Truck Cabin Market Size, Share & Industry Analysis, By Truck Class (Light Trucks, Medium Trucks, and Heavy Trucks), By Cab Type (Day Cab and Sleeper Cab), By Application (Long-Haul Freight & Logistics, Regional Distribution/Last-Mile Delivery, Construction & Infrastructure, and Others), By Propulsion Type (ICE and EV), and Regional Forecast, 2026-2034

Truck Cabin Market Size and Future Outlook

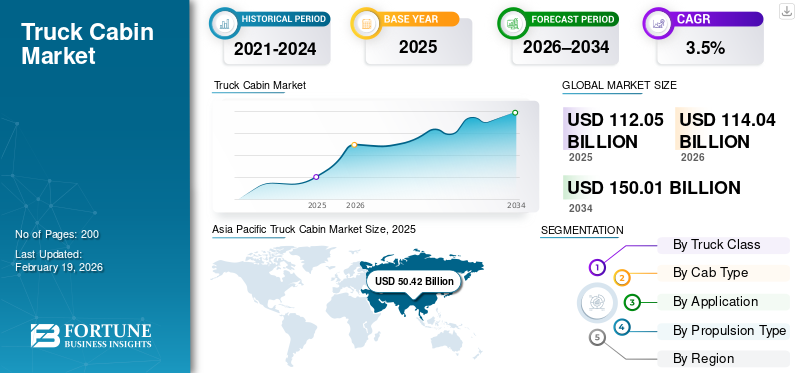

The truck cabin market size was valued at USD 112.05 billion in 2025. The market is projected to grow from USD 114.04 billion in 2026 to USD 150.01 billion by 2034, exhibiting a CAGR of 3.5% during the forecast period.

The truck cabin market refers to the segment of the commercial vehicle industry focused on designing, manufacturing, and supplying driver cabins for trucks, encompassing structures, interiors, safety systems, comfort features, and integrated electronics, serving OEM and aftermarket demand across light, medium, and heavy commercial vehicle cabin market.

Key market drivers include rising commercial vehicle production, stricter safety regulations, rising demand for driver comfort, growth in long-haul logistics, fleet modernization, and increasing integration of advanced electronics and connectivity features.

Major players in the market include Daimler Truck, Volvo Group, PACCAR, Scania, Iveco, and Tata Motors, competing through enhanced driver comfort, advanced safety systems, lightweight materials, aerodynamics, and integrated digital and connectivity solutions.

TRUCK CABIN MARKET TRENDS

Integration of Smart and Connected Technologies to Redefine Truck Cabins

A prominent trend in the market is the growing integration of smart and connected technologies. Modern cabins increasingly feature digital instrument clusters, infotainment systems, telematics, voice assistance, and advanced driver monitoring systems. Connectivity enables real-time vehicle diagnostics, navigation optimization, and seamless communication between drivers, fleets, and logistics platforms. Additionally, data-driven features such as fatigue detection and personalized cabin settings are gaining traction. This trend reflects the broader digital transformation of commercial vehicles, where the cabin acts as a control hub rather than just a driver enclosure. As software becomes central to vehicle value, technology-rich cabins are emerging as a key differentiator for truck manufacturers.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Long-Haul Freight Activity to Accelerate Demand for Advanced Truck Cabins

The steady growth of long-haul freight transportation driven by e-commerce expansion, cross-border trade, and industrial output is a major driver for the market. Fleet operators are increasingly prioritizing cabins that reduce driver fatigue, improve ergonomics, and support extended driving hours. Features such as improved sleeping berths, climate control, noise insulation, and adjustable seating are becoming essential rather than optional. In addition, regulatory pressure around driver working conditions is pushing OEMs to invest in better cabin design. As logistics companies compete on delivery efficiency and driver retention, modern, comfortable cabins are viewed as productivity-enhancing assets, directly stimulating demand for technologically advanced and premium truck cabins across regions.

- In September 2025, Mercedes-Benz Trucks highlighted that cab comfort is a key purchasing factor for its long-haul flagship Actros L ProCabin, adding sleeper/comfort upgrades (beds, mattresses, ambient lighting, and more in-cab utilities) alongside safety/assistance features.

MARKET RESTRAINTS

Stricter Global Safety and Homologation Standards to Restrain Design Flexibility

The market faces restraint from increasingly stringent and region-specific safety, crashworthiness, and homologation regulations. Cabins must comply with standards related to frontal impact, rollover protection, visibility, fire safety, and driver ergonomics, which vary across regions. This limits design flexibility and extends validation timelines, especially for OEMs operating globally. Frequent regulatory updates also require continuous redesign and re-certification, delaying product launches. Smaller manufacturers and new entrants face higher compliance barriers, which can slow innovation and restrict the introduction of differentiated cabin concepts, particularly in emerging markets with evolving regulatory frameworks.

MARKET OPPORTUNITIES

Electrification of Commercial Vehicles to Create New Cabin Design Opportunities

The shift toward electric and alternative-fuel trucks presents a significant opportunity for the market. Electric powertrains allow greater design flexibility by eliminating traditional engine and transmission constraints, enabling OEMs to reimagine cabin layouts. Flat floors, expanded interior space, and modular designs become feasible, improving driver comfort, and usability. Moreover, electric trucks emphasize digital interfaces, energy management displays, and connectivity, increasing demand for smart cabin solutions. As fleet operators adopt electric trucks for urban and regional transport, cabins tailored to quiet operation, enhanced visibility, and human-machine interaction will gain importance. This transition opens avenues for innovation and differentiation in cabin architecture and interior technologies.

- In May 2025, Mercedes-Benz Trucks announced it will expand its battery-electric portfolio based on the eActros 600, including long cab variants and tech such as the Multimedia Cockpit Interactive 2, reinforcing new cabin architectures as e-trucks scale.

MARKET CHALLENGES

Supply Chain Disruptions and Component Localization as a Major Market Challenge

A key challenge in the market is managing supply chain disruptions and ensuring localized sourcing of critical components. Cabins rely on a wide range of inputs, including structural panels, electronics, interiors, glass, and seating systems. Global disruptions, trade restrictions, and geopolitical uncertainties have increased lead times and sourcing risks. Additionally, many regions mandate local content requirements, forcing OEMs to restructure supplier networks. Ensuring consistent quality, regulatory compliance, and cost control across diversified supply bases is complex. This challenge affects production planning and can delay cabin upgrades, particularly for technologically advanced or electronically intensive cabin systems.

Segmentation Analysis

By Truck Class

Urban Freight Expansion and High Replacement Cycles to Drive Light Trucks Segment Dominance

Based on truck class, the market is classified into light trucks, medium trucks, and heavy trucks.

The light trucks segment holds the largest truck cabin market share due to its high deployment in urban logistics, municipal services, and short-haul transportation. Frequent stop-and-go operations and high annual utilization accelerate wear, driving steady demand for cabin replacements, refurbishments, and upgrades. Growing e-commerce penetration and last-mile delivery fleets further reinforce volumes, while OEMs prioritize standardized, cost-efficient cabin designs for light trucks, sustaining consistent production and aftermarket demand globally.

The heavy trucks segment holds the second-largest market share and is projected to grow at a CAGR of 4.2% over the forecast period, driven by increasing long-haul freight movement, infrastructure development, and fleet modernization. Demand for advanced cabins with enhanced comfort, safety, and sleeper configurations is accelerating adoption in this segment.

To know how our report can help streamline your business, Speak to Analyst

By Cab Type

High Urban and Regional Haulage Utilization to Sustain Day Cab Segment Dominance

In terms of cab type, the market is categorized into day cab and sleeper cab.

The day cab segment leads the market share due to its widespread use in short-haul, urban, and regional transportation. These trucks operate on high-frequency routes with quick turnaround times, leading to consistent replacement demand for standardized and durable cabins. Growing construction activity, retail distribution, and municipal operations further support volumes, while fleet operators favor day cabs for their lower acquisition cost, ease of maintenance, and suitability for dense urban environments.

The sleeper cab segment is projected to grow at a CAGR of 3.8% over the forecast period, driven by expanding long-haul freight corridors and increasing emphasis on driver comfort, rest compliance, and fatigue reduction across commercial fleets.

By Application

Expanding Cross-Border Trade and Long-Distance Freight Movement to Drive Long-Haul Freight & Logistics Dominance

Based on application, the market is segmented into long-haul freight & logistics, regional distribution/last-mile delivery, construction & infrastructure, and others.

The long-haul freight & logistics segment dominates the market due to sustained growth in cross-border trade, industrial supply chains, and bulk goods transportation. Long-distance operations place strong emphasis on advanced cabins with sleeper berths, enhanced ergonomics, climate control, and safety systems to support extended driving hours. Fleet operators prioritize cabin comfort and durability to improve driver retention and productivity, while regulatory norms on rest and safety further reinforce demand for technologically advanced and premium truck cabins in long-haul applications.

Regional distribution/last-mile delivery represent the second-largest application segment, driven by rapid urbanization, e-commerce penetration, and time-sensitive logistics. High vehicle utilization in dense urban environments sustains demand for functional, compact, and cost-efficient truck cabins tailored for frequent stops and short routes.

By Propulsion Type

Established Infrastructure and Fleet Compatibility to Sustain ICE Segment Dominance

Based on propulsion type, the market is segmented into ICE and EV.

The ICE segment dominates the truck cabin market due to its extensive global vehicle parc, well-established fueling infrastructure, and continued reliance by logistics, construction, and long-haul fleets. Fleet operators favor ICE trucks for their proven reliability, long operating range, and ease of maintenance, sustaining high demand for standardized and premium cabin configurations. Ongoing replacement cycles and gradual cabin upgrades further reinforce ICE segment dominance across both developed and emerging markets.

The EV segment is the fastest growing, expanding at a CAGR of 6.3% over the forecast period, driven by tightening emission regulations, government incentives, and rising adoption of electric trucks for urban and regional transport, boosting demand for purpose-built and technology-rich cabin designs.

Truck Cabin Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, and the rest of the world.

Asia Pacific

Asia Pacific Truck Cabin Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates and is the fastest-growing region in the truck cabin market, driven by rapid industrialization, expanding logistics networks, and high commercial vehicle production in China, India, and Southeast Asia. Growth in e-commerce, infrastructure projects, and urban freight movement is increasing demand for both light and heavy trucks. Rising fleet modernization, improving driver safety standards, and increasing exports further support strong cabin demand across OEM and aftermarket channels.

China Truck Cabin Market

The China market in 2026 is estimated at around USD 31.51 billion, accounting for the largest global share. Growth is driven by high truck production, logistics expansion, and continuous fleet replacement cycles.

India Truck Cabin Market

The Indian market in 2026 is estimated at around USD 5.25 billion, emerging as the fastest growing. Growth is supported by infrastructure development, regulatory comfort mandates, and rapid expansion of domestic freight and logistics networks.

Europe

Europe represents the second-largest market, growing at a CAGR of 3.7% over the projected period, supported by stringent safety and emissions regulations and ongoing fleet renewal. Demand is driven by replacement of aging fleets, high penetration of long-haul transport, and strong focus on driver comfort, ergonomics, and digital integration. Advanced cabin technologies and premium truck adoption remain key growth contributors across Western and Northern Europe.

Germany Truck Cabin Market

The Germany market in 2026 is estimated at around USD 6.59 billion, reflecting strong OEM presence. Growth is sustained by fleet modernization, advanced safety regulations, and high adoption of premium long-haul truck cabins.

North America

North America is the third-largest market, underpinned by high long-haul freight activity, strong logistics infrastructure, and a large installed base of heavy-duty trucks. Fleet operators prioritize durable, spacious cabins with sleeper configurations to support extended driving distances. Replacement demand, gradual technology upgrades, and stable freight volumes continue to support consistent truck cabin market growth across the U.S. and Canada.

U.S. Truck Cabin Market

The U.S. truck cabin market in 2026 is estimated at around USD 22.17 billion, driven by long-haul freight intensity, large installed truck base, strong aftermarket demand, and continued upgrades in sleeper and premium cabin configurations.

Rest of the World

The rest of the world market including Latin America and the Middle East & Africa, is witnessing gradual growth driven by infrastructure development, mining, and cross-border trade. Increasing investments in road transport, fleet renewal initiatives, and improving regulatory frameworks are boosting demand for modern truck cabins. Adoption remains cost-sensitive, but rising logistics activity is steadily improving market prospects.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Global Truck OEMs and Cabin Technology Specialists Strengthening Competitiveness in Market

The truck cabin market is dominated by leading global commercial vehicle manufacturers such as Daimler Truck, Volvo Group, PACCAR, Scania, Iveco, and Tata Motors, supported by tier-1 cabin and interior system suppliers including Faurecia, Grammer, Magna, and Continental. These players leverage integrated vehicle platforms, advanced manufacturing capabilities, and strong supplier ecosystems to deliver standardized and premium cabin solutions across truck classes. Their offerings span structural cabins, interiors, seating systems, safety features, infotainment, and driver assistance technologies.

Competitive strategies increasingly emphasize driver comfort, digital cockpits, connectivity, and compliance with evolving safety regulations. OEMs are investing in modular cabin architectures, lightweight materials, and software-defined features to enable scalability across ICE and electric trucks. Strategic collaborations with electronics providers, material specialists, and software firms, along with continuous product upgrades and global production expansion, are strengthening market positioning amid rising fleet modernization and logistics demand.

LIST OF KEY TRUCK CABIN COMPANIES PROFILED IN REPORT

- Daimler Truck Holding AG (Germany)

- Volvo Group (Sweden)

- PACCAR Inc. (U.S.)

- Scania AB (Sweden)

- IVECO Group N.V. (Italy)

- Tata Motors Ltd. (India)

- MAN Truck & Bus SE (Germany)

- Hino Motors Ltd. (Japan)

- Isuzu Motors Ltd (Japan)

- Dongfeng Motor Corporation (China)

- FAW Group Corporation (China)

- CNH Industrial (IVECO) (Netherlands)

- Hyundai Motor Company (Commercial Vehicles) (South Korea)

- Navistar International (International Trucks) (U.S.)

- Ashok Leyland Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- January 2026: Daimler Truck Poland opened a training center with 75 Actros L ProCabin demo units, expanding cabin tech awareness among dealer networks.

- November 2025: Daimler Truck Australia launched the fuel-saving Mercedes-Benz Actros ProCabin with improved aerodynamics and advanced safety radars, enhancing cabin efficiency and operator comfort.

- August 2025: DAF Trucks enhanced its XG and XG+ cabins with upgraded interior materials and driver-assistance features, reinforcing its premium positioning in the European long-haul segment.

- June 2025: Daimler Truck introduced the Multimedia Cockpit Interactive 2 across Mercedes-Benz trucks, strengthening cabin digitalization with improved displays, connectivity, and driver-assistance integration for both ICE and electric truck platforms.

- May 2025: Volvo Trucks introduced aerodynamic enhancements to cab structures inspired by aerospace tech, cutting drag, fuel use, CO2 emissions and improving cabin performance.

- January 2025: Renault and Volvo Group’s FlexEVan electric LCV joint venture unveiled a modular cabin structure for sustainable last-mile delivery vehicles starting 2026.

- January 2024: Volvo Trucks unveiled the all-new VNL with optimized cab comfort, safety, and digital integration to redefine driver experience.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.5% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Truck Class, By Cab Type, By Application, By Propulsion Type, and By Region |

|

By Truck Class |

· Light Trucks · Medium Trucks · Heavy Trucks |

|

By Cab Type |

· Day Cab · Sleeper Cab |

|

By Application |

· Long-Haul Freight & Logistics · Regional Distribution / Last-Mile Delivery · Construction & Infrastructure · Others |

|

By Propulsion Type |

· ICE · EV |

|

By Region |

· North America (By Truck Class, By Cab Type, By Application, By Propulsion Type, and By Country) o U.S. (By Truck Class) o Canada (By Truck Class) o Mexico (By Truck Class) · Europe (By Truck Class, By Cab Type, By Application, By Propulsion Type, and By Country) o Germany (By Truck Class) o U.K. (By Truck Class) o France (By Truck Class) o Rest of Europe (By Truck Class) · Asia Pacific (By Truck Class, By Cab Type, By Application, By Propulsion Type, and By Country) o China (By Truck Class) o Japan (By Truck Class) o India (By Truck Class) o Rest of Asia Pacific (By Truck Class) · Rest of the World (By Truck Class, By Cab Type, By Application, By Propulsion Type, and By Country) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 112.05 billion in 2025 and is projected to reach USD 150.01 billion by 2034.

In 2025, the Asia Pacifics market value stood at USD 50.42 billion.

The market is expected to exhibit a CAGR of 3.5% during the forecast period of 2026-2034.

The light truck segment led the market by truck class.

Rising long-haul freight activity to accelerate demand for advanced truck cabins.

Asia Pacific held the largest market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us