Warehouse Robotics Market Size, Share & Industry Analysis, By Product Type (Autonomous Mobile Robots, Automated Guided Vehicles, Articulated Robots, Collaborative Robots, and Others), By Application (Picking & Placing, Palletizing & Depalletizing, Transportation, and Packing), End-User Industry (Food & Beverage, Electronics & Electrical, Automotive, Pharmaceuticals, Independent Warehouse, E-Commerce, and Others), Payload Capacity (Below 200 Kg, 200 to 400 Kg, 400 to 600 Kg, 600 to 900 Kg, and Above 900 Kg), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

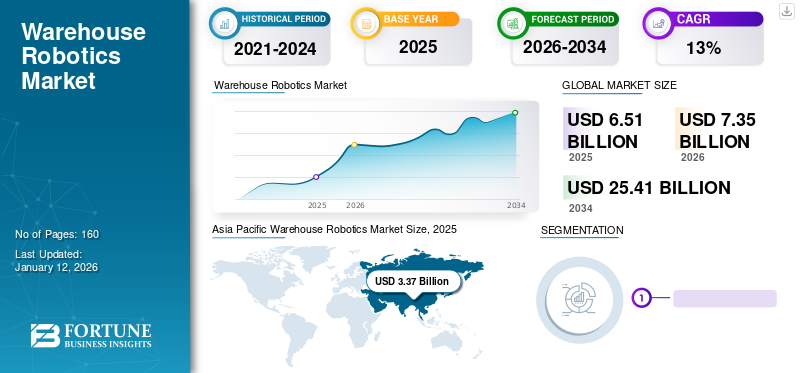

The global warehouse robotics market size was valued at USD 6.51 billion in 2025 and is projected to grow from USD 7.35 billion in 2026 to USD 25.41 billion by 2034, exhibiting a CAGR of 16.80% during the forecast period. Asia-Pacific dominated the warehouse robotics market with a share of 51.70% in 2025.

The market is driven by rising e-commerce activities, workforce shortages, and the need for operational efficiency. Heavy investments in automation, the adoption of AMRs and AGVs, and technological advancements in AI and robotics are fueling demand across industries, especially in Asia Pacific and emerging economies.

Warehouse robotics encompass industrial and service robots utilized in warehouse operations to perform various tasks such as picking, sorting, transportation, and packing. These autonomous machines are designed to replace manual work and enhance warehouse efficiency. Technological advancements in robotics and warehouse automation are fueling the demand for robots such as articulated arms, AMRs, and Automated Guided Vehicles (AGVs) for heavy lifting and carrying operations. Heavy investment by e-commerce companies is further propelling the growth of robots in warehouses. For instance, Amazon announced a capital expenditure of USD 1 billion in warehouse automation solutions, including robots, Artificial Intelligence, and Machine Learning. Several other companies are also focusing on investments in picking and material-handling bots.

The robots used in warehouses provide optimized storage facilities and increased productivity, ultimately reducing operational costs for warehouse owners. Automation is rapidly expanding across industries and countries with evolving technologies, driving the demand for robotics across various end-use industries. The increasing adoption of e-commerce activities and investments across geographies, the introduction of integrated and affordable solutions in warehousing activities, the rising implementation of automation, and workforce shortages are all positively affecting the market demand for warehouse robotics. For instance, India received investments of about USD 15 billion in 2021 for its e-commerce sector, a 5.4 times increase from the previous year. Several companies are expanding across emerging and developing economies, creating lucrative opportunities for warehouse automation and robots. In January 2022, Flipkart announced its expansion into more than 1,800 cities in India.

Robotics adoption in the warehouse has provided several benefits to the end-user industry, such as improved warehouse productivity, reduced processing time, efficient inventory management, reduced operational costs, and flexibility in managing customer demand. UNCTAD (United Nations Conference on Trade and Development) stated that online purchases have increased by 6 to 10 percentage points across various product segments, including electronics, pharmaceuticals, furniture, and cosmetics. The increased penetration of online shopping among demographics across countries is driving warehouse automation, creating a significant demand for AMRs, AGVs, articulated arms, and other types of robots. Therefore, the aforementioned factors are contributing to the warehouse robotics market growth.

Global Warehouse Robotics Market Overview

Market Size:

- 2025 Value: USD 6.51 billion

- 2026 Value: USD 7.35 billion

- 2034 Forecast Value: USD 25.41 billion, with a CAGR of 16.80% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific accounted for 51.70% of the market share in 2025, driven by the growing e-commerce sector, labor shortages, and increasing investments in automation.

- Fastest-Growing Region: Asia Pacific is also the fastest-growing region due to strong economic growth, high technology adoption, and increased use of AMRs and AGVs.

Industry Trends:

- Adoption of Autonomous Systems: Increasing integration of Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs) is transforming warehouse operations.

- AI & Robotics in Logistics: Artificial intelligence and machine learning are enhancing the efficiency of robotic systems for picking, sorting, and inventory management.

- E-commerce Expansion: Companies like Amazon are investing heavily (USD 1 billion+ in automation) to meet high demand in fulfillment centers.

- Post-COVID Automation Surge: The pandemic accelerated the need for contactless and efficient warehouse solutions, driving the adoption of robotics.

Driving Factors:

- Rapid E-commerce Growth: Rising online shopping volumes are pushing companies to adopt faster and more reliable warehouse automation solutions.

- Technological Advancements: Innovations in AI, robotics, and sensor technology are enabling more precise and adaptive robotic systems.

- Labor Shortages: Difficulty in hiring and retaining warehouse labor is prompting companies to invest in robotic alternatives.

- Efficiency & Cost Optimization: Robotics improve productivity, reduce operational errors, and help companies optimize warehouse costs.

- High Investment from Market Leaders: Logistics and e-commerce giants are investing aggressively to deploy robotics and enhance throughput.

COVID-19 IMPACT

Changing Demographics, Increased Internet Traffic, and Spending Over Online Platforms during Pandemic Augmented Market Growth

The COVID-19 pandemic accelerated the demand for robotics by forcing several businesses and retail shops to opt for online delivery options. The pandemic’s rapid spread across several countries also increased the e-commerce sector as end-users opted for online purchasing options over brick-and-mortar stores. Owing to this pandemic, warehouse operators and owners are looking for flexible solutions with minimal human interaction wherein robots deliver improved performance through item picking, sorting, transportation, and packing.

However, the pandemic period has halted several industries and their production activities but has driven customers toward the online market. An increasing number of online marketplaces and their expansion across several emerging countries are expected to drive the demand for warehouse automation post-pandemic period. The owners and operators focus on replacing non-value-added movement with robots that reduce long-term operating costs, creating lucrative opportunities for robot manufacturers. Changing consumer behavior and the growing trend toward online purchases because of the COVID-19 pandemic are anticipated to drive the growth of warehouse productivity, creating strong market demand for robotics and automation.

Moreover, the COVID-19 pandemic has boosted online purchases, surging the large volume of transactions, which creates demand for individual product picking, packing, and palletizing, creating significant demand for robots such as AMRs and AGVs.

Warehouse Robotics Market Trends:

Heavy Material Handling Capability of Robots to Drive Market Growth

Warehouses require various systems for material handling, including sorting, packaging, storage, and picking systems. Warehouse operators are increasingly inclined to replace heavy material handling tasks with robots. According to the International Federation of Robotics, more than 49,500 robots were sold in 2021 for logistics or transport activities. Mobile robots, such as AMRs and AGVs, can perform repetitive tasks and transfer products from one place to another quickly and accurately, optimizing product distribution, and increasing space efficiency.

The growing adoption of Industry 4.0 is driving the demand for automation, creating a need for warehouse robotics such as robotic arms, picking, sorting, and material handling systems. The demand for warehouse space is increasing significantly, influencing owners and operators to optimize their warehouse space. Mobile robots enable warehouse operations to scale as per changing customer demands, deploy the workforce to valuable tasks, and reduce long-term operational costs. Automated warehouses with robots require less space per volume of goods, limiting product damage and reducing energy consumption.

Download Free sample to learn more about this report.

Warehouse Robotics Market Growth Factors:

Increasing High Volume Trade of Durable and Non-Durable Products to Surge the Demand for Robots

The pandemic has fueled the market's growth, further supported by the growing trend of online purchases. This exponential growth in online consumer behavior has positively influenced heavy material handling in warehouses. Increasing demand for a wide range of products, changing young demographics across several countries, and consumer buying behavior create a strong demand for faster product handling solutions with reduced operating costs.

According to a UNCTAD survey, electronic products, pharmaceuticals, and cosmetic products have shown strong growth in online purchases in both emerging and developed countries. With the increasing demand for such durable and semi-durable products, the need for third-party logistics, independent cold storage, and warehouses is driving the demand for robots across industries.

RESTRAINING FACTORS:

High Initial Investment in the Short-Term to Hinder Market Growth

Although robots reduce overall operating costs in the long run, the initial investment is quite costly in the short term, which might limit the demand for robots and machines in warehouses. Additionally, the long-term maintenance cost of robots and software might also hinder the demand for robotics in warehouses. Warehouse goods handling requires flexibility and critical thinking, tasks that the human workforce can perform, whereas robots cannot adapt or respond to unpredictable situations. Such factors might pose a challenge to warehouse robotics.

Warehouse Robotics Market Segmentation Analysis:

By Product Type Analysis:

Automated Guided Vehicles Segment Dominated the Market Due to High Inventory Transportation Applications

Based on product type, the market is categorized into autonomous mobile robots, automated guided vehicles, articulated robots, collaborative robots, and others. The others’ segments include Cartesian robots, SCARA robots, and Delta Robots. The automated guided vehicles segment to lead the warehouse robots market.

Warehouse activities such as picking, placing, transportation, and packing create a strong demand for robots. The automated guided vehicles segment dominated and held the largest market share of 45.71% in 2026. The automated guided vehicles aid in the movement of goods from one point to another, reducing operating and workforce costs. AGVs provide intelligent routing of products through a warehouse facility, preventing any product or human damage. These heavy material handling solutions offer flexible and scalable robots with high payload capacity.

The autonomous mobile robots segment is estimated to grow owing to faster order fulfillment and reduced workforce costs. The demand for articulated robots is projected to grow over the forecast period owing to the need for higher stock-picking rates.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis:

Transportation Segment’s Growth Augmented Due to Strong Market Demand for Warehouse Robotics

Based on application, the market is segmented into picking & placing, palletizing & depalletizing, transportation, and packing. The transportation segment holds the highest market share among other applications.

Robotics is applied in various industries to enhance product handling and delivery processes. Robots used for transportation offer several benefits, such as reducing downtime, performing physically demanding tasks, and minimizing product damage. These warehouse robots optimize the loading and unloading process, enabling faster movement of goods from one location to another. Furthermore, investment in transport robots is gaining traction in the e-commerce sector, particularly with the increasing orders of varied sizes and the need for efficient delivery management.

The rising number of orders and increasing online purchases are boosting the demand for robots to manage increased inventory stock and process more orders within a shorter time. Robotic solutions, such as articulated arms, aid in handling repetitive tasks, such as picking, palletizing, depalletizing, and sorting, creating substantial growth for articulated robots in warehouses over the forecast period

By Payload Capacity Analysis:

Rising Heavy-Duty Tasks in Warehouses to Drive above 900 Kg Segment Growth

By payload capacity, the market is segmented into below 200 Kg, 200 to 400 Kg, 400 to 600 Kg, 600 to 900 Kg, and above 900 Kg.

Warehouses are increasingly adopting automation globally. Handling heavy-weight products can be challenging for the human workforce, potentially causing product damage and longer delivery times. Warehousing activities are shifting towards automation and more efficient product-handling solutions. With the surge in online purchasing, the volume of goods being traded and stored is expanding, creating a significant demand for robots capable of carrying heavy objects. Therefore, above 900 Kg payload capacity caters to about 35.51% of the market value share in 2026.

The major application of robots above 900 Kg payload capacity has their primary application in heavy load transportation and therefore has a high growth rate during the forecast period. Articulated robots with low payload capacity offer high flexibility, compact size, and lighter weight, aiding in tasks such as picking and placing, palletizing, and depalletizing small-sized objects. This creates market opportunities for robots with low payload capacities.

By End-User Industry Analysis:

The E-Commerce Segment to Hold Largest Market Share as a Result of Changing Demographics and Online Spending.

By end-user, the market is classified into food and beverage, electronics and electrical,

automotive, pharmaceuticals, independent warehouse, e-commerce, and others.

Online purchases for electronics, furniture, and cosmetics have experienced significant growth over the past few years. Consumers from emerging countries are increasingly shifting toward online purchasing. The rising demand for essential goods, such as food and beverages, personal care, and pharmaceuticals, has put pressure on the e-commerce sector to deliver products within shorter periods. This increasing demand from the e-commerce sector is boosting the need for automation in warehouses, thereby surging the growth of robots.

Third-party logistics and the e-commerce sector have witnessed the fastest growth in the warehousing space due to the increasing number of order-processing activities across emerging and developed economies. The e-commerce sector dominated the market with a share of 47.21% in 2026. Several warehouse owners are expanding their footprint and investing in robots to manage delivery times. Additionally, various governments have taken initiatives, such as constructing logistics parks and providing financial incentives, to boost the growing need for warehousing automation.

The pharmaceuticals and food and beverages industries are showing strong growth in online purchases. Key market participants focus on automating their warehouses and reducing product delivery time due to their short shelf life.

REGIONAL INSIGHTS:

By region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific Warehouse Robotics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 3.37 billion in 2025 and USD 3.83 billion in 2026, followed by Europe, with rising online purchasing and e-commerce sector growth across emerging and developed economies. North America shows high growth prospects due to increasing demand across several end-use industries.

Warehouse owners are increasingly focusing on implementing automation and embracing technological advancements in warehouses to effectively address the challenges faced by operators. Asia Pacific is emerging as a dominant region in terms of demand for warehouse robotics, primarily due to the strong demand fueled by perishable and durable goods, such as electronic products, across emerging countries. The rise in omnichannel distribution has led to an increase in the inventory volume in warehouses. Efficient management of this inventory necessitates the use of robots for faster handling of products, ultimately expected to boost the market share of warehouse robotics in the region.

China holds a Strong Market Share owing to the Rising E-Commerce Industry

China's domestic warehousing sector is poised to experience high demand for robots, propelled by the rapid growth of the e-commerce and logistics industry. Moreover, increased capital expenditure and growing investments in logistic parks are further boosting the demand for warehouse automation throughout the country. The concept of smart warehousing is gaining traction in China, creating a robust demand for mobile and standalone robots across various warehouse applications. The Japan market is projected to reach USD 0.42 billion by 2026, the China market is projected to reach USD 2.94 billion by 2026, and the India market is projected to reach USD 0.04 billion by 2026.

The escalating demand for food and beverages, and pharmaceuticals along with supportive government policies, is set to expand the market demand for robots in warehouse operations. Additionally, both domestic and international market participants, including HAI Robotics, Quicktron Intelligent Technology, HC Robotics, and ABB Ltd, are making significant inroads into the Chinese market.

To know how our report can help streamline your business, Speak to Analyst

Europe is experiencing a significant surge in warehouse robotics, primarily propelled by the remarkable growth of the e-commerce sector. The increasing number of internet users and a subsequent rise in online consumer spending have played a pivotal role in driving this growth. The pressing issue of workforce shortages, coupled with the need for expedited order fulfillment, has further amplified the adoption of robotics within the warehousing sector. Particularly, the cross-border trade of consumable products is anticipated to be a key driver for the demand of robots in European warehouses. The UK market is projected to reach USD 0.07 billion by 2026, while the Germany market is projected to reach USD 0.68 billion by 2026.

Moreover, the advent of cutting-edge technologies such as Artificial Intelligence and blockchain is significantly fueling the demand for warehouse automation, thereby contributing to substantial market expansion of robotic applications across various European countries. With a notable increase in capital investments and expenditures dedicated to automation, the market for robots in warehouse operations is witnessing robust growth, presenting promising opportunities for the foreseeable future.

North America market presents lucrative opportunities for warehouse robotic solutions due to the increasing trend of warehouse automation. Warehouse operators are creating significant demand for picking and heavy stock-carrying robots, which will boost the overall demand for robots. The U.S. market is projected to reach USD 1.05 billion by 2026.

The need for warehouse automation is growing with the rise of manufacturing facilities across Middle Eastern & African countries. Warehouse owners are increasingly adopting technologies with the assistance of robots to expedite the rising demand from the e-commerce sector.

KEY INDUSTRY PLAYERS:

Key Players are Striving to Penetrate the Market through Collaborative Measures

Key market participants are striving for new product introductions in a competitive market to penetrate the global market. Domestic startup companies are increasing their funding to enhance their market presence.

ABB Ltd., FANUC Corporation, Hikvision (Hikrobot), KION Group AG, Daifuku, Omron Corporation, and KUKA AG are focusing on developing product portfolios for a wide range of applications, including articulated robots, AMRs, and AGVs.

- In 2023, ABB Ltd. introduced a new AI-enabled navigation technology-based Autonomous Mobile Robot that aids in increasing the flexibility and efficiency of the warehouse. The Visual Simultaneous Localization and Mapping (Visual SLAM) technology helps in making intelligent navigation decisions based on its surroundings.

LIST OF TOP WAREHOUSE ROBOTICS COMPANIES PROFILED:

- ABB Ltd. (Switzerland)

- FANUC Corporation (Japan)

- Hikvision (Hikrobot) (China)

- KION Group AG (Germany)

- Daifuku (Japan)

- Omron Corporation (Japan)

- KUKA AG (Germany)

- JBT (U.S.)

- SSI Schaefer (U.S.)

- Yaskawa Motoman (Japan)

- Locus Robotics (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: DHL announced the introduction of 5,000 autonomous mobile robots across its warehouse in partnership with Locus Robotics, and is expected to take over the warehouse's picking, packing, and distribution tasks.

- May 2023: DF Automation & Robotics Sdn Bhd launched a new brand logo of AMR known as TITAN. TITAN-branded warehouse robots are built for carrying heavy weights up to 1.5 tonnes.

- March 2023: South Korean manufacturer Thira Robotics has developed a new autonomous mobile robot in the U.S. market that provides navigation facilities in changing surroundings.

- November 2022: Smart Robotics launched a robotic merchandise picker for warehouse and logistics processes for pick and place applications. The collaborative robot enables the picking and placing of lightweight products and the sorting of warehouse inventory stocks.

- September 2022: ABB Ltd. launched a new range of AMRs named Flexley mobile Robots after rebranding ASTI mobile robotics indicating the flexibility of operations that Autonomous mobile robots offer.

- January 2022: ANSCER Robotics, an Indian startup, introduced its range of autonomous mobile robots for several end-use sectors such as automotive, electronics, FMCG, and healthcare.

REPORT COVERAGE:

The report provides detailed information regarding various insights into the market. Some of these insights include growth drivers, restraints, the competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment opportunities. The market is quantitatively analyzed from 2023 to 2030 to provide a comprehensive understanding of its financial competency. The information gathered in this report has been sourced from various primary and secondary sources.

Report Scope & Segmentation:

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 16.80% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

By Application

By Payload Capacity

By End-User Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 6.51 billion in 2025 and the market will reach USD 25.41 billion by 2034.

The market is estimated to grow at a CAGR of 16.80% during the forecast period.

The growing e-commerce sector and inclination toward automation are increasing market demand for warehouse robotics, driving market growth.

The top companies in the market are ABB Ltd., FANUC Corporation, Hikvision (Hikrobot), KION Group AG, and Daifuku.

Asia Pacific is estimated to dominate the market demand for robots in warehouse applications.

Autonomous mobile robots are expected to hold the highest CAGR in the market.

The e-commerce sector held the largest market demand of about 47.21% in 2025.

Mobile robots are gaining strong market traction owing to their large payload capacity across several geographies.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us