Vehicle to Vehicle Communication Market Size, Share & Industry Analysis, By Vehicle Type (Hatchback/Sedan, SUVs, LCV, and HCV), By Technology (Dedicated Short-Range Communication (DSRC) and Cellular Communication), By Application (Traffic Safety, Traffic Efficiency, Infotainment and Payments, and Other Applications), By Sales Channel (OEM and Aftermarket), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

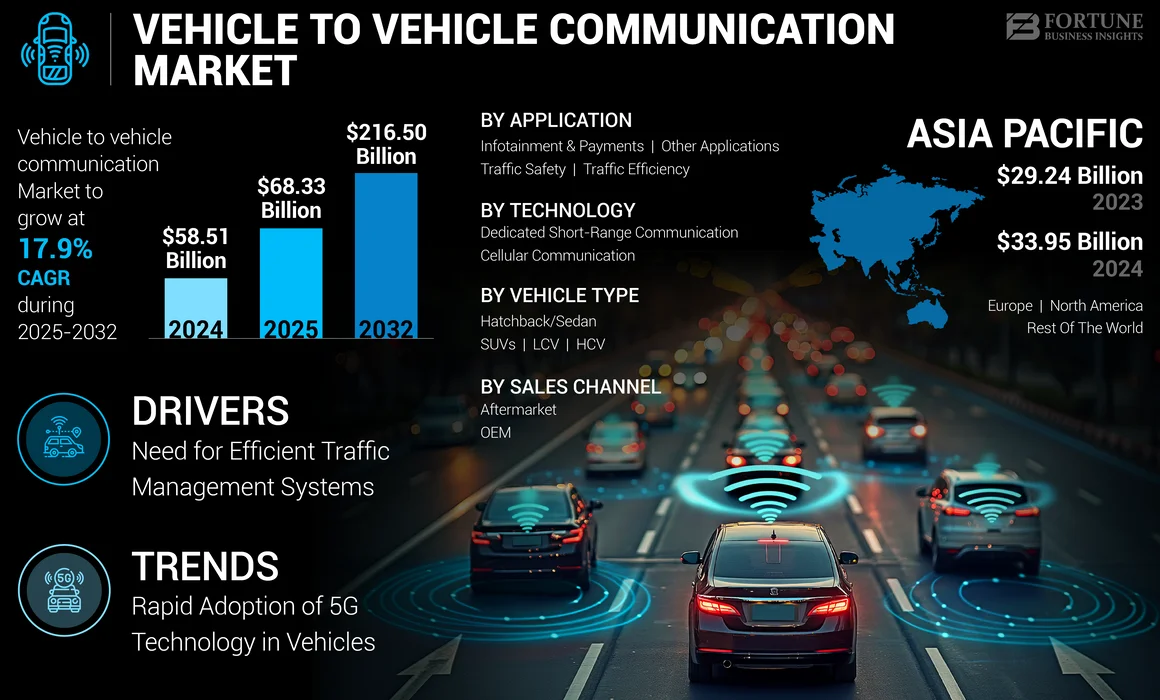

The global vehicle to vehicle communication market size was valued at USD 58.51 billion in 2024 and is projected to grow from USD 68.33 billion in 2025 to USD 216.50 billion by 2032, exhibiting a CAGR of 17.9% during the forecast period. North America dominated the vehicle to vehicle communication market with a market share of 58.02% in 2024.

Vehicle-to-vehicle (V2V) communication is an automobile technology that enables vehicles to exchange real-time information about speed, location, and direction with other nearby cars. This wireless communication system operates within a range of 300 meters, allowing vehicles to "see around corners" and detect potential hazards beyond the driver's line of sight. V2V technology aims to enhance road safety traffic efficiency by providing drivers with caution about various driving scenarios, such as blind intersections, sudden braking in heavy traffic, and approaching emergency vehicles.

Vehicle-to-Vehicle (V2V) Communication Market Overview

Market Size & Share:

- 2024 Value: USD 58.51 billion

- 2025 Estimate: USD 68.33 billion

- 2032 Forecast: USD 216.50 billion

- CAGR: 17.9% (2025–2032)

- Regional Leader: Asia Pacific- strong growth in Japan, China, and India

- Top Segment: Hatchbacks/Sedans- driven by high urban adoption and OEM integration

- Leading Tech: DSRC- short-range reliability; 5G Cellular- faster, broader applications

Key Trends and Drivers:

- 5G deployment: Enhances real-time data exchange with low latency and wider range.

- Regulatory mandates: U.S. DOT and EU C-ITS frameworks promoting mandatory V2V adoption.

- Road safety focus: Growing demand for collision avoidance, emergency alerts, and blind-spot detection.

- Tech integration: Automakers embedding V2V modules into production lines (e.g., GM, Toyota, BMW).

- Autonomous mobility: V2V enabling real-time coordination between driverless vehicles.

- Urban mobility solutions: Integration with smart traffic systems and AI-driven traffic flow optimization.

The global market growth is experiencing significant rise, driven by increasing concerns about road safety and the need for efficient traffic management. The market is benefiting from advancements in wireless communication technologies, particularly the deployment of 5G networks, which offer lower latency and longer range for V2V applications. Government regulations and initiatives promoting connected vehicle technologies are also contributing to the market expansion. The industry is witnessing a shift towards cellular-based V2V solutions, with major automakers announcing plans to integrate these systems into their vehicle lineups. As consumer awareness and acceptance of V2V technology increases, the market is expected to see continued expansion.

The COVID-19 pandemic has had a mixed impact on the vehicle-to-vehicle communication market. Initially, the automotive industry experienced disruptions in supply chains and manufacturing processes, which slowed down the implementation of V2V technologies. However, the pandemic has also accelerated the adoption of digital technologies and increased focus on contactless solutions, which potentially benefited V2V communication systems in the long run. As governments and organizations emphasize the importance of smart and connected transportation systems for better crisis management, the demand for V2V technology sees a boost. The pandemic has also highlighted the need for resilient and adaptable transportation infrastructure, which could drive further investment in V2V and related technologies.

Vehicle to vehicle communication Market Trends

Rapid Adoption of 5G Technology in Vehicles is a Growing Trend in the Market

This advancement enhances data transmission speed and reduces latency, allowing vehicles to communicate more effectively and in real-time. Major automakers, such as Ford and General Motors, are actively developing V2V systems that leverage 5G for improved safety features and traffic management solutions. Additionally, government regulations are playing a crucial role in promoting V2V technology. For instance, the U.S. Department of Transportation has proposed mandates for V2V communication in new vehicles to improve road safety. Similarly, the European Union's cooperative intelligent transport systems (C-ITS) initiative aims to standardize V2V communications technology across member states. These trends reflect a broader movement towards smarter transportation systems that prioritize safety and efficiency.

- For example, DENSO launched MobiQ in April 2024, a system designed to optimize traffic flow by integrating with existing infrastructure like traffic signals. Such innovations highlight the growing recognition of V2X as a comprehensive solution for urban mobility challenges, contributing to safer and more efficient transportation systems.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Growing Need for Efficient Traffic Management Systems is Driving the Market Growth

One major driving factors for the global vehicle to vehicle (V2V) communication market growth is the increasing demand for efficient traffic management systems. V2V technology enables real-time data sharing between vehicles, helping to reduce traffic congestion and improve overall transportation efficiency. For example, law enforcement agencies can use V2V systems to reroute traffic, adjust speed limits, and optimize traffic light schedules based on live data streams from connected vehicles. Government regulations are also supporting this trend. The European Union’s Cooperative Intelligent Transport Systems (C-ITS) initiative promotes V2V adoption for better traffic flow and reduced congestion. In the U.S., the Department of Transportation has proposed mandates for V2V systems in new vehicles to enhance traffic management capabilities. Technological advancements, including dynamic spectrum sharing, blockchain-based fleet management, and AI-driven predictive analytics, further enhance V2V’s role in traffic optimization. These developments underscore the importance of V2V in creating smarter and more efficient transportation networks.

Market Restraints

Data Privacy and Cybersecurity Concerns Hampers the Market Growth

One crucial restraining factor for the global vehicle-to-vehicle (V2V) communication market is data privacy and cybersecurity concerns. As V2V systems rely on constant wireless communication to exchange sensitive data, such as vehicle speed, location, and direction, they are vulnerable to cyberattacks. Hackers could exploit these systems to manipulate traffic flow or compromise vehicle safety, raising serious concerns among consumers and manufacturers. Governments and organizations are addressing these challenges through regulations and technological advancements. For instance, the European Union has introduced the General Data Protection Regulation (GDPR), which mandates strict data security measures for connected vehicles. Similarly, the U.S. National Highway Traffic Safety Administration (NHTSA) emphasizes cybersecurity protocols in its guidelines for V2V systems.

Market Opportunity

Enhancing Road Safety and Enabling Autonomous Driving Through Real-Time Data Exchange Between Vehicles.

V2V systems allow cars to share speed, direction, and location data, reducing collisions and optimizing traffic flow. With road accidents claiming 1.3 million lives annually (WHO), governments are mandating V2V adoption to improve safety. For instance, the U.S. NHTSA proposed V2V communication mandates for new vehicles to prevent crashes, while the EU’s C-ITS Directive promotes interoperable V2X systems. Technological advancements are accelerating adoption, Qualcomm’s Snapdragon Auto 5G Modem-RF Gen 2 (2023) supports ultra-low latency communication, while BMW and Mercedes-Benz integrate V2V in models like the ID.4 and E-Class. Government regulations, such as China’s C-V2X trials and Japan’s ITS Connect, prioritize V2V deployment.

Segmentation Analysis

By Vehicle Type

Increasing Traffic Connections and Wide Use of Hatchbacks/Sedans in Urban Areas Contribute to the Segment’s Dominance

The global market is segmented into Hatchback/Sedan, SUVs, LCV (Light Commercial Vehicles), and HCV (Heavy Commercial Vehicles), by vehicle type.

Hatchbacks and sedans are increasingly integrating V2V systems for urban traffic safety and efficiency making it dominant segment. Automakers like Toyota and Honda have introduced V2V-enabled sedans to enhance collision avoidance in congested city environments. SUVs, are growing faster due to their popularity and higher adoption rates, are emerging as a key segment, with manufacturers such as Tesla incorporating advanced V2V features into electric SUVs like the Model X.

Light Commercial Vehicles (LCVs), including delivery vans, benefit from V2V technology for optimized fleet management and route planning, supported by telematics solutions. Heavy Commercial Vehicles (HCVs), such as trucks, are adopting V2V for enhanced safety during long-haul operations, with regulations like the EU’s C-ITS initiative mandating connected solutions for commercial fleets. Technological advancements include AI-driven traffic analytics and blockchain-based fleet management systems.

By Technology

Reliable Communication Functionality of Dedicated Short-Range Communication (DSRC) Led to the Segment’s Dominance

The market is segmented into Dedicated Short-Range Communication (DSRC) and cellular communication, based on the technology.

Dedicated Short-Range Communication (DSRC) remains a dominant foundational technology in V2V systems, offering reliable communication over short distances. For example, General Motors has integrated dedicated short range communication (DSRC) in Cadillac models in year 2021 to enable real-time warnings about road hazards.

Cellular communication is gaining traction due to 5G deployment, which supports longer-range communication and lower latency. Major automakers like BMW are leveraging 5G for connected vehicle platforms. Government initiatives, such as the U.S. Department of Transportation’s push for cellular-based V2X standards, further accelerate adoption. Emerging technologies include dynamic spectrum sharing and cross-device authentication frameworks, enhancing interoperability between DSRC and cellular systems.

By Application

Increasing Vehicular Conjunction Boosts the Traffic Safety Segment’s Dominance

Based on application, the market is segmented into traffic safety, traffic efficiency, infotainment and payments, and other applications.

Traffic safety remains the core application of V2V communication, with collision avoidance systems and emergency braking alerts now standard in vehicles like GM’s Cadillac CTS and Ford’s F-150, leveraging real-time data exchange to prevent accidents.

Traffic efficiency applications are gaining momentum through smart city initiatives, exemplified by Audi’s Traffic Light Information system, which uses V2V to optimize signal timing and reduce congestion.

Infotainment and payment integrations are expanding, as seen in Tesla’s Cybercab robotaxi prototype, which combines autonomous navigation with in-vehicle payment processing. Regulatory frameworks like Europe’s GDPR and UNECE WP.29 ensure secure data handling and interoperability, while blockchain-based frameworks (e.g., MOBI’s Vehicle Identity) enhance trust in fleet tracking and diagnostics.

By Sales Channel

Growing Focus on Embedding Different Technologies into Vehicles During Production Leads to OEM’s Dominance in the Market

Based on sales channel, the market is segmented into OEM and aftermarket.

The original equipment manufacturer (OEM) segment dominates the V2V market as automakers increasingly embed communication systems directly into vehicles during production. Companies like Ford have announced plans to make V2V technology standard across their lineup by 2026.

The aftermarket segment is growing due to retrofitting demand for older vehicles; startups specializing in plug-and-play V2V devices are driving innovation here. Government incentives for adopting connected technologies in fleets further support aftermarket growth. Technological developments include modular V2V devices compatible with various vehicle types and AI-enhanced installation tools for faster retrofitting processes. These segments highlight the diverse applications and technological advancements driving the global V2V market forward while addressing specific regulatory requirements across regions.

VEHICLE TO VEHICLE COMMUNICATION MARKET REGIONAL OUTLOOK

The global market is segmented into North America, Europe, Asia Pacific, and the Rest of the World, based on geography.

Asia Pacific

Asia Pacific Vehicle To Vehicle Communication Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Large Passenger Car Market and Increasing Adoption of Automation in Vehicle Manufacturing Drive the Asia Pacific Market Growth

Asia Pacific is dominating the vehicle to vehicle communication market share driven by rapid urbanization and government investments in smart transportation. Japan and South Korea are at the forefront, with automakers like Toyota and Hyundai deploying advanced V2V technologies in their vehicles. China is also making significant strides through its "Made in China 2025" initiative, which promotes connected vehicle ecosystems. Indian cities are exploring pilot programs for traffic management using V2V systems. The rollout of 5G networks across the region enhances communication reliability, while AI integration allows for adaptive traffic signal control. Regulatory frameworks like Japan’s ITS Connect ensure standardization across platforms.

Europe

Europe is witnessing rapid growth in the V2V market due to stringent safety regulations and government initiatives like the European Union’s Cooperative Intelligent Transport Systems (C-ITS) framework. This initiative mandates the integration of V2V systems to improve traffic efficiency and reduce accidents. Countries like Germany and France are leading in adoption, with automakers such as BMW and Volkswagen incorporating V2V capabilities into their vehicles. The European Commission’s USD 3.2 billion funding for connected mobility projects underscores the region's commitment to intelligent transportation systems. Key advancements include dynamic spectrum sharing for seamless communication and end-to-end encryption protocols to address cybersecurity concerns.

North America

North America emerged as a significant player in the V2V communication market, primarily driven by strong regulatory support and technological advancements. The U.S. Department of Transportation has proposed mandatory V2V implementation in all new vehicles, significantly boosting adoption. Automakers like General Motors and Ford are integrating V2V systems into their fleets, with Cadillac models already equipped with DSRC-based communication. Investments in 5G infrastructure further enhance the region’s V2V capabilities, enabling low-latency communication for real-time traffic management and safety applications. Additionally, smart city initiatives, such as those in New York City, incorporate V2V to reduce congestion and improve road safety. Technological developments include AI-powered predictive analytics and blockchain for secure data sharing between vehicles.

Rest of the World

Regions like Latin America, and Middle East & Africa are gradually adopting V2V technologies as part of broader efforts to modernize transportation infrastructure. Brazil is investing in telematics for fleet management, while South Africa is exploring connected vehicle solutions to improve road safety. Government-backed initiatives in Saudi Arabia aim to integrate V2V systems into smart city projects such as NEOM. These regions face challenges such as limited infrastructure and benefit from increasing awareness of connected technologies and partnerships with global automakers. Developments include modular V2V devices for retrofitting older vehicles and blockchain-enabled fleet tracking systems.

COMPETITIVE LANDSCAPE

Key Industry Players

GMs Pioneering Efforts in Integrating V2V Technology into its Vehicles Contribute to its Dominance in the Market

General Motors (GM) is recognized as a leading player in the global market due to its pioneering efforts in integrating V2V technology into its vehicles. GM introduced V2V communication in its Cadillac CTS sedan, which uses Dedicated Short-Range Communication (DSRC) and GPS systems to exchange data with other cars up to 1,000 feet away. This system provides real-time alerts for potential collisions, traffic conditions, and road hazards, showcasing GM's commitment to enhancing road safety and efficiency. GM’s early adoption of DSRC technology has positioned it as a market leader, supported by its investments in intelligent transportation systems and partnerships with tech firms for advanced connectivity solutions. GM’s focus on integrating V2V into mainstream vehicles demonstrates its strategic approach to making connected vehicle technology accessible to consumers.

Toyota Motor Corporation is another key player in the V2V market, leveraging innovative technologies to strengthen its position. Toyota introduced the "LQ" concept vehicle, which integrates advanced V2V communication features alongside automated driving and augmented reality systems. The company has also been actively involved in the development of cellular-based V2X technologies, aligning with global trends toward 5G-enabled communication systems. Toyota’s efforts are supported by government initiatives like Japan’s ITS Connect program, which standardizes V2V communication protocols across the country. Additionally, Toyota has invested in AI-driven traffic management and predictive analytics for safer and more efficient transportation networks. These advancements highlight Toyota’s leadership in combining V2V with broader connected car ecosystems.

LIST OF KEY VEHICLE TO VEHICLE COMMUNICATION COMPANIES PROFILED

- Qualcomm Technologies, Inc. (U.S.)

- Toyota Motor Corporation (Japan)

- Ford Motor Company (U.S.)

- General Motors (U.S.)

- NXP Semiconductors (Netherlands)

- Cohda Wireless (Australia)

- Autotalks (Israel)

- Harman International (U.S.)

- LG Electronics (South Korea)

- Huawei Technologies Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- In March 2025, The National Highway Traffic Safety Administration (NHTSA) proposed a rule requiring vehicle-to-vehicle (V2V) communication technology in new vehicles to enhance road safety. This initiative aims to reduce traffic accidents by enabling vehicles to share critical information about their speed, location, and direction. The proposal is part of the U.S. government's broader strategy to integrate advanced safety technologies, such as advanced driver assistance systems adas, into the automotive sector.

- In February 2025, Toyota announced the integration of advanced V2V communication systems in its upcoming models, enhancing safety features such as collision avoidance and traffic management. This initiative aligns with Japan's ITS Connect program, which aims to standardize V2V communication across the country.

- In January 2025, Jaguar Land Rover (JLR) and Tata Communications expanded their partnership to enhance the connected vehicle ecosystem. The collaboration aims to improve vehicle connectivity, infotainment, and data management capabilities. This expansion will enable JLR to offer advanced connected services to its customers, enhancing the overall driving experience. The partnership focuses on leveraging Tata Communications' expertise in network connectivity and digital transformation to support JLR's global operations.

- In December 2024, General Motors announced the integration of advanced vehicle-to-vehicle communication systems in its Cadillac lineup, enhancing safety features such as collision avoidance and traffic alerts. This move is part of GM's broader strategy to lead in connected vehicle technology.

- In September 2024, The Department of Transportation (DOT) outlined plans to advance vehicle-to-everything (V2X) communications market reports along highways and intersections. The initiative is designed to improve road safety, traffic efficiency, and accessibility by enabling vehicles to communicate with each other and with roadside infrastructure. The plan includes deploying connected vehicle technologies in key transportation corridors and developing standards for V2X communication protocols.

REPORT COVERAGE

The global vehicle to vehicle communication market trend analysis report provides detailed market analysis and focuses on key aspects such as leading companies, vehicle types, design, and technology advances. Besides this, the report offers insights into the latest market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 17.9% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Vehicle Type

By Technology

By Application

By Sales Channel

By Geography

|

Frequently Asked Questions

Fortune Business Insights says the market is projected to reach USD 216.50 billion by 2032.

The market is expected to register a CAGR of 17.9% during the forecast period.

Pursuit of efficient traffic management systems is driving the market growth.

Asia Pacific led the market in 2024.

Qualcomm Technologies, Inc., Toyota Motor Corporation, Ford Motor Company, General Motors, and NXP Semiconductors are among the leading market players.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us