U.S. Utility Vegetation Management Market Size, Share & Industry Analysis, By Services (Treatment, Pre-planning and Monitoring Reactive Repair), By Technology (Insecticides & Herbicides, Plant Growth Regulators, LiDar, and Others) and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

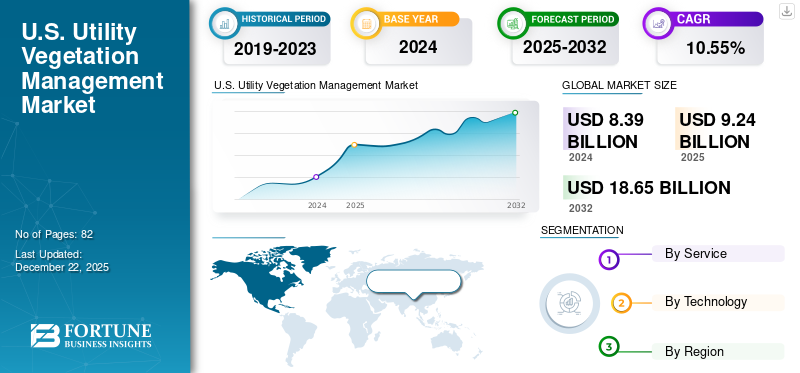

The U.S. utility vegetation management market size was valued at USD 8.39 billion in 2024. The U.S. market is projected to grow from USD 9.24 billion in 2025 and is expected to reach USD 18.64 billion by 2032, exhibiting a CAGR of 10.55% during the forecast period.

Utility vegetation management is the systematic process of controlling and maintaining vegetation near electric transmission and distribution lines to ensure safe and uninterrupted power delivery. The market is expanding due to extreme weather events, outage risk, and the emerging regulatory compliance.

Corteva is the leading player in the market. It provides various solutions, including advanced herbicide formulations, tools, and educational resources to help professionals manage vegetation effectively.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Extreme Weather Events and Outage Risk are Driving Demand for Vegetation Management

As the effects of climate change worsen, harsh weather, droughts, wildfires, and disease threaten trees and other vegetation. One of the main causes of power outages and, in certain situations, the source of serious damage to individuals, property, and communities is overgrown or weak branches and limbs that fall into distribution circuits. Utility infrastructure is frequently cited as the cause of ignition for wildfires, which are becoming more frequent and severe, especially in the western U.S.

Utilities are therefore heavily investing in proactive vegetation management to ensure grid infrastructure reliability and public safety across all states of the U.S. According to U.S. Department of Energy reports, the power utilities sector annually spends between USD 6-8 billion annually on maintenance budgets for vegetation control from overhead lines. For instance 2020, UVM expenditures topped USD 7.6 billion, excluding the USD 700 to USD 900 million for hazardous tree removal and ROW clearing. Major utilities spend over USD 100 million yearly on vegetation management, often the largest line item in annual operations budgets.

Emerging Regulatory Compliance for Utility Vegetation Management Driving UVM Services

Power lines being struck by trees and branches can result in brief flickers, long-lasting outages that affect residences and businesses, or even serious equipment damage. Strong UVM is necessary to reduce service interruptions, improve grid resilience against storms, and guarantee the seamless operation of vital infrastructure that depends on a steady power supply, since the public and regulatory bodies require consistent power delivery.

Utilities are legally required to meet strict reliability criteria established by the North American Electric Reliability Corporation (NERC). The severe repercussions of multiple significant blackout incidents prompted state and federal governments to enact laws that penalize utilities for not taking reasonable steps to guarantee the dependable operation of the electrical power lines under their jurisdiction. In order to ensure the reliable operation of the country's transmission facilities and the bulk power system, the federal government modified the Federal Power Act with the Energy Policy Act (EPAct 2005), enabling the Federal Energy Regulatory Commission (FERC) to establish an independent electric reliability organization tasked with creating and enforcing mandatory reliability standards.

MARKET RESTRAINTS

High Costs of UVM Services are Expected to Hamper Market Growth

Major utilities spend over USD 100 million yearly on vegetation management, often the largest line item in annual operations and maintenance budgets. The annual expenses are substantial, and most cannot be capitalized. The labor-intensive nature of vegetation care necessitates highly qualified arborists, specialized tools such as mulchers, chippers, bucket trucks, and frequently expensive disposal techniques. In addition to operating costs, utilities have significant administrative expenditures for managing landowner relations, public outreach, and permits.

According to Getac reports, by 2023, a quarter of the workers in the U.S. utility sector are anticipated to retire, which poses a significant obstacle. It implies that fewer professionals or recruits still learning relatively new technologies and receiving training in a complicated terrain bear the operational and maintenance responsibility for utility vegetation management. In order to address undesired vegetation and create strategic vegetation management solutions, utilities must make the most of their current workforce in the most critical areas.

MARKET OPPORTUNITIES

Technological Innovation and Data Analytics Expected to Create Opportunities for Market Growth

The conventional approach to dealing with overgrown vegetation that overflows onto utilities' right-of-way is to plan periodic maintenance on a predetermined schedule. The frequency follows a calendar rhythm but varies with geography and growth seasons. Companies prefer to forecast what the upcoming season will bring by referring to the data from the prior year. As the demands of growth and damage brought on by climate change drive the unanticipated and more frequent need for vegetation removal, such a method proves ineffectual. At the same time, utilities are searching for workable solutions that prioritize labor efficiency and public safety and security. As a more cost-effective alternative, preventative tree care and targeted tree control utilizing increasingly sophisticated geospatial technology, artificial intelligence (AI), and advanced analytics are being implemented.

For instance, in March 2025, a multi-year strategic collaboration agreement (SCA) between Hitachi Energy and Amazon Web Services (AWS) aims to speed up the energy transition by accelerating the deployment of cloud-based solutions by utilities and energy-intensive businesses. The agreement's primary goal is to provide Hitachi Plant, an ai powered plant management solution, on AWS. With the help of this creative solution, power or system outages brought on by vegetation interfering with vital infrastructure should be greatly reduced.

MARKET CHALLENGES

Labor Shortage and Aging Workforce Challenge to Market Growth

Many vegetation management activities are done manually, including post-work audits, trimming decisions, and patrolling for hazard tree inspections. A lack of skilled workers results in low productivity, which raises the possibility of errors and additional outages. It is common to witness numerous repeat work orders along the same feeders in service-level contracts for tasks such as trimming, herbicides, and asset maintenance.

According to demographics, most vegetation managers and employees at utilities have over 15 years of experience and extensive institutional knowledge. However, after ten or two years of expertise, professionals are deciding to move on to retire. This means the burden of operations and maintenance for utility vegetation management falls on a smaller segment of professionals. In order to address undesired vegetation and create strategic vegetation management solutions, utilities must make the most of their current workforce in the most critical areas.

U.S. UTILITY VEGETATION MANAGEMENT MARKET TRENDS

Increasing Application of GIS Technology and Satellite Systems is the Latest Trend

Many utilities are turning to technological advancements, such as enterprise asset management solutions that connect data and workflows to streamline operations and maintenance efforts, after realizing that the increasing number of traditional vegetation control techniques cannot meet today's issues. A Geographic Information System (GIS) is a powerful tool that allows utilities to manage and analyze enormous volumes of data related to vegetation control. It offers a means of visualizing and evaluating information on vegetation, weather trends, and other elements that affect the growth of plants. Vegetation managers can make crucial decisions using GIS data layers, such as landowner parcel information, wildfire risk, protected species ranges, and outage information.

In August 2024, two utility vegetation management-focused businesses in California collaborated on a pilot project to verify and examine satellite imagery to pinpoint specific trees that could collide with electric transmission and distribution lines. Satelytics and ACRT Pacific, two firms specializing in automated cloud-based geospatial analytics and utility vegetation management, respectively, collaborated on the project to analyze Pléiades 1A/1B satellite imagery with a resolution of 50 cm. Owing to these factors, the market is expected to grow during the forecast period.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS

U.S. President Trump announced to impose an individualized reciprocal higher tariff on the countries with which the U.S. shares high trade deficits. The reciprocal tariff will not apply to all goods. These include items covered by 50 USC 1702(b), steel/aluminum products and automobiles/auto parts already subject to Section 232 tariffs. This includes copper, semiconductors, pharmaceuticals, and lumber products, any items that could be subject to Section 232 tariffs in the future, and others.

UVM relies on equipment components such as steel for pruning tools, aluminium hardware, and transformer parts, many of which are imported or contain imported inputs. The existing Section 232 tariffs on steel and aluminium are still in effect and already increasing the capital cost for utilities. The newly added country-specific tariffs could further inflate procurement costs for tools, vehicles such as bucket trucks, and spare parts, especially those from impacted countries. However, utilities' overall exposure represents only a small portion of capital outlays. Most manufacturers or service companies in this market depend on U.S. made components.

SEGMENTATION ANALYSIS

By Service

Treatment Dominates Market Due to Regulatory Compliance

Based on services, the market is segmented into treatment, pre-planning and monitoring, and reactive repair.

Treatment services account for a major share of the market accounting for 48.28%, due to regulatory compliance and the operational necessity of regular vegetation control. State utility commissioners demand regular trimming cycles for distribution lines, while federal regulations such as NERC FAC-003-04 require utilities to keep a safe distance from high-voltage transmission lines.

The pre-planning and monitoring segment is the second leading and fastest growing segment with a U.S. utility vegetation management market growth rate of 11.88% over the forecast period. This segment includes LiDAR scanning, drone surveillance, satellite imagery, predictive analytics, and vegetation risk modeling services. The increasing adoption of risk-based vegetation management is driving demand for these services.

The reactive repair segment covers emergency response services which accounted for a growth rate of 8.41%, including storm damage cleanup, post-outage vegetation removal, and hazard tree clearing. Although it only accounts for a small percentage of the market, this segment is vital to utility operations.

To know how our report can help streamline your business, Speak to Analyst

By Technology

Insecticides & Herbicides Dominate Market Due to Comparatively Low Cost

Based on technology, the market is segmented into insecticides & herbicides, plant growth regulators, LiDar, and others.

Insecticides & herbicides hold a major share of the market accounting for 38.31% share. Using insecticides & herbicides significantly lower the expense and environmental impact of preserving utility rights of way. It is the most widely used practice for managing vegetation growth along utility rights-of-way. Utility vegetation management expenses might increase if herbicides are not employed.

Plant growth regulators is the second leading segment based on technology growing at a CAGR of 10.82%, as it lowers long-term utility maintenance costs. This technology is useful for sensitive zones where insecticides & herbicides may be restricted.

LiDAR is an emerging technology used by some advanced utility companies with a high budget for utility vegetation management. This segment is growing at a highest CAGR of 11.59% and it is expected to be in high demand due to its high-precision 3D data that enables practical risk detection, such as tree wire conflicts. IT is becoming critical for wildfire mitigation strategies, especially in extreme high-risk regions in the U.S.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Characterized by Companies Competing on Safety Records and Rapid Response Capabilities

The U.S. market for utility vegetation management services is characterized by a mix of large national service providers, mid-sized regional players, and contractors providing consulting services for vegetation management. Major players such as Lewis Tree Services, Corteva, Cyient, and others hold a significant U.S. utility vegetation management market share. These companies specialize in providing services across vegetation management practices in different terrains. Major players in this market compete on scale, safety records, and rapid response capabilities after natural calamities. Some players such as Clearway Industries and Ecocene Environmental Services serve small areas or only specific locations in the U.S.

List of the Key U.S. Utility Vegetation Management Companies Profiled

- Corteva Agriscience (U.S.)

- Lewis Tree Service (U.S.)

- TRC (U.S.)

- Cyient (India)

- NM Group (U.K.)

- UDC (U.S.)

- AiDash Inc (U.S.)

- VM West (U.S.)

- Eocene Environmental Group (U.S.)

- ClearWay Industries, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025- NM Group announced that the long-standing agreement with a significant East Coast utility has been extended. This most recent extension guarantees ongoing cooperation and demonstrates the client's faith in NM Group's capacity to provide precise and trustworthy geospatial data. NM Group will survey nearly 1,000 miles of the utility's transmission infrastructure from the air in 2025, providing a thorough dataset to aid in network planning, engineering, and vegetation management initiatives.

- May 2024- TRC Companies, Inc. assisted Otter Tail Power Company in obtaining a USD 4.4 million grant for its Next-Generation Grid Resiliency initiative. The grant will help with advanced substation assessments and repairs, drone and AI-enhanced transmission line inspection and repairs, intelligent vegetation management, and pole integrity. The North Dakota Industrial Commission made the award under the Infrastructure Investment and Jobs Act (IIJA) of the Department of Energy (DOE).

- May 2023- Corteva Agriscience announces that the newest herbicide from its extensive innovation pipeline will be marketed under BexoveldTM active. Cereal growers will have an additional option to control broadleaf weeds with the active component. Bexoveld is anticipated to be introduced by Corteva in North America in 2028 and Europe in 2030.

- August 2022- BASF Agricultural Solutions and Corteva Agriscience partnered to develop complementary herbicides and future herbicide-tolerant soybeans for farmers in North America and other regions. The partnership seeks to provide competitive alternatives for managing resistant and difficult-to-control weeds. Strong germplasm selections from Corteva and BASF seed brands and more weed management alternatives will benefit farmers.

- March 2022- Valent U.S.A. LLC and Corteva Agriscience signed an agreement to be the sole distributor of Piper EZ herbicide in the U.S. Piper EZ herbicide, a new suspension concentrates liquid formulation available through Corteva authorized distributors for the 2022 season, is for preserving control of specific grasses, broadleaf weeds, and bare ground results across various noncrop use sites.

Investment Analysis and Opportunities

- The U.S. utility vegetation management (UVM) market is an important segment of grid maintenance and wildfire prevention. It has grown significantly in the last few years due to increasing climate-related risks, particularly extreme weather events and wildfires that impact the reliability of power lines.

- In order to reduce the risk of wildfires and power outages and to guarantee community and resident safety, utilities are investing in UVM services with special emphasis on technological advancements. Major utilities are upgrading to advanced technologies for better insights and efficient management of utility vegetation.

- For instance, in November 2023, according to reports of AiDASH, over half of U.S. utilities have updated vegetation management approaches due to climate change, and 82% have or are seeking to use digital tools to upgrade operations. Moreover, the results of a survey conducted by AiDASH demonstrated that 11% of utilities have already made substantial changes, and 41% have made some changes to vegetation management strategies. 48% are yet to make any updates, but most plan to adopt digital solutions by 2025 or later.

REPORT COVERAGE

The U.S. utility vegetation management market report delivers a detailed insight into the market and focuses on key aspects such as leading companies in utility vegetation management. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 10.55% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service · Treatment · Pre-planning and Monitoring · Reactive Repair |

|

By Technology · Insecticides & Herbicides · Plant Growth Regulators · LiDar · Others |

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 8.39 billion in 2024.

The market will likely grow at a CAGR of 10.55% over the forecast period.

The treatment segment is expected to lead the market in the forecast period.

Increasing extreme weather events and outage risk are the key factors driving market growth.

Some of the top players in the market are Lewis Tree Services, Corteva, and Cyient, among others.

The U.S. market size is expected to reach USD 18.64 billion by 2032.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us