) technologies.

The MOSFET technology segment is projected to lead the market with a 56.13% share In 2026 and particularly used for low- to medium-power applications where switching speed and efficiency are critical. Companies such as Texas Instruments are actively investing in MOSFET-based solutions that offer compact designs suitable for modern EV architectures.z

IGBT segment currently is the fastest-growing segment in the market due to its robustness and efficiency in high-power applications. This technology is favored by manufacturers such as Mitsubishi Electric and Infineon Technologies for its ability to handle high voltage levels while maintaining thermal stability. As manufacturers continue to innovate, there is a growing trend toward integrating both IGBT and MOSFET technologies into hybrid solutions that leverage each other’s strengths. This approach allows for enhanced performance across a broader range of applications while addressing specific needs such as size constraints and thermal management. This segment is likely to grow with a considerable CAGR of 20.90% during the forecast period (2025-2032).

By Vehicle Type

Higher Consumer Preference Toward Electric and Hybrid Electric Vehicles to Drive the Growth of Passenger Cars Segment

By vehicle type, the market is segmented into two-wheeler, passenger cars, commercial vehicles, and train.

Among these, passenger cars dominate the traction inverter market with a share of 33.89% in 2026, driven by the rapid adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs). Major automotive manufacturers are increasingly focusing on passenger electric car electrification due to consumer demand for sustainable transportation options. For instance, companies such as Tesla and Ford are investing heavily in developing advanced inverters that enhance the performance and efficiency of their electric models. The segment is foreseen to hold 52% of the market share in 2025.

Two-wheelers are the fastest-growing segment within this category, particularly in regions such as Asia Pacific, where e-bikes and scooters are becoming popular due to urban congestion and rising fuel prices. Manufacturers such as Bajaj Auto are actively developing electric two-wheelers with integrated traction related inverters to cater to this growing market. The segment is anticipated to grow with a CAGR of 22.00% during the forecast period (2025-2032).

The rising need for efficient logistics and transportation solutions is pushing fleet operators to transition to electric options in commercial vehicles. Companies such as Daimler and Volvo are leading this transition by introducing electric trucks and buses equipped with high-performance inverters, which reduce operational costs and comply with stringent environmental regulations.

Train segment, while smaller, is witnessing innovations as rail operators look to electrify their fleets for improved efficiency. Companies such as Siemens are pioneering inverter technologies specifically designed for electric trains, contributing to sustainable rail transport.

Global Traction Inverter Market Share, By Vehicle Type, 2026

To get more information on the regional analysis of this market, Download Free sample

By Propulsion Type

BEV Segment Leads Due to Increasing Consumer Preference for Fully Electric Options

The market is categorized into Battery Electric Vehicles (BEVs) and Hybrid Electric Vehicles (HEVs).

The BEV segment holds the dominant position in the market with a share of 77.62% in 2026, due to the increasing consumer preference for fully electric options that offer zero emissions. Major automakers such as Tesla and Nissan have been at the forefront of this trend, continuously enhancing their BEV offerings with advanced inverters that improve energy efficiency and performance.

HEV segment is experiencing rapid growth as consumers seek flexible solutions that combine traditional internal combustion engines with electric propulsion systems. Manufacturers such as Toyota have successfully integrated traction related inverters into their hybrid models, enabling efficient energy management that optimizes fuel consumption. This dual approach appeals to environmentally conscious consumers and addresses a range anxiety associated with fully electric vehicles. The push toward electrification is further supported by government incentives promoting both BEVs and HEVs. For example, various countries have introduced subsidies and tax breaks for consumers purchasing hybrid vehicles, thereby stimulating demand for traction the product.

By Voltage

201 to 900V Provides Stability without compromising on Efficiency Dominating Market Growth

By voltage, the market is categorized into up to 200V, 201 to 900V, and above 901V.

The 201 to 900V segment is dominating the market with a share of 63.09% in 2026, primarily due to its suitability for most passenger EVs and commercial vehicles. This voltage range allows manufacturers such as Tesla and BYD to optimize their traction inverters for enhanced efficiency while meeting regulatory standards.

The above 901V segment is recognized as the fastest-growing category, driven by advancements in high-performance electric vehicles that require higher voltage levels for improved power density and efficiency. Companies such as Rimac Automobili are pioneering this trend with hypercars that utilize ultra-high voltage systems paired with advanced inverters designed for maximum performance. This segment is likely to document a CAGR of 26.70% during the forecast period (2025-2032).

The up to 200V category remains relevant primarily for low-power applications such as e-bikes and scooters. Manufacturers such as Ather Energy focus on developing efficient inverters within this range to cater to urban mobility solutions. Overall, the increasing focus on high-voltage systems reflects a broader industry trend toward enhancing vehicle performance while reducing energy losses, making it a pivotal area of growth within the market.

TRACTION INVERTER MARKET REGIONAL OUTLOOK

By region, the market is studied across Europe, Asia Pacific, North America, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Traction Inverter Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valued of USD 5.22 billion in 2025 and USD 6.21 billion in 2026. The region is leading the market, primarily due to the significant increase in electric vehicle (EV) sales in China. The region’s growing automotive markets, including India and other South Asian countries, are expected to boost demand for such inverters. Supportive government initiatives across prominent countries in the Asia Pacific are also driving market growth. China is foreseen to grow with a value of USD 4.71 billion in 2025. For instance, China has implemented policies to promote EV adoption, while Japan and South Korea are enhancing their local production capabilities for inverters to meet rising demand. The combination of technological advancements and favorable regulatory frameworks positions Asia Pacific as a critical player in the market. India is poised to hold USD 0.079 billion in 2025, while Japan is forecasted to reach USD 0.14 billion in the same year.

Europe

Europe is the second leading region expected to acquire USD 3.30 billion in 2025, registering a CAGR of 19.30% during the forecast period (2025-2032). The region held the second-largest market share in 2024 and is projected to experience significant growth in the market during the forecast period. The European Union’s ambitious targets for reducing carbon emissions have prompted automakers to accelerate their electrification strategies. Companies such as Volkswagen and BMW are heavily investing in advanced traction inverters to comply with these regulations while improving vehicle performance. The U.K. market continues to grow, set to expand with a value of USD 0.43 billion in 2025. Additionally, collaboration between automotive manufacturers and technology firms is fostering innovation in power electronics, with partnerships aimed at enhancing charging infrastructure and integrating smart technologies into EVs becoming increasingly common. This collaborative environment is expected to bolster the growth of such inverter’s market across Europe. Germany is estimated to be worth USD 1.03 billion in 2025, while France is set to be valued at USD 0.46 billion in the same year.

North America

North America is the third largest market expected to hit USD 2.37 billion in 2025. North America maintains a notable market share in 2024 driven by increased demand for electric vehicles and a well-developed EV infrastructure. The region’s established automotive industry, coupled with significant investments from manufacturers such as Tesla and General Motors, supports the growth of traction inverters. The U.S. market is driven by advancements in electric vehicle technology. They play a crucial role in converting DC power from batteries into AC for electric motors, enhancing vehicle performance and efficiency. The adoption of wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN) is gaining traction due to their efficiency and power density. For instance, companies like Infineon Technologies and Cree (Wolfspeed) are leading this shift, supporting automakers in improving their powertrains with advanced materials. This trend is supported by government incentives and the growing demand for electric vehicles. The U.S. market is predicted to gain USD 2.19 billion in 2025.

Rest Of The World

The rest of the world is the fourth leading region anticipated to acquire USD 0.22 billion in 2025. The rest of the world is also anticipated to grow steadily, although challenges such as inadequate EV infrastructure may hinder widespread adoption. Regions such as South America, the Middle East & Africa are gradually gaining momentum as interest in electric mobility rises due to environmental concerns and government initiatives aimed at reducing pollution. Countries such as Brazil are beginning to invest in EV infrastructure to support local manufacturers exploring electric solutions for public transportation.

COMPETITIVE LANDSCAPE

Key Industry Players

Extensive Power Electronics Expertise and Innovative Solutions Position Hitachi Ltd as a Leading Industry Player

Hitachi Ltd. is the leading player in the competitive landscape. The company has established a strong foothold due to its extensive experience in power electronics and commitment to innovation. Hitachi’s traction inverters are known for their high efficiency and reliability, making them suitable for various applications, including electric vehicles (EVs) and rail transport. The company has been actively investing in research and development to enhance its product portfolio. It focuses on next-generation technologies, such as silicon carbide (SiC) semiconductors, which improve power density and reduce energy losses. Recently, Hitachi announced advancements in its such inverter technology aimed at optimizing performance for electric buses and trains, aligning with global trends toward electrification in public transport systems. Their strategic partnerships with automotive manufacturers further bolster their market position, ensuring that they remain at the forefront of the inverter industry.

Mitsubishi Electric Corporation is also among the key market players, it has made significant strides in the traction inverter sector by leveraging its expertise in power electronics and automation technologies. The company offers a diverse range of such inverters designed for electric vehicles, hybrid vehicles, and rail applications. Mitsubishi’s commitment to sustainability is evident in its ongoing development of energy-efficient solutions that comply with stringent environmental regulations. Recently, Mitsubishi Electric announced the launch of a new line of compact inverters aimed at enhancing the performance of electric commercial vehicles. This product line emphasizes high efficiency and reduced weight, catering to the growing demand for lightweight solutions in the automotive sector. Their focus on innovation and sustainability positions Mitsubishi as a formidable competitor in the global market.

LIST OF KEY COMPANIES PROFILED:

- Siemens AG (Germany)

- Infineon Technologies AG (Germany)

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- Delphi Technologies (U.K.)

- Hitachi Automotive Systems (Japan)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- Texas Instruments Incorporated (U.S.)

- ABB Ltd (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

November 2024 - Hillcrest Energy Technologies announced its Zero-Voltage Switching (ZVS) traction inverter prototype aimed at improving cost efficiency for EV manufacturers. The prototype boasts a die area of just 3 mm²/kW, which is below the industry target for future models. This innovation is expected to reduce production costs while enhancing performance significantly.

September 2024 - STMicroelectronics announced the launch of its fourth generation STPOWER silicon carbide (SiC) MOSFET technology, specifically designed for next-generation EV traction inverters. This new technology aimed to enhance power efficiency and density, making it suitable for a broader range of electric vehicles, including mid-size and compact models. The company plans to introduce further innovations through 2027.

June 2024 - NXP Semiconductors N.V. announced a collaboration with ZF Friedrichshafen AG on next-generation SiC-based traction inverter solutions for electric vehicles (EVs). By leveraging NXP’s advanced GD316x high-voltage (HV) isolated gate drivers, the solutions are designed to accelerate the adoption of 800-V and SiC power devices.

October 2023 – Hyundai Motor Company and KIA Corporation announced their strategic partnership with Infineon Technologies AG. According to the multi-year signed supply contract, the company would supply its silicon carbide (SiC) and silicon (Si) traction inverters for upcoming Kia and Hyundai models.

July 2023, onsemi and Magna announced a long-term supply agreement (LTSA) for Magna to integrate Onsemi’s EliteSiC intelligent power solutions into its eDrive systems. By integrating Onsemi’s industry-leading EliteSiC MOSFET technology, Magna eDrive systems can offer better cooling performance and faster acceleration and charging rates, improving efficiency and increasing the range of electric vehicles (EVs).

REPORT COVERAGE

The global traction inverter market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading product applications. Moreover, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.87% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Vehicle Type

By Propulsion Type

By Technology

By Voltage

By Region

|

Frequently Asked Questions

Fortune Business Insights says the market was valued at USD 11.13 billion in 2025 and is projected to reach USD 46.00 billion by 2034.

The market is expected to register a CAGR of 16.87% during the forecast period.

Increasing electric vehicle sales is predicted to drive global market growth.

Asia Pacific leads the global market.

By propulsion type, BEV is the leading segment.

Hitachi Ltd. is the leading market player

Growing adoption of silicon carbide is a latest trend in the market

Get 20% Free Customization

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us