U.S. Enterprise Resource Planning (ERP) Software Market Size, Share & COVID-19 Impact Analysis, By Enterprise Type (Small & Medium Enterprises (SMEs) and Large Enterprises), By Deployment (Cloud, On-premise, and Hybrid), By Business Function (Financial Management, Human Capital Management, Supply Chain Management, Customer Management, Inventory & Work Order Management, and Others (Sourcing & Procurement)), By End-user (Manufacturing, BFSI, IT & Telecom, Retail & Consumer Goods, Healthcare & Life Sciences, Transportation & Logistics, Government, and Others (Aerospace & Defense)) 2025-2032

KEY MARKET INSIGHTS

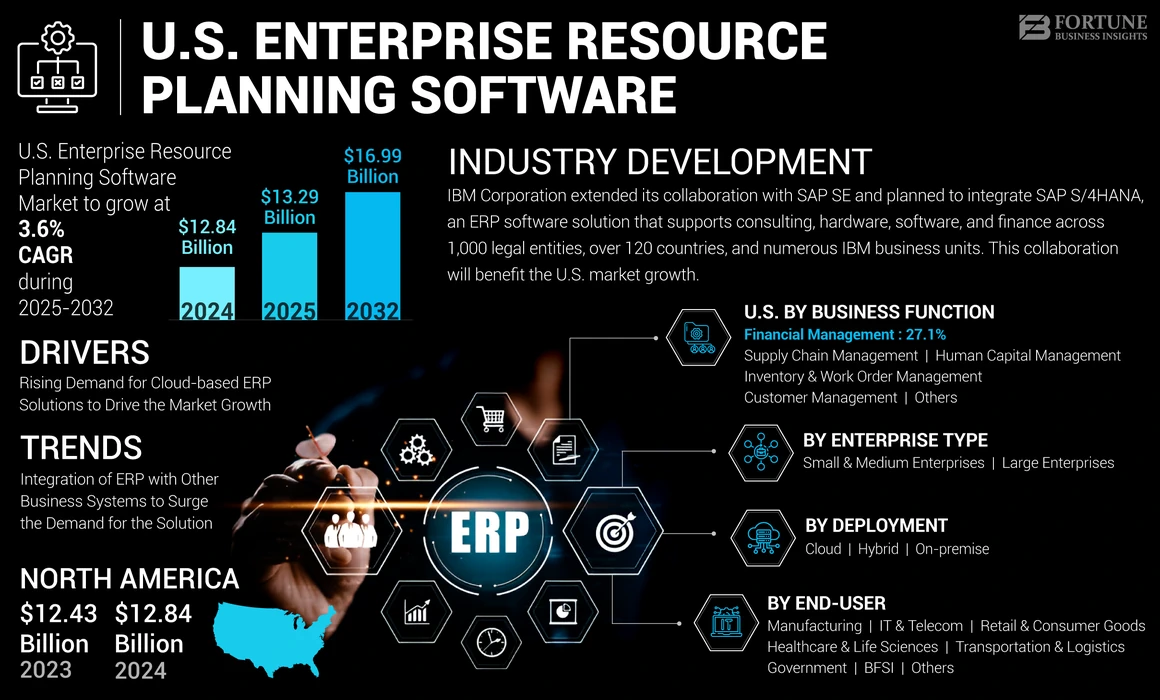

The U.S. Enterprise Resource Planning (ERP) software market size was valued at USD 12.84 billion in 2024. The market is projected to grow from USD 13.29 billion in 2025 to USD 16.99 billion by 2032, exhibiting a CAGR of 3.6% during the forecast period.

The market holds the most revenue in the U.S. owing to the high implementation of cloud-based and hybrid ERP systems to improve operational efficiency. The vendors in the country are utilizing this chance to renovate their business models to encourage ERP. For instance,

- Infor declared a "Three for Free" suite for smaller providers in the U.S. For a limited time, SMEs in the country can obtain a subscription to Infor CloudSuite Distribution for three free user licenses.

In the scope, we have considered Enterprise Resource Planning software offered by key companies such as Oracle Corporation, IBM Corporation, FinancialForce, Workday, Inc., Microsoft Corporation, Brahmin Solutions, Infor, Deltek, Acumatica, Inc., and Epicor.

COVID-19 IMPACT

Increasing Need to Manage Business Processes amid COVID-19 Pandemic to Strengthen the Market Growth

The outbreak of COVID-19 is foreseen to offer favorable opportunities for the U.S. enterprise resource planning software market during the forecast period. A surge in demand for cloud-driven ERP solutions from small and medium-sized businesses is projected to provide opportunities for investors in this market. Further, throughout the post-pandemic, companies in the country focused on solutions that support advanced planning and mitigate the impact of similar events in the future, fueling market growth.

LATEST TRENDS

Download Free sample to learn more about this report.

Integration of ERP with Other Business Systems to Surge the Demand for the Solution

Integration of other business systems, such as Customer Relationship Management (CRM) and Supply Chain Management (SCM) software, is a growing trend in the U.S. By integrating ERP systems with other systems, organizations can streamline their processes, reduce manual tasks, and gain a more comprehensive view of their operations. Hence, the abovementioned factor will increase the demand for solutions during the forecast period.

DRIVING FACTORS

Rising Demand for Cloud-based ERP Solutions to Drive the Market Growth

Enterprise Resource Planning (ERP) software is a business software that helps organizations manage and integrate their core business processes. Many organizations in the U.S. are moving their IT infrastructure to the cloud, which can provide cost savings, scalability, and flexibility. The U.S. market, software providers in the country are offering cloud-based solutions that can help organizations take advantage of these benefits without needing on-premise hardware and maintenance. For instance,

- Epicor Software's Annual Insights Report shows that approximately 94% of essential medium-sized businesses in the U.S. are implementing the cloud, up from the 25% that acknowledged the cloud as a strategic priority in 2020. Additionally, 94% believed the cloud would support future-proof their businesses.

Moreover, cloud-based ERP systems allow organizations to access their data and applications from anywhere with an internet connection, which will fuel the market growth.

RESTRAINING FACTORS

Integration with Legacy Systems to Impede the Growth

Many organizations in the U.S. have legacy systems that are difficult to integrate with modern ERP systems. Hence, the above factor can create data silos and lack of visibility into certain areas of the organization, hindering market growth in the country.

SEGMENTATION

By Enterprise Type Analysis

Implementing ERP Solutions for Managing Complex Business Process to Boost the Market

The market is bifurcated into SMEs and large enterprises based on enterprise type.

Among them, large enterprises is anticipated to hold the highest revenue share throughout the forecast period owing to the need to manage complex business processes for large enterprises. Additionally, the increasing spending capacity of large enterprises in the U.S. on adopting the latest technologies and software solutions enables the implementation of cloud-based Enterprise Resource Planning software, boosting segment growth.

Small and medium enterprises segment is expected to grow at the highest CAGR during the forecast period due to factors including reduced production cost, operational efficiency, and on-time product delivery are anticipated to boost demand for Enterprise Resource Planning solutions over the forecast period for SMEs.

By Deployment Analysis

Rise in Demand for Cloud-based Software for Maintaining Data Proficiency to Drive Market Growth

Based on deployment, we have considered it into cloud, on-premise, and hybrid.

The cloud segment leads the market with the highest CAGR owing to its growing adoption in the country. Moreover, the growing adoption of connected devices that efficiently manage business operations and deliver real-time insights enables business owners to opt for cloud-driven ERP solutions to process excessive data proficiently, fueling cloud adoption during the forecast period.

The on-premise model provides high data security and continuous organizational control. Thus, the rising need for benefits mentioned above for business proficiency across the country is expected to increase the demand for on-premise at a moderate rate.

By Business Function Analysis

To know how our report can help streamline your business, Speak to Analyst

Rise in Use of ERP Solutions to Strengthen Financial Transactions and Automate Business Processes to Drive the Market Expansion

Based on business function, the market is segmented into human capital management, financial management, customer management, supply chain management, inventory & work order management, and others.

Financial management accounted for the largest market share in the country and is expected to continue its dominance throughout the forecast period due to increasing demand by companies to automate accounting and financial tasks.

The inventory & work order management segment is projected to grow at the highest CAGR owing to the rising demand for enterprise resource planning tools to prioritize and coordinate work orders efficiently and accurately. These aforementioned factors will boost the ERP software market share.

By End-user Analysis

Increasing Need for ERP Software across Industries to Propel Market Share

Based on end-user, the market is classified into BFSI, manufacturing, IT & telecom, retail & consumer goods, transportation & logistics, healthcare & life sciences, government, and others (aerospace & defense).

Healthcare & life sciences segment is expected to grow at the highest CAGR throughout the forecast period in the country owing to managing patient records effectively. Implementing this solution in hospitals and healthcare companies would provide benefits such as better patient care, cutting operational costs, and initiating better healthcare processes.

In addition, manufacturing is expected to hold a significant share owing to the rising need to monitor vendor performance and improve visibility throughout the supply chain, which is expected to drive segment growth.

KEY INDUSTRY PLAYERS

The key players in the country are providing a wide range of ERP software solutions across all business segments. Also, through collaborations, players gain expertise and expand their business by reaching a mass customer base. Additionally, the key players focus on market share expansion and customer reach through strategic acquisition.

LIST OF KEY COMPANIES PROFILED:

- Oracle Corporation (U.S.)

- IBM Corporation (U.S.)

- FinancialForce (U.S.)

- Workday, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Brahmin Solutions (U.S.)

- Infor (U.S.)

- Deltek (U.S.)

- Acumatica, Inc. (U.S.)

- Epicor (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In May 2022, IBM Corporation extended its collaboration with SAP SE and planned to integrate SAP S/4HANA, an ERP software solution that supports consulting, hardware, software, and finance across 1,000 legal entities, over 120 countries, and numerous IBM business units. This collaboration will benefit the U.S. market growth.

- In March 2021: Acumatica, Inc., a provider of cloud and browser-based ERP software, introduced a cloud-based Acumatica R1 software that offers best-in-class features and a robust user experience. Such initiatives by significant players in the country are expected to drive the market growth.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research on the U.S. market includes key areas to understand the industry better. Additionally, the research provides insights into the most recent market trends and analysis of technologies implemented in the U.S. Further, it highlights the growth restrictions and elements, allowing the reader to understand the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.6% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Enterprise Type, Deployment, Business Function, and End-user |

|

By Enterprise Type |

|

|

By Deployment |

|

|

By Business Function |

|

|

By End-user |

|

Frequently Asked Questions

The market is projected to reach USD 16.99 billion by 2032.

In 2024, the market stood at USD 12.84 billion.

The market is projected to grow at a CAGR of 3.6% in the forecast period (2025-2032).

Rising demand for cloud-based ERP solutions to drive the market growth.

Oracle Corporation, IBM Corporation, FinancialForce, Workday, Inc., Microsoft Corporation, Brahmin Solutions, Infor, Deltek, Acumatica, Inc., and Epicor are the major market players in the U.S. market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us