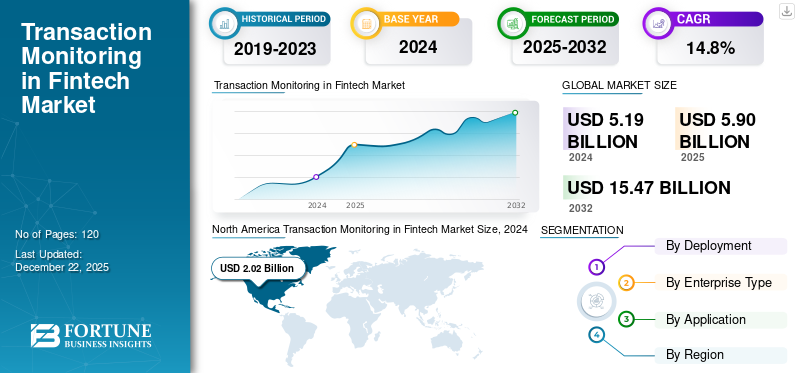

Transaction Monitoring in Fintech Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (Small & Mid-size Enterprises and Large Enterprises), By Application (Identity Verification, Transaction Screening & Ongoing Monitoring, Anti-Money Laundering, Fraud Detection and Prevention, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global transaction monitoring in fintech market size was valued at USD 5.19 billion in 2024. The market is projected to grow from USD 5.90 billion in 2025 to USD 15.47 billion by 2032, exhibiting a CAGR of 14.8% during the forecast period. North America dominated the global market with a share of 38.92% in 2024.

Transaction monitoring in fintech market comprises analyzing financial transactions to identify suspicious activities. In the evolving world of digital finance, fintech firms depend largely on advanced technologies and algorithms to monitor real-time transactions and detect any abnormalities that may direct potential high risks.

Transaction monitoring is an essential solution in fintech for enterprises as it helps maintain the reliability of their operations, obeys regulations, and safeguards against financial crimes in less time. For instance,

- As per the Association of Certified Fraud Examiners (ACFE) report, enterprises with active transaction monitoring solutions identify fraud 58% quicker than those deprived of such systems, minimizing median fraud losses by around 33%.

Impact of Generative AI

Rising Need to Protect Against Cyber-frauds to Create Various Market Opportunities

As fintech and generative AI merge, they help to redefine the financial industry. It offers new opportunities for fintech providers. Gen AI helps fintech in various areas, such as improved cybersecurity and risk management, operational simplification and cost minimization, automated regulatory compliance, and profit maximization, among others.

Generative AI plays an essential role in monitoring faster transaction activities. It quickly recognizes unusual patterns, fading potential irregularities or manipulations. The real-time management of transactions is key to upholding marketplace compliance and integrity. It assures fair practices and protects both the market stability and the institution's interests.

Also, with fintech transactions managing billions of dollars every day, it is necessary to implement robust cybersecurity measures. Hence, GenAI is growing in terms of renovating cybersecurity in fintech transactions. For instance,

- As per the Fraud and Financial Crime Survey 2024 by BioCatch, 72% of professionals stated that their enterprise faced cases of fake identities while onboarding new clients.

Impact of Reciprocal Tariffs

The announcement of new tariffs has increased uncertainty in economic policy, which generally weakens economic activities by prompting enterprises and households to delay their investment, consumption decisions, and hiring. Economic policy improbability can be quantified by leveraging the Economic Policy Uncertainty (EPU) Index, a measure developed to capture uncertainty across economic policy decisions.

An increase in tariffs can lead to trade wars across different countries, such as the U.S., China, Vietnam, and others. Hence, it will impact cross-border transactions across the globe.

Such economic impact can result in fewer financial investments, thereby reducing financial transactions. Thus, it can hamper the overall market progress across different countries.

TRANSACTION MONITORING IN FINTECH MARKET TRENDS

Proliferation of AI and Machine Learning-based Solutions to Propel Market Expansion

The incorporation of artificial intelligence (AI) and machine learning (ML) into financial crime compliance programs is expected to grow significantly.

The incorporation of artificial intelligence (AI) and machine learning (ML) into financial criminality compliance plans is estimated to progress significantly. AI-based systems are being installed to identify multifaceted patterns in financial transactions, enhancing the productivity and accurateness of recognizing suspicious activity. For instance,

As per the industry expert’s survey, 62% of financial institutions are presently leveraging AI and ML in certain capacities for AML operations, and this is projected to grow to 90% in 2025.

With machine learning, AML solutions are becoming more refined at identifying subtle money laundering strategies such as structuring or layering. Predictive prototypes are progressively being implemented to highlight uncommon patterns that customary rule-driven systems may miss, minimizing false positives.

Real-time transaction monitoring for probable financial crime is anticipated to become the norm. The fast handling power of AI enables faster identification of doubtful transactions, minimizing the time between discovery and response.

MARKET DYNAMICS

MARKET DRIVERS

Growing Need to Adhere to AML Compliance Obligations to Drive Demand for Transactions Monitoring Solutions in Fintech

The transaction monitoring in fintech market is a part of the Anti-Money Laundering (AML) compliance team’s requirements that are established by regulatory authorities. These regulations are standard practices that fintech enterprises and other financial institutions need to follow and adopt to stay compliant.

Fintech firms need to comply with AML/KYC requests, which comprise several processes, such as AML screening, document verification, and reporting of illegal activity, among other obligations. To address the issue of fintech money laundering, companies need to continuously observe customer transactions and evaluate current and historical customer data to get wide-ranging insights into customer activity. Hence, various national governments are implementing AML compliance regulations to prevent fraud in transactions. For instance,

- In October 2024, the Indian government allied with fintech firms to develop an indigenous anti-money laundering (AML) system and transaction monitoring tailored to address financial fraud in the country.

MARKET RESTRAINTS

False Positives in Identifying Fintech Transactions Can Hamper Market Growth

Transaction monitoring in fintech systems can create false positive warnings where genuine transactions are identified as suspicious. Handling and examining these wrong positives can be resource-intensive and time-consuming, thereby leading to interruptions in identifying and resolving fraudulent activities. For instance,

- A genuine business transaction can be flagged as suspicious owing to unusual patterns, but it can be identified as a one-time occurrence afterward.

- Transactions related to customers with common names that match names on government watchlists can lead to false hits.

These false positives can have substantial implications for fintech companies. They can lead to increased operational costs, as extra resources are mandatory to examine and clear identified transactions. Thus, the inability to identify fake positive warnings can hamper transaction monitoring in fintech market growth.

MARKET OPPORTUNITIES

Integration of Blockchain with Transaction Monitoring in Fintech to Open-up Numerous Market Opportunities

The merging of traditional transaction monitoring with blockchain mechanisms generates new, robust competencies for security and transparency. Fintech companies and financial institutions are progressively incorporating blockchain into their monitoring structures to improve the immutability and traceability of transaction records.

Blockchain-assimilated monitoring system helps to create tamper-proof, permanent audit trails while empowering real-time verification of transactions over distributed networks. The integration offers improved transparency, enhanced cross-border transaction visibility, minimized reconciliation requirements, and many other benefits. Hence, market players are developing and introducing new blockchain-driven solutions for better security. For instance,

- In September 2024, Crystal Intelligence collaborated with Clear Junction to reinforce regulatory control and transaction monitoring for digital assets. With the partnership, Crystal incorporates its blockchain advanced analytics and ensures compliance mechanisms within the risk management framework of Clear Junction to improve security actions for its institutional customers globally.

Hence, the incorporation of blockchain opens up various market opportunities.

Download Free sample to learn more about this report.

Segmentation Analysis

By Deployment

Cloud Segment Takes the Lead Due to Rising Need to Enhance compliance and Data Security

Based on deployment, the market is bifurcated into cloud and on-premise.

The cloud segment accounts for the highest market share and is projected to grow with the highest CAGR during the forecast period, owing to the rise in fintech companies entering into advanced cloud-based solutions. Cloud-driven solutions improve compliance and data security, developing trust in financial services. Cloud incorporation minimizes costs, enhances disaster recovery, and fast-tracks financial innovation. For instance,

- In June 2023, Google Cloud launched an AI-driven AML (Anti-Money Laundering) tool for financial institutions to more efficiently and proficiently identify money laundering. Google Cloud's AML AI offers a combined machine learning (ML)--generated customer risk score as a substitute for rules-driven transaction notifying.

By Enterprise Type

Severe Compliance Regulations to Propel Demand for Transactional Monitoring Among Small and Mid-sized Enterprises

By enterprise type, the market is classified as small & mid-size enterprises and large enterprises.

Small and mid-sized enterprises are anticipated to grow with the highest CAGR during the forecast period. Anti-Money Laundering (AML) obedience has become more multifaceted, building automated screening tools crucial not only for large businesses but also for small and medium-sized enterprises (SMEs). As regulatory requirements stiffen, SMEs need to adopt effective compliance approaches to mitigate reputational and financial risks. Such factors contribute to the increasing growth rate of SMEs in the market.

Large enterprises hold the highest market share for the year 2024. As large enterprises have to deal with a huge number of financial transactions, the need to protect and use transaction monitoring in Fintech solutions also increases. Different types of transaction monitoring in fintech are easily obtainable for these enterprises that leverage it to enhance the speed and accuracy of the enhanced due diligence (EDD) process, identify and stop fraud, and analyze transactional data to discover money laundering.

By Application

Increasing Focus on Preventing Fraudulent Activities Boosts Fraud Detection and Prevention Segment Growth

By application, the market is segmented into identity verification, transaction screening & ongoing monitoring, anti-money laundering, fraud detection and prevention, and others (proxy detection, etc.).

The fraud detection and prevention segment dominates the market and is expected to rise with the highest CAGR during the forecast period. The rising number of fraudulent activities across various fintech domains increases the demand for solutions to prevent fraud. Transaction screening and monitoring, along with protected onboarding, are the preceding ways to identify and deter Fintech fraud. For instance,

- As per Sumsub's Identity Fraud Report 2023, the rate of identity fraud circumstances in the fintech sector surged by 73% between 2021 and 2023, from 0.67% to 1.16% – moderately an uptick in a short time.

Anti-money laundering held a decent market share owing to its several benefits, such as analyzing transactions in real-time to identify apprehensive activities and safeguard compliance with rules, offering benefits such as improved security, enhanced risk management, minimized financial losses, and reduced false positives.

Transaction Monitoring in Fintech Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America

North America Transaction Monitoring in Fintech Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the highest market share in 2024, owing to higher adoption and implementation of Fintech technologies. The U.S. also has a huge presence of financial tech firms that are increasing the usage of these transactional solutions in the region. Higher adoption of various fintech implementations such as embedded finance, open banking financial services, net banking, Regtech, and other deployments aids the region's transaction monitoring in fintech market share. For instance,

- According to industry experts, around 90% of individuals in the U.S. currently leverage fintech services. Thus, it stimulates fintech firms to keep up with the trends and proactively implement advanced emerging technologies to offer the anticipated level of services.

Europe

Europe is anticipated to progress with a substantial growth rate. The region has the presence of a maximum number of key players across countries such as the U.K., Germany, France, and Spain, among others, that aid the region's market progress. The region also has a growing number of fintech startups and investments that contribute to the region's market growth. For instance,

- As per Industry Experts, the U.K. dominates the fintech market in Europe while accounting for 40% of top deals in the country in the second quarter of 2024.

Asia Pacific

Asia Pacific is projected to grow with the highest CAGR during the forecast period, owing to the growth of digital financial services in countries such as India, South Korea, Japan, Australia, and other countries. As digital financial services rise in popularity, the requisite for improved data privacy and cybersecurity also increases. Customers demand secure platforms, and highlighting cybersecurity not only protects users but also helps fintech gain a competitive advantage in a progressively digital landscape. For instance,

- As per industry experts, the top trends prompting user experiences in Asia Pacific include super apps and embedded finance (25.6%), open banking APIs (23.7%), and cross-border payments (24.1%).

Middle East & Africa and South America

The growth in digital banking, financial services, and insurance and the increasing adoption of fintech solutions contribute to an increase in growth rates in the Middle East & Africa and South America. Countries such as Brazil, Turkey, UAE, and South Africa have also attracted various venture capital investments in fintech. Such factors aid the transaction monitoring in fintech market development in these regions.

COMPETITIVE LANDSCAPE

Key Industry Players

New Product Innovations and Collaborations Assist Key Players Magnify Business Expansion

Players in the market, such as Oracle Corporation, Sanction Scanner, NICE Actimize, FICO, and SAS Institute Inc., among other players, are introducing new tools to enhance their position in the market. These players are leveraging modernized technological developments, addressing Fintech firms' demand, and attaining a competitive edge. They prioritize enhancing solution offerings and strategic alliances, mergers, and investments to strengthen their portfolio.

LIST OF KEY TRANSACTION MONITORING IN FINTECH COMPANIES PROFILED

- Oracle Corporation (U.S.)

- Shufti (U.K.)

- Sanction Scanner (U.K.)

- FICO (U.S.)

- SAS Institute Inc. (U.S.)

- FIS (U.S.)

- Ondato (U.K.)

- NICE Actimize (U.S.)

- Acuity Knowledge Partners (U.K.)

- Moody's Corporation (U.S.)

- AML Watcher (U.S.)

- Unit21, Inc. (U.S.)

- Merkle Science (U.S.)

- Anaptyss (Georgia)

KEY INDUSTRY DEVELOPMENTS

- April 2025: AMLYZE introduced AMLTRIX, an open knowledge initiative developed to normalize and transform the defense against money laundering. It serves as an AML knowledge graph, forming money laundering tactics, methods, and risk indicators into an effortlessly accessible format.

- April 2025: NICE Actimize stated the accessibility of Xceed AI agents to be integrated into Xceed AI FRAML solutions. Xceed AI agents are developed to combat financial crime and fraud, incorporating seamlessly into work operations to identify emergent risks and minimize operational strain.

- January 2025: AML Incubator and AML Watcher formed a strategic alliance to strengthen the compliance framework for financial institutions. The partnership unifies inventive technology with deep regulatory proficiency to generate a strong AML compliance ecosystem.

- September 2024: Oracle launched a financial crime and compliance management service developed to help fintech, banks, and other financial organizations recognize probable financial crime and compliance disputes and reduce compliance costs.

- October 2023: AMLYZE and Shufti Pro collaborated to improve AML services. With the partnership, AMLYZE integrates Shufti Pro's identity verification services to improve its present compliance module product line further. AMLYZE, a RegTech firm, specializes in anti-financial crime solutions for FinTechs, crypto businesses, and neo-banks.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of transaction monitoring in fintech market. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 14.8% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Application

By Region

|

Frequently Asked Questions

The market is projected to reach USD 15.47 billion by 2032.

In 2024, the market was valued at USD 5.19 billion.

The market is projected to grow at a CAGR of 14.8% during the forecast period.

By deployment, the cloud segment leads the market.

Growing need to adhere to AML compliance obligations to drive the demand for transaction monitoring solutions in fintech.

Oracle Corporation, Sanction Scanner, NICE Actimize, FICO, and SAS Institute Inc. are the top players in the market.

North America held the highest market share in 2024.

By application, fraud detection and prevention are expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us