3 Cylinder ICE Market Size, Share & Industry Analysis by Component (Piston, Crankshaft, Cylinder, Connecting Rod, and Others), By Vehicle Type (Two-Wheelers, Passenger Vehicles, and Light Commercial Vehicles), By Fuel Type (Petrol and Diesel), By Engine Capacity (Less than 1000 CC, 1000 CC- 1200 CC, and More than 1200 CC), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

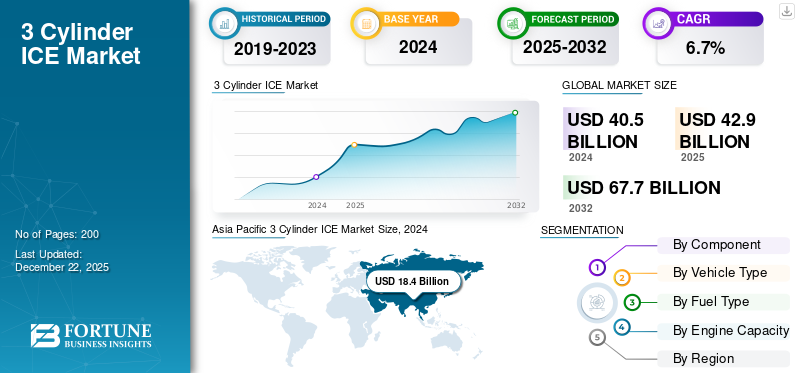

The global 3 cylinder ICE market size was valued at USD 40.5 billion in 2024. The market is projected to grow from USD 42.9 billion in 2025 to USD 67.7 billion by 2032, exhibiting a CAGR of 6.7% during the forecast period.

3 cylinder ICEs are internal combustion engines with three cylinders typically arranged in an inline configuration. They are valued for their compact design, lower weight, and reduced friction, which lead to improved fuel efficiency and lower production costs compared to traditional four-cylinder engines. With the adoption of turbocharging and direct injection technologies, these engines are increasingly able to deliver higher power outputs while meeting stringent emission standards.

The market is growing steadily, driven by regulatory pressure for cleaner mobility, the trend of vehicle downsizing, and rising demand in emerging economies. Automakers are integrating three-cylinder platforms into both entry-level passenger cars and hybrid models to balance efficiency with performance. The Asia Pacific remains a leading region, supported by increasing vehicle production in India and China, while developed markets in Europe are adopting 3CEs for compliance with carbon emission targets.

Several major automotive manufacturers are actively innovating. For instance, Ford’s 1.0 L EcoBoost 3 Cylinder ICE highlights advancements in compact turbocharged systems; BMW’s B38 engine family demonstrates modular design for premium models; while General Motors’ Small Gasoline Engine series emphasizes aluminum construction and direct injection. Continuous innovation in lightweight materials, fuel injection, and hybrid compatibility is strengthening the growth outlook for this market.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Fuel-Efficient and Compact Engines to Drive Market Growth

Global emission regulations and fuel economy standards are pushing automakers to downsize engines without compromising performance. 3 cylinder ICEs offer an efficient balance, delivering reduced friction, lower weight, and cost savings compared to larger four-cylinder counterparts. Their compact size also supports integration into smaller vehicles and hybrids, aligning with consumer demand for affordable and efficient mobility. These benefits are anticipated to drive product adoption, impelling 3 cylinder ICE market growth.

- For instance, in May 2024, Renault and Geely launched the HORSE Powertrain joint venture, aiming to produce 5 million hybrid and efficient combustion engines annually, with three-cylinder platforms at the core of their strategy.

MARKET RESTRAINTS

Higher Vibration and Noise Levels Compared to Four-Cylinder Engines to Restrict Market Expansion

Despite efficiency gains, 3 cylinder ICEs face limitations in noise, vibration, and harshness. Their odd cylinder configuration leads to less natural balance, often requiring additional engineering solutions such as counter-balancer shafts or sound insulation. These measures increase costs and sometimes offset the original advantage of engine downsizing.

- For example, independent vehicle reviews highlight that cars using Ford’s 1.0 L EcoBoost often report higher vibration and cabin noise compared to equivalent four-cylinder rivals.

MARKET OPPORTUNITIES

Integration of 3 Cylinder ICEs with Hybrid and Electric Powertrains to Create Lucrative Growth Opportunities

Electrification creates a strong growth avenue, as 3 cylinder ICEs are well-suited for hybrid powertrains and range extenders. Their small footprint, lightweight structure, and flexible output make them ideal companions for electric motors in hybrid-electric and plug-in hybrid vehicles. This positions them as enablers of cost-effective electrification in both mature and emerging markets.

- For instance, in June 2025, Mahindra announced its development of a 1.2 L three-cylinder turbocharged engine integrated with a series-parallel hybrid system for the upcoming XUV 3XO, aimed at improving fuel efficiency and lowering emissions in compact SUV applications.

3 CYLINDER ICE MARKET TRENDS

Increasing Adoption of Turbocharging and Lightweight Materials for Performance Gains

Turbocharging, direct injection, and lightweight alloys are being widely adopted to enhance the output and efficiency of 3 cylinder ICEs. Automakers are using modular designs, allowing the same engine family to be scaled across 3-, 4-, and 6-cylinder units. This approach reduces R&D costs while enabling high performance from compact, efficient engines.

- For example, Jaguar Land Rover’s Ingenium family includes inline-3 engines built with aluminum blocks, variable valve timing, and turbochargers, ensuring flexibility across multiple vehicle categories.

MARKET CHALLENGES

Balancing Cost-Efficiency with Consumer Expectations for Refinement and Durability Stands as a Market Growth Challenge

The main challenge is balancing cost-efficiency with consumer expectations of refinement, durability, and performance. As 3 cylinder ICEs move into heavier or premium vehicles, customers demand smoother operation and long-term reliability. Meeting these demands requires engineering investment that can erode the affordability advantage.

- For example, compact SUVs using turbocharged 3 cylinder ICEs, such as the Nissan Rogue or Ford Escape, have faced consumer skepticism over long-term reliability despite their efficiency benefits.

Download Free sample to learn more about this report.

Segmentation Analysis

By Component

Critical Role in Power Delivery and Emission Compliance Supported Cylinder Segment’s Dominance in 2024

On the basis of the component, the market is classified into piston, cylinder, crankshaft, connecting rod, and others.

In 2024, the global market was dominated by the cylinder segment, owing to its critical role in determining engine performance, durability, and emission compliance. Automakers are investing in lightweight alloys and modular cylinder blocks to improve thermal efficiency and reduce weight. This focus on innovation, combined with regulatory pressure, has reinforced the dominance of cylinders in the 3 cylinder ICE architecture.

- For instance, General Motors’ Small Gasoline Engine (SGE) family features an aluminum cylinder block with integrated exhaust manifold, helping achieve both weight reduction and emission control.

By Vehicle Type

Rising Demand for Compact and Fuel-Efficient Cars to Propel Passenger Vehicles Segment Growth

Based on vehicle type, the market is segmented into two-wheelers, passenger vehicles, and light commercial vehicles (LCVs).

To know how our report can help streamline your business, Speak to Analyst

In 2024, the market was dominated by passenger vehicles, particularly hatchbacks and compact sedans. The growth of this segment is attributed to the rising demand for affordable, fuel-efficient cars, coupled with manufacturers increasingly adopting three-cylinder platforms for cost and emission advantages. Automakers are also expanding their offerings in this category with turbocharged variants to enhance power delivery.

- For example, BMW offers its B38 3 Cylinder ICE across the Mini and BMW 2 Series, catering to urban passenger car markets with high efficiency and performance balance.

By Fuel Type

Consumer Preference for Affordable and Low-Emission Options Strengthens Petrol Segment

Based on fuel type, the market is segmented into petrol and diesel.

In 2024, the petrol segment dominated the global market due to shifting consumer preference toward gasoline vehicles in light of stringent emission norms on diesel. Petrol engines are relatively cheaper to manufacture, lighter in weight, and provide smoother operation, making them the preferred choice for compact passenger cars. Declining diesel acceptance in Europe and growth in emerging Asian economies have further reinforced this dominance.

- For instance, Ford’s 1.0 L EcoBoost three-cylinder petrol engine is widely adopted across its Fiesta, Focus, and EcoSport models globally.

By Engine Capacity

Optimal Balance of Power and Efficiency Drove 1000–1200 CC Segmental Dominance in 2024

Based on engine capacity, the market is segmented into less than 1000 CC, 1000–1200 CC, and more than 1200 CC.

In 2024, the 1000–1200 CC category held the largest market share owing to its optimal balance between fuel efficiency and power delivery. Engines in this range are widely used in passenger cars and compact SUVs, offering flexibility across both emerging and developed markets. Automakers are adopting turbocharged 1.0–1.2 L engines to meet stricter efficiency and emission requirements without compromising performance.

- For example, Volkswagen’s 1.0 TSI 3 Cylinder ICE, available in Polo and T-Roc, delivers robust performance while maintaining compliance with Euro 6d emission standards.

3 Cylinder ICE Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and rest of the world.

Asia Pacific

Asia Pacific 3 Cylinder ICE Market Size, 2024 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominated the global 3 cylinder ICE market share in 2023 and continued its leadership in 2024. Factors supporting this dominance include large-scale vehicle production in China and India, rising consumer demand for compact and affordable passenger cars, and active involvement of governments in enforcing fuel efficiency and emission regulations. The region’s presence of domestic automakers, combined with increasing penetration of global brands, further strengthens its leadership in the global market.

- For instance, in November 2023, Tata Motors scaled the production of its Revotron 1.2 L 3 Cylinder ICE for compact passenger vehicles in India, showcasing the region’s strong demand for such platforms.

North America

Other regions such as Europe and North America are also witnessing notable growth. The steady growth of the North American market is supported by offerings such as Ford’s 1.0 L EcoBoost and GM’s three-cylinder variants, which are increasingly integrated into compact SUVs and crossovers.

Europe

The Europe market growth is supported by emission regulations such as Euro 6d and the accelerated adoption of turbocharged three-cylinder petrol engines. Countries including Germany, the U.K., and France are leading adoption through their compact and premium passenger car markets. Europe is expected to maintain steady growth over the coming years.

Rest of the World

Over the forecast period, markets in the rest of the world, including Latin America and the Middle East & Africa, are projected to grow at a moderate pace. Rising urbanization and demand for entry-level passenger cars in these regions are expected to drive adoption, although the scale remains smaller compared to Asia Pacific and Europe.

COMPETITIVE LANDSCAPE

Key Industry Players

Diversified Portfolios and Strategic Alliances to Emerge as Key Steps to Strengthen Market Leadership

The 3 cylinder ICE market displays a semi-concentrated structure worldwide, with both established automakers and regional manufacturers contributing to overall supply. Leading players are investing in advanced designs, modular engine platforms, and hybrid compatibility to maintain a competitive edge. Their global presence is reinforced by wide product portfolios, extensive distribution networks, and collaborative development initiatives.

Ford Motor Company, BMW AG, and General Motors are among the dominating players in this space. These companies leverage their three-cylinder portfolios, such as Ford’s EcoBoost family, BMW’s B38 modular engines, and GM’s Small Gasoline Engine (SGE) series, to address both mass-market and premium vehicle segments. Their leadership is further supported by global sales reach, sustained R&D investments, and integration of turbocharging and lightweight materials to enhance performance and compliance with emission norms.

In addition, other prominent players include Renault Group, Tata Motors, Toyota Motor Corporation, and Hyundai Motor Company. These companies are undertaking strategies such as regional manufacturing expansion, alliances for hybrid technologies, and product launches targeting compact passenger cars and SUVs.

- For instance, in July 2024, Tata Motors unveiled its new 1.2 L three-cylinder direct-injection turbo-petrol engine, branded “Hyperion,” which will power the upcoming Curvv coupe-SUV. This underscores the company’s push into premium compact SUV offerings.

LIST OF KEY 3 CYLINDER ICE COMPANIES PROFILED

- Ford Motor Company (U.S.)

- Toyota Motor Corporation (Japan)

- Hyundai Motor Group (South Korea)

- Volkswagen Group (Germany)

- Volvo (Sweden)

- PSA Stellantis (Netherlands)

- BMW Group (Germany)

- Triumph Motorcycles (U.K.)

- Suzuki Motor Corporation (Japan)

- Geely Group (China)

KEY INDUSTRY DEVELOPMENTS

- July 2025: Chinese OEM ZXJC launched the 820RR, a high-performance motorcycle powered by a newly developed three-cylinder inline engine producing 150 hp and 85 Nm of torque, marking its entry into the middleweight superbike segment.

- June 2025: Yamaha filed patents for a 3-cylinder engine paired with an electric turbocharger, aimed at significantly improving throttle response and efficiency.

- November 2024: Honda revealed a water-cooled V3 engine with an integrated electric compressor (e-blower). This world-first design is aimed at delivering stronger torque at low RPM while improving packaging through compact dimensions.

- December 2023: CFMoto, a Chinese OEM, filed a patent for a new 675 cc 3-cylinder engine. This indicates a clear strategy to enter the middleweight performance bike space where triples are highly valued for their balance of torque and revving capability.

- May 2023: BMW Motorrad filed a patent for an innovative stressed-member frame design that directly integrates its upcoming 3-cylinder engine as a load-bearing structural component.

REPORT COVERAGE

The global market analysis provides an in-depth study of market size and forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market over the forecast period. It offers information on technological advancements, new product launches, key industry developments, and details on partnerships and mergers & acquisitions. The research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.7% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component · Piston · Crankshaft · Cylinder · Connecting Rod · Others |

|

By Vehicle Type · Two-Wheelers · Passenger Vehicles · Light Commercial Vehicles |

|

|

By Fuel Type · Petrol · Diesel |

|

|

By Engine Capacity · Less than 1000 CC · 1000 CC- 1200 CC · More than 1200 CC |

|

|

By Geography · North America (By Component, Vehicle Type, Fuel Type, Engine Capacity, and Country) o U.S. o Canada o Mexico · Europe (By Component, Vehicle Type, Fuel Type, Engine Capacity, and Country) o U.K. o Germany o France o Italy o Rest of Europe · Asia Pacific (By Component, Vehicle Type, Fuel Type, Engine Capacity, and Country) o China o Japan o India o South Korea o Rest of Asia Pacific · Rest of the World |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 40.5 billion in 2024 and is projected to reach USD 67.7 billion by 2032.

In 2024, the Asia Pacific market value stood at USD 18.4 billion.

The market is expected to exhibit a CAGR of 6.7% during the forecast period of 2025-2032.

In 2024, the passenger vehicle segment led the market by vehicle type.

The key factor driving the market is the rising demand for fuel-efficient and compact engines.

Ford Motor Company, Hyundai Motor Group, Volkswagen Group, and PSA Stellantis are some of the prominent players in the market.

Asia Pacific dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us