Xylene Market Size, Share & Industry Analysis, By Type (Ortho-Xylene, Meta-Xylene, Para-Xylene, and Mixed Xylene), By Application (Solvents, Monomers, and Others), By End-User (Paints & Coatings, Plastics & Polymers, Adhesives, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

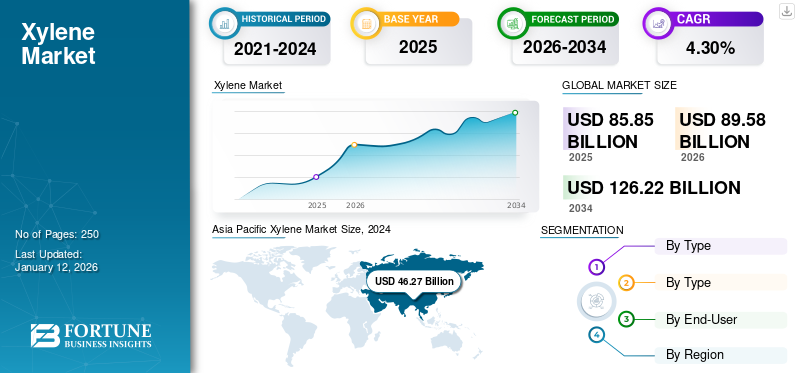

The global xylene market size was valued at USD 85.85 billion in 2025. The market is projected to grow from USD 89.58 billion in 2026 to USD 126.22 billion by 2034, exhibiting a CAGR of 4.30% during the forecast period. Asia Pacific dominated the xylene market with a market share of 56.30% in 2025.

Xylene is a colorless, flammable liquid hydrocarbon mainly used as a solvent in various industries, such as paints & coatings, adhesives, and chemicals. Its significance arises from its ability to dissolve resins and act as a key ingredient in industrial applications, thereby enhancing product efficiency and performance. The market is experiencing high growth due to rising industrialization, increasing demand for petrochemical products, and expanding applications in various sectors. The growing requirement for paints and coatings in renovation and infrastructure development projects is expected to drive market expansion during the forecast period. The major players operating in the market include LG Chem, MITSUBISHI GAS CHEMICAL COMPANY, INC., Honeywell International Inc., INEOS, Shell plc, and Reliance Industries Limited.

Global Xylene Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 85.85 billion

- 2026 Market Size: USD 89.58 billion

- 2034 Forecast Market Size: USD 126.22 billion

- CAGR: 4.30% from 2026–2034

Market Share:

- Asia Pacific dominated the xylene market with a 56% share in 2025, driven by rapid industrialization, infrastructure development, and rising demand for paints, coatings, adhesives, and packaging materials across countries like China, India, Japan, and Southeast Asia.

Key Country Highlights:

- China: With aggressive infrastructure expansion under initiatives like the Belt and Road Initiative and massive petrochemical investments, China remains the largest consumer and producer of xylene globally.

- India: Backed by the government’s commitment to invest USD 1.72 trillion in infrastructure from FY 2024–2030, xylene demand is surging across construction, paints, and coatings sectors.

- Japan: High demand for durable, high-performance materials in automotive and industrial coatings drives xylene consumption. The country also focuses on refining technology advancements and environmental safety standards.

- Europe: Despite strict environmental regulations, countries like Germany and France maintain steady xylene demand due to its application in high-performance coatings, automotive parts, and the chemical industry.

MARKET TRENDS

Rising End-Use Demand and Advancements in Refining Technologies to Drive Market Growth

The market is gaining momentum due to its widespread application in producing Purified Terephthalic Acid (PTA), which is essential for manufacturing polyester used in packaging, textiles, and consumer goods. Additionally, increasing demand for solvents and chemicals in the automotive, construction, and industrial sectors is further fueling the market expansion. Technological advancements in refining and petrochemical processing are also playing a key role, as they enable higher efficiency and yield of the product from crude feedstock. These factors collectively contribute to the growth and diversification of the market.

MARKET DYNAMICS

MARKET DRIVERS

Growing Industrial Applications and Urbanization to Drive Product Demand

The rising industrialization and urbanization, especially in emerging economies significantly drives the product demand across various applications, including paints, coatings, adhesives, and chemical processing. As infrastructure projects expand, the need for high-performance solvents also increases, which directly boosts product consumption. Additionally, its crucial role in producing plastics, resins, and synthetic fibers makes it integral to modern industrial development. Advancements in petrochemical refining technologies are further improving production efficiency, enhancing product’s availability for key industries. With the increasing use of advanced manufacturing techniques and sustainable chemical solutions, the global market will have significant growth in the coming years.

MARKET RESTRAINTS

Fluctuation in the Raw Material Prices Hinder Market Growth

Fluctuations in the prices of raw materials, particularly crude oil and petrochemical feedstocks, significantly impact the profit margins and manufacturing costs for producers. Rising crude oil prices drive up production expenses, which reduces profit margins, while lower raw material costs enhance profitability. To mitigate these challenges, companies focus on cost optimization strategies, such as improving refining efficiency and exploring alternative feedstocks. These factors act as restraints on the growth of the market during the forecast period.

MARKET OPPORTUNITIES

Technological Innovations and Infrastructure Development to Boost Market Growth

Advancements in refining technologies, automation, and AI-driven process optimization are giving new opportunities in the market. Industries are increasingly investing in digital monitoring systems and process automation to enhance production efficiency, reduce operational costs, and ensure product consistency. Additionally, rising investments in infrastructure development, mainly in emerging economies, are driving product demand in construction materials, paints, and coatings. The expansion of petrochemical facilities and modernization of manufacturing plants further support market growth, creating a strong way for product consumption in the coming years.

- According to a CRISIL (Credit Rating Information Services of India Limited) report, India is projected to invest approximately USD 1.72 trillion in infrastructure between fiscal years 2024 and 2030, more than doubling the USD 804 billion spent in the previous seven years. This substantial investment is expected to boost the product demand used in construction materials, paints, and coatings.

MARKET CHALLENGES

Rising Health and Environmental Concerns Create Challenges for the Market

The market faces significant challenges due to health and environmental concerns. Prolonged exposure to xylene can lead to serious health-related problems such as respiratory problems, neurological disorders, and skin irritation, particularly for workers handling the chemical, prompting strict safety regulations and handling protocols. Additionally, the product’s toxic nature poses environmental risks as well, as improper disposal or accidental spills can contaminate air, water, and soil, harming ecosystems. These concerns have led to stringent regulatory restrictions on its production and usage. Manufacturers are now focusing on developing safer alternatives to comply with environmental standards and minimize risks.

TRADE PROTECTIONISM

Geopolitical tensions have heightened resource nationalism, prompting governments to impose tariffs, trade barriers, and export restrictions to protect domestic industries. These measures pose challenges for the market by disrupting supply chains, raising costs, and limiting global trade opportunities.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Growing Demand for Para-Xylene to Drive Market Expansion Across Multiple Industries

Based on type, the market is classified into ortho-xylene, meta-xylene, para-xylene, and mixed xylene.

The para-xylene segment held the leading market share, driven by its extensive use in the production of Purified Terephthalic Acid (PTA), a key raw material for polyester fibers, Polyethylene Terephthalate (PET) bottles, and plastic products. The rising demand for polyester-based textiles, driven by urbanization and population growth, is significantly boosting its consumption. Additionally, the growing packaging sector is increasing the need for PET-based materials. The growing industrialization, infrastructure development, and advancements in petrochemical refining technologies are further strengthening the production and supply of para- type of product.

On the other hand, ortho-xylene plays a crucial role in the production of phthalic anhydride, a key ingredient used in making plastics, resins, and coatings. These materials are essential in industries such as construction and automotive, where durability and performance are crucial. Additionally, this type is used in the production of plasticizers, which enhances the flexibility of PVC plastics used in pipes and cables. The rising demand for weather-resistant coatings and high-performance plastics is driving the growth of the segment.

Meta-xylene is primarily used to produce isophthalic acid, which is an essential component in high-performance polymers and coatings. These materials are valued for their strength, chemical resistance, and heat stability, which makes them ideal for applications in aerospace, automotive, and industrial coatings. As industries seek more durable and advanced materials, the demand for meta-types of products is expected to grow in the coming years.

Mixed-xylene, a combination of the three-types including ortho, meta, and para-xylene, and is highly known for its high solvency properties, which makes it an essential component in paints, adhesives, and automotive applications. In the paint and coatings industry, it ensures smooth blending, uniform texture, and quick drying, which are crucial for high-performance finishes in the construction and automotive sectors. Additionally, it is used in the automotive industry as fuel additives, cleaning agents, and protective coatings for vehicle components. With urbanization and infrastructure expansion, the demand for this type continues to rise.

By Application

Expanding Demand for Solvents in Industrial and Commercial Sectors Supports its Dominance

Based on application, the market is classified into solvents, monomers, and others.

Solvents accounted for the largest xylene market share in 2024. Xylene, as a solvent, plays a critical role in various industries, such as paints, coatings, and adhesives. It has excellent solvency properties, which allow for the efficient dissolution of resins, dyes, and other organic compounds, ensuring smooth application and uniform consistency in industrial and commercial coatings. Xylene-based solvents are also used in the automotive and construction industries to thin paints and clean equipment. Additionally, it is used in laboratories and chemical processing for sample preparation and purification. With industrial expansion and growing demand for high-performance coatings and adhesives, the solvent segment continues to expand significantly.

Xylene-based monomers serve as essential building blocks in the production of plastics, synthetic fibers, and resins, making them vital for industries like textiles, packaging, and construction. Additionally, these monomers contribute to engineering plastics and high-performance resins. With the growing demand for lightweight materials, the monomers segment is expected to grow.

By End-User

Plastics & Polymers Segment Accounted for Highest Share owing Product Adoption in PET Production

Based on end-user, the market is classified into paints & coatings, plastics & polymers, adhesives, and others.

The plastics & polymers segment holds the largest share of the market, largely due to its essential role in producing PET and other widely used polymers. PET is a key material in packaging, textiles, and various consumer goods due to its durability and lightweight properties. The growing need for high-quality and durable plastic materials in industries such as packaging is driving the demand for xylene-based polymers. Additionally, continuous advancements in polymer manufacturing techniques, along with increasing investment in the petrochemical sector, are further fueling the market growth.

The rising demand for paints & coatings is significantly driving the product consumption, as it acts as a vital solvent that enhances durability and drying properties in coating formulations. In the construction industry, coatings are essential for protecting buildings, bridges, and infrastructure from wear and environmental exposure. Moreover, in the automotive sector, it is used in high-quality paints that provide corrosion resistance and surface protection for vehicles. With increasing urbanization, expanding infrastructure projects, and a growing automotive sector, the need for high-performance coatings continues to grow, which further drives the product demand.

Additionally, the adhesives industry relies on the product for its excellent solvency and bonding properties, which makes it an important component in both industrial and commercial adhesive formulations. Xylene effectively dissolves various resins and synthetic polymers, facilitating the production of adhesives with enhanced strength and durability. The continuous expansion in construction activities, increased furniture production, and advancements in automotive design collectively drive the product demand in adhesives.

Xylene Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific

Asia Pacific Xylene Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the global market with the value of USD 50.57 billion in 2026, driven by rapid industrialization, urbanization, and infrastructure development in China, India, Southeast Asia, and Japan. The growing demand for plastics, paints, adhesives, and coatings in the construction and manufacturing industries significantly boosts product consumption. Additionally, rising investments in petrochemical facilities, expanding automotive production, and increasing demand for packaging materials further help in market growth. Government initiatives supporting smart city projects, affordable housing, and industrial expansion also contribute to the strong product demand in the region.

North America

North American dominated the market with a valuation of USD 14.61 billion in 2026, driven by strong demand from the automotive, construction, and packaging industries. The U.S. and Canada heavily rely on the product for manufacturing high-performance coatings, adhesives, and plastics, which are essential in industrial and commercial applications. Government initiatives supporting development and industrial modernization are further increasing consumption. Additionally, the presence of major petrochemical manufacturers and advancements in refining and processing technologies contribute to market expansion in the region.

Europe

Europe dominates the global market with the value of USD 8.30 billion in 2026, The market in Europe is influenced by strict environmental regulations and a strong industrial base, particularly in the chemical and automotive sectors. The product demand remains high due to its extensive use in coatings, adhesives, and plastics. Major economies such as Germany, France, and the U.K. are investing in advanced manufacturing technologies, enhancing production efficiency and product quality. Additionally, the increasing use of products in the pharmaceutical and packaging industries, along with continuous infrastructure development, drives market growth.

Rest of the World

In regions such as Latin America, and the Middle East & Africa, the market is expanding due to increasing industrialization, urban development, and government-run initiatives in construction and manufacturing. The product’s use as a solvent in paints, coatings, and adhesives is growing, particularly in Middle Eastern countries, where large-scale infrastructure projects are underway. Additionally, rising investments in the petrochemical sector, with the need for cost-effective materials in developing nations, are helping in market expansion. Political stability, foreign investments, and the adoption of advanced refining technologies are further contributing to the xylene market growth in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Innovation and Strategic Expansion to Strengthen Market Position of Leading Manufacturers

The market is highly competitive, with major players focusing on capacity expansion, technological advancements, and strategic mergers & acquisitions to enhance their market presence. Key global companies include LG Chem, MITSUBISHI GAS CHEMICAL COMPANY, INC., Honeywell International Inc., INEOS, Shell plc, and Reliance Industries Limited. These companies compete based on product quality, cost efficiency, and regional market penetration. Additionally, advancements in refining technologies and the growing demand from industries such as plastics and coatings further give competition. While global leaders dominate established markets, regional players are increasingly investing in production capabilities to capture growth opportunities in emerging economies.

LIST OF KEY XYLENE COMPANIES PROFILED

- MITSUBISHI GAS CHEMICAL COMPANY, INC. (Japan)

- Chevron Phillips Chemical Company LLC. (U.S.)

- Indian Oil Corporation Limited (India)

- LG Chem (South Korea)

- Honeywell International Inc. (U.S.)

- Eastman Chemical Company (U.S.)

- China National Petroleum Corporation (China)

- INEOS (U.K.)

- Reliance Industries Limited. (India)

- Exxon Mobil Corporation (U.S.)

- Shell plc (U.K.)

KEY INDUSTRY DEVELOPMENTS

- December 2022: INEOS and SINOPEC finalized a 50/50 joint venture to construct a new petrochemical complex in Tianjin, China, which includes a 1.2 million tons per annum cracker and a 500 ktpa High-Density Polyethylene (HDPE) plant. The project is fully operational, which strengthens the companies’ presence in the petrochemical industry.

- April 2021: Tecnimont Private Limited was awarded an Engineering, Procurement, Construction, and Commission (EPCC) contract by Indian Oil Corporation Limited to develop a comprehensive Paraxylene (PX) and Purified Terephthalic Acid (PTA) plant in Paradip, Odisha. The project valued at USD 450 million aims to enhance India’s petrochemical production capacity.

REPORT COVERAGE

The global market analysis provides market size and forecast by all segments included in the report. It includes details on market dynamics and trends expected to drive the market in the forecast period. It offers information of key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.30% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 89.58 billion in 2026 and is projected to reach USD 126.22 billion by 2034.

In 2025, the market value stood at USD 48.34 billion.

The market is expected to exhibit a CAGR of 4.30% during the forecast period of 2026-2034.

The plastics & polymers segment led the market by end-user.

Growing industrial applications and rising urbanization are driving the market.

LG Chem, MITSUBISHI GAS CHEMICAL COMPANY, INC., Honeywell International Inc., INEOS, Shell plc, and Reliance Industries Limited are some of the leading players in the market.

Asia Pacific dominated the market in 2025 in terms of share.

Growing demand for high-performance coatings and adhesives, expanding petrochemical and polymer industries, and increasing investments in industrial manufacturing are some of the factors expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us