Aircraft Flight Control System Market Size, Share & Industry Analysis, Type (Primary Control Surfaces System and Secondary Control Surfaces System), By Component (Control Surfaces, Actuators, Flight Control Surface Mechanism, Sensors, Cockpit control, and Others), By Platform (Commercial Aircraft (Narrow Body, Wide Body, Regional Jet, and Commercial Helicopter), Military Aircraft (Combat & Multirole, Military Transport Aircraft, and Military Helicopter), Business Jets, and General Aviation Aircraft), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

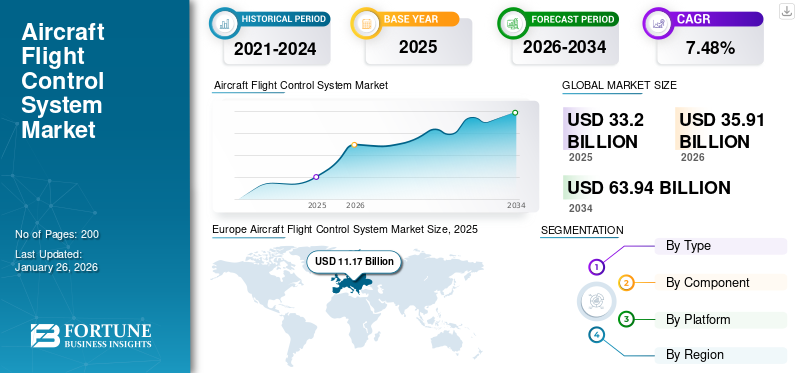

The global aircraft flight control system market size was valued at USD 33.2 billion in 2025 and is projected to grow from USD 35.91 billion in 2026 to USD 63.94 billion by 2034, exhibiting a CAGR of 7.48% during the forecast period. Europe dominated the aircraft flight control system market with a market share of 33.65% in 2025.

Aircraft flight control system refers to the mechanism used to maneuver an aircraft. The flight control system aids the pilot in controlling the aircraft precisely. The system comprises the cockpit, flight control surfaces, and the hydraulic-mechanical links and controls. At present, the majority of military and commercial airplanes utilize hydro-mechanical control systems, although newer airplanes are adopting electronic flight control systems or fly-by-wire technology.

The rise in passenger traffic, driven by increasing disposable incomes in developing nations, has led to a higher demand for air travel. Consequently, airlines are increasing their fleets to meet this demand, which is anticipated to drive market growth. Additionally, the increasing need for drones in military missions is expected to boost market expansion during the projected timeframe further.

Industry leaders, including BAE Systems, Honeywell Aerospace, and Collins Aerospace, are heavily investing in next-generation fly-by-wire systems with enhanced cybersecurity features and AI-assisted flight envelope protection technologies. Major players are increasingly prioritizing modular, software-defined flight control systems with adaptive algorithms while simultaneously expanding capabilities for urban air mobility platforms and autonomous flight operations to meet emerging industry demands.

Global Aircraft Flight Control System Market Overview

Market Size & Forecast

- 2025 Market Size: USD 33.20 billion

- 2026 Market Size: USD 35.91 billion

- 2034 Forecast Market Size: USD 63.94 billion

- CAGR: 7.48% from 2026–2034

Market Share

- Europe dominated the market with a 33.65% share in 2025, driven by the presence of leading OEMs (Airbus, Leonardo, Thales) and ongoing advancements in fly-by-wire and automated control technologies. The region’s focus on sustainability and next-generation avionics further strengthens its position.

- By type, the primary control surface system segment led the market in 2024, owing to its essential role in aircraft maneuverability and safety across commercial and military platforms.

Key Country Highlights

- Europe (France, U.K., Germany): Strong presence of OEMs, R&D initiatives, and increasing adoption of AI-enabled flight control technologies.

- North America (U.S.): Driven by high defense spending, commercial aircraft production, and advanced fly-by-wire systems from Boeing, Honeywell, and Collins Aerospace.

- Asia Pacific (China, India): Fastest-growing region due to rising air passenger traffic, regional fleet expansion, and government-backed aerospace programs.

- Rest of the World (Middle East, Latin America): Growth fueled by aviation infrastructure modernization and rising demand for military aircraft upgrades.

Market Dynamics

Market Drivers

Increasing Demand for Aircraft Transport to Propel Market Growth

Changes in customer preferences toward products related to aircraft flight control actuation systems are driving market growth. Urbanization, evolving lifestyles, and rising disposable incomes have boosted the need for advanced solutions in this industry. Consumers are gaining a greater understanding of the advantages of aircraft flight control actuation systems, such as safety, efficiency, and sustainability, contributing to the aircraft flight control system market growth. Increasing demand for air transport is another major factor fueling the development of the aircraft flight control system industry. As incomes rise globally and middle-class citizens in developing economies expand, the demand for air transport increases. To meet this demand, airlines are increasing their fleets, boosting the need for new airplanes equipped with advanced flight control systems. These systems are instrumental in providing efficiency, reliability, and safety to modern aircraft, thus supporting market growth.

For instance, in October 2022, BAE Systems and Supernal, two major flight control system manufacturers, signed an agreement to design and develop the computer control system for Supernal's Electric Vertical Take-Off and Landing (eVTOL). BAE Systems would support Supernal by helping define the architecture of a lightweight electric flight system for its autonomous aircraft, which will safely and efficiently control the aircraft’s operations during flight.

Market Restraints

Stringent Regulations to Limit Market Growth

Although aircraft flight control systems offer many benefits, strict regulations pose a significant obstacle to market expansion. Obtaining approval from regulatory authorities for these systems is a lengthy and expensive process, primarily due to safety and operability requirements. Regulatory authorities have become increasingly cautious following the fatal crashes involving the MCAS on Boeing 737 Max 8 planes. As a result of the plane crashes caused by the Maneuvering Characteristics and Augmentation System (MCAS), the procedures have become stricter, which is anticipated to limit market expansion.

While the aircraft flight control systems market size remains on an upward trajectory, stringent regulations pose significant hurdles that could restrict growth. Striking a balance between rigorous standards and fostering innovation will be critical in shaping the future of this vital sector in aviation.

Market Opportunities

Growing Demand for High-Performance Aircraft to Act as a Major Market Opportunity

An increase in the need for advanced planes with reliable flight control systems is a significant factor driving market growth. Major OEMs have delivered aircraft equipped with the most up-to-date technology and support systems to enable precise flight control. These systems enhance navigation, promote fuel efficiency, and streamline operations. Additionally, multiple airlines are requesting aircraft with minimal expenses, resulting in an increased need for suitable aircraft flight systems equipped with cutting-edge digital technology. Furthermore, the anticipated growth in the use of supersonic and hypersonic aircraft for both military and commercial applications is projected to drive growth in the aircraft flight control surfaces market in the coming years.

For instance, in December 2022, a technology demonstration for Russia's future supersonic passenger plane was planned to enter production in 2023, according to reports in state media. It will be built at the Chaplygin Siberian Institute of Aeronautical Sciences (SibNIA), using MiG-29 fighters as a base platform.

The aerospace industry is witnessing a robust transformation driven by the demand for high-performance aircraft across various segments, including traditional, hybrid, and fully electric models. This evolution is marked by technological advancements aimed at improving fuel efficiency, reducing emissions, and meeting the growing needs of both commercial airlines and military operations. As these trends continue, the market is expected to expand significantly over the coming years, reflecting a broader shift toward sustainability in aviation.

Market Challenges

Design and Regulatory Procedures to Challenge Market Development

Design issues and certification procedures significantly limit the development of the flight control system market. Design issues involve solving aerodynamic non-linearity and solving computational problems in model-based design. Additionally, these systems are expensive to develop and maintain. Certification procedures are time-consuming and costly due to strict safety standards. Comprehensive testing and validation are needed to achieve global aviation standards, which can slow down the release of new technologies. They add to the cost and time of development, constraining market growth and the utilization of sophisticated flight control systems. Furthermore, they also act as barriers to entry and innovation for new players in the market.

Aircraft Flight Control System Market Trends

Download Free sample to learn more about this report.

Emergence of Automated Flight Control Systems to Bolster Market Growth

Recent developments in the aircraft flight control systems market highlight the rise and application of automated flight control systems. These systems aid in minimizing errors and facilitating seamless aircraft movement throughout operations. Aircraft producers and airlines favor this technology due to its precise inputs, which enhance the efficiency of aircraft as a whole. Many Original Equipment Manufacturers (OEMs) have started testing these systems, recognizing their potential to transform the flight control systems market. For instance,

- Europe witnessed aircraft flight control system market growth from USD 9.36 Billion in 2023 to USD 10.26 Billion in 2024.

- In June 2023, Skyryse, a Flight automation specialist company, launched a comprehensive flight test campaign with its highly automated FlightOS flight control system. The company claims that the system can improve safety and reduce pilot workload for a variety of aircraft, including helicopters, fixed-wing aircraft, and eVTOL aircraft.

These systems utilize advanced algorithms and AI technology to provide precise inputs, thereby enhancing overall aircraft performance. The emergence of automated flight control systems represents a pivotal development in aviation technology and is poised to drive the flight control system market significantly. As the demand for efficient and safe air travel continues to rise, the industry faces the challenges posed by automation while adhering to regulatory standards. The future of aviation is likely to see a greater reliance on these advanced systems, shaping both commercial and military aircraft operations.

Impact of COVID-19

The outbreak of the COVID-19 pandemic had a dramatic impact on passenger transport, related services, and revenue. The pandemic affected the flight control market due to lower demand for air travel led to lower aircraft utilization, which in turn lowered the need for modern frameworks. Operations were adjusted to enhance security, impacting flight effectiveness. Supply chain disturbance further slowed down the production and delivery of parts. Regardless of these challenges, the pandemic accelerated technological developments, such as developments in electrical systems, which are advantageous to benefit the market in the long term.

Segmentation Analysis

By Type

Primary Control Surface System Segment Dominated Due to Growing Demand Narrow-body Aircrafts

Based on type, the market is categorized into primary control surfaces system and secondary control surfaces system.

The primary control surface system segment accounted for the largest market share in 2026, representing 53.40% of the total market share. The system’s main components include the rudder, aileron, and elevator, which control the aircraft's key movements, including yawing and stalling. The primary control system is crucial for steering the aircraft, making it an essential component in all aircraft. Primary control surfaces systems maintain significantly higher demand due to their critical role in basic aircraft maneuverability and safety. Unlike secondary systems, primary controls are essential for fundamental flight operations and cannot be compromised or eliminated in any aircraft design. The accelerating commercial aviation market, particularly in narrow-body segments, drives substantial demand as each new aircraft requires these systems.

Continuous advancements in the secondary control surface system are anticipated to drive this segment’s growth at the highest CAGR during the forecast period. The additional system includes components such as flaps, slats, stabilizers, and spoilers, which support the main surface systems. Technological advancements and upgrades in these components are anticipated to contribute to the segment's growth during the forecast period as companies integrate cutting-edge technologies to improve their functionality.

- For instance, in July 2023, BAE Systems successfully completed a 24-hour flight of its PHASA-35, which climbed to more than 66,000 feet, reaching the stratosphere before making a successful landing.

By Component

Control Surfaces Segment Led Owing to Comprehensive Coverage of Flight Movements

By component, the market is classified into control surfaces, actuators, flight control surface mechanisms, sensors, cockpit control, and others.

The control surfaces segment held the largest aircraft flight control system market share in 2026, accounting for 34.73% of the total market share. Control surfaces are aerodynamic components that enable pilots to modify and manage the airplane's flight position, making them a critical structural element of the flight control system. They are categorized into primary and secondary control surfaces, each serving distinct functions in managing the aircraft's movements around its three primary axes: roll, pitch, and yaw.

- The actuators segment is expected to hold a 18.61% share in 2024.

The flight control surface mechanism segment will experience the highest CAGR during the projected duration due to the increasing technological developments and applications of these mechanisms in modern aircraft.

To know how our report can help streamline your business, Speak to Analyst

By Platform

Increasing Aircraft Deliveries Encouraged Growth of Commercial Aircraft Segment

Based on platform, the market is segmented into commercial aircraft, military aircraft, business jets, and general aviation aircraft. The commercial division is further categorized into narrow-body, wide-body, regional jet, and commercial helicopter segments. The military aircraft category is subdivided into combat & multirole, military transport aircraft, and military helicopters.

The commercial aircraft segment held the largest market share in 2026, accounting for 67.50% of the total market share. The growth can be attributed to the rising popularity of air travel, rising aircraft deliveries, and advancements in aircraft flight control systems.

The military aircraft sector will experience a notable CAGR from 2025 to 2032. The increase is driven by the rising use of flight control systems in military settings, especially in supersonic and ultrasonic fighter jets, as technology in this sector progresses.

- For instance, in July 2023, BAE Systems unveiled a new research facility, FalconWorks, to accelerate the development of advanced airborne combat capabilities. As a research and development hub, FalconWorks aimed to deliver cutting-edge new aviation capabilities to the U.K. and its allies.

Aircraft Flight Control System Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and Rest of the World.

Europe

Europe Aircraft Flight Control System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe’s market valuation reached USD 11.17 billion in 2025 and increased to USD 12.11 billion in 2026, leading the market, supported by the presence of major OEMs and an expanding global footprint. The region hosts several prominent companies that produce airframes for both commercial and military planes. Aircraft flight control systems are critical for the safe and efficient operation of aircraft, encompassing a variety of technologies and methodologies. In Europe, advancements in flight control systems are being driven by both established aerospace companies and innovative research projects aimed at enhancing performance, safety, and environmental sustainability. The UK market is projected to reach USD 2.52 billion by 2026, while the Germany market is projected to reach USD 1.96 billion by 2026.

North America

The market in North America is expected to grow at a healthy rate, driven by increased air travel within the U.S. In 2024, North America held the second-largest share of the market. The increasing need for composite aircraft flight control systems has led to the region's significant market dominance. Furthermore, key regional factors will further enhance the market growth in the projected timeframe.

The U.S. market maintains global leadership, fueled by significant defense spending and a robust aerospace manufacturing ecosystem anchored by Boeing, Collins Aerospace, and Moog. Recent Pentagon investments in next-generation military aircraft programs have accelerated the development of advanced fly-by-wire technologies incorporating AI-enhanced safety features and adaptive control algorithms. The Us market is projected to reach USD 8.07 billion by 2026.

Asia Pacific

Asia Pacific is expected to experience the highest growth rate due to the expanding aviation industry and the increasing presence of OEMs. Recent developments include an increase in airport construction and significant international technological advancements. Furthermore, government initiatives are playing a significant role in propelling the aviation sector's expansion, boosting the market in the region. Continual cross-border conflicts and emerging terrorism are also motivating governments to strengthen their military assets. The Japan market is projected to reach USD 1.47 billion by 2026, the China market is projected to reach USD 2.36 billion by 2026, and the India market is projected to reach USD 1.76 billion by 2026.

- For instance, in July 2023, Elbit Systems, an Israeli defense company, was selected to supply two ATR 72-600 aircraft equipped with mission suites.

Rest of the World

The rest of the world market is anticipated to achieve a higher growth rate in the coming years due to a growth in aircraft deliveries and the existing aircraft backlog. The rest of the world includes Latin America, and Middle East & Africa, which are anticipated to grow as aviation infrastructure develops in these areas. Furthermore, economic growth in these regions will contribute to the overall market growth.

Competitive Landscape

Key Market Players

Key Players Focus on Providing Advanced and Accurate Aircraft Flight Control Systems to Sustain Market Positions

Various global and regional players dominate the market for aircraft flight control systems, shaping key trends and analysis. Major players in the market bid on a range of products, with a strong emphasis on developing effective, precise, and lightweight aircraft control systems for original equipment manufacturers. Leading players in the industry include the Airbus SAS, The Boeing Company, and Leonardo SpA. Airbus SAS is anticipated to dominate the market due to its global reach. Other key players, such as BAE Systems, Leonardo SpA, Thales Group, and Lockheed Martin Corporation, engage in new product launches, partnerships, and acquisitions to maintain their market positions.

List of Key Aircraft Flight Control System Companies Profiled

- Honeywell International Inc. (U.S.)

- Moog (U.S.)

- Collins Aerospace (U.S.)

- Parker Hannifin (U.S.)

- Safran (France)/

- BAE Systems (U.K.)

- Leonardo SpA (Italy)

- Thales Group (France)

- Lockheed Martin Corporation (U.S.)

- The Boeing Company (U.S.)

- Airbus SAS (France)

Key Industry Developments

- November 2024 – JetZero completed partnership deals with top suppliers for the main parts of the Flight Control System on its large Blended Wing Body (BWB) prototype. Signing the contracts is a crucial milestone in the journey toward construction and testing, with plans for test flights to commence in 2027.

- October 2024- Olsen Actuators and Drives supplied Vertical Aviation, a worldwide leader in aviation and innovation, with an activation and drive package for the essential flight control activation frameworks for the VA-1X model pre-production aircraft. Vertical is making secure, cleaner and more convenient air travel. Airplane AC02 is the most recent version of its VX4 electric vertical take-off and landing (eVTOL) aircraft.

- August 2024- Boeing has chosen BAE Frameworks to overhaul the fly-by-wire (FBW) flight control computers (FCC) for the F-15EX Hawk II and F/A-18E/F Super Hornet warrior aircraft. The FCCs include common core hardware that backs the quad-redundant FBW flight control frameworks (FCS), ensuring the security, reliability, strength, and performance required for these advanced military platforms.

- August 2024 – BAE Systems and Microsoft entered into a strategic partnership to streamline the development, deployment, and management of digital defense capabilities in an increasingly data-driven environment. This collaboration brings together BAE Systems' expertise in constructing intricate digital systems for the military and government with Microsoft's strategy in app development utilizing the Azure Cloud platform.

- July 2022 – Leonardo and BAE Systems announced advancements in their collaboration efforts between the U.K. and Italy for the demonstration aircraft under the Future Combat Air System (FCAS) program. This collaboration is part of a defense cooperation roadmap initiated by both countries.

Report Coverage

The aircraft flight control system market research report offers detailed insights, emphasizing top companies, types of products, and key product uses. Additionally, the report provides information on market trends and the competitive landscape while also showcasing important industry advancements. Along with the factors mentioned earlier, several other factors have contributed to the growth of the global market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.48% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Component

By Platform

By Region

|

Frequently Asked Questions

The market was valued at USD 33.2 billion in 2025 and is projected to reach USD 63.94 billion by 2034.

The market is projected to record a CAGR of 7.48% during the 2026-2034 forecast period.

By platform, the commercial aircraft segment accounted for a majority of the market share in 2025.

Increasing demand for aircraft transport to propel market growth.

Airbus SAS, Honeywell International Inc., and The Boeing Company are the leading players in the global market.

Asia Pacific is the fastest-growing region in the market during the study period (2026-2034).

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us