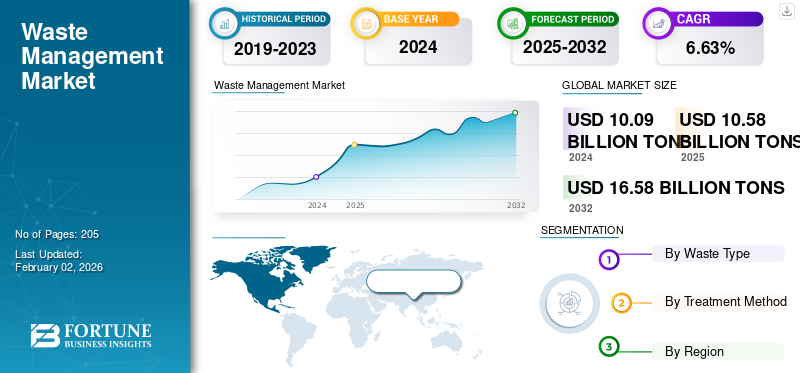

Waste Management Market Size, Share & Industry Analysis, By Waste Type (Municipal Solid Waste (MSW), Industrial Waste, Construction & Demolition (C&D) Waste, Mining & Quarrying Waste, and Others), By Treatment Method (Collection & Transport, Landfilling, Recycling/Material Recovery, Waste-to-Energy (WtE), Composting & Anaerobic Digestion, and Others), and Regional Forecast, 2025-2032

Waste Management Market Size and Future Outlook

The global waste management market size was valued at USD 10.09 billion tons in 2024. The market is projected to grow from USD 10.58 billion tons in 2025 to USD 16.58 billion tons by 2032, exhibiting a CAGR of 6.63% during the forecast period. Asia Pacific dominated the global waste management market with a market share of 38.25% in 2024.

The market is rising globally due to increasing urbanization, industrialization, and increasing environmental awareness. Every year, the world produces billions of tons of waste, and without proper handling, it contributes to pollution, greenhouse gas emissions, and ecosystem damage.

Governments and international organizations such as the United Nations Environment Programme (UNEP) and the OECD are enforcing stricter waste regulations, encouraging recycling and circular economy initiatives. Consumers are also more conscious of sustainability, pushing companies to adopt eco-friendly disposal and recycling practices. Technological innovations such as smart collection systems, waste-to-energy (WtE) conversion, and digital tracking have made waste management technologies more efficient and economically viable. Additionally, rising investments in green infrastructure and renewable energy have positioned efficient waste management as a critical part of global sustainability goals. These factors have been driving the market share in recent years.

For instance, Veolia is a leading waste management services and environmental services company headquartered in Paris, France. It manages solid and hazardous waste, water treatment, and energy recovery projects globally. Veolia operates recycling and WtE facilities that convert millions of tons of waste into reusable materials and energy annually, promoting resource efficiency and environmental protection.

MARKET DYNAMICS

MARKET DRIVERS:

Rapid Urbanization & Population Growth to Propel Market Growth

Rapid urbanization and population growth have emerged as the most significant forces driving the global waste management industry. As more people migrate to cities in search of better livelihoods, urban areas are expanding at an unprecedented rate. According to the United Nations, over 56% of the global population now lives in urban areas, a figure expected to reach 68% by 2050. This demographic shift intensifies pressure on waste management infrastructure, leading to soaring volumes of municipal solid waste (MSW).

The United Nations Environment Programme (UNEP) estimates that the world currently generates over 2.1 billion tons of MSW annually, and this could nearly double to 3.8 billion tons by 2050 if waste generation continues to outpace management capacity. Urban regions, particularly in developing economies across Asia and Africa, face the greatest challenges, including limited landfill space, open dumping, poor waste segregation, and inadequate recycling systems.

MARKET RESTRAINTS:

High Cost of Waste Collection, Treatment, and Disposal to Restrict Market Expansion

One significant challenge hindering the waste management market growth is the higher cost of waste collection, treatment, and disposal. Developing and maintaining modern recycling plants, sanitary landfills, and waste-to-energy (WtE) facilities requires substantial capital investment, which many developing nations struggle to afford.

Establishing modern landfills, recycling facilities, and waste-to-energy plants requires heavy investment and advanced technology. In many developing regions, limited funding and inadequate public-private partnerships hinder expansion. Operational costs such as fuel, labor, and maintenance further strain municipal budgets. Additionally, transporting waste from densely populated cities to treatment sites increases expenses.

MARKET OPPORTUNITIES:

Transition Toward Circular Economy is Anticipated to Create Growth Opportunities

The global waste management industry is entering a phase of significant opportunity driven by sustainability goals, technological innovation, and policy reforms. One of the key opportunities lies in the transition toward a circular economy, where waste is viewed as a valuable resource rather than a burden. Recycling, reuse, and resource recovery are opening new markets for secondary raw materials, creating both environmental and economic benefits.

For instance, according to the European Union’s Circular Economy Action Plan (CEAP), it could increase EU GDP by 0.5% and create around 700,000 new jobs by 2030, while significantly reducing waste generation and carbon emissions. The plan also drives investment in advanced recycling technologies and producer responsibility schemes, setting a global benchmark for waste reduction and resource efficiency.

MARKET CHALLENGES:

Poor Waste Segregation at the Source Presents Significant Challenges for Market Growth

Poor waste segregation at the source remains one of the most pressing challenges in the global waste management sector. Effective waste management begins at the household, industrial, and commercial levels, where proper separation of organic, recyclable, and hazardous materials is essential. However, in many countries, particularly developing economies, waste is often mixed, making downstream recycling, composting, and energy recovery inefficient and costly. According to the United Nations Environment Programme (UNEP), inadequate segregation leads to the loss of nearly 60–70% of recyclable materials, undermining circular economy initiatives.

WASTE MANAGEMENT MARKET TRENDS:

Growing Popularity of Waste-to-Energy (WtE) Technologies is a Key Market Trend

The rise of Waste-to-Energy (WtE) technologies marks a pivotal evolution in global waste management. WtE systems convert non-recyclable municipal solid waste into electricity, heat, or biofuels through processes such as incineration, pyrolysis, gasification, and anaerobic digestion. These technologies not only reduce landfill dependency but also contribute to renewable energy generation and greenhouse gas mitigation.

According to the International Energy Agency (IEA), modern WtE plants can recover up to 30% of the energy embedded in waste while adhering to strict emission standards. Countries such as Japan, Germany, and Sweden have successfully integrated WtE into their circular economy frameworks, turning waste disposal challenges into energy solutions.

Download Free sample to learn more about this report.

Segmentation Analysis

By Waste Type

Municipal Solid Waste (MSW) is Dominant Owing to Growing Emphasis on Circular Economy Practices

On the basis of waste type, the market is classified into municipal solid waste (MSW), industrial waste, construction & demolition (C&D) waste, mining & quarrying waste, and others.

In 2025, the municipal solid waste (MSW) segment dominates with a 41.34% share. A combination of environmental mandates, urbanization pressures, and the growing emphasis on circular economy practices is driving the Municipal Solid Waste (MSW) sector. At the same time, regulatory frameworks aimed at minimizing landfill dependence such as landfill taxes, diversion targets, and bans on certain waste streams, are accelerating the adoption of waste-to-energy, composting, recycling, and material-recovery technologies.

The Construction & Demolition (C&D) Waste segment is experiencing the fastest growth and is expected to grow at a CAGR of 7.89%. The growth in this segment is attributed to rapid urbanization, large-scale infrastructure development, and continuous building renovations across emerging and developed markets. The expansion of residential, commercial, and industrial construction significantly increases debris such as concrete, wood, metals, and plastics. Additionally, stricter environmental regulations, rising adoption of green building practices, and growing emphasis on recycling and resource recovery are driving more formal management of C&D waste.

To know how our report can help streamline your business, Speak to Analyst

By Treatment Method

Landfilling Dominates Market Due to Its Ability to Handle Large Volume of Waste

On the basis of treatment method, the market is classified into collection & transport, landfilling, recycling/material recovery, Waste-to-Energy (WtE), composting & anaerobic digestion, and others.

In 2025, the landfilling segment dominates with a 29.62% share. Landfilling continues to be one of the most widely used waste management methods across the globe due to its simplicity, cost-effectiveness, and capacity to handle large waste volumes. Many developing and even some developed nations rely heavily on landfills as they require lower capital investment and technological input compared to advanced options such as recycling or waste-to-energy (WtE) facilities.

The recycling/material recovery segment is experiencing the fastest growth and is expected to grow at a CAGR of 9.52%. The recycling/material recovery is the fastest-growing segment in waste management as it aligns directly with global policies pushing for circular economy implementation, reduced landfill use, and lower carbon emissions. Governments are enforcing stricter recycling targets, extended producer-responsibility schemes, and bans on landfilling recyclable materials, which significantly increase investment in advanced sorting, separation, and reprocessing technologies.

Waste Management Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Waste Management Market Size, 2024 (USD billion tons) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the dominant share in 2023, valued at 3.64 billion tons, and also took the leading share in 2024 with 3.86 billion tons. The Asia Pacific region is experiencing rapid growth in the waste management sector due to accelerating urbanization, industrialization, and population expansion. Home to over 60% of the world’s population, countries such as China, India, Japan, and South Korea are generating massive volumes of municipal, industrial, and hazardous waste. According to the United Nations Environment Programme (UNEP), Asia alone accounts for nearly half of the world’s total waste generation, and this figure continues to rise as urban lifestyles and consumer demand expand.

Europe

The demand for waste management in Europe stems from a combination of stringent environmental policy, mature infrastructure, and a strong commitment to circular economy principles. The European Union has implemented comprehensive legislation such as the Waste Framework Directive, the Circular Economy Action Plan, and national Extended Producer Responsibility (EPR) schemes that mandate high rates of recycling, recovery, and proper disposal.

The market in Germany is valued at 0.53 billion tons in 2025. Germany’s strict environmental laws, advanced recycling systems, and strong circular economy policies drive the waste management market share. Over 65% of waste in Germany is recycled or recovered through waste-to-energy (WtE) plants, making it a global leader in sustainable waste management.

North America

During the forecast period, North America is projected to record a growth rate of 5.70% and reach the valuation of 3.05 billion tons in 2025. The U.S. and Canada generate some of the world’s largest volumes of municipal and industrial waste, driven by consumerism and industrial activity. This necessitates advanced systems for recycling, landfill management, and waste-to-energy (WtE) operations.

The U.S. is expected to record a valuation of 2.69 billion tons in 2025. Several environmental, economic, and regulatory factors drive waste management in the U.S. Growing urbanization and population density increase the volume of municipal solid waste, creating a stronger need for efficient collection, recycling, and disposal systems. Rising environmental awareness also pushes households and businesses to adopt sustainable practices, boosting demand for recycling programs and waste-to-energy solutions. For instance, from January 2022 onwards, the states, namely California, New York, and Vermont, have implemented organics recycling mandates that encourage or require households and businesses to separate food scraps from regular trash. These programs divert millions of tons of organic waste from landfills each year, reducing methane emissions while increasing demand for composting facilities and related waste-to-energy initiatives.

Middle East & Africa

The market in the Middle East & Africa is estimated to reach 0.78 billion tons in 2025. In the region, the GCC is estimated to reach 0.38 billion tons in 2025. This growth is majorly owing to rising investments in the circular economy and green waste technologies.

Latin America

Over the forecast period, the Latin America region is anticipated to show tremendous opportunities for waste management. Many cities in the region, such as São Paulo, Mexico City, and Buenos Aires, face mounting challenges from inadequate waste collection and growing landfill dependence. Governments are now prioritizing modern recycling systems, waste-to-energy projects, and public–private partnerships to improve efficiency and reduce pollution. The Latin American market in 2025 is set to record 0.50 billion tons in its valuation. In Latin America, Brazil is set to attain the value of USD 0.29 billion tons in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players:

Vendors are Actively Expanding Market by Using Data Analytics and Performance Dashboards

The demand for waste management among key companies such as Veolia, SUEZ Group, Waste Management, Inc. (WM), Republic Services, Inc., and others is increasingly using data analytics and performance dashboards to track waste streams, vendor performance (collection times, volume, contamination rates), and compliance. Businesses working with vendors are conducting waste audits to understand exactly what and how much waste is generated, then using that to set goals for reduction, recycling, and reuse.

In mid-2025, Waste Management Inc. (WM) announced long-term plans (to 2027) targeting revenue of USD 28.5-29.25 billion, driven by investments in recycling, renewable energy, organics infrastructure, and regulated/hazardous waste streams.

LIST OF KEY WASTE MANAGEMENT COMPANIES PROFILED:

- Veolia (France)

- SUEZ Group (France)

- Waste Management, Inc. (WM) (U.S.)

- Republic Services, Inc. (U.S.)

- Clean Harbors, Inc. (U.S.)

- Biffa plc (U.K.)

- Remondis SE & Co. KG (Germany)

- Renewi plc (U.K.)

- Stericycle, Inc. (U.S.)

- Covanta Holding Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In October 2025, the city of Gold Coast in Australia unveiled a major development plan to convert a landfill site into a “waste-to-energy” precinct. The project targets diverting up to 97 % of waste from landfill by building an integrated recycling and energy precinct, including a facility that turns non-recyclable waste into power.

- In October 2025, Dubai Municipality launched the “Circle Dubai” initiative under the Dubai Integrated Waste Management Strategy 2021‑2041. The plan aims at 100% diversion of waste from landfill and at least 56% recycling, via smart collection, education campaigns, and digital platforms.

- In September 2025, Tiruchirappalli City Corporation (in the Indian state of Tamil Nadu) stepped up efforts in plastic-waste management by partnering with cement plants to use non-recyclable plastics as alternative fuel. The city generates ~400–450 tons of waste daily and has achieved ~75% source segregation.

- In September 2024, Biffa plc acquired a construction & demolition (C&D) recycling firm (L&S Waste Management) in Hampshire, England.

- In April 2024, Covanta Holding Corporation rebranded to Reworld Waste (formerly Covanta) to reflect its shift into broader sustainable waste solutions beyond just waste-to-energy.

REPORT COVERAGE

The global waste management market analysis provides an in-depth study of the market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ATTRIBUTE | DETAILS |

| Study Period | 2019-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Period | 2019-2023 |

| Growth Rate | CAGR of 6.63% from 2025-2032 |

| Unit | Volume (billion tons) |

| Segmentation | By Waste Type, Treatment Method, and Region |

| By Waste Type |

|

| By Treatment Method |

|

| By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at 10.09 billion tons in 2024 and is projected to reach 16.58 billion tons by 2032.

In 2024, the market value stood at 3.86 billion tons.

The market is expected to exhibit a CAGR of 6.63% during the forecast period of 2025-2032.

The municipal solid waste (MSW) segment led the market by waste type.

The market is driven by stricter environmental regulations and rising urban waste generation.

Veolia, SUEZ Group, Waste Management, Inc., and others are some of the prominent players in the market.

Asia Pacific dominated the market in 2024.

Major factors expected to favor waste management adoption include stricter regulatory mandates aimed at reducing landfill use and increasing recycling efficiency.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us