AI-powered Emotion Analytics Platform Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Technology (Facial Recognition, Speech & Voice Analysis, Text-based Emotion Detection, Multimodal Emotion Recognition, and Physiological Monitoring), By End-User (Healthcare, Automotive & Transportation, Retail & E-commerce, Education, Media & Entertainment, IT, Government & Public Safety, BFSI, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

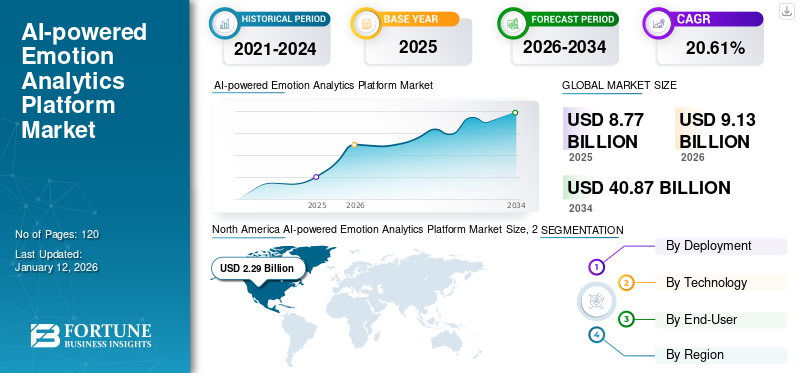

The global AI-powered emotion analytics platform market size was valued at USD 8.77 billion in 2025. The market is projected to grow from USD 9.13 billion in 2026 to USD 40.87 billion by 2034, exhibiting a CAGR of 20.61% during the forecast period. North America dominated the global market with a share of 30.45% in 2024.

AI-powered emotion analytics refers to the use of artificial intelligence technologies to detect, interpret, and analyze human emotions by processing data from facial expressions, voice tone, body language, physiological signals, and other biometric inputs. The goal is to understand real-time emotion, enabling more responsive and personalized interactions between humans and digital systems.

By leveraging data from cameras, sensors, and audio inputs, businesses can assess customer sentiment, predict behavior, and adapt interactions accordingly, whether online or in physical environments.

As companies increasingly focus on human-centric innovation and personalized service, emotion analytics stands out as a key enabler, supported by rapid advancements in machine learning, edge AI, and privacy-conscious sensing solutions.

Market players such as Affectiva, Emotibot, Cognovi Labs, and Raydiant are continuously focusing on innovating more advance AI-powered emotion analytics platforms to maintain their share in this competitive market.

Impact of Generative AI

Evolving Capabilities of Generative AI in Emotion Interpretation Propels Market Growth

Generative AI is significantly transforming the AI-powered emotion analytics platform market by enhancing capabilities, improving accuracy, and expanding applications. Generative AI can synthesize human-like emotional responses, thereby improving sentiment analysis in chatbots, virtual assistants, and customer service platforms.

- For instance, in June 2024, Talkdesk announced the launch of GenAI-powered Talkdesk Navigator, which modifies content, promotions, and suggestions based on customers’ profiles, history, usage trends, geographic location, demographic information, and even their present emotional state.

Generative AI can also create synthetic emotion datasets (e.g., simulated facial expressions and voice modulations) to train emotion recognition models without privacy concerns. For instance,

- In October 2024, Cerence Inc. expanded its partnership with Renault to integrate AI-driven features and human-like communication into the automaker's next-generation, multi-modal in-car assistant, Reno.

Impact of Reciprocal Tariffs

The impact of reciprocal tariffs on the AI-powered emotion analytics market can be significant, especially given the global nature of Artificial Intelligence (AI) hardware and software supply chains.

Emotion analysis systems rely on specialized FMCW sensors, semiconductors, and IoT components. Reciprocal tariffs between manufacturing countries (e.g., the U.S. vs. China or the EU vs. U.S.) could increase import/export costs of these components, which makes the technology more expensive to produce or deploy in target markets. For instance,

- Suppose countries such as Poland or Asia face tariffs when exporting to the U.S. In that case, they may either pass on the increased costs to American retailers or seek alternative suppliers to remain competitive.

AI-POWERED EMOTION ANALYTICS PLATFORM MARKET TRENDS

Multi-Modal System to Create New Opportunities for Market

Multi-modal systems are emerging as a key trend in the market, as they address critical gaps in single-mode systems while unlocking transformative applications. These systems solve the incomplete emotion problem and also power next-gen human interaction, as voice assistants such as Amazon Alexa can analyze vocal tone, facial expressions, and contextual cues.

Additionally, car manufacturers are deploying multi-sensor emotion AI systems to create safer and more intuitive driving experiences by merging real-time biometrics with contextual awareness. For instance,

- Hyundai’s emotion-reading cabin system adjusts music/lighting based on multi-sensor mood data.

MARKET DYNAMICS

MARKET DRIVERS

Rising Focus on Improving Customer Experience to Drive Market Growth

Consumers today expect interactions with brands to be exceptionally personalized, empathetic, and immediate. Conventional techniques (such as surveys or Net Promoter Scores) are often slow and frequently miss capturing genuine feelings.

An emotion analytics platform powered by AI addresses this issue by evaluating real-time sentiment analysis through voice, facial expressions, and text (including chats, emails, and reviews). These systems can detect subtle emotions (such as frustration, excitement, or confusion) that customers might not openly express. For instance,

- In June 2023, Pizza Hut implemented an AI-powered emotion analytics system in its outlets, enhancing customer experience. This "emotion AI" tool reads facial expressions to gauge a customer’s mood and then recommends food items accordingly.

Additionally, businesses can now implement these solutions extensively across both digital and physical channels, gaining instant emotional insights that influence prompt business choices. This is expected to boost the AI-powered emotion analytics platform market growth in the coming years.

MARKET RESTRAINTS

Strict Government Regulations Can Hamper Market Growth

Government regulations pose significant restraints to the adoption of AI-powered emotion analytics due to strict biometric data laws and developing AI-related legislation.

Laws such as the EU's GDPR and California's CCPA categorize emotional data, such as that obtained from facial expressions or physiological signals, as sensitive personal information, which necessitates clear user consent and imposes severe penalties for non-compliance. For instance,

- In February 2025, the EU banned emotion-tracking AI under the new AI Act, effective from 2 August 2025. The regulation prohibits the use of AI to monitor emotions in the workplace or manipulate users online, aiming to protect people from discrimination and exploitation.

MARKET OPPORTUNITIES

Increasing Use of AI-powered Emotion Analytics in Brick-and-Mortar Retail Creates Lucrative Opportunities for Market Players

The revival of brick-and-mortar retail, fueled by consumers’ desire for experiential shopping, has created a massive opportunity for AI-powered emotion analytics. Physical stores are leveraging emotion AI technologies to enhance customer engagement, optimize store layouts, and boost sales conversion.

These technologies also enable hyper-personalized in-store experiences with smart mirrors & interactive displays, which use facial emotion tracking to recommend products based on real-time reactions. AI can help in reducing cart abandonment by using features such as queue emotion monitoring, and it can also provide cashier less emotion AI. For instance,

- An AI can use facial mood analysis to customize post-purchase offers (e.g., a happy shopper gets loyalty points; a frustrated one gets a discount).

Download Free sample to learn more about this report.

Segmentation Analysis

By Deployment

Cloud Segment to Lead, Driven by Scalability and Compute Power

Based on deployment, the market is bifurcated into cloud and on-premise.

The cloud segment is expected to hold the major share in the market and is also set to grow with the highest CAGR during the study period, as it provides unlimited computing power for processing voice, facial, and text emotion data from millions of users simultaneously. Their deployment model also enables real-time emotion detection for live commerce, telehealth applications, and call centers. For instance,

- In March 2025, Teleperformance announced the implementation of AI to soften Indian call center accents in real-time, improving clarity while keeping the speaker’s tone and emotion. Built by Sanas, the tech supports emotional expression, aligning with an AI-powered emotion analytics platform to enhance customer experience without losing the human touch.

Cloud-based deployment doesn’t require hardware cost, allowing small businesses to avoid expensive GPU servers or edge devices. Companies can integrate emotion AI in days, compared to months for on-premises setups.

By Technology

Ease of Deployment of Facial Recognition Makes It a Dominant Segment

By technology, the market is classified as facial recognition, speech & voice analysis, text-based emotion detection, multimodal emotion recognition, and physiological monitoring.

The facial recognition segment holds the majority share in the market due to its mature technology, ease of deployment, and established use cases in various sectors such as retail, healthcare, and security. For instance,

- In February 2025, Tech company Wayvee developed an AI-powered, camera-free analytics system for brick-and-mortar stores that detects shopper emotion arousal using radar-based sensors.

Facial recognition has a lower implementation cost as it works with existing cameras and requires no additional hardware investment. Plug-and-play SaaS solutions support this trend by easily integrating via simple APIs.

The multimodal emotion recognition segment is expected to grow at the highest CAGR during the study period as it combines voice, face, text, and biometric features together. This reduces error by cross-validating emotions (e.g., a stressed voice + clenched fists + rapid typing = frustration). It also detects sarcasm, micro-expressions, and concealed feelings better than single-mode AI.

By End-User

Increasing Use of Emotion-Aware Technologies Boosts Healthcare Segment Growth

By end-user, the market is classified as healthcare, automotive & transportation, retail & e-commerce, education, media & entertainment, IT, government & public safety, BFSI, and others.

Healthcare holds the majority share in the market, driven by post-pandemic demand for scalable mental health assessments and the widespread adoption of emotion-aware technologies. Teletherapy platforms now include voice pattern analysis detecting depression biomarkers. For instance,

- In March 2025, Researchers from the University of Illinois and NCSA developed an AI tool that uses short voice recordings to detect anxiety and depression. By analyzing speech during a one-minute naming task, machine learning models identify mental health conditions with explainable results.

Additionally, Facial micro-expression tracking during video sessions enables therapists to detect fleeting emotional responses that often reveal suppressed feelings or emotional conflicts. For instance,

- In December 2023, Researchers at the University of Basel used AI to analyze facial expressions in therapy sessions, accurately detecting emotions such as happiness, sadness, and fear, even brief micro-expressions.

The BFSI segment is expected to grow with the highest CAGR as AI-powered emotion analytics platforms are being applied in areas such as fraud prevention, customer experiences, and regtech compliance. Recent emerging technology, such as Emotion-aware IVR (Interactive Voice Response) systems, is developing customer service in banking by using real-time voice analysis to detect frustration, stress, or urgency in a caller's tone. For instance,

- In June 2024, SoftBank developed an AI-powered "emotion canceling" system to reduce stress for call center workers by softening angry customer voices. The AI identifies emotional tones and adjusts the voice's intensity without altering the words, making conversations less aggressive.

AI-powered Emotion Analytics Platform Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America AI-powered Emotion Analytics Platform Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds the major AI-powered emotion analytics platform market share due to its world-class research institutions (MIT's Affective Computing Group and Stanford's Human-Centered AI Institute). Various academic-commercial collaborations have taken place in these institutions. For instance,

- Affectiva, a software company that focuses on Emotion AI, was spun out of the MIT Media Lab in 2009.

North America's dominance in related technologies, such as 5G networks and edge computing, offers the essential framework for large-scale real-time emotion processing. This ideal combination of research excellence, market readiness, technological foundations, and valuable applications solidifies its ongoing leadership in emotion AI innovation across the globe.

The U.S. leads the market as it is home to companies such as Affectiva, CognoviLabs, and Raydiant, which drive innovation in detecting human emotions through facial expressions, voice tone, and behavioral cues.

Europe

Europe is expected to grow at a significant CAGR during the forecast period. The region’s healthcare system focuses on deploying ethical, clinically validated, and emotion AI to understand patients’ behavior. For instance,

- In January 2024, the University of Basel published a study that shows that AI can reliably detect emotions from facial expressions during psychotherapy, matching human therapists' accuracy and even spotting subtle micro-expressions.

Additionally, businesses across Europe are increasingly recognizing the value of emotion insights for customer service, employee wellness, and product development.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the study period due to government-led digital transformation, demographic advantages, and rapid technological adoption. This blend of factors creates multiple opportunities in the market.

The widespread use of mobile payments, surpassing 80% in important regions such as China, South Korea, and Singapore, enhances opportunities for emotion AI, as digital transactions produce extensive behavioral data that can be examined for sentiment patterns. The automotive sector is at the forefront of the emotion AI revolution, with companies aiming to redefine user experiences. For instance,

- Toyota’s Kirobo Mini, a small robot designed to offer emotional companionship, uses a built-in camera to recognize facial expressions and detect emotions, adjusting its speech and behavior accordingly.

Middle East & Africa and South America

The Middle East is expected to grow at a stable CAGR due to rapid emotion AI adoption across booming sectors and government-led digital transformation initiatives. For instance,

- In April 2025, Dubai Health Authority became the first in the Middle East to adopt the AI-powered Genesys system in its contact center. The system uses emotion analytics to enhance service by understanding customer sentiment through voice and digital channels.

South America is expected to grow at a steady CAGR, driven by unique regional dynamics that balance gradual digital transformation with increasing societal acceptance of affective computing. Nations such as Brazil, Chile, and Argentina are progressively upgrading their digital infrastructure and adopting AI technologies to enhance user experiences and boost operational efficiency.

COMPETITIVE LANDSCAPE

Key Industry Players

Major Companies to Develop Enhanced AI-powered Emotion Analytics Platforms to Strengthen Their Market Positions

The major AI-powered emotion analytics platform companies in the market are Affectiva, Eyeris, Realeyes, and Uniphore. They aim to utilize ML and cloud technologies to deliver solutions for detecting, interpreting, and responding to human emotions.

LIST OF KEY AI-POWERED EMOTION ANALYTICS PLATFORM COMPANIES PROFILED

- Affectiva (U.S.)

- Entropik Technologies Pvt. Ltd. (India)

- Morphcast Inc (U.K.)

- Emotibot (China)

- Eyeris (U.S.)

- Realeyes (U.S.)

- Uniphore (U.S.)

- CognoviLabs (U.S.)

- Wayvee Analytics (U.K.)

- Raydiant (U.S.)

- Tobii (Sweden)

- iMotions (Denmark)

- Opsis Pte. Ltd (Singapore)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Nihilent launched Emoscape, a groundbreaking Emotion AI platform rooted in the age-old Indian text, the Natyashastra. By incorporating the treatise's nine fundamental emotion states into an advanced, contactless AI system, Emoscape facilitates precise identification and understanding of human emotions through subtle body movements, entirely without wires or sensors.

- March 2025: Alibaba Group Holding Ltd. launched a new artificial intelligence model capable of detecting emotions. In two showcases, researchers from Alibaba’s Tongyi Lab demonstrated their new open-source R1-Omni, which can deduce a person's emotional state from a video while also providing descriptions of their attire and surroundings.

- June 2024: UK Train Stations evaluated CCTV Systems utilizing emotion recognition technology. Passengers at eight train stations throughout the U.K. were monitored using AI-enabled CCTV cameras.

- June 2024: Researchers in Finland created an AI model capable of analyzing human emotions as they occur. Presently, the model can recognize six emotional states: joy, boredom, annoyance, anger, hopelessness, and anxiety. It is based on a psychological theory suggesting that emotions arise when human cognition assesses events from various perspectives.

- February 2024: Researchers at Dartmouth announced the creation of the first smartphone app named Moodcapture to employ artificial intelligence along with facial-image processing technology to accurately identify the early signs of depression, often before the individual themselves is aware of any issues.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, technology types, and leading applications of AI-powered emotion analytics platform solutions. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the AI-powered Emotion Analytics Platform market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 20.61% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Technology

By End-User

By Region

|

Frequently Asked Questions

The market is projected to reach USD 40.87 billion by 2034.

In 2025, the market was valued at USD 8.77 billion.

The market is projected to grow at a CAGR of 20.61% during the forecast period.

The cloud segment is expected to lead the market with the highest CAGR during the forecast period.

Rising focus on improving customer experience is a key factor driving market expansion.

Affectiva, Morphcast Inc., Realeyes, and Uniphore are the top players in the market.

North America holds the major market share.

By technology, the multimodal emotion recognition segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us