U.S. Electric Vehicle Charger Manufacturing Market Size, Share & Industry Analysis, By Charger Type (Level - 1, Level - 2, and Level - 3), By Power Output (Up to 3 kW, 3.1 KW to 20kW, 21 kW to 150 kW, and Above 151 kW), By Installation Type (Fixed and Portable), By End-User (Residential (Single Home Charging & Multi home Charging) and Commercial), Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

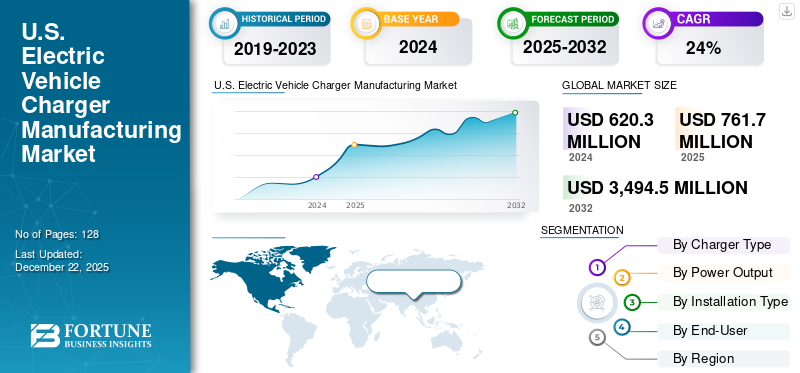

The U.S. electric vehicle charger manufacturing market size was valued at USD 620.3 million in 2024 and is projected to grow from USD 761.7 million in 2025 to USD 3,494.5 million by 2032, exhibiting a CAGR of 24.3% during the forecast period.

The U.S. electric vehicle charger manufacturing market encompasses production, distribution, installation, and maintenance of electric vehicle charging stations and its related components. These stations, also known as EVSE (Electric Vehicle Supply Equipment), are essential for recharging electric vehicle batteries. The market includes a wide range of products, from residential Level 1 and Level 2 chargers to commercial and public Level 2 and DC Fast Charging (DCFC) stations.

The market is a rapidly expanding sector that plays a pivotal role in the transition towards sustainable clean transportation. As the demand for electric vehicles continues to surge, the need for robust and efficient charging infrastructure has become increasingly critical. This development drives the U.S. electric vehicle charger manufacturing market.

Download Free sample to learn more about this report.

U.S. Electric Vehicle Charger Manufacturing Market Trends

Bi-Directional Charging Used in Electric Vehicles to Drive the Market Growth

Vehicle-to-Grid (V2G) Technology: Bidirectional chargers enable energy flow both, to and from the vehicle. This capability allows EVs to draw power from the grid and return excess energy to it. This technology supports grid stability and offers potential financial benefits to EV owners through energy trading. This technology increased the demand for EV chargers, thereby increasing technological advancement in electric vehicle charging manufacturing.

In May 2024, Fermata and Xcel Energy introduced a transformative’ V2X bidirectional charging pilot in Colorado. The project is Xcel’s first pilot examining the bill impacts and the potential for improved resiliency that can result from utilizing bidirectional charging and V2X systems.

In August 2024, Nissan announced that it had approved an updated bidirectional charger for its Leaf EV, giving owners another option for using their cars as mobile energy sources.

In March 2023, Tesla announced that it has a plan to adopt Bi-Directional Charging by 2025.

MARKET DYNAMICS

Market Drivers

Government Policies and Incentives to Significantly Increase the Demand for Electric Vehicle Charger Manufacturing

One of the primary drivers of the U.S. electric vehicle charger manufacturing market is the robust support from federal and state governments. The Biden administration's infrastructure bill, known as the Infrastructure Investment and Jobs Act (IIJA), allocates USD 7.5 billion to build a national network of EV charging stations. This funding is aimed at reviving the deployment of chargers across highways, urban areas, and rural communities. Additionally, states such as California, New York, and Texas have implemented incentives, such as tax credits, rebates, and grants, to promote the adoption of electric vehicles and the installation of charging infrastructure.

California has some of the most important policies for promoting EV adoption. The state offers a variety of incentives, including rebates for the purchase of EVs, grants for the installation of charging stations, and funding for EV charging research and development. The California Energy Commission (CEC) has allocated over USD 1 billion to support the deployment of electric vehicle charger manufacturing.

For instance, In January 2025, U.S. Senator Alex Padilla (D-Calif.) announced that the U.S. Department of Transportation would award USD 122.9 million for six California projects to build zero-emission vehicle charging and fueling EV infrastructure, including over USD 55 million for medium- and heavy-duty zero-emission vehicles. The funding comes through the Federal Highway Administration’s Charging and Fueling Infrastructure Grant Program, which was created by the Bipartisan Infrastructure Law. The Charging and Fueling Infrastructure Grant Program aims to strategically deploy electric vehicle (EV) charging infrastructure and other alternative fueling infrastructure projects in publicly accessible locations in urban and rural communities, including downtown areas and local neighborhoods. This development drives the electric vehicle charger manufacturing market growth.

MARKET RESTRAINTS

High Initial Costs for Setting Up Electric Vehicle Charging Stations May Hamper the Market Growth

A key obstacle hindering the expansion of the U.S. Electric Vehicle (EV) charging market is the high cost of installation and upkeep. Setting up EV chargers, especially fast chargers, demands a large upfront investment in equipment, software, and infrastructure. There are also extra expenses for electrical upgrades, permits, and labor. Moreover, maintenance costs can be significant since chargers need routine servicing to function properly and meet safety regulations. These financial challenges can discourage businesses and local governments from installing an adequate number of charging stations.

The cost of the actual charging stations, which can range from USD 2,000 to USD 50,000 or more, depends on the type of charger (Level 1, Level 2, or DC fast charger). DC fast chargers, which are essential for long-distance travel, are significantly more expensive due to their advanced technology and higher power output.

Installing an EV charger often requires substantial electrical upgrades to the existing infrastructure. This includes upgrading the electrical panel, installing new wiring, and ensuring adequate power supply. The cost of these upgrades can be a significant barrier, especially for older buildings or those in rural areas. Thus, the high initial costs for setting up electric vehicle charging stations may hamper the U.S. electric vehicle charger manufacturing market growth.

MARKET OPPORTUNITIES

Use Of Wireless Charging Will Boost The Technological Developments In The Charging Infrastructure Of Electric Vehicles

The electric vehicle market in the U.S. is witnessing remarkable expansion fueled by a compound of government incentives, public interest in environmentally friendly transport, and improvements in battery technology.

Wireless charging, already a common feature for mobile phones, is now being adapted for electric vehicles. This technology permits electric vehicle batteries to recharge simply by parking the car over a charging pad implanted in the ground. While reproducing the functionality of wireless phone chargers, this system operates on a much larger power scale.

The technology must be both robust and secure, as the energy exchanged in these wireless systems far exceeds that of a typical wireless cell phone charger. One of the main concerns for customers buying an electric vehicle is range anxiety, which is the fear of running out of battery and not finding a charging station close enough. Charging equipment manufacturers are producing power banks for cars, as the one used to charge smartphones can be ordered from a mobile app.

Build America, Buy America Act (BABA) And Its Impact On The Market

Build America, Buy America Act (BABA) was enacted as part of the Infrastructure Investment and Jobs Act (IIJA) on November 15th, 2021, which mandates that all iron, steel, manufactured products, and construction materials used in federally funded infrastructure projects be produced in the U.S. This legislation aims to bolster domestic manufacturing, strengthen supply chains, and support American jobs.

Federal agencies are required to ensure compliance with these provisions, with waivers granted only under specific circumstances, such as public interest considerations, non-availability of materials, or unreasonable cost increases. BABA requires that on or after May 14th, 2022, the head of each Federal agency shall ensure that none of the funds made available for a federal financial assistance program for infrastructure may be obligated for a project unless all of the iron, steel, manufactured products, and construction materials used in the project are produced in the U.S.

BABA applies to the construction, alteration, maintenance, or repair of public infrastructure undertaken by nonfederal entities using federal financial assistance. Infrastructure is defined very broadly and includes the structures, facilities, and equipment for infrastructure.

Impact of The New Political Administration In The U.S. On The Market

Succeeding the 2024 U.S. presidential election, Donald Trump of the Republican Party has been elected as president, defeating Kamala Harris of the Democrat party. Trump secured 312 electoral votes, surpassing the 270 needed to win, while Harris received 226134. Trump also won the national popular vote with a plurality of 49.8%, marking the first time a Republican has done so since George W. Bush in 20042. While Trump's communications director labeled it a "landslide" victory, the data indicates a closer contest, with Trump's vote share dipping below 50% as counting proceeded1. The US election is essentially a series of 50 state-by-state contests rather than a singular national race.

As Trump assumes office, potential changes to the political administration include shifts in policy priorities, cabinet appointments, and legislative agendas. Given that the Republican party has also secured victories in both chambers of Congress, Trump will likely have considerable authority to implement his plans. He has expanded his appeal across nearly all demographic groups of voters, achieving a resurgence that is unparalleled by any other recently defeated president in modern history. Trump's victory can be attributed to the economy, healthcare, and foreign policy.

Segmentation Analysis

By Charger Type

Increasing Adoption of AC Private and Public Charging Stations to Drive the Level-2 Charger Segment Growth

By charger type, the electric vehicle charger manufacturing market is segmented into Level-1, Level-2, and Level-3.

Level-2 segment dominated the market with the most significant EV charger manufacturing market share in 2024. The increasing adoption of AC private and public charging stations across the country is a major factor driving market growth. Level 2 chargers are popular for businesses looking to add value for visitors, employees, and tenants due to their combination of fast charging and relatively easy installation.

For instance, in August 2024, Governor Gavin Newsom announced that California has surpassed 150,000 public and shared private chargers installed statewide, including 137,648 Level 2 chargers and 14,708 fast chargers. This announcement comes just weeks after California posted its second-highest-ever market share in zero-emission vehicle (ZEV) sales. This devolvement drives market growth.

The Level-3 segment accounted for a considerable U.S. EV charger manufacturing market share in 2024. Its rapid growth is largely fueled by the fast-charging capabilities offered by direct current (DC), which enable electric vehicles to gain 3 to 20 miles of range per minute of charging. As drivers increasingly seek ultra-fast charging options, stations pledging a full charge in just 10-20 minutes are gaining traction and significantly contributing to the projected growth of this segment throughout the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Power Output

Growing Investments By Manufacturers in the Above 151 kW Segment Drives the Market Growth

Based on power output, the market is divided into Up to 3 kW, 3.1 KW to 20 kW, 21 kW to 150 kW, and Above 151 kW.

The above 151 kW segment held the maximum market share with the highest CAGR over the forecast period. The above 151 kW segment represents cutting-edge EV charging technology and experiences the fastest growth during forecast years. The segmental growth is attributed to increasing investment by manufacturers such as Tesla Supercharge Network, Electrify Americas, and others.

The 3.1 KW to 20kW segment held a significant market share in 2024. The rotor is the rotational part of the motor. This growth is attributed to increased adoption of home charging, workplace charging, and public destination charging. These chargers are ideally suited for locations where vehicles are parked for extended periods, such as office parking lots, shopping centers, or public garages.

By Installation Type

Increasing EV Infrastructure Investment by the Government to Drive the Fixed Segment

Based on installation type, the market is segmented into fixed and portable.

The fixed segment held a dominant market share in 2024. The 100 kW to 250 kW motor is used in high-power passenger cars and medium-duty commercial vehicles due to high power output, high efficiency, low maintenance, and operating cost. The U.S. federal and state governments, alongside private organizations, are focusing on substantial investments in EV infrastructure as part of nationwide electrification goals. Under the U.S. Infrastructure Investment and Jobs Act, USD 7.5 billion is allocated to build a nationwide network of 500,000 electric vehicle chargers. Funds are distributed to the National Electric Vehicle Formula Program to provide states with funds to deploy charging and fueling infrastructure strategically. This infrastructure must be publicly accessible, and states will work with the Department of Transportation and the Department of Energy to formulate proposals. This increasing investment fueled the demand for Fixed chargers during forecast years.

The portable segment held a significant market share in 2024. This segmental growth is attributed to rising product offering by OEM’s. For instance, In August 2023, Lectron reveled new Level 1 portable EV chargers. The Lectron Level 1 EV Charger is a portable unit designed for on-the-go charging. It offers a charging speed of up to 1.65 kW at 15 amps. A NEMA 5-15 plug connects to standard 110 V outlets.

By End-User

Increasing Charging Infrastructure Programs by Major OEMs to Drive the Residential Segment

Based on end-user type, the market is segmented into residential (Single home charging & Multi Home Charging) and commercial.

The residential segment held a majority market share in 2024. The segmental growth is attributed to major players' increasing charging infrastructure programs. In October 2024, ChargePoint announced that drivers who purchase a ChargePoint Home Flex residential charger in the U.S. would be able to include a simple, affordable, and straightforward home installation with their purchase. The new service provides a frictionless “one-stop shop” for an EV driver to purchase and install a home charger.

The commercial segment held a significant market share in 2024. Organizations are increasingly investing in EV chargers to attract customers and meet sustainability goals. In October 2024, The Defense Innovation Unit (DIU) announced that it had delivered a new dual-use commercial electric vehicle (EV) charging process with integrated physical and digital infrastructure to enable fast and cost-effective EV charging. The “Service Charging” process optimizes the accelerated deployment of advanced EV technology solutions, including nearly 120 new EV Charging Facilities (EVCF) at 10 locations across the country. This development drives the market growth during the forecast period.

U.S. ELECTRIC VEHICLE CHARGER MANUFACTURING REGIONAL OUTLOOK

West region dominated the U.S. electric vehicle charger manufacturing market share (California representing majority of the share) and stood at USD 304.6 million in 2024. The west region, particularly California, leads the nation in EV adoption and charging infrastructure. With aggressive state policies promoting clean energy and a robust network of charging stations, California accounts for a substantial portion of the country's EV chargers. For instance, in the first half of 2024, California added 24,202 electric vehicle (EV) charging stations, bringing the total number of chargers in the state to over 150,000. This makes California the state with the largest national EV charging network in the U.S.

Southwest is anticipated to show significant market growth. The Southwest is witnessing a surge in EV adoption, fueled by increasing environmental awareness and state incentives. Arizona and Nevada are investing in electric vehicle charging networks to support the growing number of EVs. In August, the Arizona Department of Transportation announced the first set of awards to design, build and operate a network of 18 fast-charging stations on interstate highways. Each station will have at least four charging ports. They’ll be installed along I-10, I-8, I-40, I-17 and I-19.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus on the Development of EV Charging Technologies to Drive the Competition

The U.S. electric vehicle charger manufacturing market is highly competitive. These players are constantly trying to gain a strong foothold in the market by adopting various strategies. These strategies include product differentiation & development, expansion of sales & distribution network, and partnerships & collaborations, etc.

ChargePoint is one of the largest and most established players in the U.S. Electric Vehicle charger manufacturing market. Known for its extensive Level 2 charging network, the company focuses on both public and private charging solutions, catering to residential, commercial, and fleet customers. In June 2024, ChargePoint singed a strategic partnership with LG Electronics (LG) to enable LG EV charging hardware to be powered by ChargePoint software.

LIST OF KEY COMPANIES PROFILED

- ChargePoint Inc. (U.S.)

- Tesla (U.S.)

- Eaton (Ireland)

- Blink Charging Co. (U.S.)

- Electrify America (U.S.)

- Leviton Manufacturing Co., Inc. (U.S.)

- Wallbox Chargers (U.S.)

- BorgWarner Inc. (U.S.)

- Enphase Energy (U.S.)

- EVoCharge (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In October 2024, Leviton introduced its first-ever 400 Amp Meter Main Load Center, along with a 300 Amp model. This innovative addition to Leviton’s product line is designed to meet the growing demand for larger electrical service in large-scale residential applications, highly electrified homes, and future-proofing installations. With this new offering, Leviton continues to provide advanced electrical solutions that cater to the evolving needs of modern homes and installations.

- In August 2024, Enphase Energy, Inc. Introduced its new North American Charging Standard (NACS) connectors for its entire line of IQ EV Chargers. NACS connectors and charger ports have recently become the industry standard embraced by several major automakers for electric vehicles (EVs).

- In August 2024, BorgWarner Inc. introduced its new DC charging station. Providing a scalable power range of 120 kW up to 360 kW, this fast charging station is the ideal solution for the rapid charging requirements of public charging and commercial EV fleet applications.

- In March 2024, Wallbox Chargers signed a contract with the Washington Department of Commerce’s Electric Vehicle Charging Program, valued at USD 25.6 Million. The awards, announced as part of the Department’s first round of the program, will be used to deploy Wallbox’s latest AC Level 2 charger, the Pulsar Pro, across 148 multifamily housing properties throughout the state of Washington.

- In July 2024, Wallbox Charger announced that it had a USD 45 million investment, which includes USD 35 million from lead investor Generac Power Systems, Inc., a leading U.S. designer and manufacturer of energy technology solutions and other power products. The strategic investment reinforces the partnership with Generac and highlights Wallbox’s strong position in the market.

REPORT COVERAGE

The research report covers a detailed market analysis. It focuses on key aspects such as leading companies, product types, and leading product applications. Besides this, the report offers insights into the market trends and highlights key automotive industry developments. In addition to the factors mentioned above, the report delivers an in-depth analysis of several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 24.3% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Charger Type

|

|

By Power Output

|

|

|

By Installation Type

|

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 620.3 million in 2024 and is projected to reach USD 3,494.5 million by 2032.

In 2024, the West market size stood at USD 304.6 million.

The market will exhibit a promising growth rate of 24.3% CAGR during the forecast period.

The Level-2 charger type segment held the largest share of the market in 2024.

Government policies and incentives to significantly increase the demand for electric vehicle charger manufacturing.

ChargePoint Inc., Tesla, and Eaton are the major players in the U.S. market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us