AI in Warehousing Market Size, Share & Industry Analysis, By Component (Hardware, Software, and Services), By Deployment (On-premises and Cloud), By Application (Inventory Management, Order Picking & Sorting, Warehouse Optimization, Predictive Maintenance, and Supply Chain Visibility), By Industry (Logistics & Transportation, Retail & E-commerce, Food & Beverage, Manufacturing, Healthcare, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

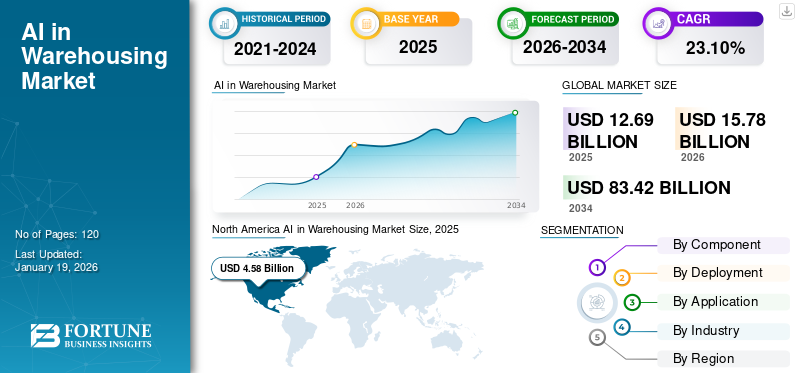

The global AI in warehousing market size was valued at USD 12.69 billion in 2025 and is projected to grow from USD 15.78 billion in 2026 to USD 83.42 billion by 2034, exhibiting a CAGR of 23.10% during the forecast period. North America dominated the market with a share of 36.10% in 2025.

AI is revolutionizing warehouses by automating the internal processes of warehouses. AI-powered technologies are enabling advancements in inventory management, supply chain management, order picking and sorting, predictive maintenance, and other applications. It helps warehouse management systems to make well-informed decisions regarding procurement and transportation. AI-driven software uses algorithms to analyse market trends, historical data, and other relevant factors, contributing to more scalable operations, bolstering market growth.

AI systems provide real-time analytics, which help warehouse managers to make data-driven decisions that play a vital role in improving efficiency and profitability. The ability to track inventory, shipments, and operational performance in real time leads to more effective decision-making. This trend is gaining rapid pace and is expected to boost market growth in the coming years.

The market is dominated by established key players, such as Amazon Web Services, Inc., Honeywell International, Inc., IBM Corporation, Oracle Corporation, and Locus Robotics. These players focus on engaging in partnership with leading warehousing companies and tech providers. Through these partnerships, market players integrate their AI and cloud services into logistics and warehousing operations to strengthen their businesses, further fueling market growth across the globe.

IMPACT OF RECIPROCAL TARIFF

Many AI-enabled solutions used in warehousing, such as AI-powered sensors, robotic systems, and warehouse management software (WMS), are often sourced from countries with established tech hubs, including the U.S., Japan, China, and South Korea. However, the imposition of tariffs under the Trump administration has the potential to increase the cost of importing these critical components, which can result in raising the overall price of implementing AI solutions in warehouses. This rise in cost can significantly hamper smaller businesses that have limited capital to invest in AI infrastructure, due to which they can delay or reduce their AI adoption in their businesses, thereby slowing market growth.

MARKET DYNAMICS

Market Drivers

Growing Adoption of AI Technology in Retail Sector Drives Market Growth

The growing popularity of the online retail sector is putting warehouse facilities under pressure to fulfil customers' expectations for faster and more efficient deliveries. The integration of AI technologies in warehouses plays an important role in enabling quicker processing times, improving warehouse operations, and enhancing inventory management. For instance,

- According to industry experts, in 2023, 56% of businesses have already integrated AI into at least one function. This figure is anticipated to reach 57% in regions such as the Middle East and North Africa.

Furthermore, the adoption of AI technologies such as automation and robotics leads to cost savings by reducing manual intervention and minimizing human errors. Automation helps retail businesses to streamline processes and optimize resource allocation, significantly reducing operational costs. These advantages are major factors contributing to the growth of the AI in warehousing market.

Market Restraints

High Initial Investments May Hinder Market Growth

The initial investment required for AI-enabled warehouse automation systems, including sensors, robotics, and AI software, is highly expensive. This high initial investment makes it difficult for small and medium-sized enterprises (SMEs) and startups to afford advanced AI solutions. Furthermore, integration of AI solutions into existing warehouse infrastructures also requires significant modifications, which adds to the overall cost of adoption. Thus, a higher cost required for the integration of AI-enabled warehouse automation systems may act as a barrier to market growth.

Market Opportunities

Surge in Dependence on AI-Powered Predictive Maintenance Creates Lucrative Opportunities for Market Growth

Warehouses across the globe are increasingly adopting AI-powered predictive maintenance software, owing to its proven ability to reduce downtime by up to 30–50%, extend equipment lifespan by 17-20%, and lower maintenance costs by 7-10%. Predictive algorithms also help optimize usage cycles for sorting machines, conveyor systems, robotic arms, automated guided vehicles (AGVs), and Automated storage/retrieval systems (AS/RS).

In addition, on multiple occasions, equipment failures may lead to accidents. The incorporation of an AI-powered predictive maintenance system eliminates the frequent downtime of the system, thereby enhancing compliance with safety standards. Thus, the growing adoption of AI-powered predictive maintenance systems in warehouses is expected to fuel market growth during the forecast period.

AI in Warehousing Market Trends

Rising Popularity of Autonomous Robots in Warehouse Operations is a Prominent Market Trend

Maintaining accurate inventory has long been a critical yet challenging task for warehouse operators. Traditional manual checks are time-consuming and may lead to human error while performing this task. This task is challenging, especially in large warehouses, where a variety of products need to be maintained correctly to gain customers' trust. To overcome these challenges, large warehouses are increasingly deploying autonomous robots to maintain accurate inventory checks. For instance,

- According to an industry survey, it is projected that 4 million commercial warehouse robots are going to be installed in over 50,000 warehouses by 2025.

Furthermore, warehouses usually store several products of various shapes, weights, and sizes. To handle this product diversity, robots play a vital role in handling the products carefully and reducing the risk of product damage compared to manual handling. Thus, these factors play a crucial role in fueling the AI in warehousing market growth.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Component

Hardware Segment Led Due to Its Rapid Adoption to Boost Operational Efficiency in Warehouses

Based on component, the market is divided into hardware, software, and services.

The hardware segment accounted for the largest market share of 11.97% in 2026. The adoption of AI-enabled hardware, such as robots, sensors, and cameras that automate crucial warehouse functions and enhance operational efficiency, is significantly increasing in warehouses globally. These hardware devices are important for real-time data collection, monitoring, and handling a variety of materials in warehouses.

The software segment is anticipated to grow at the highest CAGR during the forecast period. AI-driven software supports warehouse managers through functionalities such as recording images or video feed for item recognition, barcode scanning, and damage detection. Moreover, it also provides contactless, real-time inspection and inventory verification. This feature is beneficial for warehouses to optimize operations.

By Deployment

Rising Demand for Flexible and Cost-Saving Platforms Propelled Cloud Segment Growth

Based on deployment, the market is bifurcated into on-premises and cloud.

The cloud segment accounted for the largest market share of 13.55% in 2026 and is expected to continue its dominance with the highest CAGR during the forecast period. Cloud platforms offer flexibility, scalability, and cost savings by removing the need for on-premises IT infrastructure. These platforms provide real-time data access and allow for seamless integration with other digital tools and systems. Moreover, they do not require a high initial investment for the deployment of IT infrastructure, which is essential in on-premise platforms.

The on-premises segment is expected to grow at a moderate CAGR during the forecast period, as a few businesses still prefer on-premises platforms, owing to their data security and control over their IT infrastructure.

By Application

Surging Need for Continuous Inventory Tracking Fueled Inventory Management Segment Growth

Based on application, the market is classified into inventory management, order picking & sorting, warehouse optimization, predictive maintenance, and supply chain visibility.

Inventory management captured the largest market share of 9.68% in 2026, owing to its growing reliance on Autonomous Mobile Robots (AMRs) and drones. It enables continuous inventory tracking without shutting down operations. For instance,

- According to industry experts, 52% of warehouse managers expect that increased spending on automation technology would play a vital role in driving warehouse market growth.

Warehouse optimization is anticipated to grow at the highest CAGR during the forecast period. AI technology is mainly used to enhance warehouse operations and streamline the order packing process. Integration of AI technology increases picking speed by 30-50%, with minimal error, boosting segment growth.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Increase in Online Shopping Propelled Retail & E-commerce Segment Growth

Based on industry, the market is categorized into logistics & transportation, retail & e-commerce, food & beverage, manufacturing, healthcare, and others (energy & utilities).

The retail & e-commerce segment accounted for the largest market share in 2024, owing to a rise in online shopping. AI technology helps retailers and e-commerce companies to personalize customer experiences, automate order fulfillment, and manage inventory more effectively in real-time. Multiple retail giants, such as Amazon, Walmart, Flipkart, and others, are significantly investing in incorporating AI technology in their warehouses. For instance,

- Amazon estimates that warehouse automation could save USD 10 billion annually by 2030.

Manufacturing is projected to grow at the highest CAGR during the forecast period. AI-enabled platforms help producers optimize production processes, reduce unplanned frequent breakdowns by up to 50% and increase machine life by 20-30%. For instance,

- According to industry experts, unplanned downtime costs U.S. manufacturers approximately USD 50 billion annually.

Thus, the manufacturing industry is significantly focusing on the adoption of AI technology in its manufacturing process to enhance productivity in a rapidly evolving industrial landscape.

AI IN WAREHOUSING MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America AI in Warehousing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 4.58 billion in 2025 and USD 5.58 billion in 2026. The presence of an advanced digital infrastructure, high internet penetration, a strong presence of leading AI vendors, and prominent investments in automation in North America play a pivotal role in driving market growth in the region. Moreover, market players are focusing on prioritizing operational efficiency and customer service, which are key factors revolutionizing AI in warehousing operations. For instance,

- Walmart, an American multinational retail corporation, predicts that AI and automation are expected to contribute around USD 20 billion in Earnings Before Interest and Taxes (EBIT) by 2029.

In the U.S., AI in warehousing is significantly adopted in retail & e-commerce, transport & logistics, food & beverages, and manufacturing. Robotics and AI technologies play an important role in reducing labor costs. Furthermore, persistent labor shortages across the U.S. further promote the need for AI in warehousing across the country. These factors play an important role in fueling market growth across the U.S. The U.S. market is projected to reach USD 3.9 billion by 2026.

South America

The adoption of AI in warehousing is growing significantly in South America, owing to rising investments in logistics tech ecosystems in countries such as Brazil, Argentina, and Chile. Furthermore, local startups such as Loggi and Intelipost are focusing on implementing AI technology into warehousing and delivery orchestration. These advancements are helping to modernize regional logistics infrastructure and are expected to fuel the market growth across the region.

Europe

In Europe, AI in warehousing is growing at a prominent pace, driven by labor shortage in countries such as Germany and Italy, where an aging population is impacting workforce availability. Moreover, tight labor laws limiting overtime and shift flexibility further hamper warehouse operations. Additionally, rising wage inflation in countries such as Poland, the Czech Republic, and the Netherlands fuels demand for the adoption of AI technology in warehouses. The UK market is projected to reach USD 0.78 billion by 2026, while the Germany market is projected to reach USD 0.77 billion by 2026. For instance,

- In April 2025, Locus Robotics deployed its LocusOne solution at one of France’s leading consumer electronics and home appliance retailers. This deployment is expected to create a significant shift in France’s warehouse operations from manual operations to fully robotic solutions in the country’s warehouse sector.

Middle East & Africa

The Middle East & Africa region is expected to showcase noteworthy growth during the forecast period, driven by rising investments in smart infrastructure, including AI-driven logistics hubs. For instance,

- UAE's DP World is heavily investing in smart warehouse technologies and the Dubai Logistics Corridor to improve its logistics capabilities.

- In Saudi Arabia, initiatives such as NEOM's logistics zone and smart ports are significantly investing in automated warehousing technology to support the country’s digital transformation.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the forecast period. Emerging economies such as Indonesia, India, the Philippines, and Vietnam are developing new Grade-A warehouses and logistics parks. According to industry experts, India’s warehouse stock capacity is expected to double by 2027. Furthermore, logistics hubs in Vietnam and China are expanding rapidly, which is further fueling market growth in the region. The Japan market is projected to reach USD 0.78 billion by 2026, the China market is projected to reach USD 0.8 billion by 2026, and the India market is projected to reach USD 0.57 billion by 2026. For instance,

- In April 2025, Zebra Technologies expanded its channel partner network across India, aiming to expand its business across the country.

Competitive Landscape

KEY INDUSTRY PLAYERS

Top Companies Emphasize New Product Introductions to Increase Their Customer Base

Leading companies are engaged in increasing their global geographical presence by offering industry-specific solutions. They are tactically concentrating on acquisitions and partnerships with regional players to uphold their supremacy across regions. Moreover, major players are unveiling new solutions to boost their consumer base. A rise in continuous R&D investments for product introductions boosts market revenue. Hence, key participants are quickly applying these strategic efforts to sustain their competitiveness in the market.

Long List of AI in Warehousing Companies Studied

- Amazon Web Services, Inc. (U.S.)

- Alphabet Inc. (Google LLC) (U.S.)

- Honeywell International, Inc. (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Locus Robotics (U.S.)

- Zebra Technologies Corporation (U.S.)

- SAP SE (Germany)

- Siemens AG (Germany)

- ABB Ltd. (Switzerland)

- Microsoft Corporation (U.S.)

- Symbotic Inc. (U.S.)

- GreyOrange (U.S.)

- Vecna Robotics, Inc. (U.S.)

- Attabotics Inc. (Canada)

- Mech‑Mind Robotics (China)

- AutoStore AS (Norway)

- Knapp AG (Austria)

- Korber AG (Germany)

- Swisslog (Switzerland)

….and more

KEY INDUSTRY DEVELOPMENTS

- June 2025: Amazon introduced two major AI innovations in its warehouse operations. These advancements include an AI-powered demand forecasting model that supports Amazon’s supply chain and Wellspring, a generative AI mapping technology to optimize warehouse operations.

- May 2025: Siemens expanded its industrial AI offerings by introducing advanced AI agents developed to work effortlessly across industrial applications.

- March 2025: Locus Robotics unveiled LocusINTELLIGENCE, an AI-driven business intelligence software. This platform is built to offer continuous optimization, real-time decision-making, deep operational insights, and achieve improved efficiency.

- March 2025: ABB Ltd. expanded its portfolio in robotic solutions for e-commerce and logistics supply chains. Additionally, the company introduced two new AI-powered functional modules for warehouse operations.

- February 2025: Locus Robotics entered into a partnership with BITO Lagertechnik. Through this collaboration, the company aims to deliver an end-to-end solution to BITO Lagertechnik for automated order fulfillment in warehouse operations and enhance their productivity.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market, such as Amazon Web Services, Inc., Honeywell International, Inc., IBM Corporation, Oracle Corporation, and Locus Robotics, are increasingly investing in innovative AI technologies to enhance warehousing operations. Furthermore, governments are incentivizing AI, robotics, and smart manufacturing investments. These initiatives reduce capital risk and enhance investor confidence in long-term return on investment (ROI). For instance,

- In January 2024, the EU Horizon Europe funds approximately USD 750 million for AI and Industry 4.0 startups and pilots.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 23.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Deployment

By Application

By Industry

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is expected to reach USD 83.42 billion by 2034.

In 2026, the market was valued at USD 15.78 billion.

The market is projected to grow at a CAGR of 23.10% during the forecast period.

By application, the inventory management segment led the market.

The growing adoption of AI technology in the retail sector is a key factor driving market growth.

Zoom Communications, Inc., BigMarker, Cvent Inc., Hubilo Technologies Inc., Zoho Corporation Pvt. Ltd., Remo, vFairs, EventMobi, 6Connex, and Microsoft Corporation are the top players in the market.

North America dominated the market with a share of 36.10% in 2025.

By industry, the manufacturing segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us