U.S. Electric Vehicle Battery Housing Market Size, Share & Industry Analysis, By Vehicle Type (Passenger Car and Commercial Vehicle), and By Material (Steel, Aluminum, and Others (Carbon Fiber & Carbon Glass)), 2024–2032

KEY MARKET INSIGHTS

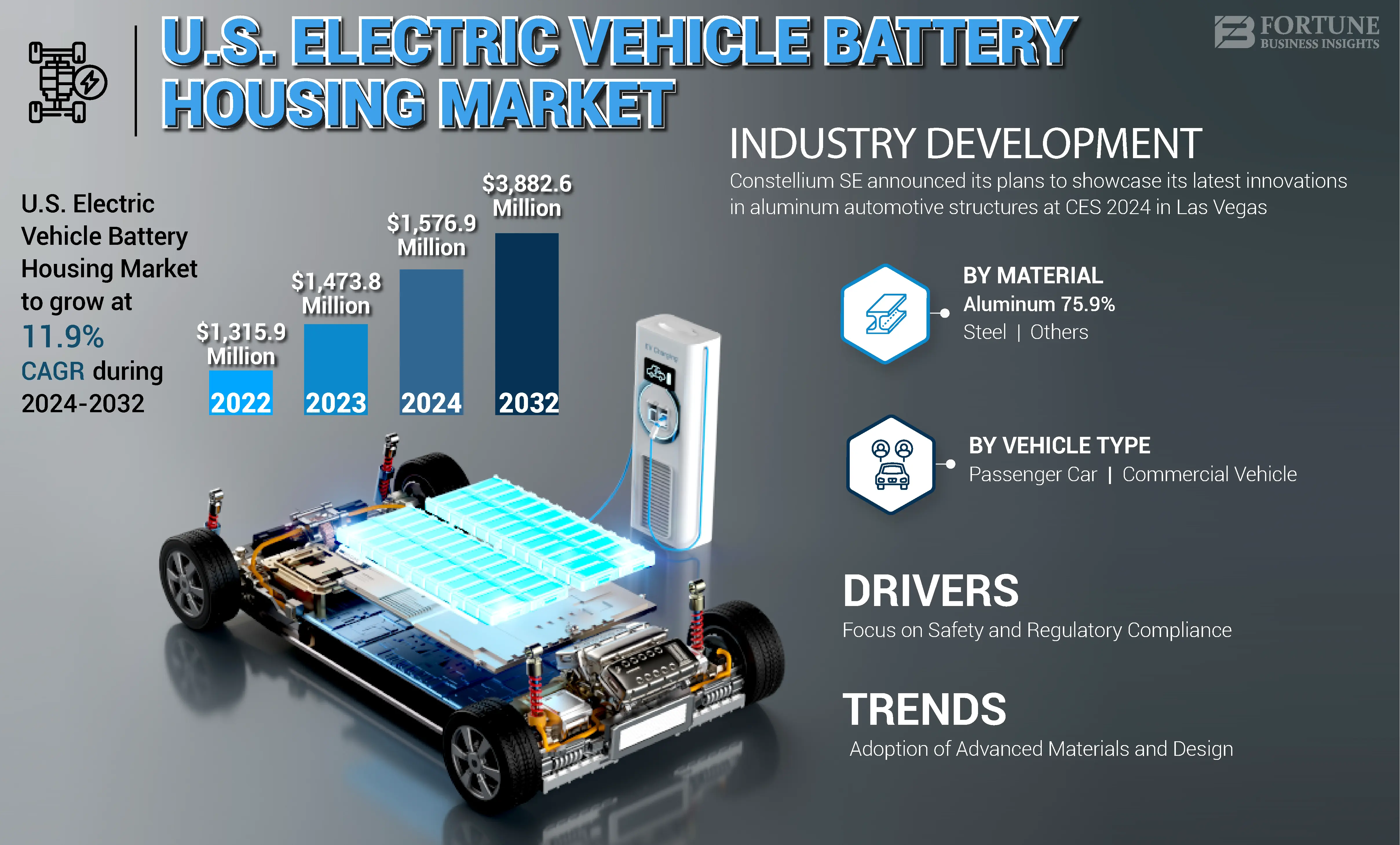

The U.S. electric vehicle battery housing market size was valued at USD 1,473.8 million in 2023 and is projected to grow from USD 1,576.9 million in 2024 to USD 3,882.6 million by 2032, exhibiting a CAGR of 11.9% during the forecast period.

Electric vehicle (EV) battery housing refers to the protective chassis surrounding the battery pack within an electric vehicle. This housing is crucial for safeguarding the battery from physical damage, thermal events, and environmental factors. Made from materials like aluminum, steel, or composites, it also incorporates thermal management systems to regulate temperature and enhance performance, ensuring the longevity and safety of the battery cells

The COVID-19 pandemic significantly influenced the U.S. Electric Vehicle (EV) battery housing market, primarily through supply chain disruptions. During the pandemic, the production of critical components such as lithium-ion batteries faced substantial setbacks due to shortages of essential materials such as lithium and cobalt. This disruption hindered the overall production of EV batteries and, consequently, the battery housings or battery cases designed to protect these vital components. Despite these challenges, the pandemic also accelerated the shift toward electric vehicles as consumers became more environmentally conscious and sought for sustainable alternatives to traditional combustion engines.

Government incentives and policies promoting EV adoption further fueled this trend. For example, the U.S. federal government introduced tax credits for electric vehicle purchases, boosting demand for high-quality battery housings that ensure safety and performance. As manufacturers adapted to these challenges by investing in advanced technologies and materials, the market began to recover, setting a foundation for future growth in the EV battery housing sector.

U.S. Electric Vehicle Battery Housing Market Trends

Rising Adoption of Advanced Materials and Design is a Latest Trend in the Market

The U.S. electric vehicle battery housing market is experiencing a significant shift toward advanced materials and innovative designs aimed at enhancing performance and safety. A notable development is the increasing use of lightweight composite materials, such as carbon fiber reinforced plastics (CFRP), which can reduce battery housing weight by up to 40% compared to traditional materials such as aluminum and steel. This weight reduction improves vehicle efficiency and enhances thermal management, which is critical for maintaining optimal battery temperatures during operation.

For instance, in September 2023, Envalior introduced a novel composite material that meets stringent thermal runaway tests for electric vehicle EV battery housing EV battery housings, showcasing the industry's focus on safety and performance. Additionally, companies such as Magna International are expanding their manufacturing capabilities to meet the growing demand for electric vehicles. This includes securing a contract with General Motors to supply battery enclosures for the 2024 Chevrolet Silverado EV. This trend reflects a broader commitment to sustainability and innovation within the U.S. EV battery housing market.

Download Free sample to learn more about this report.

U.S. Electric Vehicle Battery Housing Market Growth Factors

Increased Focus on Safety and Regulatory Compliance to Propel Market Growth

A significant driving factor in the U.S. Electric Vehicle (EV) battery housing market is the increased focus on safety and regulatory compliance. As electric vehicles become more prevalent, manufacturers face growing pressure to meet stringent safety standards set by regulatory bodies. This has led to substantial investments in developing advanced battery housing solutions that enhance safety features, such as thermal management and structural integrity. For example, the National Highway Traffic Safety Administration (NHTSA) has introduced guidelines that require rigorous testing of battery enclosures to prevent fire hazards during crashes. Companies such as Magna International are responding by designing battery housings that comply with these regulations and incorporate innovative materials and technologies to improve performance. This emphasis on safety is crucial, as it directly impacts consumer confidence and the widespread acceptance of electric vehicles, thus driving growth in the battery housing sector.

RESTRAINING FACTORS

Limited Recycling Infrastructure for Battery Components Restraining Market Growth

A crucial restraining factor in the U.S. electric vehicle battery housing market growth is due to limited recycling infrastructure for battery components. As the adoption of electric vehicles increases, the need for efficient end-of-life management of EV batteries and their housings becomes increasingly critical. However, current recycling processes for lithium-ion batteries are not well-established, leading to environmental concerns regarding waste management and resource recovery. For instance, while companies such as Redwood Materials are working on developing recycling solutions for EV batteries, the overall charging infrastructure remains inadequate to handle the expected volume of used battery housings. This limitation poses challenges for manufacturers striving to ensure sustainability while complying with environmental regulations. The lack of a robust recycling framework can hinder market growth by increasing costs and complicating supply chains, as manufacturers may face difficulties sourcing recycled materials for new battery housings.

U.S. Electric Vehicle Battery Housing Market Segmentation Analysis

By Vehicle Type Analysis

Growing Consumer Shift Toward Electric Passenger Car Boosts the Passenger CarDominant Segment

By vehicle type, the market is divided into passenger car and commercial vehicle.

The passenger car segment is dominating the U.S. Electric Vehicle battery housing market share. This segment benefits from increasing consumer demand for electric vehicles driven by environmental awareness and government incentives such as federal tax credits for EV purchases. Major automakers such as Tesla and Ford are at the forefront, producing electric models that require advanced battery housings to ensure safety and performance. For instance, Tesla’s Model 3 utilizes a robust battery enclosure designed for optimal thermal management and structural integrity, enhancing overall vehicle efficiency. As more consumers make a transition towards electric passenger vehicles, this segment is expected to maintain its leadership in the market, with substantial growth expected as manufacturers continue to innovate to meet evolving safety and performance standards.

The commercial vehicle is the fastest-growing segment within the U.S. EV battery housing market, driven by the electrification of logistics and public transport sectors. Companies are increasingly adopting electric buses, trucks, and vans to reduce operational costs and meet sustainability goals. For example, major players such as Daimler and Proterra are developing electric commercial vehicles that require specialized battery housings designed for durability and safety under heavy use conditions. The push for zero-emission fleets in urban areas further accelerates this trend as municipalities invest in electric public transport solutions. As regulations tighten around emissions and sustainability, the commercial vehicle segment is expected to see rapid expansion, reflecting a shift toward greener transportation solutions in various industries.

By Material Analysis

Aluminum’s Light Weight Properties Makes Aluminuma Dominating Segment

As per material, the market is divided into steel, aluminum, and others (carbon fiber & carbon glass).

Aluminum is rapidly becoming the leading material in the electric vehicle battery housing market, primarily due to its lightweight properties that significantly enhance vehicle efficiency. This lightweight characteristic improves driving range and reduces energy consumption, making aluminum an attractive choice for manufacturers. Its corrosion resistance and thermal conductivity further solidify its suitability for high-performance applications. For example, Tesla utilizes aluminum in the battery housing of its Model 3 to optimize performance while adhering to safety standards. As a result, the aluminum segment is anticipated to experience substantial growth as manufacturers prioritize lightweight designs to enhance overall vehicle efficiency.

Despite aluminum's advantages, steel remains a prominent option for EV battery housings due to its strength and cost-effectiveness. Steel provides excellent structural integrity and impact protection, making it suitable for various applications. Manufacturers such as Ford incorporate steel in their battery enclosures to strike a balance between cost and safety while meeting regulatory requirements. However, the weight of steel can negatively impact overall vehicle efficiency.

To know how our report can help streamline your business, Speak to Analyst

KEY INDUSTRY PLAYERS

Extensive Experience in Product Development has Made Magna Dominate the Market

The leading player in the U.S. EV battery housing market is Magna International Inc. (Canada). Magna has established itself as a dominant force by leveraging its extensive experience in automotive manufacturing and engineering. The company specializes in producing advanced battery enclosures that ensure safety, structural integrity, and thermal management for electric vehicle batteries. For example, Magna signed a contract with General Motors to supply battery enclosures for the 2024 Chevrolet Silverado EV, showcasing its capability to meet the needs of major automotive manufacturers. Additionally, Magna's expansion of its electric vehicle structures facility in St. Clair, Michigan, highlights its commitment in increasing production capacity and innovation in battery housing solutions. This strategic focus on lightweight and durable materials positions Magna as a leader in the market.

ThyssenKrupp AG (Germany) also holds a significant presence in the Electric Vehicle Battery Housing Market growth. The company is recognized for its high-strength steel products, which are widely used in battery housings due to their emphasis on safety and cost-effectiveness. Their innovative development of lightweight yet robust battery enclosures and advanced battery technology aligns with the growing demand for efficient electric vehicles, making them a key competitor in this rapidly evolving industry.

List of Top U.S. Electric Vehicle Battery Housing Companies:

- Magna International Inc. (Canada)

- ThyssenKrupp AG (Germany)

- Novelis Inc. (U.S.)

- American Battery Solutions, Inc. (U.S.)

- QuantumScape Corporation (U.S.)

- Clarios (U.S.)

- SGL Carbon (Germany)

- Nemak, S.A.B. de C.V (Mexico)

- Norsk Hydro ASA (Norway)

- Electrovaya Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- January 2024- Constellium SE announced its plans to showcase its latest innovations in aluminum automotive structures at CES 2024 in Las Vegas. The company is known for its advanced lightweight aluminum components and is expected to highlight sustainable solutions designed for both automakers and consumers. Constellium is expected to present a wide range of aluminum solutions created to meet the rise in demand for lightweight and sustainable materials in the automotive sector.

- February 2023- Magna International secured a contract with General Motors (GM) to supply battery enclosures for the upcoming 2024 Chevrolet Silverado EV, which will be assembled at GM's Factory ZERO. Production of these enclosures began in late 2023 at Magna's Electric Vehicle Structures facility in St. Clair, Michigan, where the company already manufactures battery enclosures for the GMC HUMMER EV. To accommodate this expansion, Magna is adding a 740,000-square-foot extension to its current 345,000-square-foot facility, which opened in 2021. This substantial investment highlights Magna's commitment to meeting the rising demand for electric vehicle components while enhancing production capabilities.

- August 2023- Linamar Corporation completed its acquisition of three battery enclosure manufacturing facilities from Dura-Shiloh. Initially announced on May 30, 2023, this all-cash transaction, valued at USD 325 million, was contingent on regulatory approvals which have since been fulfilled. The three facilities, located in Alabama, North Macedonia, and Czechia, will now operate under the newly established Linamar Structures Operating Group. Each site specializes in manufacturing battery enclosures for battery electric vehicle (BEV) applications. Linamar's Executive Chair and CEO, Linda Hasenfratz, expressed excitement about this acquisition, viewing it as a significant step in the company's transition toward electrified works mobility and a boost to its Structures & Chassis business portfolio. This move is expected to accelerate Linamar's strategy to enhance its electrified product offerings and increase its future BEV content.

- September 2022- Minth Group announced a collaboration with Renault Group to produce battery casings for EVs. The joint venture supports the installation of two new production lines in Ruitz in 2023, with an expected capacity of 300,000 battery casings per year by 2025. These casings would used in electric models, including the future R5.

- February 2022 - Nemak, S.A.B. de C.V. secured a contract worth USD 350 million to manufacture battery housings for fully electric vehicles of global customers. Nemak aimed to install three new manufacturing facilities in Europe and North America to support the joining and assembly requirements for producing the housing. The investment for this expansion is expected to amount to approximately USD 200 million.

REPORT COVERAGE

The U.S. electric vehicle battery housing market report provides a detailed analysis focusing on key aspects such as leading market players, competitive landscape, and vehicle type. Besides, the report includes insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

[GtCrnEohPTl]

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 11.9% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Vehicle Type · Passenger Car · Commercial Vehicle |

|

By Material · Steel · Aluminium · Others (Carbon Fibre & Carbon Glass) |

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 1,473.8 million in 2023.

The market is projected to grow at a CAGR of 11.9% over the forecast period.

The passenger cars segment leads the market due to the adoption of passenger vehicles U.S.

SGL Carbon, ThyssenKrupp AG, and Magna, and Nemak, S.A.B. de C.V, are some of the top key players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us