Vacuum Pressure Impregnated Transformer Market Size, Share & Industry Analysis, By Phase (Single-Phase and Three-Phase), By Installation (Outdoor and Indoor), By Rating (less than 5 MVA, 5 MVA to 30 MVA, and More than 30 MVA), By Application (Industries, Inner-City Substations, Indoor and Underground Substations, Renewable Generation, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

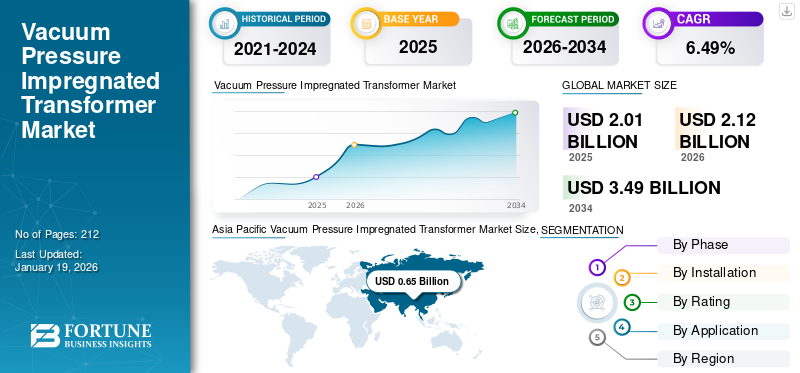

The global vacuum pressure impregnated transformer market was valued at USD 2.01 billion in 2025. It is projected to be worth USD 2.12 billion in 2026 and reach USD 3.49 billion by 2034, exhibiting a CAGR of 6.49% during the forecast period.

A vacuum pressure impregnated transformer is a dry-type transformer assembled in the factory using a unique vacuum and pressure resin infusion process. The windings, after being oven-dried, are infused with resin, which bonds a heavy insulating layer to them. This results in superior mechanical strength, thermal stability, and resistance to moisture and dust.

Industrialization, urbanization, EV charging, and digital infrastructure (such as data centers) are increasing the demand for electricity. VPI transformers are fire-safe, moisture-resistant, and oil-free, making them compatible for densely populated urban areas and critical facilities (hospitals, airports, metros). The vacuum pressure impregnation market is growing due to increasing industrial demand, new technologies, sustainability trends, wider application areas, and regional industrial growth. This sets the strong foundation for market development in the forecast period. Technological advancements in materials, thermal design, digital capabilities, and eco-friendly innovations are further strengthening the value of VPI transformers, driving adoption across industrial, utility, and renewable energy sectors.

ABB, CG Power & Eaton are the leading providers in the VPI transformer market. With established footprints in North America, Europe, Asia Pacific, and the Middle East, these companies participate in large infrastructure and industrial projects. The market share of VPI transformers is rising as they provide safe, eco-friendly, and reliable performance while supporting growing electricity demand, renewable energy expansion, and modern infrastructure development.

MARKET DYNAMICS

Market DRIVERS

Grid Expansion and Modernization to Drive Market Growth

Numerous grid assets, particularly in North America, Europe, and the Asia Pacific region, are decades old. Modernization requires transformers that are efficient, safe, and low-maintenance, with VPI transformers emerging as the preferred choice. Smart grids need transformers that deliver excellent reliability, low losses, and compatibility with digital monitoring. VPI transformers, with their long service life and durable insulation, meet these requirements effectively.

In November 2023, Hitachi Energy introduced an innovative solution to safeguard distribution transformers from transient voltage: Transformers with Transient Voltage Protection (TVP) Technology. The company also opened its newest transformer factory in Bac Ninh, Vietnam, during a major industry event, using the occasion to showcase this innovative technology.

MARKET RESTRAINTS

High Manufacturing and Installation Costs to Restrain Market Growth

The uptake of vacuum pressure impregnated (VPI) transforms is limited by their relatively high production and installation costs. The VPI production technique requires specialized equipment such as vacuum chambers, resin impregnation systems, and controlled curing facilities. The specialized setup makes these transformers more expensive to manufacture than conventional dry-type or oil-immersed transformers. In addition, the large design and heavier overall product weight of VPI transformers increase complexity and cost for handling, transportation, and installation. These higher initial costs limit deployment in cost-sensitive projects, especially in developing regions, and can constrain overall vacuum pressure impregnated transformer market growth.

MARKET OPPORTUNITIES

Increasing Demand for Safer and Eco-Friendly Transformer Solutions Creates an Opportunity for Market Growth

The rising focus on safety, energy efficiency, and environmental sustainability is opening many doors for the vacuum pressure impregnated (VPI) transformer market. Unlike oil-immersed transformers, VPI transformers are non-combustible, environmentally safe, and require minimal maintenance, making them highly desirable for indoor facilities and crowded regions. Urbanization, the extension of metro and rail systems, and the development of smart infrastructure are driving demand for compact, safe transformer design. These factors are contributing to the growing market opportunities for vacuum pressure impregnated transformers.

Global momentum toward reducing carbon emissions and enhancing grid reliability is further accelerating the adoption of VPI transformer units across commercial buildings, renewable energy, and industrial use. This trend is expected to create new growth opportunities for OEMs, both in developed regions and in rapidly urbanization economies. In August 2025, Eaton announced the completion of its acquisition of Resilient Power Systems, a developer and manufacturer of energy solutions that include solid-state transformer-based technology, further strengthening its position in the advanced transformer market.

Vacuum Pressure Impregnated Transformer Market Trends

Increasing Adoption in Renewable Energy Projects to Drive Industry Growth

The accelerating transition to renewable energy is likely to create strong growth avenues for the vacuum pressure impregnated (VPI) transformer market. VPI transformers are increasingly being utilized in solar farms, wind projects, and other renewable projects due to their fire safety, smaller footprint, and ability to operate reliably in sensitive environmental locations.

Their oil-free design makes them particularly attractive for renewable projects, where environmental standards and reliability are critical. As countries expand renewable power capacity to achieve decarbonization goals, demand for medium voltage and distribution transformers, including VPIs, is expected to increase substantially, driving market growth.

In February 2023, Hitachi Energy, a world technology leader advancing a sustainable energy future, launched the next-generation TXpert Hub as part of its digitalization ecosystem for transformers. The TXpert collects, stores, and analyzes information from digital sensors embedded in transformers, enabling advanced monitoring and performance optimization.

Download Free sample to learn more about this report.

SEGMENTATION Analysis

By Phase

Rising Demand for Safe Power Distribution in Residential Sectors Drives Single-Phase Segment Growth

The vacuum pressure impregnated transformer market by phase covers single-phase and three-phase. The Single-phase segment captures the largest vacuum pressure impregnated transformer market share due to its widespread use in residential, commercial, and light industrial applications. Single-phase VPI transformers are economical, compact, easier to install than three-phase versions, and are well-suited for low- and medium-voltage electricity distribution.

The three-phase segment is the second-largest segment in the market and is steadily emerging, driven by the broader adoption across industrial, commercial, and utility applications. Furthermore, three-phase VPI transformers are typically used for medium- to large-capacity power distribution, making them essential for high-demand environments.

By Installation

Outdoor Segment Dominates due to its Widespread Utilization in Power Distribution Systems

The market is segmented by installation into outdoor and indoor. Outdoor is the dominating segment in the market due to its widespread utilization in power distribution systems, renewable energy developments, and manufacturing facilities. Outdoor VPI transformers are designed to handle environmental stresses and temperature variations, and natural elements such as dust, sand, and humidity, making them very reliable in medium-voltage applications. With their superior insulation and strong fire safety characteristics, they are the preferred choice in utilities and industries that require safe and reliable power distribution in outdoor environments.

Indoor is the second dominating segment in the market and is gaining momentum as demand grows for compact, fireproof, low-maintenance power distribution systems. The indoor vacuum pressure impregnated transformers sector is increasingly being adopted in urban infrastructure considerations, commercial buildings, and residential apartments, where safety and space efficiency are critical.

By Rating

Growing Demand From Large-Scale Industrial Facilities Drives 30 MVA Segment Growth

The market is segmented by rating into less than 5 MVA, 5 MVA to 30 MVA, and more than 30 MVA. The more than 30 MVA segment dominates the vacuum pressure impregnated (VPI) transformer market, as many large industrial facilities, utility substations, and renewable energy projects require high-capacity transformers that require dependable and safe power distribution.

5 MVA to 30 MVA is the second dominating segment in the market, with widespread applications in industrial plants, commercial buildings, renewable energy projects, and medium-voltage distribution networks.

By Application

Growing Demand for Reliable and Efficient Power Distribution in Manufacturing Plants Boosts the Industries Segment Growth

The market is segmented by application into industries, inner-city substations, indoor and underground substations, renewable generation, and others. The industries segment is the dominating segment in the market, due to increasing demand for reliable, safe, and efficient power distribution in manufacturing facilities, refineries, data centers, and other energy-intensive facilities.

Inner-city substations are the second-dominating segment in the market. The inner-city substations segment is expanding due to rising demand for compact, fire-safe, low-noise transformers that can provide reliable power distribution in densely populated urban environments.

VACUUM PRESSURE IMPREGNATED TRANSFORMER MARKET REGIONAL OUTLOOK

The market has been analyzed geographically in North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

North America

Asia Pacific Vacuum Pressure Impregnated Transformer Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The North America vacuum pressure impregnated transformer market is rapidly expanding as a result of ongoing grid modernization efforts, increasing renewable energy projects, and growing demand for safe, environmentally friendly, low-maintenance transformers in urban infrastructure and industrial projects.

U.S.

The U.S. vacuum pressure impregnated transformer market is witnessing strong growth, driven by investments in grid reliability, expansion of renewable energy, and demand for fire-safe, eco-friendly transformers in commercial and industrial applications.

Europe

In Europe, growth is fueled by the rising adoption of renewable energy, stricter environmental and fire safety regulations, and the growing demand for easy-to-maintain, environmentally friendly transformers for urban infrastructure and industrial facilities.

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 0.65 billion in 2025 and USD 0.69 billion in 2026. Asia Pacific is the dominating and fastest-growing region in the market. Growth is being driven by rapid urbanization, accelerating industrialization, increasing renewable energy installations, and major government initiatives focused on modernizing power distribution networks with safe, reliable, and eco-friendly transformer solutions.

Latin America

The growth of the vacuum pressure impregnated (VPI) transformers market in Latin America is primarily attributed to higher investments in power infrastructure, increased uptake of renewable energy projects, and increasing need for safe, efficient, low-maintenance transformers in urban and industrial markets.

Middle East and Africa

The MEA vacuum pressure impregnated (VPI) transformer market is growing steadily, supported by increasing investments in power infrastructure, increased industrial and economic activity, and renewable energy development. Governments’ initiatives to diversify energy generation and modernize electricity networks are also driving demand for safe, reliable, and environmentally safe transformer solutions.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Vendors are Actively Involved in Opening New Manufacturing Plants to Expand Production Capacity

Vendors are increasingly concentrating on expanding their manufacturing footprint by developing new sites to accommodate the accelerating demand for vacuum pressure impregnated transformers.

- In May 2022, Hitachi Energy India Ltd opened its new transformer components plant in Vadodara, Gujarat. This plant would manufacture dry bushings using the most reliable technology available, known as 'Resin Impregnated Paper'. This will be the first manufacturing facility in India to produce resin-impregnated paper bushings up to the 400kV voltage level. This dry technology enhances the thermal, electrical, and mechanical performance of transformer bushings, making them more resilient and reliable, critical attributes for transformers used in power grids.

List of Key Vacuum Pressure Impregnated Transformer Companies Profiled in the Report:

- ABB (Switzerland)

- Bharat Heavy Electricals Limited (India)

- CG Power (India)

- Eaton (Ireland)

- Fuji Electric (Japan)

- General Electric (U.S.)

- Hitachi Energy (Switzerland)

- Raychem RPG (India)

- Schneider Electric (France)

- Siemens Energy (Germany)

- TMC Transformers (Italy)

- Toshiba Energy Systems (Japan)

- WEG (Brazil)

- URJA Techniques (India)

- Magneto Electric (Canada)

KEY INDUSTRY DEVELOPMENTS

- In July 2025, Hitachi Energy, a global leader in electrification, announced the supply of 69 kV HiDry dry-type transformers for an offshore wind power project by China Huaneng Group at the L Site in northern Shandong Peninsula, eastern China. This new product provides environmental benefits, supports stable grid integration, and ensures a reliable power supply for the offshore wind farm, assisting customers in expanding offshore wind power successfully.

- In June 2025, CG Power and Industrial Solutions Ltd received an order for the supply and servicing of the 765kV Transformer package 7TR-12 Bulk from the Power Grid Corporation of India Ltd.

- In May 2023, Huntsman's Advanced Materials team teamed up with TBEA Group, a top player in the manufacturing of power transmission and distribution equipment, known for producing USD 260 million kVA of transformers annually, making it the largest in the world. Together, they developed an outdoor dry-type transformer (DDT) with the highest voltage and capacity globally.

- In April 2023, Eaton acquired a significant stake in the Chinese power distribution company Jiangsu Ryan Electrical. The US power management company announced that it has completed the acquisition of a 49% stake in Jiangsu Ryan Electrical Co. Ltd. The company manufactures power distribution and sub-transmission transformers in China.

- In April 2022, Siemens Energy introduced a new dry-type single-phase transformer for pole applications, designed to meet the technological needs of the American grid. The cast-resin distribution transformer offers a dependable and eco-friendly alternative to oil-filled transformers.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product type, and competitive landscape. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.49% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Phase · Single-Phase · Three-Phase |

|

By Installation · Outdoor · Indoor |

|

|

By Rating · Less than 5 MVA · 5 MVA to 30 MVA · More than 30 MVA |

|

|

By Application · Industries · Inner-City Substations · Indoor and Underground Substations · Renewable Generation · Others |

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 2.01 billion in 2025.

In 2025, the Asia Pacific market value stood at USD 0.65 billion.

The market is expected to exhibit a CAGR of 6.49% during the forecast period (2026-2034).

The industries segment leads the market by application.

Grid expansion and modernization a key factors driving market growth.

Some of the top major players in the market are ABB, CG Power, and Eaton.

Asia Pacific dominates the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us