Additive Masterbatch Market Size, Share & Industry Analysis, By Type (Antimicrobial, Antioxidant, Flame Retardants, and Others), By Carrier Resin (Polyethylene (PE), Polypropylene (PP), Polystyrene (PS), and Others), By End-use Industry (Packaging, Automotive, Building & Construction, Agriculture, Consumer Goods, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

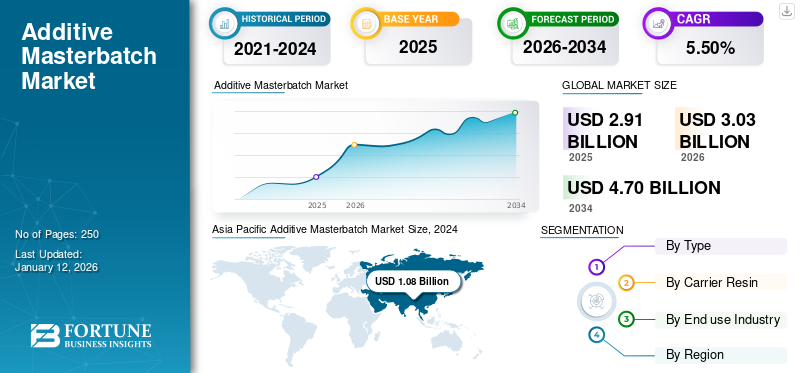

The global additive masterbatch market size was valued at USD 2.91 billion in 2025. The market is projected to grow from USD 3.03 billion in 2026 to USD 4.70 billion by 2034, exhibiting a CAGR of 5.50% during the forecast period. Asia Pacific dominated the additive masterbatch market with a market share of 37% in 2025.

An additive masterbatch is a solid or liquid mixture where additives are dispersed in a carrier material, typically a polymer compatible with the base plastic. This formulation allows for the uniform distribution of additives during processing, such as extrusion or injection molding, enhancing the final product’s properties. The global market is experiencing notable growth, driven by the wide range of packaging, automotive, construction, and consumer goods applications. Additive masterbatches enhance the functionality of plastics by improving characteristics such as UV resistance, flame retardancy, antimicrobial properties, and processability. Clariant, Ampacet Corporation, Cabot Corporation, and PLASTIKA KRITIS S.A. are the key players operating in the market.

ADDITIVE MASTERBATCH MARKET TRENDS

Development of Antimicrobial, Antiviral, and Antistatic Masterbatches, Especially in Post-Pandemic Era, is a Prominent Trend

The post-pandemic era has created a heightened demand for materials with enhanced safety features. This includes everything from antimicrobial surfaces in public spaces to antiviral products designed for healthcare and consumer use. Governments and international organizations are also increasingly focusing on health, hygiene, and safety standards, thereby driving manufacturers to invest in materials that meet these evolving regulations.

Consumers are more conscious about product safety and hygiene than ever before, directly influencing manufacturers to develop innovative masterbatches that offer antimicrobial, antiviral, and antistatic properties. As the demand for these specialized masterbatches grows, there is also an increasing push for sustainable solutions. Manufacturers are working to develop antimicrobial, antiviral, and antistatic masterbatches that are eco-friendly and have a minimal environmental footprint.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Value-Added Plastic Products to Boost Market Growth

Industries such as packaging, automotive, construction, and electronics increasingly seek plastics that offer superior properties. Additive masterbatches enable incorporating functionalities such as UV resistance, flame retardancy, antimicrobial properties, and anti-static behavior, enhancing the performance and durability of plastic products. In sectors where visual appeal is crucial, such as consumer goods and packaging, additive-type masterbatches allow for vibrant colors, special effects, and improved surface finishes. This capability supports brand differentiation and meets consumer preferences for visually appealing products.

Further, the push toward sustainability has increased the use of recycled plastics. Additive types of masterbatches play a pivotal role in enhancing the properties of recycled material and improving their mechanical strength, color consistency, and overall quality, thereby supporting circular economy practices.

MARKET RESTRAINTS

Increasing Volatility in Raw Material Prices to Limit Market Expansion

The production of masterbatches relies heavily on petroleum-based raw materials such as polymers, pigments, and additives. Fluctuations in the prices of these commodities introduce uncertainty into cost projections, hindering market stability and profitability. Rising raw material prices elevate the cost of product manufacturing.

For instance, polymers can constitute up to 50% of the total production cost, making the industry highly sensitive to price changes in these inputs. This volatility makes it challenging for manufacturers to anticipate and manage production expenses, negatively impacting their bottom line.

MARKET OPPORTUNITIES

Focus on Sustainability and Eco-Friendly Solutions to Positively Impact Market Growth

Governments across the globe are implementing stringent regulations to reduce plastic waste and promote the use of sustainable materials. These policies drive the demand for products that enhance plastics' recyclability and biodegradability. For instance, regulations in the European Union and North America encourage the adoption of eco-friendly masterbatches in various industries.

Moreover, consumers increasingly prioritize environmentally friendly products, leading to a surge in plastic demand with reduced environmental impact. Additive masterbatches that enable the production of biodegradable and recyclable plastics are becoming essential in meeting consumer preferences.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Rising Applications in Healthcare and Medical Industries Boosted Antimicrobial Segment Growth

Based on type, the market is classified into antimicrobial, antioxidant, flame retardants, and others.

The antimicrobial segment accounted for the largest global market share, driven by its widespread application in industries where hygiene and microbial resistance are paramount. These additives are essential in manufacturing medical devices, hospital furnishings, and equipment that require a high hygiene standard to prevent healthcare-associated infections. Further, governments and regulatory bodies globally are implementing strict guidelines to ensure product safety and hygiene. For instance, the U.S. Food and Drug Administration (FDA) and Environmental Protection Agency (EPA) have established rigorous standards for antimicrobial products, particularly in the healthcare and food sectors.

The antioxidant segment is expected to witness steady growth over the forecast period. They are essential in extending the lifespan of plastic products by preventing degradation, making them vital in packaging and automotive applications.

By Carrier Resin

Packaging Industry Expansion and Need for Sustainable Solution to Drive Polyethylene (PE) Segment

Based on carrier resin, the market is divided into Polyethylene (PE), Polypropylene (PP), Polystyrene (PS), and others.

Polyethylene (PE) will continue to account for the largest additive masterbatch market share. PE’s flexibility and durability make it a preferred choice for packaging applications. Additive masterbatches enhance properties, including UV Resistance and antimicrobial features, catering to the increasing demand for high-performance packaging materials. Furthermore, the push for recyclable and eco-friendly plastics has led to the development of PE masterbatches that improve recyclability and reduce environmental impact.

Polypropylene (PP) is likely to grow significantly, owing to innovations in masterbatch formulations and the development of PP products with specialized properties, expanding their application in various sectors. PP’s lightweight and high-impact resistance make it suitable for automotive components.

By End-use Industry

Enhanced Product Protection and Sustainability Initiatives to Boost Packaging Segment Growth

On the basis of end-use industry, the market is segmented into packaging, automotive, building & construction, agriculture, consumer goods, and others.

The packaging segment dominated the market share in 2024. Additive masterbatches improve barrier properties, UV resistance, and antimicrobial characteristics, extending shelf life and ensuring product safety. The shift toward recyclable and biodegradable packaging materials increases the demand for masterbatches that facilitate these properties.

The automotive segment is expected to experience notable growth during the forecast period. These masterbatches enable the production of lightweight plastic components, contributing to improved fuel efficiency. Additives such as UV stabilizers and flame retardants increase the lifespan and safety of automotive parts.

The building and construction segment is likely to grow considerably as the flame retardant additives help meet stringent building codes and safety standards. Moreover, they provide UV protection and thermal stability to construction materials, ensuring longevity.

Additive Masterbatch Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Additive Masterbatch Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the global market with a 37% share in 2026. Rapid industrialization in countries such as China and India fuels the demand in the packaging, automotive, and construction sectors. Increasing urban populations drive the need for infrastructure and consumer goods, and boost the product demand. Government investments in infrastructure and a shift toward eco-friendly materials enhance the additive masterbatch market growth.

China leads the Asia Pacific market due to its robust manufacturing sector, particularly electronics, automotive, and packaging. The country’s focus on sustainable production processes has increased the demand for biodegradable masterbatches.

North America

North America is experiencing significant growth driven by automotive, packaging, and healthcare demand. The healthcare industry’s need for antimicrobial and high-performance plastics boosts the masterbatch applications. The U.S. leads the North American market, strongly emphasizing innovative, high-quality plastic products and an extensive consumer goods sector. The growing adoption of recycled plastics and government regulations promoting sustainability fuel the market.

Europe

Europe is the second-largest market for masterbatches. Stringent regulations such as the European Green Deal and REACH promote the adoption of eco-friendly masterbatches. Emphasis on recycling and reducing environmental impact accelerates the use of biodegradable and recycled content masterbatches. High-quality plastic products are in demand across the packaging, automotive, and construction industries. Germany, France, and Italy are the prominent European countries due to their well-established manufacturing sectors and commitment to sustainable practices.

Latin America

Latin America shows consistent growth, with countries, including Brazil and Argentina are leading the demand for plastic additives. The growing packaging and automotive industries are further driving the market growth. Rising technological advancements support the development of specialized masterbatches. Brazil is at the forefront, with major players including Petrobras and Braskem contributing to the market.

Middle East & Africa

The market in the Middle East & Africa region is expected to witness considerable growth in the near future. This region is an emerging market with increasing demand in the packaging, automotive, and consumer goods sectors. Growing industrialization activities and urbanization boost the need for plastic additives. Countries such as UAE and South Africa are witnessing increased demand for plastic additives, driven by expanding construction and packaging industries.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Expansion and Acquisitions by Key Companies Resulted in Their Dominating Positions in Market

The global market is fragmented with companies such as Clariant, Ampacet Corporation, Cabot Corporation, PLASTIKA KRITIS S.A., Plastiblends, Tosaf, Penn Color Inc., and others, along with small and medium regional players operating in different parts of the globe. Companies are exploring new markets through expansion and acquisition to gain a competitive advantage. For instance, leading players invest in emerging regions, particularly Asia Pacific, to establish a foothold and influence global market share dynamics.

LIST OF KEY ADDITIVE MASTERBATCH COMPANIES PROFILED

- Clariant AG (Switzerland)

- Ampacet Corporation (U.S.)

- Cabot Corporation (U.S.)

- Avient Corporation (U.S.)

- Plastika Kritis S.A. (Greece)

- Plastiblends India Ltd. (India)

- LyondellBasell Industries (Netherlands)

- Penn Color, Inc. (U.S.)

- Tosaf Group (Israel)

- RTP Company (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Avient Corporation unveiled a series of UV-resistant additive masterbatches tailored for agricultural films. These masterbatches aim to enhance the durability and lifespan of greenhouse films, contributing to improved crop protection and agricultural productivity.

- March 2025: Clariant announced the launch of a new range of biodegradable additive masterbatches designed to enhance the sustainability of packaging materials. This development aligns with the company’s commitment to providing eco-friendly solutions in response to increasing environmental regulations and consumer demand.

- February 2025: Ampacet introduced a novel antimicrobial additive masterbatch aimed at improving the hygiene of food packaging materials. This product is engineered to inhibit bacterial growth, extending packaged goods' shelf life and ensuring consumer safety.

- May 2024: Cabot Corporation has launched a new product line of REPLASBLAK universal circular black masterbatches made with certified sustainable materials. This launch marks the introduction of two new products, the industry's first-ever universal circular black masterbatches featuring content certified by the International Sustainability & Carbon Certification (ISCC PLUS).

- October 2022: Clariant introduced new additives at K 2022 to promote the sustainable evolution of plastics. These additives help prevent scratches and marks on the surfaces of products during handling, transportation, and end use. This is especially advantageous for applications prone to scuffing, such as interior automotive parts, such as dashboards and door panels, casings for household appliances, cosmetics packaging, and lightweight luggage.

REPORT COVERAGE

The global additive masterbatch market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on key regions/countries, key industry developments, new product launches, and details on partnerships, mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.50% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Carrier Resin

|

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.03 billion in 2026 and is projected to reach USD 4.70 billion by 2034.

In 2025, the market value stood at USD 1.08 billion.

The market is expected to exhibit a CAGR of 5.50% during the forecast period of 2026-2034.

The antimicrobial segment led the market by type.

Focus on sustainability and eco-friendly solutions is expected to drive market growth.

Clariant, Ampacet Corporation, Cabot Corporation, PLASTIKA KRITIS S.A., Plastiblends, Tosaf, and Penn Color Inc. are the top players in the market.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us