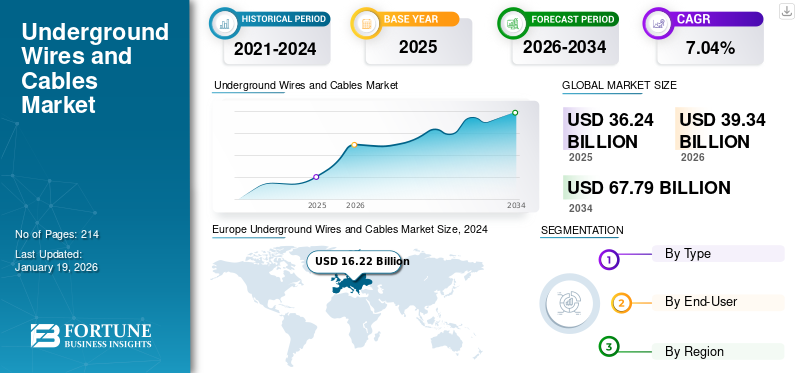

Underground Wires and Cables Market Size, Share & Industry Analysis, By Type (Power Cable and Communication Cable), By End-User (Residential, Commercial, Industrial, and Utility), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global underground wires and cables market size was valued at USD 36.24 billion in 2025. The market is projected to grow from USD 39.34 billion in 2026 and is expected to reach USD 67.79 billion by 2034, exhibiting a CAGR of 7.04% during the forecast period. Europe dominated the underground wires and cables market with a share of 49.21% in 2025.

Rapid urban growth and considerable infrastructure advancements are the key factors contributing to the market share. As urban areas expand and new development initiatives arise, underground cabling is crucial for effective power distribution, telecommunications, and smart city technologies. Infrastructure initiatives, including metro systems, railway electrification, and low-cost housing projects, heighten the need for underground cables to guarantee a continuous and secure power supply.

Underground cables, often considered specialty cables, exhibit greater resilience against severe weather occurrences, incidents, and external damage in comparison to overhead lines. This attribute enhances their reliability and minimizes the potential for outages triggered by storms, fires, or various other disturbances. These factors are driving the market growth in recent years.

Prysmian Group is a leading global company in underground wires and cables, serving the energy and telecom sectors. The company has been continuously investing in R&D for developing high-performance, sustainable cable solutions, including HVDC and submarine systems. It supports global energy transition projects and grid modernization, securing major contracts including Germany’s SuedOstLink. Prysmian also focuses on digital integration and smart cable monitoring systems to enhance reliability.

UNDERGROUND WIRES AND CABLES MARKET TRENDS

Expansion of Renewable Energy and EV Infrastructure to Lead Market Growth

Underground cables are used to connect solar farms, wind parks, and EV charging stations, especially in densely populated or high-traffic areas. As solar and wind power projects, along with EV charging networks and battery storage systems, expand, especially in urban and high-density areas, there is a growing need for safe, reliable, and space-efficient underground cabling. These cables enable seamless integration of clean energy sources into the grid while minimizing visual impact and exposure to weather-related disruptions.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Industrialization and Infrastructure Development to Drive Market Growth

Rising urban development requires contemporary electrical infrastructures for residential, commercial, and industrial buildings, leading to a demand for underground cables. Government programs such as India’s Saubhagya and DDUGJY schemes additionally enhance market expansion by emphasizing grid modernization and rural electrification.

The transition to smart grids and renewable energy initiatives (solar, wind) necessitates the use of specialized underground cables, including medium-voltage smart cables featuring integrated fiber optics and HVDC systems. These technologies provide effective power transmission and durability in challenging environments, and all these factors are expected to drive the underground wires and cables market growth in the coming years.

MARKET RESTRAINTS

High Installation Costs of Underground Wires and Cables to Hinder Market Growth

The market for underground wires and cables encounters considerable limitations due to elevated installation expenses. These expenses are considerably greater than those associated with overhead lines, typically varying from four to fourteen times more costly based on voltage and distance. For instance, the building of a 69 kV underground transmission line may cost approximately USD 1.5 million per mile, in contrast to roughly USD 285,000 per mile for an overhead line of equivalent voltage.

MARKET OPPORTUNITIES

Technological Advancements, Such as Integration of Smart Grid Technology to Boost Market

Smart grid technology integrated with renewable energy is greatly enhancing the market by facilitating a more efficient, dependable, and sustainable electricity system. Smart grids offer sophisticated situational awareness, real-time monitoring, predictive analytics, and automated control features that proficiently handle the variable and intermittent characteristics of renewable energy sources such as solar, wind, hydroelectric, and geothermal power. Thus, technological advancements are expected to boost the demand for underground wires and cables.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Increasing Urbanization and Smart Cities Boost Power Cable Segment Growth

Based on type, the market is divided into power cable and communication cable.

Power cables are the dominating segment in the market. As cities grow, there is less space and tolerance for overhead power lines. Underground cables are preferred in urban and smart city projects due to they save space, reduce visual pollution, and are safer in crowded environments.

By End-User

Rising Safety Concerns Accelerate Demand for Underground Wires and Cables in Utility Sector

By end-user, the market is divided into residential, commercial, industrial, and utility.

Utility is expected to hold the dominant underground wires and cables market share. Underground cables are less exposed to hazards such as lightning, storms, falling trees, or accidental contact. This makes them safer for utility use, especially in densely populated or disaster-prone regions.

UNDERGROUND WIRES AND CABLES MARKET REGIONAL OUTLOOK

The market has been analyzed over five primary regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Underground Wires and Cables Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe is the dominated the market with a valuation of USD 17.84 billion in 2025 and USD 19.33 billion in 2026.region in the global underground wires and cables market, owing to Europe’s swift expansion in renewable energy initiatives and advancements in electric power, such as offshore wind farms and solar energy, which greatly increases the need for underground high-voltage cables necessary for effective, long-distance transmission with minimal losses. The EU Green Deal and objectives for carbon neutrality by 2050 propel investments in environmentally friendly, robust underground cables. Additionally, authorities require underground installations for safety, environmental, and urban planning considerations.

North America

The increasing use of renewable energy sources, including wind and solar, necessitates significant transmission infrastructure to link generation locations to the grid. Underground cables play a crucial role in the safe and efficient delivery of power from frequently isolated or environmentally delicate renewable projects, including offshore wind farms and large solar installations.

The objective of the Biden administration to attain 100% carbon-free electricity by 2035 is to speed up investments in renewable energy infrastructure, raising the need for underground cables.

In the U.S., underground wires and cables are widely adopted as they are high-voltage cables that reduce the accidental risk linked with electrocution, downed power lines, wildfires caused by ignited sparking lines, and other incidents. Thus, a rise in energy demand in the commercial, industrial, and residential sectors for long-distance power transmission, communication networks, and others drives the market growth.

Asia Pacific

Asia Pacific is the fastest-growing region in the market due to the rapid urban development, and the demand for attractive streetscapes is prompting utility companies to substitute overhead lines with underground cables, particularly in crowded urban locations where space and appearance are essential. Underground cables are more resistant to weather-related interruptions and provide increased reliability, establishing them as a favored option for upgrading outdated electrical infrastructure and improving grid resilience.

Latin America

Substantial investments in power distribution, industrial parks, smart city initiatives, and urban development are boosting the demand for underground cables, which provide advantages in reliability and aesthetics compared to overhead lines. Brazil, the biggest market in the area, is increasing its renewable energy capacity (solar, wind) and updating its grid, driving the requirement for specialized underground power cables. Rapid establishment of 5G networks and data centers in Brazil, Mexico, and various other nations is fueling the need for fiber optic and telecommunications cables, with many placed undergrounds for safety and efficiency.

Middle East & Africa

The deployment of 5G networks and the growth of fiber optic infrastructure are driving the need for underground cables that facilitate high-speed data transfer and network dependability. Enhancements to transmission and distribution networks, such as smart grids, necessitate significant underground cabling to boost efficiency and minimize maintenance. Saudi Arabia tops the market in revenue due to its vast infrastructure development, renewable energy initiatives, and government-driven diversification strategies.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Increasing Investments in Power Transmission and Distribution Systems by Leading Suppliers to Boost Market Revenue

Furukawa Electric Co., Ltd.’s underground wires and cables division is expanding mainly due to the high demand for extra-high voltage underground power cables in Japan and increasing renewable energy initiatives, especially submarine and underground cables for offshore wind energy. In March 2022, Furukawa Electric Co., Ltd. and S. L. Development Construction Corporation obtained a submarine power transmission project in the Philippines worth around USD 35.7 million.

List of Key Underground Wires and Cables Companies Profiled

- Furukawa Electric Co., Ltd. (Japan)

- Prysmian Group (U.S.)

- Sumitomo Electric Industries, Ltd. (Japan)

- Ducab (Dubai)

- ABB Group (Switzerland)

- Nexans (France)

- LS Cable and Systems (South Korea)

- Elsewedy Electric (Egypt)

- NKT Cables (Denmark)

- TFKable (Poland)

- Zhenglan Cable (China)

- Dow Inc. (U.S.)

- Finolex Cables (India)

- Paraflex Wires and Cables (India)

- Havells (India)

KEY INDUSTRY DEVELOPMENTS

- In November 2024, RTE engaged five suppliers, Prysmian, Nexans, NKT-SolidAl, and Hellenic Cables, to ensure the provision of underground power cables for its projects through 2028. Valued at USD 1.16 billion, this agreement includes the supply and installation of approximately 5,200 kilometers of underground cables for voltage levels between 90,000 and 400,000 volts.

- In June 2024, Sumitomo Electric declared the purchase of a majority stake in Südkabel, a well-known German manufacturer of high-voltage cables, and the increase of its production abilities in Mannheim, Germany, to domestically produce the highest quality 525 kV HVDC cables to aid the German government's net-zero goals.

- In April 2024, Hellenic Cables Americas, the American branch of Belgian Cenergy Holdings, received support from the U. S. Department of Energy for its upcoming cable manufacturing plant, which will be located in Baltimore, Maryland. The facility will be valued at around USD 300 million, pending a final investment decision (FID).

- In January 2024, the U.S. Department of Energy (DOE) granted USD 34 million for 12 initiatives throughout 11 states to enhance and update America's old power grid by creating cost-efficient, high-speed, and secure undergrounding technologies.

- In June 2023, Ducab Group entered into a Memorandum of Understanding with Baker Hughes to develop and produce power cables for electrical submersible pumps. As part of the ‘Make it in the Emirates’ initiative, the Memorandum of Understanding also carries the possibility of a future agreement concerning Ducab’s role in producing pumps for Baker Hughes in UAE.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service processes, competitive landscape, and leading sources of underground wires and cables. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2021-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.04% from 2021 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 36.24 billion in 2025.

In 2025, the Europe market value stood at USD 17.84 billion.

The market is expected to exhibit a CAGR of 7.04% during the forecast period of 2026-2034.

The utility segment led the market by end user.

Rapid industrialization and infrastructure development to drive market growth

Some of the top major players in the market are Furukawa Electric Co., Ltd, Prysmian Group, and Nexans.

Europe holds the largest share of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us