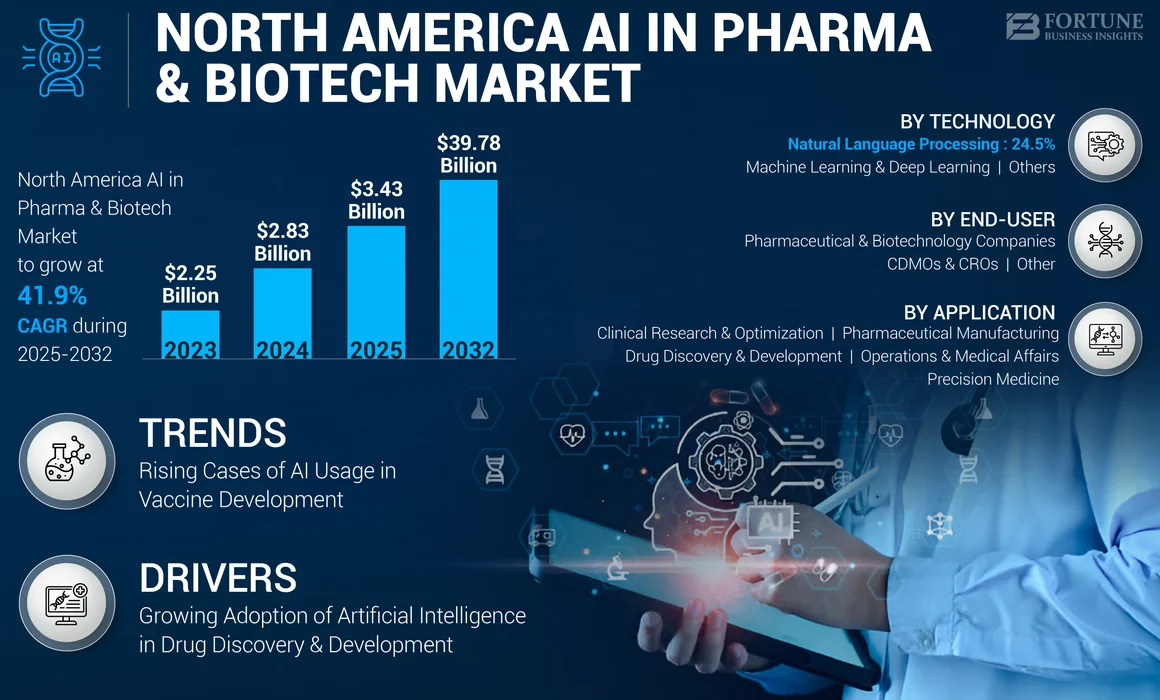

North America AI in Pharma & Biotech Market Size, Share & Industry Analysis, By Technology (Machine Learning & Deep Learning, Natural Language Processing, and Others), By Application (Drug Discovery & Development, Clinical Research & Optimization, Precision Medicine, Pharmaceutical Manufacturing, and Operations & Medical Affairs), By End-User (Pharmaceutical & Biotechnology Companies, CDMOs & CROs, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The North America AI in pharma & biotech market size was valued at USD 2.83 billion in 2024. The market is projected to be worth USD 3.43 billion in 2025 and reach USD 39.78 billion by 2032, exhibiting a CAGR of 41.9% during the forecast period.

The integration of AI in pharma & biotech sectors in North America is transforming drug discovery, development, and personalized medicine. The market is expected to witness a strong upward trajectory in the near future. Some of the key players operating in the market include NVIDIA Corporation, Insilico Medicine, Recursion, and IBM.

Artificial intelligence is applicable in various stages of drug discovery, such as drug designing, drug screening, chemical synthesis, drug repurposing, and polypharmacology. Additionally, AI algorithms can analyze data from large populations to identify trends & patterns, thus helping in predicting the effectiveness of potential drugs for specific patient populations.

Some of the driving factors for the market include increasing adoption of AI in drug discovery and development, a growing number of collaborations between technology providers & pharmaceutical companies, and increasing funding initiatives by private and government sectors.

MARKET DYNAMICS

MARKET DRIVERS

Growing Adoption of Artificial Intelligence in Drug Discovery & Development to Boost Market Growth

Artificial Intelligence plays a crucial role in the drug discovery process. One of the major concerns that can be addressed by implementing AI-powered tools is time consumption as well as the cost required for the complete process. Thus, owing to the various benefits offered by AI over traditional methods, several pharmaceutical & biotechnology companies are adopting AI solutions, particularly in North America.

Furthermore, significant investments are being channeled into AI applications within biotech, with venture capital firms and large pharmaceutical companies forming strategic partnerships to leverage AI capabilities.

- For instance, as per an article published in January 2025 by Scilife N.V., 95% of pharmaceutical companies stated that they have invested or are planning to invest in AI capabilities.

MARKET RESTRAINTS

Data Privacy and Data Breach Concerns Hinder Market Growth

Although the adoption of AI in the pharmaceutical industry is rapidly growing, certain factors are limiting this growth. The concerns associated with data privacy, data breaches, and misuse of patients’ data are some of the major factors limiting the North America AI in pharma & biotech market growth.

Moreover, AI in pharma & biotech industry faces other significant challenges, including issues in growth, diversity, scale, and uncertainty of data. The data required for clinical studies is complex and diverse. This affects the uniformity of the data models, limiting the market’s growth.

MARKET OPPORTUNITIES

Rising Demand for Personalized Medicines to Offer Lucrative Growth Opportunities

In recent years, the market space for personalized medicine has been witnessing exponential growth. This field holds a strong promise in improving patient care by delivering patient-specific, tailored medicines based on individual genetic profiles. Thus, with several advantages of AI in personalized medicine, pharmaceutical companies are now shifting their focus on implementing AI.

- For instance, ReviveMed Inc. is a well-known firm that focuses on revolutionizing the field of precision medicine with the integration of AI.

MARKET CHALLENGES

Concerns Related to Ethical Implications of Using AI in Trials Challenges Market Growth

The ethical implications of using AI in clinical trials are one of the major concerns faced by the industry. The potential for bias in AI algorithms might result in unfairness in data, affecting clinical trial outcomes. Furthermore, patient data privacy concerns due to the risk of misuse of sensitive personal information also create challenges during clinical trials. Additionally, regulatory hurdles in approving the integration of AI in the pharmaceutical industry is also a point of concern. All these factors comprehensively challenge North America AI in the pharma & biotech market.

Moreover, the evolving nature of AI technologies pose a huge challenge in establishing appropriate regulatory frameworks to ensure safety and efficacy. The lack of standardized guidelines for AI-based drug approval is a major challenge faced by the pharmaceutical industry.

The initial investment for AI infrastructure and talent acquisition is large, potentially limiting adoption among smaller firms. Additionally, the Return on Investment (ROI) from AI initiatives may take time to materialize, making it difficult for organizations to justify the expense.

NORTH AMERICA AI IN PHARMA & BIOTECH MARKET TRENDS

Rising Cases of AI Usage in Vaccine Development has evolved as a Significant Market Trend

The adoption of new vaccine development AI platforms, which allow researchers to employ AI and machine learning to model protein and cellular interactions and rapidly advance the science, has aided this innovation acceleration. The data required for the vaccine development process is complex and unformatted. AI-enabled vaccine development models can reduce the time of the research process and produce a medicine effectively, eventually speeding up the treatment time of a single patient. Thus, vaccine development using AI is considered one of the significant trends in the AI in pharma & biotech market in North America.

Artificial Intelligence-based algorithms expedite the identification of potential drug candidates by analyzing vast datasets, thereby reducing the time and cost associated with traditional drug discovery methods.

The incorporation of AI with big data analytics allows for comprehensive analysis of clinical trials, genomic data, and patient records, leading to more informed decision-making. This has resulted in the increasing adoption of AI-powered tools in various aspects of the pharmaceutical field.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a positive impact on the market. The pandemic significantly boosted the use of AI tools by pharmaceutical companies in various aspects. Several vaccine manufacturers shifted toward AI-powered tools for the development of vaccines and drug repurposing.

- For instance, Moderna Inc., a developer of mRNA-based COVID-19 vaccine, used AI to facilitate the synthesis of mRNA sequences. This resulted in mRNA output rising from 30 to 1,000 per month.

However, in 2023 and 2024, the market witnessed slower growth owing to the lesser usage of AI tools for COVID-19-related products. In the coming years, the market is expected to witness strong growth.

Segmentation Analysis

By Technology

Potential to Accelerate Drug Development Led to Dominance of Machine Learning & Deep Learning Segment

On the basis of technology, the market is sub-segmented into machine learning & deep learning, natural language processing, and others. In 2024, the machine learning & deep learning segment dominated the market with the highest North America AI in pharma & biotech market share. The segment is anticipated to maintain its dominance throughout the study period. This can be attributed to the advantages offered by these technologies for pharmaceutical companies. Some of the advantages of machine learning & deep learning include accelerated drug development, improved diagnosis, and enhanced clinical trials, resulting in reduced timelines & costs.

- For instance, Landing AI is a software provider company that offers machine learning platforms for pharmaceutical manufacturing.

On the other hand, the natural language processing segment is projected to witness a notable compound annual growth rate during the study period. Natural language processing has revolutionized the pharmaceutical industry by enhancing the development of treatment plans and optimizing treatment options.

To know how our report can help streamline your business, Speak to Analyst

By Application

Wide Adoption of AI in Drug Discovery & Development Boosted the Dominance of Segment

Based on application, the market is classified into drug discovery & development, clinical research & optimization, precision medicine, pharmaceutical manufacturing, and operations & medical affairs. The drug discovery & development segment held the leading position in 2024. Contributing factors to this dominance include the growing need for the speedy development of innovative therapies to combat various chronic diseases, the rapidly growing adoption of AI in drug discovery, and strategic alliances between pharmaceutical companies & AI technology.

- For instance, in September 2024, Gilead Sciences and Genesis Therapeutics announced a strategic partnership for the discovery and development of new small molecule therapies using AI.

On the other hand, the clinical research & optimization segment is also anticipated to witness considerable growth over the forecast period. As AI can significantly reduce overall time consumption & costs and accelerate the drug discovery process, researchers are keener to adopt these tools.

- For instance, as per an article published in January 2025 by Scilife N.V., timeline reductions of 80% and cost savings of 70% per trial can be achieved through the use of artificial intelligence tools.

Similarly, precision medicine is another application of AI that is witnessing notable growth in the study period. By leveraging AI technologies in personalized medicine, pharmaceutical companies are able to combine a large volume of data from various sources, such as genomic profiles, medical records, wearable device data, and patient-reported outcomes.

By End-User Analysis

Increasing Focus on Integration of AI in Pharmaceutical Workflow Fostered Pharmaceutical & Biotechnology Companies Segment Expansion

Based on end-user, the market is categorized into pharmaceutical & biotechnology companies, CDMOs & CROs, and others. The pharmaceutical & biotechnology companies segment captured the highest share of the market in 2024. An increasing number of investment initiatives, growing adoption of AI-powered tools, and a supportive regulatory environment have majorly driven the segment growth. In addition, the number of products based on AI in the clinical pipeline supports segment growth.

- For instance, in September 2024, AstraZeneca and Immunai Inc. signed a multi-year collaboration agreement for immune system research using AI-powered tools.

The CDMOs & CROs segment is expected to witness a significant growth rate in the near future. Owing to the advantages offered by the integration of AI and the increasing shift toward contract manufacturing, these end-users are also focusing on the use of AI in development & manufacturing workflows.

North America AI in Pharma & Biotech Market Country Outlook

By country, the market is divided into the U.S. and Canada.

U.S.

In 2024, the U.S. dominated the North America AI in pharma & biotech market with a total revenue generation of USD 2.58 billion. The country’s dominance in the market is driven by substantial investments in R&D, a robust technological infrastructure, a favorable regulatory environment, high adoption of AI-powered tools in the drug development process, and other aspects of pharmaceutical workflow coupled with a significant number of collaborations between by key operating players and pharmaceutical companies in the country.

- For instance, in November 2023, Code Ocean partnered with Allen Institute to enhance research in neuroscience. This partnership aims to increase workflow efficiency.

Canada

The Canadian AI in pharma & biotech market is anticipated to witness comparatively slower growth in the coming years. This can be attributed to the increasing adoption of AI among researchers, pharmacies, and Canadian pharmaceutical companies across the country.

COMPETITIVE LANDSCAPE

Key Market Players

Wide Portfolio of Key Players Helps to Gain Leading Positions in the Market

In terms of the competitive landscape, the North America AI in pharma & biotech market reflects a highly fragmented structure. Any single organization does not influence the market’s growth trajectory. The current market shows several characteristics, such as a high number of collaborations between leading pharmaceutical companies and technology providers, an expanding product & service portfolio to fulfill growing market demands, and a rapidly increasing number of new entrants in the market.

NVIDIA Corporation is one of the leading entities in the market. The company has a broad portfolio of AI offerings for pharmaceutical & biotechnology companies. The company also focuses on strategic collaborations to strengthen its market presence.

- For instance, in January 2025, NVIDIA Corporation collaborated with Arc Institute, IQVIA, Mayo Clinic, and Illumina Inc. to enhance drug discovery, genomics, and the healthcare industry.

Other key players operating in the market include Insilico Medicine, Recursion, IBM, Atomwise Inc., Code Ocean, and others. Along with these players, the market comprises several small-scale players who are increasingly emphasizing collaborations and partnerships to expand their offerings.

- For instance, in August 2022, Atomwise Inc. and Sanofi signed a multi-target research collaboration for advanced drug discovery. Under this agreement, Sanofi leveraged the company’s AtomNet platform for computational discovery and research.

Trade Protectionism

Trade policies significantly impact the nature of the global pharmaceutical supply chain. Protectionist measures, such as tariffs and import restrictions, can disrupt the availability of raw materials and components essential for drug development and manufacturing. Companies must navigate these complexities to maintain operational efficiency.

LIST OF KEY NORTH AMERICA AI IN PHARMA & BIOTECH COMPANIES PROFILED:

- Insilico Medicine (U.S.)

- Atomwise Inc. (U.S.)

- BPGbio, Inc. (U.S.)

- IBM (U.S.)

- Code Ocean (U.S.)

- Recursion (U.S.)

- Cloud (U.S.)

- ReviveMed Inc. (U.S.)

- NVIDIA Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025: PathAI, Inc. introduced a new AI-powered tool - PathAssist Derm, to advance dermatology research.

- January 2025: Insilico Medicine signed an agreement with Menarini Group for the development and commercialization of a preclinical small molecule in the oncology space.

- January 2025: Absci Corporation and Owkin signed an agreement for the rapid discovery & designing of novel therapeutics.

- October 2024: Recursion expanded its partnership with Google Cloud to leverage the latter company’s technologies in order to support Recursion's drug discovery platform.

- July 2024: Moderna, a Flagship company Pioneering mRNA technology, raised an additional USD 3.6 billion to apply AI in drug discovery and early-stage clinical trials. This move underscores the growing confidence in AI's potential to revolutionize biotech research.

- March 2024: NVIDIA Corporation introduced two dozen new generative AI microservices for the healthcare industry.

- May 2023: Eli Lilly and Company collaborated with XtalPi for drug discovery using artificial intelligence.

REPORT COVERAGE

The North America AI in pharma & biotech market overview provides a detailed analysis of the industry. It emphasizes key aspects, such as major companies, technology, applications, end users, and a few others. In addition, it includes detailed insights into market dynamics, new product launches, technological advancements, and key industry developments such as mergers, partnerships, and acquisitions.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 41.9% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Technology

By Application

By End-User

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 2.83 billion in 2024 and is projected to reach USD 39.78 billion by 2032.

The market is expected to exhibit steady growth at a CAGR of 41.9% during the forecast period.

By technology, the machine learning & deep learning segment led the market in 2024.

The increasing adoption of artificial intelligence in drug discovery & development is one of the major factors boosting the North American market growth.

NVIDIA Corporation, Insilico Medicine, Recursion, and IBM are some of the major players in the market.

The U.S. dominated the market in 2024.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us