Western Europe Drug Delivery Market Size, Share & Industry Analysis, By Type (Oral {Tablet [Oral Dispersible Tablets, Modified Release Tablets, Coated Tablets & Others], Capsules, Liquid or Syrup, & Others} and Injectable {Conventional Injectables, Pre-filled Syringes, Auto-injectors, Pen-injectors, Wearable Injectors, & Others}), By Device Type (Conventional & Advanced), By Application Area (Central Nervous System, Digestive System (Metabolism), Endocrine System, Immune System, & Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, & Others), & Country Forecast, 2026-2034

KEY MARKET INSIGHTS

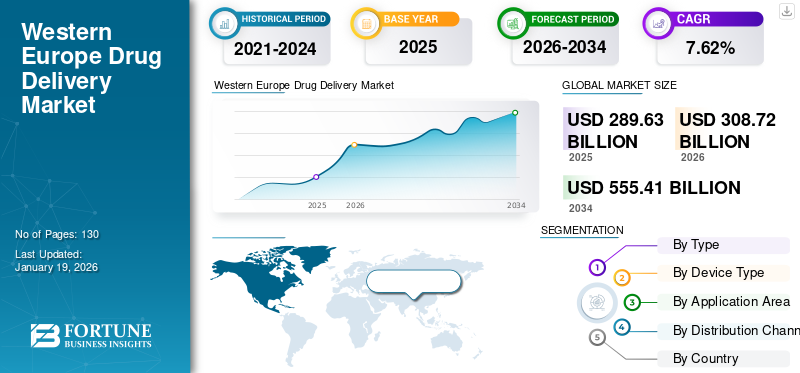

The Western Europe drug delivery market size was valued at USD 289.63 billion in 2025. The market is projected to grow from USD 308.72 billion in 2026 to USD 555.41 billion by 2034, exhibiting a CAGR of 7.62% during the forecast period.

Drug delivery refers to the method of drug administration in humans as a part of therapeutics. Various aspects of drug delivery deal with the dosage formulations, drug delivery technology, pharmacology, and patient monitoring. The growth of the market is attributed to an aging population, rising prevalence of chronic conditions, and increasing focus on patient-centric treatments. For instance, in January 2024, an estimated 449.3 million Europeans were above the age of 65 years. This population accounted for an estimated 21.6% of the overall population in Europe.

Certain factors such as increasing demand for advanced drug delivery technologies, substantial investments by market players to boost innovation, and extensive emphasis on research and development activities are projected to offer a favorable environment for market growth. Furthermore, biologic innovations and personalized medicine are accelerating the use of delivery systems for improved therapeutic results, patient compliance, and reduced toxicity.

Some of the major players in the market are BD, Novartis AG, Gerresheimer AG, West Pharmaceutical Services Inc., and Novo Nordisk. These players focus on capacity expansion, extensive focus on investments and technological advancements, and strategic partnerships to hold a considerable market share along with an extended customer base.

MARKET DYNAMICS

Market Drivers

Patient Preference for Home-Based and Self-Administered Therapies Accelerate Market Growth

Substantial shift of patient preference for home-based and self-administered therapies accelerate the Western Europe drug delivery market growth. In addition, governments in Europe are also focusing on reducing hospital burdens as well as resource optimization with an aim to decrease healthcare costs. Along with this, the introduction of technologically advanced devices such as pen injectors, autoinjectors, and wearable injectors is also projected to accelerate market growth by 2032. Such demand for devices is further encouraging manufacturers to enter the market with introduction and approval of novel devices.

- For instance, in April 2023, LTS LOHMANN Therapie-Systeme AG announced the acquisition of Sorrel Medical’s wearable injector business with the aim of entering the market. The company is planning to expand its market share in wearable injectors for small and large molecule drug delivery.

Advancements in such drug delivery systems offer user-friendly designs, integrated dose-tracking features, and remote monitoring capabilities, consequently leading to increased demand for these products in Europe.

Market Restraints

High Competition and Pricing Pressure from Generics Deter Market Growth

The market is becoming highly competitive, with established multinational companies, regional companies, and new startups competing for the Western Europe drug delivery market share. Though competition stimulates innovation, competition also exerts extreme pressure on prices, particularly in tender-based markets such as public healthcare systems. In addition, procurement agencies and hospitals emphasize low cost in lieu of state-of-the-art features, and so manufacturers have to cut prices in order to win orders. This process limits the profit margin and may decrease the money available for subsequent research and development.

- For instance, in August 2025, Novo Nordisk witnessed a decline in sales of its drug called Ozempic due to competition and the U.S. tariff issues.

Further, the entry of generic drugs along with identical low-cost products is also estimated to have a negative impact on the market growth.

Market Opportunities

Growing Approvals for Biologics Serve Significant Development Opportunities

The European pharmaceutical marketplace is experiencing rapid growth in the application of biologic drugs and biosimilars, and specifically for the treatment of cancer, autoimmune disease, and rare disease. These therapies often require the attainment of precise dosing, stability to avoid degradation, and delivery in intricate systems such as prefilled syringes, autoinjectors, and wearables. As healthcare becomes more outpatient and patient self-administration-focused, there exists a tremendous opportunity for market players to manufacture tailored drug delivery devices to meet the particular patient's needs.

- In June 2025, SHL Medical and SCHOTT Pharma announced a strategic collaboration to introduce the first large-volume autoinjector. The new technology allows the delivery of several large molecules for disease treatments.

In addition, healthcare authorities and governments in Europe are also promoting biosimilar use in order to ease healthcare spending.

Market Challenges

Diverse Regulations and a Continually Updating Regulatory Landscape Stifle Market Growth

Navigating through the regulatory policies of various countries in Europe is one of the considerable challenges for market growth. Though the European Medicines Agency (EMA) plays a prominent role in device introductions in Europe, the member states still have responsibility for select approvals, reimbursement, and compliance obligations. With drug delivery systems, it becomes a tedious process for the companies to get approval.

Further, international companies have to align not only with the pharmaceutical regulations of the EMA but also with the EU Medical Device Regulation (MDR), where rigorous clinical evidence, technical files, and post-market surveillance are required. This dual alignment substantially affects total turnaround time, cost, and resource investment in product development.

WESTERN EUROPE DRUG DELIVERY MARKET TRENDS

Increasing Emphasis on Reusable Drug Delivery Systems for Waste Reduction

Europe is witnessing a strong focus on healthcare cost-containment and environmental regulation policies, the reusable autoinjectors are one of the emerging trends in drug delivery devices. As single-use autoinjectors produce significant medical waste, reusable autoinjectors are designed with a reusable injector body where interchangeable replaceable drug cartridges or prefilled syringes can be used. This significantly reduces the amount of disposable plastic and toxic material in waste stream, in alignment with the sustainability vision of the EU and national preferences in the procurement of healthcare devices. As there is a rising trend toward the utilization of reusable injectors, market players are actively launching new products.

- For instance, in October 2024, Nemera announced the launch of a reusable auto-injector at the CPHI program, which was held in Milan, Italy. The device is specially manufactured for parenteral drug delivery.

Newly launched devices have improved ergonomics, reliable performance on repeated use, and in some versions, electronic dose tracking built in to facilitate adherence. These benefits of devices play a prominent role in their adoption by patients as well as healthcare providers.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Oral Drug Delivery Leads Owing to its Multiple Benefits Over its Counterpart

Based on type, the market is segment is projected to dominate the market with a share of 51.10% in 2026.into oral and injectable. Oral drug delivery dominates the Western Europe drug delivery market share driven by patient convenience, non-invasive nature of drug administration, cost-effectiveness, and high adherence levels. In addition, extensive applications in chronic disease management and access to advanced formulations such as modified-release tablets accelerate the segment growth.

- In September 2024, Evonik announced the launch of the EUDRACAP capsule to enable drug delivery in the ileocolonic region. The company has developed this solution for targeted drug delivery of oral formulations.

The injectables segment is expected to register the fastest CAGR during the forecast period. The growth is attributed to the rise in biologics, biosimilars, and target therapies that require parenteral delivery. Moreover, increased use of self-injecting devices, such as autoinjectors and prefilled syringes, and hospital-to-home transfers are driving its adoption.

By Device Type

Conventional Drug Delivery Devices Dominate with Affordability and Established Production

Based on device type, the market is bifurcated into conventional and advanced. The conventional devices segment held a maximum share of the market Share 66.48% in 2026 owing to lowered prices, well-established production, and common physician experience. In addition, extensive generics and OTC applications of oral and injectable drugs are also responsible for the segment’s maximum market share.

- For instance, in November 2023, Proveca received approval from the European Commission for Pediatric Use Marketing Authorisation (PUMA) for its Aqumeldi orodispersible tablets. The tablets are prescribed for heart failure in children under 18 years old.

Further, advanced devices are projected to register the fastest CAGR during the forecast period. Growth of this segment is prominently driven by demand for personalized therapies, administration of biologics, and superior treatment adherence. In addition, supportive EU regulations for innovation and rising investment in drug delivery technologies R&D are accelerating adoption across healthcare settings.

By Application Area

Considerable Incidence of Immune Disorders to Boost Segment Growth

Based on application area, the market is fragmented into the central nervous system (CNS), digestive system (metabolism), endocrine system, immune system, and others. The immune system segment dominated the Western Europe drug delivery market in 2024. The segment growth is majorly attributed to the prevalence of autoimmune disorders, growing applications of biologics, and the prevalent use of self-administering injectable therapies. In addition, substantial investments by companies for new drug development is also estimated to support the segment’s growth.

The central nervous system (CNS) segment is estimated to register a considerable CAGR during the forecast period with increasing prevalence of neurological disorders such as multiple sclerosis, epilepsy, and Parkinson’s disease, coupled with the introduction of targeted therapies.

- For instance, in March 2021, Angelini Pharma received approval from the European Commission for its new drug, ONTOZRY. The drug is developed for the treatment of seizures.

By Distribution Channel

Hospital Pharmacies are Major Distribution Channels as they Deal with Challenging Therapies

Based on distribution channel, the market is divided into hospital pharmacies, retail pharmacies, and others. The hospital pharmacies segment dominated the market in 2024 owing to hospitals’ responsibility for inpatient treatments, dealing with challenging therapies such as biologics, and providing for controlled distribution in healthcare institutions. With their integration in hospital-based disease management pathways, there is assured demand for both injectable and oral delivery systems.

The retail pharmacies segment is estimated to register fastest CAGR during the forecast period fueled by expansion of home-based care, drug self-administration, and emphasis on effective chronic disease management.

WESTERN EUROPE DRUG DELIVERY MARKET REGIONAL OUTLOOK

By geography, the market is categorized into Germany, France, U.K., Italy, Spain, Switzerland, and the rest of Western Europe.

Germany

Germany dominated the European market in 2024 with a valuation of USD 83.79 billion in 2026. The Germany drug delivery market growth is attributed to a well-developed healthcare system, established pharmaceutical manufacturing, and high per capita healthcare expenditure. In addition, ongoing R&D investments and established regulations facilitate innovation, and governmental emphasis on sustainability is boosting environmentally friendly device development.

- In November 2023, Eli Lilly and Company announced its plan to construct a new high-tech manufacturing site in Alzey, Germany. This new facility will focus on the expansion of its parenteral (injectable) product and device manufacturing network.

U.K.

The U.K. drug delivery market is with a share of 51.85% in 2026 to register a considerable CAGR during the forecast period. The regional market’s growth is attributed to a dynamic clinical research environment and emphasis on the cost-effectiveness of therapy. In addition, the rising incidence of chronic illnesses and governmental support is also projected to have a positive impact on the market growth.

- For instance, in August 2025, Enable Injections, Inc. announced approval for its enFuse body injector in the U.K. market.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Emphasize Expansion to Boost Their Market Share

The Western Europe drug delivery market is fragmented, as a higher number of companies account for a major market share. Pfizer Inc., Gerresheimer AG, and Merck & Co., among few others, are prominently operating in the market. Growing emphasis on providing technologically advanced drug delivery solutions for chronic conditions and extensive investments are responsible for the market growth. Additionally, other players such as BD, Catelent Inc., Novo Nordisk, and others are also actively engaged in order to expand their percentage in the Western Europe drug delivery market.

LIST OF KEY WESTERN EUROPE DRUG DELIVERY MARKET COMPANIES PROFILED

- Gerresheimer AG (Germany)

- BD (U.S.)

- Catalent, Inc. (U.S.)

- Baxter (U.S.)

- West Pharmaceutical Services (U.S.)

- Ypsomed (Switzerland)

- Medtronic (Ireland)

- Nemera (France)

KEY INDUSTRY DEVELOPMENTS

- August 2025: Ypsomed received UKCA approval for its ServoPen and ServoPen Fix. Through this, the company received permission to commercialize its product in the U.K.

- June 2025: FoodFirst Health and Liva Healthcare entered into a strategic collaboration to introduce evidence-based reimbursed treatment for the diabetic population in the Netherlands.

- March 2024: Gerresheimer announced the scale-up of its syringe plant in Bünde, Germany, to support high-volume demand for biologic injectables. Novo Nordisk also introduced a next-generation digital pen injector tailored for European diabetes care protocols.

- March 2023: Catalent and Grünenthal announced a successful collaboration focused on the reformulation of an investigational medicine to improve its bioavailability.

- January 2020: Gerresheimer announced the expansion of the Gx RTF ClearJect product line. The material used for the syringe is a high-performance polymer called COP (cyclic olefin polymer). The material is suitable for use as primary packaging for sophisticated medications, especially for sensitive, biologicals, biosimilars, and biobetters.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.62% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Oral o Tablet § Oral Dispersible Tablets (ODTs) § Modified Release Tablets § Coated Tablets § Others o Capsules o Liquid or Syrup o Others · Injectable o Conventional Injectables o Pre-filled Syringes o Auto-injectors o Pen-injectors o Wearable Injectors o Others By Device Type · Conventional · Advanced By Application Area · Central Nervous System (CNS) · Digestive System (Metabolism) · Endocrine System · Immune System · Others By Distribution Channel · Hospital Pharmacies · Retail Pharmacies · Others By Country/Sub-Region · Europe (By Type, Device Type, Application Area, Distribution Channel, and Country) o Germany o France o U.K. o Italy o Spain o Switzerland o Rest of Western Europe |

Frequently Asked Questions

The Western Europe drug delivery market size is projected to grow from $308.72 billion in 2026 to $555.41 billion by 2034.

The market is expected to exhibit a CAGR of 7.62% during the forecast period (2026-2034).

In 2025, the market value stood at USD 83.79 billion.

By type, the oral segment led the market.

The key factors driving the market are the increasing prevalence of chronic conditions and growing approval for targeted therapies.

BD, Novo Nordisk, and Pfizer are the top players in the market.

Germany dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us