AI in Clinical Trials Market Size, Share & Industry Analysis, By Offering (Software /Platforms and Services) By Technology (Machine Learning, Natural Language Processing, and Others), By Application (Patient Recruitment & Retention, Trial Design & Protocol Optimization, Data Collection & Management, Predictive Analytics & Outcome Modeling, and Others), By Specialty (Oncology, Neurology, Cardiovascular, and Others), By End User (Pharmaceutical Companies, Contract Research Organizations (CROs), and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

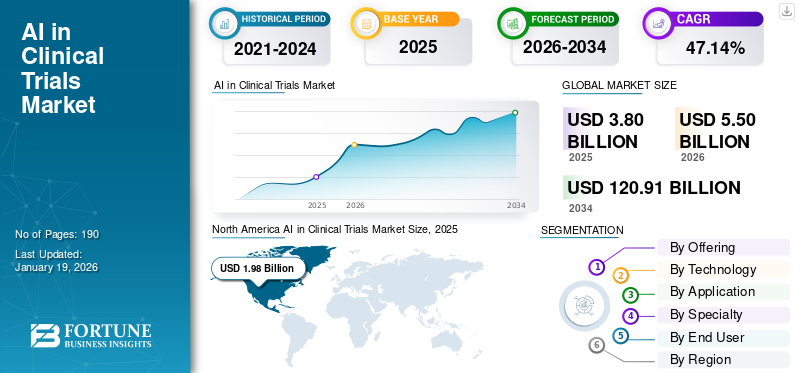

The global AI in clinical trials market size was valued at USD 3.8 billion in 2025 and is projected to grow from USD 5.5 billion in 2026 to USD 120.91 billion by 2034, exhibiting a CAGR of 47.14% during the forecast period. North America dominated the AI in clinical trials market with a market share of 52.26% in 2025.

The integration of Artificial Intelligence (AI) tools in clinical trials is witnessing a strong upward trajectory in recent years. These AI technologies are applied across the clinical trial design, execution, monitoring, and analysis of clinical trials.

High influx of investment, focus of technological advancements, and advantages offered by these technologies are prominently driving the market growth.

Furthermore, the market encompasses several major players with IQVIA Inc., Dassault Systèmes, and AiCure at the forefront. Broad product portfolio with innovative launches, and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Adoption of AI due to Rising Clinical Trial Costs and Complexity to Propel the Market Growth

Increasing adoption of AI-based solutions to reduce timelines and costs associated with clinical trials is a prominent driver for the AI in clinical trials market growth. The drug development process requires high investment with lengthy timelines and high failure rates. Artificial intelligence based solutions help in reducing costs by streamlining recruitment, automating data cleaning, and enabling adaptive designs. Owing to these advantages, several pharmaceutical companies, contract research organizations, and other entities involved in clinical trials are shifting their focus on the integration of such tools.

Additionally, AI also addresses the increasing costs and risks that pharmaceutical and biotechnology companies face across the clinical trial lifecycle, making it an important driver of market expansion.

- In September 2022, IQVIA Inc. published a report which compared decentralized clinical trial (DCT) models vs traditional trial models across productivity, quality, and trial delivery metrics. The study further stated that DCT-enabled trials delivered measurable reductions in both time and cost vs traditional workflows.

MARKET RESTRAINTS

Data Privacy and Regulatory Compliance to Restrict Market Expansion

Concerns associated with patient data and requirement of compliance with strict regulatory guidelines slowers the adoption of AI based tools in multinational trials. Strict regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in Europe create barriers to cross-border data exchange and multi-site collaborations. This results in additional cost and time to trial operations, in turn limiting the overall market growth to certain extent.

- For example, in September 2021, an article was published in Springer Nature Link, which explained the challenges for protecting health information and privacy in a new era of artificial intelligence.

MARKET OPPORTUNITIES

Expansion in Emerging Markets to Create Lucrative Growth Opportunities

With the rapidly evolving marketspace for pharmaceutical products, the manufacturing of products is moving out of in-house facilities and toward outsourcing. Several studies and surveys also stated the growing trend of outsourcing manufacturing services. Regions such as Asia Pacific, Latin America, and Middle East & Africa offer cost advantages and untapped populations, but trial efficiency requires AI to handle fragmented health data and optimize logistics.

- For instance, according to the 19th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production published in April 2022, around 30% of the total respondents are planning to offshore their more than half of the clinical trials/operations to China, India, or any other low-cost country in the next five years.

MARKET CHALLENGES

Challenges Associated with Integration of Traditional IT Systems to Hamper Market Growth

One of the significant factors challenging the market growth is integration with legacy IT systems used by pharmaceutical companies and CROs. The integration cost of modern AI platforms into traditional IT systems, fragmented electronic data capture (EDC) systems, and paper-based records creates challenges in adoption, resulting in operational inefficiencies. As a result, even when pharmaceutical companies invest in advanced AI tools, their full potential is often underutilized due to bottlenecks in connecting with existing infrastructure.

- For instance, a study published in January 2022 in Frontiers in Medicine demonstrated the issues of multiple data sources and data integration challenges for machine learning in precision medicine.

AI IN CLINICAL TRIALS MARKET TRENDS

Shift toward Decentralized & Hybrid Trials is a Significant Market Trends

In recent years, the marketspace for clinical trials is witnessing a shift toward decentralized & hybrid trials. The adoption of decentralized clinical trial (DCT) elements such as remote patient monitoring, telemedicine, remote labs, and investigational-product distribution has increased notably since COVID-19. These approaches rely on a digital platform to capture data, enhance participant engagement, logistics, and monitoring. Thus, owing to these advantages offered by AI tools in conducting decentralized and hybrid trials, the adoption of hybrid trials is growing.

- For instance, according to a survey published in October 2021, decentralized clinical trial adoption jumped from around 28% pre-pandemic to around 87% during/after COVID-19 pandemic, with approximately 95% planning to increase use.

Download Free sample to learn more about this report.

Segmentation Analysis

By Offering

High Demand for Outsourcing Contributed to Growth of Services Segment

On the basis of offering, the market is classified into software/platforms and services.

The services segment accounted for the dominant AI in clinical trials market share in 2026, representing 52.74% of the total market share. The growing demand for services due to the shifting trend toward CROs and specialized service providers to implement AI-driven solutions across various stages of clinical trials have significantly driven the segment growth. Moreover, the rising complexity of multi-country, decentralized, and adaptive trials has amplified outsourcing, with CROs integrating AI tools into their service offerings to deliver end-to-end trial support. Medidata, and AiCure are some of the prominent players that offer services in this market.

To know how our report can help streamline your business, Speak to Analyst

By Technology

High Usage of Machine Learning Contributed to Segmental Growth

On the basis of technology, the market is classified into machine learning, natural language processing, and others.

The machine learning segment accounted for the leading share of the market in 2026, representing 55.90% of the total market share. It is a most versatile and widely applied technology. These AI algorithms can process massive, complex datasets in a shorter timeline resulting in reduced trial timelines and costs. Its scalability across multiple applications results in its widespread integration, thus driving the segment growth. IQVIA Inc. and Dassault Systèmes are some of the major players in the market that offer ML based AI solutions for clinical trials.

The natural language processing segment is expected to grow at a CAGR of 44.74% over the forecast period.

By Application

Growing Demand for Quick Clinical Trials Leads to Growth of Patient Recruitment and Retention Segment

In terms of application, the market is categorized into patient recruitment & retention, trial design & protocol optimization, data collection & management, predictive analytics & outcome modeling, and others.

The patient recruitment & retention segment captured the largest AI in clinical trials market share in 2026, accounting for 31.45% of the total market share. In 2025, the segment is anticipated to dominate with 32.7% share. AI-powered recruitment and retention platforms play an important role in addressing challenges associated with enrollment and retention of patients. This results in faster completion of clinical trials by significantly reducing trial delays and costs.

- For instance, in November 2024, researchers from the National Institutes of Health (NIH) announced the development of an AI algorithm that helps in speeding up the process of matching potential volunteers to relevant clinical research trials listed on ClinicalTrials.gov.

The predictive analytics & outcome modeling segment is expected to witness 52.05% growth rate over the forecast period.

By Specialty

Increasing Usage of Artificial Intelligence in Oncology Clinical Trials Supplemented Segment Growth

Based on specialty, the market is segmented into oncology, neurology, cardiovascular, and others.

The oncology segment held the dominant position in 2026, accounting for 39.25% of the total market share. Factors fostering the dominance of this segment include high clinical trial volume, complexity of new drug molecules, and use of AI for biomarkers for disease detection. In addition, growing focus on precision oncology is further expected to boost the segment growth throughout the forecast period.

- For instance, according to an article published by The Institute of Cancer Research in March 2025, a new AI fingerprint technology was developed by scientists that can accurately show how cancer cells respond to new drugs.

The neurology segment is set to flourish with a growth rate of 48.98% growth across the forecast period.

By End User

Active Involvement in Artificial Intelligence Implementation by Pharmaceutical Companies Propelled Segment Growth

Based on end-user, the market is segmented into pharmaceutical companies, contract research organizations (CROs), and others.

In terms of end-user, in 2024, the global market was dominated by pharmaceutical companies. Emphasis on high R&D investment for AI integration, access to massive clinical and real-world patient datasets making it easier to deploy AI, focus on partnerships with solution providers, and strong regulatory alignment are few key factors supporting the dominance of this segment. Furthermore, the segment is set to hold 59.9% share in 2025.

- For instance, in November 2021, Novartis AG partnered with Microsoft to accelerate the discovery & development of innovative medicines.

In addition, the contract research organizations (CROs) segment is projected to grow at a CAGR of 48.56% during the study period.

AI in Clinical Trials Market Regional Outlook

By geography, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America AI in Clinical Trials Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America captured the leading position in 2025, valued at USD 1.98 billion, and also took the dominating share in 2026 with USD 2.87 billion. This dominance can be attributed to factors such as strong presence of global leaders, high R&D spending by the U.S. pharmaceutical and biotechnology industry, and acceptance of digital end points by the regulatory bodies (U.S.FDA). In 2026, the U.S. market is estimated to reach USD 2.64 billion. The increasing number of clinical trials in the country supported the growing demand for AI solutions in the region.

- For instance, according to an article published by Pharmaceutical Research and Manufacturers of America in March 2025, the U.S. biopharmaceutical industry invested over USD 30 billion directly in clinical trial sites across the U.S. in 2023.

Other regions such as Europe and Asia Pacific are anticipated to witness a notable growth in the coming years. During the forecast period, the European region is projected to record the growth rate of 44.81%, which is the third highest amongst all the regions and touch the valuation of USD 0.75 billion in 2025. This is primarily due to the high trial activity in oncology and rare diseases in these regions and rising government investments in AI and biotech leading to high demand for these solutions. Backed by these factors, countries including the UK market is projected to reach USD 0.23 billion by 2026, while the Germany market is projected to reach USD 0.26 billion by 2026 and France to record USD 0.14 billion in 2025.

After Europe, the market in Asia Pacific is estimated to reach USD 0.83 billion in 2025 and secure the position of second-largest region in the market. In the region, Japan market is projected to reach USD 0.27 billion by 2026, the China market is projected to reach USD 0.31 billion by 2026, and the India market is projected to reach USD 0.24 billion by 2026.

Over the study period, Latin America and Middle East & Africa regions would witness a moderate growth in this marketspace. The Latin America market in 2025 is set to record USD 0.15 billion as its valuation. Government initiatives to modernize health IT and trial infrastructure further drive usage in these regions. In Middle East & Africa, GCC is set to attain the value of USD 0.04 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Technologically Advanced Product Offerings coupled with Strong Presence of Key Companies in Leading Regions Supported their Leading Position

The market space for global AI in clinical trials market represents a semi-concentrated structure with presence of few dominant players complemented by a growing group of mid-sized innovators and specialized startups. IQVIA and Medidata (a Dassault Systèmes company) are some of the prominent entities in the market that leverage their scale, established relationships with pharmaceutical companies, and end-to-end clinical trial platforms.

- For instance, in January 2025, IQVIA and NVIDIA Corporation signed a collaboration agreement to accelerate the use of AI in life sciences and healthcare.

The other notable players Deep 6 Ai which was recently acquired by Tempus in 2025, Antidote Technologies, and AiCure are focusing on specific key areas such as patient recruitment, protocol optimization, and adherence monitoring, supported by funding and partnerships with pharma/CROs. Their agility allows them to innovate quickly, and witness a strong growth in the near future.

LIST OF KEY AI in CLINICAL TRIALS COMPANIES PROFILED

- IQVIA Inc. (U.S.)

- Dassault Systèmes (France)

- AiCure (U.S.)

- Insilico Medicine (U.S.)

- TEMPUS (U.S.)

- Median Technologies (France)

- Saama (U.S.)

- IBM (U.S.)

- NVIDIA Corporation (U.S.)

- Phesi (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2025: PhaseV, and Bioforum signed a strategic partnership agreement to boost the efficiency of clinical trials through advanced AI/ML technology.

- June 2025: Advarra introduced the Council for Responsible Use of AI in Clinical Trials with focus on accelerating innovation in clinical trials.

- June 2025: Veeda Lifesciences entered in partnership with Mango Sciences, a U.S. based healthcare AI and data company to leverage AI capabilities in clinical trials services.

- April 2025: ConcertAI and Bayer AG signed a multi-year agreement to accelerate clinical development in precision oncology. Through this, Bayer will use artificial intelligence and machine learning (AI/ML)-derived insights.

- March 2025: A European Medicines Agency committee cleared the use of AIM-NASH – an artificial intelligence (AI) tool in clinical trials. It is aimed to help identify of the severity of a type of fatty liver disease.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 47.14% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Offering · Software / Platforms · Services |

|

By Technology · Machine Learning · Natural Language Processing · Others |

|

|

By Application · Patient Recruitment & Retention · Trial Design & Protocol Optimization · Data Collection & Management · Predictive Analytics & Outcome Modeling · Others |

|

|

By Specialty · Oncology · Neurology · Cardiovascular · Others |

|

|

· |

|

|

By End User · Pharmaceutical Companies · Contract Research Organizations (CROs) · Others |

|

|

By Geography · North America (By Offering, Technology, Application, Specialty, End User, and Country) o U.S. o Canada · Europe (By Offering, Technology, Application, Specialty, End User, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Offering, Technology, Application, Specialty, End User, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Offering, Technology, Application, Specialty, End User, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Offering, Technology, Application, Specialty, End User, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.8 billion in 2025 and is projected to reach USD 120.91 billion by 2034.

In 2025, the market value stood at USD 3.8 billion.

The market is expected to exhibit a CAGR of 47.14% during the forecast period of 2026-2034.

The machine learning segment led the market by technology.

The key factors driving the market are the rise of decentralized and hybrid trials, growing need to manage massive and growing volumes of clinical trial data, and regulatory encouragement.

IQVIA Inc., Dassault Systèmes, and AiCure, are some of the prominent players in the market.

North America dominated the market in 2025.

Increase in demand from pharmaceutical companies for faster trial timelines and supportive regulatory agencies are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us