Unsaturated Fatty Acid Market Size, Share & Industry Analysis, By Type (Polyunsaturated Fatty Acids (PUFA) and Monounsaturated Fatty Acids (MUFA)), By Source (Plant-based and Animal-based), By Application (Food & Beverages, Pharmaceuticals, Cosmetics and Personal Care, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

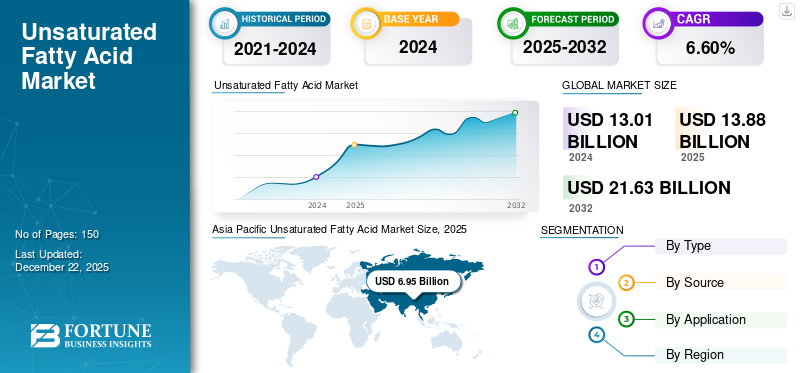

The global unsaturated fatty acid market size was valued at USD 13.88 billion in 2025. The market is projected to grow from USD 14.81 billion in 2026 to USD 24.56 billion by 2034, exhibiting a CAGR of 6.60% during the forecast period. Asia Pacific dominated the unsaturated fatty acid market with a market share of 50% in 2025.

Unsaturated fatty acids are extracted primarily from plant-based oils (like olive, sunflower, and soybean) and animal-based sources (such as fish oils). The global market is witnessing significant growth opportunities driven by various applications like food & beverages, pharmaceutical, and chemical sectors. Their inclusion in functional foods, dietary supplement, pharmaceuticals, and personal care products has surged, driven by increasing consumer awareness of heart health, inflammation reduction, and skin nourishment. Companies leverage technological advancements in extraction and purification to meet demand for high-purity fatty acids. Rising demand for energy storage, biodegradable polymers, and other emerging green sectors is driving the market growth.

The main players working in the market include PMC Biogenix, Inc., CREMER OLEO GmbH & Co. KG, Emery Oleochemicals, BASF, and Cargill.

UNSATURATED FATTY ACID MARKET TRENDS

Rising Use of Fatty Acids in Functional Foods and Nutraceuticals

The growing demand for functional foods and nutraceuticals has boosted the use of unsaturated fatty acids in health-focused products. Omega-3 and Omega-6 fatty acids are now commonly added to fortified juices, protein bars, dairy alternatives, meal replacement shakes, and supplements because of their well-known benefits for heart, brain, and eye health. Likewise, monounsaturated fats such as oleic acid are used in products targeting cholesterol and metabolic support. Increased consumer focus on preventive health, driven by an aging society and the rise in chronic diseases, is encouraging brands to develop omega-rich products.

MARKET DYNAMICS

MARKET DRIVERS

Growing Use of Fatty Acids in Foods and Fortified Products are Supporting Market Growth

The production of functional foods and fortified consumables has created new growth avenues for unsaturated fatty acids. These compounds are now widely added to dairy alternatives, breakfast cereals, juices, protein bars, and infant formulas to enhance their nutritional value. With consumers seeking convenient ways to improve their health, the addition of omega-3 and omega-6 fatty acids into everyday food products has become mainstream. Additionally, rising interest in immunity-boosting and brain-enhancing nutrition is further strengthening this trend. Food manufacturers are also leveraging health claims and clean-label, positioning to market fatty acid-included products.

MARKET RESTRAINTS

Oxidation and Stability Issues Could Restrain the Market Growth

Unsaturated fatty acids easily react with oxygen because of the double bonds in their structure, which makes them unstable. This instability causes them to spoil quickly, develop bad smells, and lose their nutritional value. These issues make it hard for companies to use them in foods, medicines, or cosmetics. To protect them from breaking down, manufacturers need to use antioxidants, special packaging, or advanced protective methods. However, these solutions increase the cost and make production more complicated. As a result, this is a major challenge that slows down the unsaturated fatty acid market growth.

MARKET OPPORTUNITIES

Expansion of the Vegan and Plant-Based Food Industry Poses a Strong Growth Opportunity

The rapid rise in veganism and plant-based eating habits has created an expansive opportunity for plant-derived unsaturated fatty acids. With growing concerns about animal welfare, climate change, and personal health, consumers are increasingly shifting away from animal-based fats in favor of healthier, sustainable alternatives. Oils extracted from flaxseed, canola, sunflower, soybean, and algae are rich in omega-3, omega-6, and omega-9 fatty acids, making them ideal for incorporation into plant-based dairy, meat analogues, and vegan supplements. Moreover, plant-based formulations are more acceptable across diverse dietary preferences.

According to the Observatory of Economic Complexity (OEC), in 2023, the global trade for veg fats was USD 2.93 billion. Mexico and Spain hold the largest share in the export, with 10.5% and 8.95% of the share respectively.

MARKET CHALLENGE

Supply Chain Disruptions and Raw Material Volatility are Affecting Market Stability

The market is highly dependent on the availability and consistency of raw materials such as fish oil, algae, and plant-based oils like soybean, sunflower, flaxseed, and canola. Any disruption in the supply chain due to climate change, geopolitical tensions, regulatory shifts, or crop failures can significantly impact production capacity and pricing. Furthermore, transportation challenges and rising fuel costs affect the logistics and cold-chain requirements essential for maintaining product integrity during distribution.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Growing Adoption of Polyunsaturated Fatty Acids (PUFA) in Various Applications is Driving the Segment Growth

Based on type, the market is classified into Polyunsaturated Fatty Acids (PUFA) and Monounsaturated Fatty Acids (MUFA).

The polyunsaturated fatty acids segment holds the largest unsaturated fatty acid market share, as they include omega-3 and omega-6 fatty acids, which play crucial roles in cardiovascular health, brain development, and inflammatory regulation. PUFAs are essential fatty acids containing more than one double bond in their chemical structure, commonly found in fish oils, flaxseed, walnuts, and sunflower oil. Rising awareness about lifestyle-related disorders and aging-related cognitive decline is significantly boosting demand for PUFA-rich formulations.

Monounsaturated Fatty Acids (MUFAs) are considered by a single double bond in their fatty acid chain and are primarily sourced from olive oil, canola oil, avocados, and nuts. Recognized for their ability to improve heart health by reducing bad cholesterol levels (LDL) while maintaining good cholesterol, MUFAs have found a strong foothold in the food and beverage sector. Their incorporation in functional foods, dietary oils, and wellness snacks is on the rise due to increasing health consciousness.

By Source

Growing Use of Plant-based Sources in Fatty Acids Products is Fueling the Segment Growth

Based on the source, the market is classified into plant-based and animal-based.

Plant-based sources hold the largest share in the unsaturated fatty acids market, driven by the growing global demand for sustainable, vegan, and allergen-free nutritional options. These sources include oils extracted from flaxseed, sunflower, canola, soybean, olive, chia seeds, and avocados, which are rich in both monounsaturated and polyunsaturated fats. They are widely utilized in dietary supplements and functional foods, vegan cosmetics, and plant-derived pharmaceutical formulations.

Animal-based sources primarily include fish oils (such as cod liver oil, mackerel oil, and salmon oil) and fat extracts from dairy, meat, and eggs. Rich in omega-3 fatty acids like EPA and DHA, these sources are highly valued in the pharmaceutical and nutraceutical sectors for their proven cardiovascular and neurological benefits. Fish oil-based dietary supplements dominate global shelves, especially in North America and the Asia Pacific, due to rising awareness of heart health and cognitive support.

By Application

Food & Beverages Holds the Leading Position Due to Rising Demand for Functional Foods

Based on the applications, the market is classified into food & beverages, pharmaceuticals, cosmetics and personal care, and others.

The food & beverages segment holds the largest share due to the rising demand for functional foods that support cardiovascular health, weight management, and overall wellness. The fatty acids, especially omega-3 and omega-6, are incorporated into a wide range of products, including edible oils, dairy alternatives, fortified beverages, spreads, bakery goods, and snack bars. As consumers become more label-conscious, clean-label and plant-based fatty acid-enriched products are gaining traction.

The pharmaceutical application is steadily expanding, with a particular focus on cardiovascular, neurological, inflammatory, and metabolic disorders. Omega-3 fatty acids, notably EPA and DHA derived from fish oils or microalgae, are extensively used in prescription drugs, over-the-counter supplements, and clinical nutrition products. Pharmaceutical companies are investing in research and development to create purified formulations with enhanced bioavailability and minimal side effects.

In the cosmetics and personal care segment, these acids are increasingly valued for their moisturizing, anti-aging, and anti-inflammatory properties. Commonly used in creams, serums, lotions, shampoos, and conditioners, these fatty acids help restore the skin barrier, reduce transdermal water loss, and improve elasticity. With consumer demand shifting toward natural and sustainable ingredients, cosmetic companies are increasingly favoring plant-based fatty acids over synthetic alternatives.

Unsaturated Fatty Acid Market Regional Outlook

By region, the market is categorized into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Unsaturated Fatty Acid Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region holds the largest share in the industry, propelled by rising health consciousness, increasing disposable incomes, and urbanization. Countries such as China, India, Japan, and South Korea are experiencing a significant surge in demand for PUFA- and MUFA-rich foods, beverages, supplements, and personal care products. The functional food sector is rapidly expanding, supported by lifestyle changes and a growing prevalence of cardiovascular conditions. Japan continues to lead in omega-3 innovation, while China's aging population and growing middle class are driving mass adoption of fortified products.

North America

In North America, the industry is witnessing significant growth due to rising awareness of heart health, aging-related nutritional needs, and lifestyle diseases such as obesity and diabetes. The U.S. leads the region with significant demand for omega-3 and omega-6 fatty acids used in dietary supplements, functional foods, and pharmaceuticals. Additionally, the growing use of fatty acids in cosmetics, especially products focused on anti-aging and skin health, further contributes to market expansion.

Europe

Europe’s market is shaped by stringent food safety regulations, increasing demand for natural ingredients, and a strong clean-label movement. Countries like Germany, France, and U.K. are leading consumers of plant-based and marine-derived fatty acids, particularly in functional foods and nutraceuticals. Health awareness campaigns emphasizing omega-3 and omega-6 fatty acids’ cardiovascular and cognitive benefits are supporting steady demand.

Latin America

The market in Latin America is steadily gaining momentum, driven by a growing awareness of health and wellness, especially related to cardiovascular and metabolic disorders. Countries such as Brazil, Mexico, and Argentina are experiencing increased demand and consumption of omega-enriched supplements and fortified foods as consumer education improves. Additionally, the pharmaceutical and cosmetics sectors are expanding their use of fatty acids in dermatological and therapeutic formulations.

Middle East & Africa

In the Middle East & Africa region, the industry is at an emerging stage but showing promising growth potential. Rising urbanization, increasing investment in healthcare infrastructure, and dietary shifts toward heart-healthy foods are key growth drivers. Gulf countries such as the UAE and Saudi Arabia are witnessing higher demand for fortified foods and omega-3 supplements among the urban population.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Leading to their Dominating Positions

The market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key market players include PMC Biogenix, Inc., CREMER OLEO GmbH & Co. KG, Emery Oleochemicals, BASF, and Cargill, among others. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY COMPANIES PROFILED

- Twin Rivers Technologies, Inc. (U.S.)

- PMC Biogenix, Inc. (U.S.)

- CREMER OLEO GmbH & Co. KG (Germany)

- Emery Oleochemicals (U.S.)

- Cailà & Parés (Spain)

- BASF (Germany)

- Lýsi hf (Iceland)

- Cargill (U.S.)

- Otto Chemie Pvt. Ltd. (India)

- IOI Oleo GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS

- November 2024: BASF partnered with Acies Bio to drive sustainable production of “Personal and Home Care Ingredients". This partnership focuses on biotechnology, specifically developing fermentation technology from methanol to produce fatty alcohols, essential building blocks for various ingredients in the home and personal care markets, including surfactants.

- June 2024: PMC Biogenix, a global manufacturer of specialty chemicals, announced a major expansion and restructuring to meet growing market demand. The company is investing in its Memphis, Tennessee, facility to increase capacity for high-value products like metal stearates, fatty amides, and specialty esters.

- April 2023: KLK OLEO announced a new expansion site in West Port, Malaysia, represented by the groundbreaking ceremony, which marks a strategic step for the company as a leading global oleochemical producer. The expansion focuses on increasing the production capacity for fatty alcohols and fatty acids fractions, allowing KLK OLEO to better cater to its worldwide customer base.

- April 2023: KLK OLEO, the manufacturing division of Malaysia's Kuala Lumpur Kepong Berhad (KLK), completed its acquisition of a controlling stake in Temix Oleo, an Italy-based oleochemical company. This strategic acquisition allows KLK OLEO to expand its product offerings in the oleochemical market.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.60% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Polyunsaturated Fatty Acids (PUFA) · Monounsaturated Fatty Acids (MUFA) |

|

By Source · Plant-based · Animal-based |

|

|

By Application · Food & Beverages · Pharmaceuticals · Cosmetics and Personal Care · Others |

|

|

By Geography · North America (By Type, Source, Application, and Country) o U.S. (By Application) o Canada (By Application) · Europe (By Type, Source, Application, and Country) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Rest of Europe (By Application) · Asia Pacific (By Type, Source, Application, and Country) o China (By Application) o Japan (By Application) o India (By Application) o South Korea (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Type, Source, Application, and Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Type, Source, Application, and Country) o GCC (By Application) o South Africa (By Application) · Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 13.88 billion in 2025 and is projected to reach USD 24.56 billion by 2034.

What was the value of the Unsaturated Fatty Acid market in Asia Pacific in 2025?

The market is expected to exhibit a CAGR of 6.60% during the forecast period of 2026-2034.

The polyunsaturated fatty acids segment led the market by type in 2025.

The increasing use of fatty acids in healthy and fortified foods, helping the market to grow.

PMC Biogenix, Inc., CREMER OLEO GmbH & Co. KG, Emery Oleochemicals, BASF, and Cargill are some of the leading players in the market.

Asia Pacific dominated the market in 2025.

The growing awareness of health benefits and increasing use of fatty acids in functional foods, supplements, and cosmetics is likely to drive the adoption of the product in the forthcoming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us