Algae Products Market Size, Share & Industry Analysis, By Source (Macroalgae [Chlorophyta (Green), Rhodophyta (Red) and Phaeophyta (Brown) and Microalgae [Spirulina, Chlorella, and Others]), By Application (Food & Beverages, Animal Feed, Nutraceutical & Dietary Supplements, and Others), and Regional Forecast, 2026-2034

Algae Products Market Size and Future Outlook

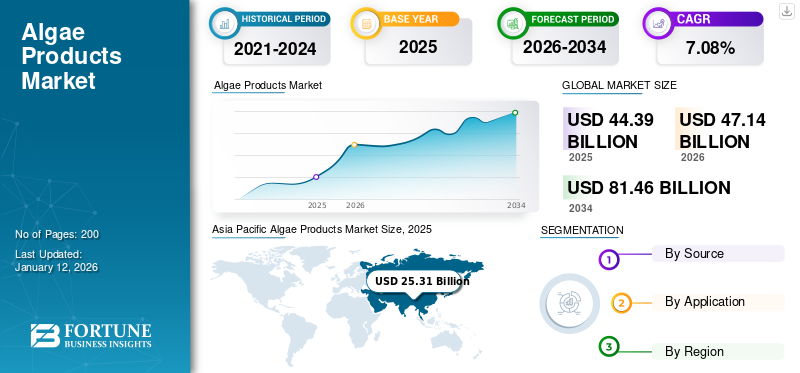

The global algae products market size was valued at USD 44.39 billion in 2025. The market is projected to grow from USD 47.14 billion in 2026 to USD 81.46 billion by 2034, exhibiting a CAGR of 7.08% during the forecast period. Asia Pacific dominated the algae products market with a market share of 53.46% in 2025.

Algae products refer to various foods derived from algae, a diverse group of photosynthetic eukaryotic organisms. These products are increasingly recognized for their nutritional, industrial, and ecological benefits. Algae can be classified into microalgae (such as Chlorella and Spirulina) and macroalgae (such as Chlorophyta). They play a crucial role in ecosystems as oxygen producers and as a foundational food source for aquatic life.

The market growth is driven by increasing consumer demand for natural and sustainable alternatives across various sectors, including food, pharmaceuticals, and cosmetics. Algae products are recognized for their health benefits, such as supporting immune function and cardiovascular health, which further fuels their popularity in dietary supplements and functional foods. Key players operating in the market include Cargill, Incorporated, Cyanotech Corporation, Corbion N.V., Algenol Biotech, and others.

Algae Products Market Snapshot & Highlights

Market Size & Forecast

- 2025 Market Size: USD 44.39 billion

- 2026 Market Size: USD 47.14 billion

- 2034 Forecast Market Size: USD 81.46 billion

- CAGR: 7.08% from 2026–2034

Market Share

- Asia Pacific led the market with a 53.46% share in 2025, driven by rising demand for plant-based, functional, and sustainable ingredients.

- By source, macroalgae dominated due to wide usage in food, cosmetics, and nutraceuticals.

- By application, food & beverages held the largest share, supported by the clean-label and health food trends.

Key Country Highlights

- China: Major producer and consumer; strong demand for seaweed-based foods.

- United States: Growth driven by spirulina and chlorella in supplements.

- India: Rising cultivation of red and green algae for health products.

- UAE: Large-scale microalgae investment boosts regional production.

Market Dynamics

Market Drivers

Growing Use of Microalgae in Food Sector to Foster Market Growth

The growing use of microalgae in the food sector is positively impacting the algae products market. Microalgae are recognized for their exceptional nutritional profile, which is comparable to traditional protein sources such as eggs. They provide various health benefits, including anti-inflammatory, antioxidant, and antimicrobial properties. These characteristics make microalgae increasingly popular in nutraceuticals and dietary supplements. The integration of microalgae into the food sector is reshaping the market by addressing both nutritional needs and sustainability challenges. As consumer preferences shift toward healthier and environmentally friendly options, the demand for microalgae-based products is expected to continue its upward trajectory, making it a promising area for investment and innovation in the coming years.

Rising Focus on Environmental Sustainability to Create Conducive Environment for Expansion of Industry

Macroalgae, such as seaweed, play a crucial role in capturing and storing carbon dioxide from the atmosphere, which helps mitigate climate change. This ability positions them as a sustainable alternative to traditional agricultural practices that contribute to greenhouse gas emissions. Macroalgae provide essential ecosystem services, including habitat creation for marine life, nutrient cycling, and oxygen production. Their cultivation can enhance biodiversity and support marine ecosystems. Moreover, the perception of macroalgae as "superfoods" is growing, leading to increased consumer interest in their health benefits, which further drives market demand.

Market Restraints

Initial Investment and Operational Costs to Hamper Market Growth

Cultivating and processing algae requires substantial initial capital investment, particularly for advanced cultivation systems such as photobioreactors or raceway ponds. These high costs can limit market entry for smaller players and affect overall algae products market growth. Maintaining optimal growth conditions for algae, such as temperature control and aeration, incurs high energy costs. This further escalates production expenses, making it challenging for new entrants to compete with established companies.

Market Opportunities

Growing Applications in Cosmetic and Personal Care Industries to Pave Way for Growth Opportunities

Algae are recognized for their numerous health benefits, such as anti-aging properties, hydration, and skin nourishment. These attributes make algae an attractive ingredient in skincare products such as moisturizers, serums, and face masks. The increasing awareness of these benefits among consumers further drives demand for algae-infused cosmetics. There is a rising consumer demand for cruelty-free, vegan, and organic cosmetic products. This shift toward natural formulations supports the growth of the market as consumers seek safer and more sustainable options.

Market Challenges

Quality Control Issues and Competition from Conventional Sources to Pose Challenge for Market Growth

Ensuring the purity and safety of algae products is a significant challenge. Variability in water quality used for cultivation and environmental factors can affect the quality of the final product. Maintaining consistent quality is crucial for consumer trust and regulatory compliance. Moreover, the market faces stiff competition from traditional food sources and supplements that are well-established in consumer markets. This competition can limit market penetration for algae-based alternatives, particularly if consumers are not fully aware of their benefits.

Algae Products Market Trends

Increasing Interest in Chlorophyta or Green Macroalgae to Influence Market Growth

The increasing interest in Chlorophyta, or green macroalgae, is significantly influencing the growth of the algae products market, particularly within the nutraceutical sector. This trend is driven by the unique health benefits associated with green seaweeds, including their rich content of bioactive compounds. Green macroalgae are recognized for their diverse array of bioactive compounds, such as fatty acids, polysaccharides, and phenolic compounds. These components have demonstrated various health benefits, including antioxidant, anti-inflammatory, and anticancer properties. The ongoing research into its bioactive compounds further promises to unlock further applications in both the nutraceutical and pharmaceutical industries.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic significantly impacted the global market, leading to both challenges and opportunities. The pandemic caused disruptions in logistics and transportation, which resulted in a slowdown of algae sales, particularly in the first quarter of 2020. This was due to factory closures and reduced operational capacities at algae processing facilities, especially in major producing countries such as China, Japan, and the Indonesia.

However, despite initial setbacks, there was a notable increase in demand for microalgal species, such as spirulina and chlorella, as consumers became more health-conscious during the pandemic. This shift was driven by a growing interest in nutritional content and dietary supplements.

Segmentation Analysis

By Source

Growing Health Awareness Among Consumers to Drive Macroalgae Segment Growth

On the basis of the source segment, the market includes macroalgae and microalgae.

Among all the categories, the macroalgae segment led the market and held a significant share worldwide. Macroalgae are rich in essential nutrients, including proteins, vitamins, and minerals, making them attractive for food and beverage applications. Their health benefits, such as anti-inflammatory and antioxidant properties, further enhances their appeal. They are utilized in various sectors, including food, nutraceuticals, cosmetics, and biofuels. The versatility of macroalgae as a raw material supports its dominance in the market. This segment is estimated to be worth 98.02% in 2026.

The microalgae segment is projected to experience notable growth with a CAGR of 9.12% during the forecast period (2025-2032). Microalgae cultivation is recognized for its potential to contribute to sustainable biomass production and greenhouse gas reduction. Their ability to absorb carbon dioxide during photosynthesis makes them a valuable asset in combating climate change. Increased investment in research and development is enhancing the production efficiency of microalgae. Innovations such as genetic engineering are being explored to optimize strains for higher yields and better quality. This segment dominated the market with a share of 2% in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Application

Growing Demand for Sustainable Food Products to Fuel Food & Beverages Segment Growth

In terms of application, the market is segmented into food & beverages, animal feed, nutraceutical & dietary supplements, and others.

The food & beverages segment dominates the algae products market share and is anticipated to gain significant momentum in the coming years. Consumers are increasingly seeking natural, wholesome, and sustainable food products. Algae serve as an effective and natural alternative to industrial additives, providing essential lipids, minerals, vitamins, and algae proteins. This shift toward clean-label products has significantly accelerated the market's growth in the foods & beverages sector.

The animal feed segment is projected to experience substantial growth with a market share of 46.49% in 2026. The global population is rising, leading to a higher demand for animal protein, particularly meat and dairy products. This trend is especially pronounced in emerging economies where dietary habits are shifting toward more protein-rich diets, driving the need for livestock production and, consequently, animal feed.

The prevalence of chronic diseases continues to rise globally, prompting consumers to turn to nutraceuticals for management and prevention. This includes a focus on functional foods and probiotics, which are gaining traction for their health benefits, particularly in managing gastrointestinal health and boosting immunity.

The nutraceutical & dietary supplements segment is expected to grow at a CAGR of 7.86% during the forecast period (2025-2032).

Algae Products Market Regional Outlook

The market is studied across North America, Asia Pacific, Europe, South America, and Middle East & Africa.

Asia Pacific

Asia Pacific Algae Products Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominated the global market with a valuation of USD 23.73 billion in 2025 and USD 25.31 billion in 2026 and is also projected to grow at a robust rate, with significant contributions from major markets such as China, India, Japan, and South Korea. Rapid urbanization and industrial development in emerging economies such as India and Japan are creating new opportunities for algae product manufacturers. Increased industrial activities lead to higher demand for sustainable raw materials such as algae. China is leading the market and is anticipated to capture a share of USD 17.48 billion in 2026. There is a notable rise in research activities aimed at exploring new applications for algae products. Investments in R&D are crucial for developing innovative products that meet evolving consumer preferences and industry standards. For instance, in June 2023, the Global Red Sea Algae Research Foundation was inaugurated in Kumbakonam, Tamil Nadu. This foundation marks a significant step in marine research, focusing on the study of red algae and its applications. The foundation would conduct extensive research on various aspects of red algae, including their ecological roles, potential for sustainable harvesting, and applications in industries such as pharmaceuticals, food, and biotechnology. Government initiatives to promote the cultivation and usage of algae in several industries is also boosting the market growth in the Asia Pacific region. India is estimated to be worth USD 0.93 billion in 2026, while Japan is set to be valued at USD 5.11 billion in the same year.

North America

North America is the second largest market, projected to reach a market value of USD 10.27 billion in 2026, exhibiting a CAGR of 6.55% during the forecast period (2026-2034). The region benefits from advanced research and development facilities, which foster innovation in algae product applications, including food supplements, nutraceuticals, and biofuels. This strong focus on sustainable technologies enhances the region's competitive edge in the algae market. Economic factors play a significant role as well. The region has a relatively high disposable income, which allows consumers to spend more on health-conscious products. Additionally, there is a growing prevalence of chronic diseases that drive demand for natural dietary supplements. The U.S., in particular, is expected to witness significant growth due to its large population and extensive research activities in the field. The U.S. market is increasing, expected to reach a market value of USD 8.15 billion in 2026.

Europe

Europe is the third leading region, expected to be valued at USD 7.9 billion in 2026. This region is expected to experience significant growth during the forecast period. European consumers are increasingly favoring natural and organic products over synthetic alternatives. This shift is particularly evident in the food, cosmetics, and nutraceutical sectors, where there is a strong demand for ingredients that are perceived as healthier and safer. The U.K. market is growing, anticipated to be valued at USD 0.93 billion in 2026. The European Union's stringent regulations on food safety and quality encourage the use of natural ingredients. This regulatory environment supports the algae market by ensuring that algae products meet high standards, thereby enhancing consumer trust. Supportive regulatory frameworks, particularly those encouraging sustainability and renewable energy, are bolstering the algae market. For instance, initiatives such as the EU's Renewable Energy Directive promote the use of biofuels derived from algae. Technological advancements in algae cultivation and processing are improving production efficiencies, making it more feasible for companies to invest in this sector. Germany is estimated to be worth USD 1.41 billion in 2026, while France is set to be valued at USD 1.66 billion in the same year.

South America

South America is the fourth largest market and is anticipated to capture a share of USD 2.56 billion in 2025. In this region, Brazil dominates the algae products market. Economic growth in countries such as Brazil and Argentina is leading to increased per capita income, which fuels demand for higher-quality algae products. As consumers become more affluent, they are more likely to invest in health-oriented products, including those derived from algae. The emphasis on sustainable food sources is significant in Brazil. Algae are recognized for their minimal environmental impact compared to traditional agriculture, making them an attractive option for consumers and producers.

Middle East & Africa

The market in the Middle East and Africa is experiencing substantial growth due to several interrelated drivers. Increased awareness among consumers regarding the health benefits of algae products, such as their rich nutrient profile (including omega-3 fatty acids, vitamins, and antioxidants), is a significant driver. Consumers are actively seeking natural and sustainable food alternatives as they become more health-conscious. As disposable incomes rise in many Middle Eastern & African countries, consumers are more willing to spend on premium health products, including those derived from algae. This economic shift supports the growth of the market by expanding the consumer base. The presence of untapped markets within the region presents significant opportunities for growth. Prominent players in the market are investing in new manufacturing plants in order to shape the future landscape of the market in the region. For instance, in June 2024, KEZAD Group signed a significant lease agreement with Astha Biotech, marking a major step in the development of sustainable biotechnology in Abu Dhabi. Astha Biotech invested USD 12 million to establish a 38,000-square-meter microalgae production facility at KEZAD Al Ain. This facility aims to produce high-value microalgae for various industries, including health, cosmetics, food, and aquaculture. The UAE market is set to be worth USD 0.15 billion in 2025.

Competitive Landscape

Key Market Players

Product Innovation and Sustainability are the Major Trends Being Followed by Market Players

The competitive landscape of the global market is characterized by a diverse array of players and strategic initiatives aimed at capturing market share. Prominent companies in the market include Cargill, Incorporated, Archer Daniels Midland Company (ADM), BASF SE, Cyanotech Corporation, and Algenol Biotech.

Global Algae Products Market Ranking Analysis, 2025

|

Rank |

Company Name |

|

1 |

Cargill, Inc. |

|

2 |

Archer-Daniels-Midland Company |

|

3 |

BASF SE |

|

4 |

Ctaotech Corporation |

|

5 |

Algenol Biotech |

Cargill Inc. is a major player in the global food and agriculture sector, including the algae products market. Cargill has established a strong presence in the market, focusing on innovation and sustainability. Another leading player in the market is Archer Daniels Midland Company (ADM). It is one of the leading agricultural processors and food ingredient providers, and it is actively involved in the development and production of algae-based products.

List of Key Algae Products Companies Profiled

- Koninklijke DSM N.V. (Netherlands)

- BASF SE (Germany)

- Cyanotech Corporation (U.S.)

- Cargill Inc. (U.S.)

- The Archer-Daniels-Midland (U.S.)

- Fuji Chemical Industries Co., Ltd. (AstaReal Co., Ltd.) (Japan)

- MiAlgae Ltd (U.S.)

- Corbion N.A. (Netherlands)

- Algenol Biotech (U.S.)

- Algae Systems, LLC (U.S.)

Key Industry Developments

- September 2024 – Two U.S. companies, Algae Cooking Club and Spotlight Foods, launched innovative cooking oils derived from microalgae, marking a significant advancement in sustainable food technology. Both companies utilize a fermentation process where microalgae are fed plant based sugars from sugarcane in large tanks, converting them into edible oil within a few days. This method is designed to minimize resource use compared to traditional vegetable oils.

- August 2024 – French startup Edonia successfully raised USD 2.19 million in funding, led by Asterion Ventures, to advance its innovative microalgae-based meat alternatives. The funding aims to support the commercialization of Edonia's products, which utilize microalgae such as spirulina and chlorella, which are known for their sustainability and nutritional benefits.

- September 2023 – Corbion N.V. launched AlgaPrime DHA P3, a new algae-based omega-3 ingredient aimed at enhancing the sustainability and nutritional profile of pet food. This product addresses the growing demand for sustainable active nutrition in the pet food industry, particularly as consumers become more environmentally conscious about their pet's diets.

- July 2023 – Zivo Bioscience, Inc. commenced the sales of its proprietary algal biomass, branded as Zivolife, aimed at the human food market. Zivo signed an exclusive distribution agreement with ZWorldwide, Inc. to market Zivolife primarily in North America. This partnership is expected to drive ongoing sales and expand the product's reach within the growing algae food market.

- March 2023 – M&M Labs and Lyxia Corporation launched a new line of vegan algal omega-3 supplements at the Natural Product Expo West. The supplements are formulated using solvent-free microalgal DHA oil, flaxseed oil, and AlgaLab Refined EPA oil sourced from Lyxia Corporation. These ingredients provide essential omega-3 fatty acids, which are crucial for cardiovascular, neurological, vision, and immune system health.

Report Coverage

The global algae products market research report analyzes the market in-depth. It highlights crucial aspects such as prominent companies, the market segmentation, competitive landscape, algae types, and application usage areas. Besides this, it provides insights into the global market demand and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.08% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Source

o Chlorophyta (Green) o Rhodophyta (Red) o Phaeophyta (Brown)

o Spirulina o Chlorella o Others By Application

|

|

By Region North America (By Source, Application, and Country) · The U.S. (By Application) · Canada (By Application) · Mexico (By Application) Europe (By Source, Application, and Country) · France (By Application) · Spain (By Application) · U.K. (By Application) · Italy (By Application) · Germany (By Application)

Asia Pacific (By Source, Application, and Country) · China (By Application) · India (By Application) · Japan (By Application) · Australia (By Application)

South America (By Source, Application, and Country) · Brazil (By Application) · Argentina (By Application)

Middle East & Africa (By Source, Application, and Country) · UAE (By Application) · South Africa (By Application) · Rest of the Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the worldwide market size was valued at USD 47.14 billion in 2026 and is anticipated to record a valuation of USD 81.46 billion by 2034.

Fortune Business Insights says that the global market value stood at USD 44.39 billion in 2025.

The global market is projected to grow at a significant CAGR of 7.08% during the forecast period.

By application, the food & beverage segment dominates the market.

Growing use of microalgae in the food sector is likely to drive the demand in the market.

Koninklijke DSM N.V., BASF SE, Corbion N.V., Euglena Co., Ltd., and others are some of the leading players globally.

Asia Pacific dominated the global market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us