Acute Wound Care Market Size, Share & Industry Analysis, By Type (Advanced Wound Dressing [Antimicrobial Dressings, Alginate Dressings, Foam Dressings, Hydrocolloid Dressings, and Others], Traditional Wound Care Products, Negative Pressure Wound Therapy, Bioactives, and Others), By Application (Surgical Wounds and Others), By End-user (Hospitals, Clinics, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

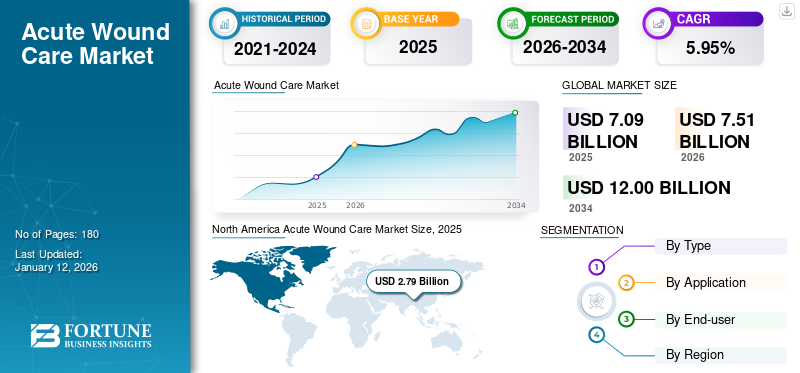

The global acute wound care market size was valued at USD 7.09 billion in 2025. The market is projected to grow from USD 7.51 billion in 2026 to USD 12 billion by 2034, exhibiting a CAGR of 5.95% during the forecast period. North America dominated the Acute Wound Care Market with a market share of 39.28% in 2025.

Acute wound care refers to the management of wounds that heal efficiently within a few weeks through the normal stages of healing, such as surgical incisions or traumatic injuries. The growing prevalence of burn injuries is contributing to an increasing number of surgical procedures among patients. This, along with growing awareness about the benefits of wound care among patients, is also resulting in the growing demand for these products in the market. Key market players, such as 3M, Smith+Nephew, and ConvaTec Inc., are focusing on research and development activities to develop and introduce novel products, which is expected to further strengthen their position in the global acute wound care market.

- According to 2024 statistics published by the National Center for Biotechnology Information (NCBI), it was estimated that about 600,000 individuals suffer from burn injuries in the U.S. annually.

The market is poised for substantial growth, driven by technological advancements, the increasing prevalence of chronic diseases, and a rising number of surgical procedures.

Global Acute Wound Care Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 7.09 billion

- 2026 Market Size: USD 7.51 billion

- 2034 Forecast Market Size: USD 12 billion

- CAGR: 5.95% from 2026–2034

Market Share:

- Region: North America dominated the market with a 39.28% share in 2025. The region's growth is driven by the increasing per capita healthcare expenditure, a high number of surgical procedures, and the presence of adequate reimbursement policies for wound care products.

- By Application: The Surgical Wounds segment held the largest market share in 2024. The segment's dominance is attributed to the rising number of surgical procedures for various conditions, which in turn increases the incidence of surgical wounds requiring effective care.

Key Country Highlights:

- Japan: As a key country in the fast-growing Asia Pacific region, Japan is experiencing market growth due to a rising aging population, an increasing incidence of surgical site infections, and a growing number of new product launches by key players.

- United States: The market is fueled by a high prevalence of acute wounds, including an estimated 600,000 burn injuries annually and a high volume of cardiac surgical procedures (approximately 275,000 to 300,000). The market is also supported by consistent new product approvals from the U.S. FDA, such as 3M's Veraflo Therapy line.

- China: Growth is supported by a rising geriatric population and increasing per capita healthcare expenditure, which was reported at USD 354.3. The country's expanding healthcare infrastructure is also driving the demand for advanced wound care products.

- Europe: The market is propelled by a significant and increasing prevalence of acute wounds. In the U.K., for example, the prevalence of acute wounds saw a 71% increase between 2012 and 2018. The market is also driven by a high volume of surgical procedures and new product launches by major European companies.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Prevalence of Acute Wounds to Augment Market Demand

The growing prevalence of acute wounds, including burns and surgical wounds, is resulting in an increasing number of patient admissions and treatment rates globally. The growing geriatric population is another vital factor resulting in the increasing patient population suffering from these conditions. Thus, the growing geriatric population, along with a rising awareness of advanced wound care, is likely to boost the adoption of these products in the market.

- According to the 2023 data published by the China State Council, there are 297 million people aged 60 and above living in China.

The rapid rise in surgical site infections is further increasing the number of patient admissions, resulting in a growing focus of key players to launch novel acute wound care products in the market. According to a 2024 article published by the National Center for Biotechnology Information (NCBI), it was reported that approximately 0.5% to 3.0% of all surgical patients develop a surgical site infection.

Additionally, the increasing prevalence of acute wounds has prompted governments globally to create awareness campaigns promoting early diagnosis and treatment. This, along with improved reimbursement policies in developed and emerging countries, is expected to drive the adoption of these solutions and drive growth in the global acute wound care market.

MARKET RESTRAINTS

Lower Diagnosis and Treatment Rates in Emerging Countries to Limit Product Adoption

Acute wounds such as surgical wounds, burn injuries, and others can progress from mild to severe if not assessed, diagnosed, and treated promptly. However, a limited number of healthcare facilities, particularly in emerging countries such as Brazil, China, and India, is resulting in reduced diagnosis and treatment rates in these countries.

- For instance, according to the 2025 data published by International Citizens Insurance, it was reported that there are about 600 hospitals in South Africa.

Additionally, limited access to well-developed healthcare infrastructure and a lack of established guidelines and action plans by governing bodies further limit the adoption of these products in the market. These challenges are key factors behind the lower diagnosis and treatment rates, hampering the growth of the market globally.

MARKET OPPORTUNITIES

Enhanced Reimbursement Policies to Offers Lucrative Market Growth Opportunities

The global demand for advanced wound care products is increasing, significantly supporting the global acute wound care market growth. Improvements in reimbursement policies and expanded medical coverage are expected to further facilitate product adoption globally. Key players are focusing on developing novel products and jointly providing reimbursement facilities, further expected to offer broad opportunities for global market growth in the future.

- In July 2023, Redress's product ActiGraft PRO product, an advanced whole blood wound care solution, became commercially available in the U.S. It is eligible for Medicare and Medicare Advantage reimbursement nationally under codes NCD 270, G-0465, 270.3, and G-0460. The procedure is reimbursed at around USD 1,726.0 per application, for up to 20 applications per hospital outpatient facility and wound care center.

Additionally, various government initiatives are contributing to the development of better wound care infrastructure and services, thereby supporting product adoption and market demand.

Therefore, availability of adequate reimbursements policies along with increasing demand about the advanced products are presenting an opportunity in the market. Moreover, growing investment in R&D activities and the introduction of novel wound healing solutions by key players are further expected to accelerate the adoption of acute wound care products globally.

MARKET CHALLENGES

High Cost Associated with Treatment to Restrict Adoption of Advanced Wound Care Products

The growing prevalence of acute wounds worldwide and the increasing demand for effective and advanced wound care management solutions are some of the major factors expected to drive market growth. However, the cost-to-benefit ratio of current wound care products is often witnessed as unfavorable.

The high cost of advanced wound care products and higher changing frequencies of the products exert a huge economic cost burden on both healthcare systems and patients in developed and emerging countries.

- For instance, according to 2025 data published by the Centers for Disease Control & Prevention (CDC), the estimated cost of surgical site infection is about USD 3.3 billion. These infections also lead to an extended hospital length of stay of about 9.7 days, with the hospitalization costs increasing by USD 20,000 per admission.

This, along with an extended recovery period and lack of reimbursement policies, especially in emerging countries, has limited the adoption of advanced wound care products, thereby restricting market growth.

Other Prominent Challenges

Lack of Awareness: Insufficient awareness regarding proper wound management, especially in developing regions, is a critical challenge in the market.

ACUTE WOUND CARE MARKET TRENDS

Rising Demand for Advanced Solutions Is a Key Market Trend

One of the most prominent trends in the global market is the shift from traditional to advanced wound management products. Increasing awareness of the clinical effectiveness of advanced wound care products compared to conventional dressings used in wound care is driving a preference for more innovative options such as advanced wound dressings and related technologies.

- According to 2022 data published by Wound Management & Prevention (WMP), the demand for advanced wound care is projected to increase by 25.0% by 2060.

Key players are constantly engaging in R&D initiatives to introduce advanced products aimed at capturing emerging opportunities in the market. Advanced wound care solutions such as specialized dressings offer excellent features such as high absorbency, anti-adhesive properties, and tissue regeneration capabilities, making them suitable for wound care needs among the patient population. Therefore, an increasing number of companies engaged in developing and expanding their advanced wound care portfolios is expected to further boost the adoption of these products in the market.

Other Prominent Trends:

- Telemedicine and Digital Care: The rise of telemedicine and digital care has been a major factor driving innovation in the market to execute remote wound treatments.

Download Free sample to learn more about this report.

Trade Protectionism

Trade protectionism can impact the market by affecting the supply chain and the cost of raw materials, leading to increased prices for wound care products. This may hinder market growth, especially in regions heavily reliant on imports for medical supplies.

Segmentation Analysis

By Type

Increasing Number of Product Launches to Boost Advanced Wound Dressing Segment Growth

Based on type, the market is divided into advanced wound dressing, traditional wound care products, negative pressure wound therapy, bioactives, and others. The advanced wound dressings are further divided into antimicrobial dressings, alginate dressings, foam dressings, hydrocolloid dressings, and others.

The advanced wound dressings segment dominated the market in 2024. The growing prevalence of burn injuries, along with the growing focus of key players to launch novel advanced wound dressings such as alginate dressings, foam dressings, and others, is driving higher adoption rates, thereby boosting the advanced wound dressing segmental growth.

- For instance, according to 2022 data published by Science Direct, an estimated 3.6 million patients suffering from orthopedic injuries visit hospitals each year in the U.S.

The traditional wound care products and negative pressure wound therapy segments are also expected to grow with a considerable market share. The growth is due to the growing focus of leading players on acquisitions and mergers aimed at expanding their geographical presence and strengthening their product portfolio.

By Application

Growing Prevalence of Surgical Procedures Encouraged Segment Growth

Based on application, the market is classified into surgical wounds and others.

The surgical wounds segment dominated the global acute wound care market in 2024. The increasing number of surgical procedures for various conditions, including neurological disorders, cardiovascular conditions, and others, is contributing to the rising number of surgical wounds, thereby supporting the demand for wound care products in the market.

- For instance, according to 2022 statistics published by the National Center for Biotechnology Information (NCBI), approximately 275,000 to 300,000 cardiac surgical procedures were performed in the U.S.

The others segment is expected to grow at a considerable CAGR during the forecast period. The growth is due to the growing prevalence of burn injuries and other conditions, prompting key players to intensify their R&D activities and launch novel products to the market.

By End-user

Favorable Reimbursement Policies Encouraged Hospitals Segment Growth

Based on end-user, the market is segmented into hospitals, clinics, homecare settings, and others. The hospitals segment held the largest market share in 2024, driven by factors, including a growing number of hospitals, favorable reimbursement policies for wound care products, and other related factors. This results in the rising demand for wound care products in healthcare settings.

- For instance, according to the 2025 statistics published by the American Health Association (AHA), there are about 6,093 hospitals in the U.S.

The clinics segment is also expected to grow with the considerable CAGR during the forecast period due to a preferential shift by patients toward clinics, owing to their easy accessibility, convenience, and reduced waiting time. Additionally, the growing availability of advanced products incorporating novel technology in these settings is further likely to contribute to the growth of the segment in the market.

Acute Wound Care Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Acute Wound Care Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market, generating a revenue of USD 2.79 billion in 2025. The growing per capita healthcare expenditure, increasing number of surgical procedures, adequate reimbursement policies, growing number of key players introducing novel products are some of the factors contributing to the growth of the market.

- For instance, in January 2023, Convatec Inc. launched the ConvaFoam in the U.S. market. It is an advanced foam dressing designed to address the needs of healthcare providers and their patients. It can be used on a spectrum of wound types and stages, while also providing skin protection.

In the U.S., the increasing prevalence of burn injuries and rising awareness about the benefits of early diagnosis and treatment are major factors fueling the demand for acute wound care products in the market.

Europe

Europe is expected to grow with a significant rate during the forecast period. The growth is due to the increasing prevalence of acute wounds among patients, coupled with a rising focus on the establishment of new R&D facilities among the key players. This, along with the growing preference for the treatment of acute wounds at-home care settings, is further expected to support the demand for these products in the market.

- For instance, according to 2021 statistics published by Wounds UK, an increase of 71% was observed in the prevalence of acute wounds from 2012 to 2018 in the U.K.

Asia Pacific

Asia Pacific is projected to witness a considerable CAGR during the forecast period. The growing aging population, rising incidence of surgical site infections, and rising per capita healthcare expenditure are among the major factors expected to drive market growth. Additionally, the rising number of key players are focusing on launching new products with an aim to strengthen their portfolios, further supporting market expansion.

- For instance, according to 2024 CEIC Data, China’s per capita healthcare expenditure was reported USD 354.3.

Latin America

Increasing emphasis on the development of healthcare infrastructure, growing awareness about the benefits of early diagnosis and treatment of acute wounds, and increasing number of product launches are some of the major factors contributing to the growth of the market in the region. This, along with the increasing number of hospitals and clinics in the region, is also expected to support the growth of the market in the region.

- For instance, according to 2020 data published by Elsevier B.V., around 1.0 million people suffer from burns annually in Brazil.

Middle East & Africa

The region is witnessing growth owing to the increasing healthcare expenditures, increasing number of surgical procedures, and growing prevalence of acute wounds. Moreover, awareness initiatives such as regional conferences and greater acceptance of advanced wound care products, particularly in Saudi Arabia are expected to support market growth.

- In April 2024, the 2nd Global Conference on Advanced Wound Care and Wound Management was organized in Dubai, UAE. Centered on the theme "Innovations in Wound Care: Holistic Approaches for Enhanced Healing," the event provided a platform to explore new insights and advancement in wound care and management.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Introduction of New Products to Boost their Market Share

The global market is consolidated, with companies such as 3M, Smith+Nephew, and Mölnlycke Health Care AB, accounting for a significant share.

3M is one of the key players in the industry, supported by several growth factors, such as its strong geographical presence, continuous focus on new product launches, and strategic acquisitions and partnerships.

- In April 2023, 3M received U.S. FDA approval for two innovative products under the 3M Veraflo Therapy line, 3M Veraflo Cleanse Choice Complete Dressing and 3M V.A.C. Veraflo Cleanse Choice Dressing, aimed at expanding its product offerings.

On the other hand, increasing focus on research and development activities to introduce novel advanced wound care products such as foam dressings and hydrogel dressings among key players, including Coloplast A/S and Mölnlycke Health Care AB, is anticipated to contribute to the expanding global acute wound care market share and further drive innovation in the industry.

LIST OF KEY ACUTE WOUND CARE COMPANIES PROFILED

- Coloplast A/S (Denmark)

- Convatec Inc. (U.K.)

- Mölnlycke Health Care AB (Sweden)

- Smith+Nephew (U.K.)

- 3M (U.S.)

- Medline Industries, LP (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Plastod S.p.A (Italy)

KEY INDUSTRY DEVELOPMENTS

- January 2024: Coloplast A/S launched the Biatain Silicone Fit for pressure injury prevention and wound management with an aim to expand its product offerings in the U.S.

- April 2024: Smith+Nephew launched the negative pressure wound therapy system Renasys Edge with an aim to strengthen its product portfolio globally.

- April 2024: Mölnlycke Health Care AB announced the acquisition of P.G.F. Industry Solutions GmbH, the manufacturer of Granudacyn, a range of solutions for wound cleansing and moisturizing, with an aim to strengthen its presence in wound cleansing products.

- September 2023: Coloplast A/S acquired Kerecis, a company in the biologics wound care segment, with an aim to expand its product offerings for wound care products.

- January 2023: Convatec Inc. launched ConvaFoam, a family of advanced wound dressings with an aim to address the needs of healthcare providers and their patients.

REPORT COVERAGE

The global market report provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the prevalence of acute wounds in key regions/countries, key industry developments, new product launches, technological advancements in acute wound care products, and details on partnerships, mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 5.95% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 7.09 billion in 2025 and is projected to reach USD 12 billion by 2034.

In 2025, the market value stood at USD 7.09 billion.

The market is expected to exhibit a CAGR of 5.95% during the forecast period of 2026-2034.

The advanced wound dressing segment led the market by type.

The key factors driving the market are the increasing number of surgical procedures, increasing prevalence of acute wounds, and rising number of product launches.

3M, Smith+Nephew, and Mölnlycke Health Care AB are the top players in the market.

North America dominated the market in 2025.

Increased awareness of early diagnosis and treatment, the launch of technologically advanced products, and an increase in the demand for these products in developing countries are some of the factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us