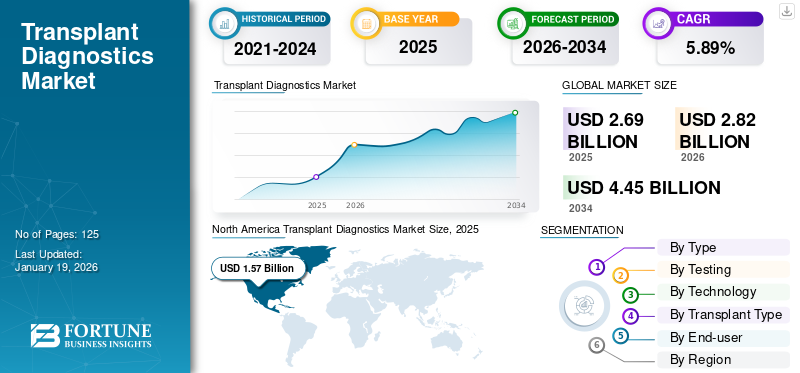

Transplant Diagnostics Market Size, Share & Industry Analysis, By Type (Instruments, Reagents & Consumables, and Software & Service), By Testing (HLA Typing, Crossmatch Testing, Donor-Specific Antibody Screening, Rejection Monitoring, and Infection & Graft Monitoring), By Technology (PCR, Next-Gen Sequencing, Sanger Sequencing, Flow Cytometry, Serological Assays), By Transplant Type (Solid Organ Transplantation {Kidney, Liver, & Lung}, & Stem Cell / Bone Marrow Transplantation), By End User (Hospitals & Transplant Centers, and Research & Academic Institutions), & Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global transplant diagnostics market size was valued at USD 2.69 billion in 2025 and is projected to grow from USD 2.82 billion in 2026 to USD 4.45 billion by 2034, exhibiting a CAGR of 5.89% during the forecast period. North America dominated the transplant diagnostics market with a market share of 58.43% in 2025.

Transplant diagnostics involve molecular or immunological testing in order to determine donor-recipient compatibility in addition to monitoring post-transplant outcomes. Transplant diagnostics are essential in minimizing transplant patient rejection, maximizing transplant success in the long run, as well as in making choices in immunosuppressive therapy.

Market growth is prominently driven by a growing number of organ transplant procedures, increased developments in molecular diagnostics technologies, and an expansion in customized therapy approaches in transplantation. Additionally, active efforts by governments toward organ donation promotion and strengthening of healthcare infrastructure are also expected to contribute to the market growth during the forecast period.

Some of the major players in this sector are Thermo Fisher Scientific, Bio-Rad Laboratories, F. Hoffmann-La Roche Ltd., Qiagen, and Illumina Inc. These companies are focused on innovation in molecular test platforms and in sequencing technologies. Moreover, strategic alliance with transplant centers, research centers in academic institutions, as well as with biopharma companies further establishes their presence in the market.

MARKET DYNAMICS

Market Drivers

Extensive Growth in Organ Transplant Procedures and Donor-Recipient Matching Needs to Boost Market Growth

The rising number and increasing demand for organ transplantation worldwide are prominently driving the global market growth. This increase is directly related to the growing prevalence of chronic diseases such as kidney failure, liver disease, and heart problems. In addition, the waiting list for organ receivers is increasing every year. This scenario increases the demand for advanced diagnostic tools for accelerating the procedures.

- For instance, according to data published by Kidney Care U.K., in 2024, an estimated 6,250 people in the U.K. were on the waiting list to receive a kidney transplant. Also, according to the data, around 1,000 people in the U.K. donate a kidney per year.

Further, the introduction of technologies such as genomic sequencing, next-generation sequencing (NGS), and biomarker testing has made it easier to check if a transplant will work before and after surgery. These tools help healthcare professionals detect early signs of rejection or infection.

Market Restraints

Limited Availability of Organ Donors to Hamper Market Growth

Limited availability of donor organs against the rise in demand for transplantation procedures is estimated to deter the market growth by 2032. Despite increased awareness programs in addition to those launched by governments for encouraging transplant activity, organ availability remains much lower compared to patients available for waiting lists. This gap leads to restricted transplant procedures per year, indirectly hindering transplant diagnostic test utilization.

- According to data published by Donate Life America, an estimated 5,600 people in the U.S. die per year waiting for an organ transplant. Moreover, according to the same data, for every 8 minutes, a new patient is added to the waiting list for an organ transplant.

As the adoption of transplant diagnostics is directly related to the number of transplant surgeries conducted, a lack of available donor organs results in a restraining factor for the market. Despite technical advancements and increased diagnostic specificity, unless available organs increase proportionately in response to patient requirements, the market is not likely to register considerable growth.

Market Opportunities

Increasing Investments in Transplant Infrastructure to Offer Lucrative Opportunity for Market Growth

Increasing investments in transplant-related activities and infrastructure offer a substantial opportunity for market growth during the forecast period. Both governments and private industry players are building specialized transplant centers and developing awareness programs for promoting organ donation. This is driving up the overall base of transplant procedures globally.

- For instance, in April 2025, Victoria Hospital announced the opening of a new organ retrieval and transplant center in Bengaluru, India. The state department of medical education announced an investment of USD 1.1 million for this project.

With more procedures, there will be a requirement for corresponding and recipient monitoring diagnostics that will also offer opportunities for new products and increased coverage for companies. In developing countries, investment in healthcare infrastructure will offer new markets in the future.

Market Challenges

Stringent Regulatory and Reimbursement Policies to Offer Market Challenge

The market faces a major challenge of rigorous regulatory clearances. The transplant diagnostics need to be extremely safe and reliable, and that makes it a laborious and expensive process for receiving approvals. This slows down new product introductions in the industry and the rate at which hospitals can acquire higher-end solutions.

Furthermore, restricted reimbursement helps create further pressure. In nations globally, insurance providers and healthcare systems fail to reimburse for the complete transplant diagnostic test amount. This makes patients or hospitals pay for more, inhibiting wider adoption. Together, these delay the growth rate for developing and advanced regions.

TRANSPLANT DIAGNOSTICS MARKET TRENDS

Shift Toward Non-Invasive Monitoring is One of the Market Trends

A trend for the transplant diagnostics industry is higher utilization of non-invasive testing technologies. Blood-based biomarker testing and advanced sequencing are under development for the detection of signs for organ rejection without biopsy. These methods reduce patient risk, improve comfort, and allow for earlier detection of complications.

- For instance, in June 2024, Omixon received IVDR approval for its NanoTYPE, a HLA amplification kit. The new kit incorporates the sequencing technology of Oxford Nanopore Technologies.

In addition, laboratories and hospitals are adopting such solutions as they help them observe patients more frequently and at reduced risk. This trend is expected to continue due to several companies that are spending on research toward putting legitimate non-invasive instruments into practice in clinics. It is also gaining acceptance among patients, further leading to the expansion of the market.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Substantial Number of Transplant Procedures Positively Impacted Growth of Reagents & Consumables Segment Growth

Based on type, the market is classified into instruments, reagents & consumables, and software & services.

The reagents & consumables segment dominated the market accounting for 67.33% of the market share in 2026. The segment growth is attributed to the substantial utilization of reagents & consumables during the diagnostic procedure. In addition, increasing adoption of advanced sequencing technologies also boosts the demand for reagents and kits. Unlike instruments, which are purchased once and used for years, consumables such as test kits, reagents, and assay materials must be replenished continuously.

The instruments segment is estimated to register a considerable CAGR during the forecast period. Certain factors, such as an increasing number of transplant procedures in the emerging nations, technological advancements, and rising transplant infrastructure, are expected to offer a lucrative opportunity for segment growth.

- For instance, in August 2025, Naruvi Hospitals, Vellore, India, announced the opening of an advanced liver transplant clinic to provide liver transplants and liver treatments.

To know how our report can help streamline your business, Speak to Analyst

By Testing

Emphasis on Higher Success Rate of Transplants Coupled with Strict Regulations to Boost Rejection Monitoring Segment Growth

Based on testing, the market is segmented into HLA typing, crossmatch testing, donor-specific antibody (DSA) screening, rejection monitoring, and infection & graft monitoring.

Rejection monitoring testing dominated the market with a 46.46% share in 2026. This testing plays a major role in monitoring the transplant success for the long term. After surgery, patients require early detection and repeat evaluation to detect signs of rejection and adjust treatment plans as needed. Further, these tests are performed multiple times during the post-transplant period. Moreover, increasing number of product launches with advanced capabilities is also estimated to have a positive impact on the market growth.

- For instance, in March 2025, Thermo Fisher Scientific announced the launch of its new HLA typing kit for histocompatibility issues.

On the other hand, donor-specific antibody (DSA) screening is expected to grow at a notable CAGR due to its expanding role in improving transplant outcomes. Increased awareness among clinicians about the importance of detecting antibodies to prevent both acute and chronic rejection is driving its adoption.

By Technology

Extensive Availability of PCR to Boost Segment Growth

Based on technology, the market is categorized into PCR, next-generation sequencing, Sanger sequencing, flow cytometry, serological assays, and others.

Polymerase Chain Reaction (PCR) technology accounted for 26.71% of the market share in 2026 due to its wide availability, lower cost, and established use in molecular testing. In addition, hospitals and diagnostic labs widely prefer to utilize PCR-based assays for HLA typing, cross-matching, and routine monitoring due to their superior accuracy. Moreover, PCR technology also provides rapid results, which play a major role in quick compatibility results.

Next-generation sequencing (NGS) is expected to record the highest growth rate in the market. Increasing adoption of personalized medicine and the need for accurate matching to reduce rejection risks are driving the shift toward NGS-based diagnostics. Further, emphasis of healthcare facilities to focus on the adoption of advanced technologies is also responsible for the segment’s high CAGR.

- For instance, in June 2024, Devyser Diagnostics AB announced extension of its collaboration with Thermo Fisher Scientific with an aim to utilize its NGS products for post-transplant diagnostics.

By Transplant Type

High Prevalence of Chronic Conditions to Boost Growth of Solid Organ Transplant Segment

Based on transplant type, the market is segmented into solid organ transplant, and stem cell/bone marrow transplantation.

Solid organ transplant holding a 95.21% market share in 2026. The segment growth is attributed to the significant prevalence of chronic conditions, which is leading to extensive demand for organ transplants. Further, active government involvement to decrease the burden of chronic conditions by supporting organ transplant programs is also estimated to have a positive impact on the segment growth.

- For instance, according to data published by the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) in September 2024, an estimated 0.8 million people in the U.S. are suffering from end-stage kidney disease.

On the other hand, the stem cell/bone marrow transplant segment is estimated to exhibit considerable CAGR by 2032. The segment growth is prominently driven by increasing incidence of blood-related disorders such as leukemia, lymphoma, anemia, and increasing awareness about stem cell therapies.

By End-user

Robust Focus on Research & Development to Accelerate Growth of Academic and Research Institute Segment Growth

Based on end-user, the market is divided into hospitals & transplant centers, research & academic institutions, and others.

The hospitals and transplant centers segment accounted for the largest market share in 2024. The majority of the transplant procedures are performed in hospitals and transplant centers due to the adequate availability of resources. In addition, hospitals receive strong support through government funding and insurance coverage for transplant procedures, which further drives the dominance of this segment.

On the other hand, research and academic centers are estimated to register considerable growth over the forecast period. These institutions conduct clinical trials and research studies to evaluate advanced testing techniques, biomarkers, and sequencing technologies. Increased funding from government agencies and private organizations is fueling their activities.

TRANSPLANT DIAGNOSTICS MARKET REGIONAL OUTLOOK

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Transplant Diagnostics Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America accounted for USD 1.57 billion in 2025. The market in North America stood at USD 1.51 billion in 2024. The dominance of North America in the global market is attributed to the increasing number of organ transplant procedures coupled with a strong healthcare infrastructure. Further, government support for organ donation programs and major investments in advanced diagnostic technologies are also crucial factors for market expansion. Moreover, increased awareness among both patients and doctors about the value of early rejection monitoring continues to drive the North America transplant diagnostics market.

In the U.S., the market is further supported by a large patient population, strong uptake of next-generation sequencing, and significant investment in transplant-related research.

- For instance, in July 2025, a team of transplant surgeons at USF Health and Tampa General Hospital conducted the world’s first bloodless heart-liver transplant.

Europe

The market in Europe held a significant share in 2024. Certain factors, such as growing awareness about organ donation, active government support, and rising adoption of advanced molecular technologies, are playing a vital role in Europe transplant diagnostics market growth. In addition, partnerships between universities, biotech firms, and transplant centers are fostering innovation in diagnostic technologies, adding to market growth. The UK market is valued at USD 0.08 billion by 2026, while the Germany market is valued at USD 0.09 billion by 2026.

- For instance, in April 2025, Rotary e-Club of Organ Donation U.K. and British Liver Trust signed a strategic partnership to boost the organ donation campaign and awareness in the U.K.

Asia Pacific

Asia Pacific transplant diagnostics market is expected to witness the highest CAGR during the forecast period. Countries such as India, China, and Japan are witnessing higher demand for organ transplants due to rising rates of lifestyle-related diseases. Governments are working to boost organ donation rates and improve clinical capacity, which is opening up new opportunities for diagnostic adoption. At the same time, global companies are entering the market with advanced, cost-effective technologies, helping to accelerate adoption. Patient awareness is also rising, supporting steady growth in this region. The Japan market is valued at USD 0.03 billion by 2026, the China market is valued at USD 0.11 billion by 2026, and the India market is valued at USD 0.05 billion by 2026.

- For instance, in August 2025, Terumo Corporation announced its plan to acquire OrganOx Limited in order to enter into the organ transplant market. OrganOx is engaged in the manufacturing and commercialization of an organ preservation machine.

Latin America and Middle East & Africa

The transplant diagnostics market in Latin America and the Middle East & Africa is expected to witness considerable growth due to continuous developments in healthcare infrastructure and rising investments in specialized transplant centers. The Latin America market growth is being driven by a growing number of patients with kidney and liver conditions, along with stronger government efforts to promote organ donation programs. In the Middle East & Africa, investments in modern hospitals, especially in GCC countries, are creating opportunities to adopt advanced diagnostic technologies.

- For instance, in September 2023, Thermo Fisher Scientific and Devyser announced the extension of their collaboration to increase the NGS services, specifically for post-transplant diagnostics in Brazil.

COMPETITIVE LANDSCAPE

Key Industry Players

Strong Emphasis on Technological Developments to Drive Revenue Growth for Key Market Players

The market is moderately consolidated, as few players are actively engaged and holding considerable market share. Players such as Illumina, Thermo Fisher Scientific, Qiagen, and Werfen are some of the players actively operating in the market and have comparatively considerable global transplant diagnostics market share.

Moreover, other major players, including Bio-Rad Laboratories Inc., Abbott, F. Hoffmann-La Roche Ltd, and others, are focusing on expansion of their product upgradation and strengthening their market share. These market players have also increased their emphasis on mergers and partnerships with other players to expand their service offerings.

LIST OF KEY TRANSPLANT DIAGNOSTICS COMPANIES PROFILED

- Hoffmann-La Roche Ltd. (Switzerland)

- Illumina (U.S.)

- Thermo Fisher Scientific (U.S.)

- Qiagen (Germany)

- Admera Health, LLC (U.S.)

- Bio-Rad Laboratories Inc. (U.S.)

- Bruker (U.S.)

- Werfen (U.S.)

- BD (U.S.)

- Other Prominent Players

KEY INDUSTRY DEVELOPMENTS

- February 2025: Devyser AB announced a strategic partnership with Pirche AG. The partnership aims to validate the working of Devyser AB’s transplant diagnostics biomarkers with Pirche’s TxPredictor AI-based platform.

- July 2024: Thermo Fisher Scientific announced the launch of its new pre-transplant assay with an aim to improve kidney transplant outcomes.

- May 2020: Veracyte and CareDx announced strategic partnership for its nCounter testing system, which is specifically designed for transplant rejection analysis.

- June 2019: Eurofins Viracor, LLC announced acquisition of Transplant Genomics Inc. with an aim to expand its presence in the market.

- February 2019: Natera Inc. announced strategic partnership with Thermo Fisher Scientific with an aim to co-distribute its kidney transplant test in the U.S.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.89% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Instruments · Reagents & Consumables · Software & Service |

|

By Testing · HLA Typing · Crossmatch Testing · Donor-Specific Antibody (DSA) Screening · Rejection Monitoring · Infection & Graft Monitoring |

|

|

By Technology · PCR · Next-Generation Sequencing · Sanger Sequencing · Flow Cytometry · Serological Assays · Others |

|

|

By Transplant Type · Solid Organ Transplantation o Kidney o Liver o Lung o Others o Stem Cell / Bone Marrow Transplantation |

|

|

By End-user · Hospitals & Transplant Centers · Research & Academic Institutions · Others |

|

|

By Region · North America (By Type, Testing, Technology, Transplant Type, End-user, and Country) o U.S. (By Transplant Type) o Canada (By Transplant Type) · Europe (By Type, Testing, Technology, Transplant Type, End-user, and Country/Sub-region) o Germany (By Transplant Type) o U.K. (By Transplant Type) o France (By Transplant Type) o Spain (By Transplant Type) o Italy (By Transplant Type) o Rest of Europe (By Transplant Type) · Asia Pacific (By Type, Testing, Technology, Transplant Type, End-user, and Country/Sub-region) o China (By Transplant Type) o Japan (By Transplant Type) o India (By Transplant Type) o Australia (By Transplant Type) o South Korea (By Transplant Type) o Rest of Asia Pacific (By Transplant Type) · Latin America (By Type, Testing, Technology, Transplant Type, End-user, and Country/Sub-region) o Brazil (By Transplant Type) o Mexico (By Transplant Type) o Rest of Latin America (By Transplant Type) · Middle East & Africa (By Type, Testing, Technology, Transplant Type, End-user, and Country/Sub-region) o GCC (By Transplant Type) o South Africa (By Transplant Type) · Rest of the Middle East & Africa (By Transplant Type) |

Frequently Asked Questions

Fortune Business Insights says that the global market value at USD 2.82 billion in 2026 and is projected to reach USD 4.45 billion by 2034, exhibiting a CAGR of 5.89% during the forecast period.

In 2025, the market value stood at USD1.57 billion.

The market is expected to exhibit a CAGR of 5.89% during the forecast period.

By type, the reagents & consumables segment led the market.

The key factors driving the market are the increasing prevalence of chronic conditions and the rising demand for organ transplant procedures.

Werfen, Illumina, Thermo Fisher Scientific, and Roche are the top players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us