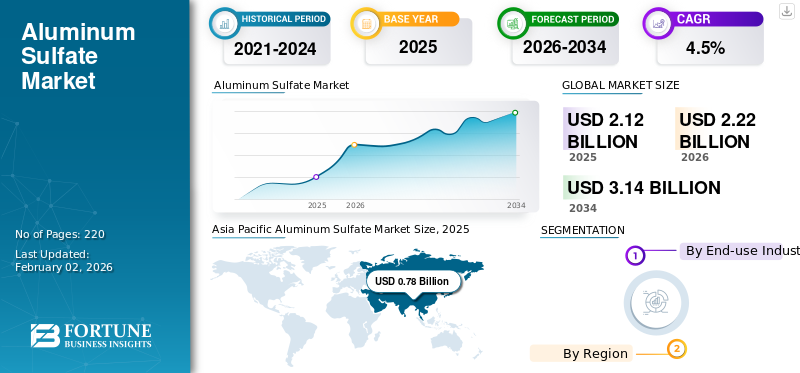

Aluminum Sulfate Market Size, Share & Industry Analysis, By End-use Industry (Water & Wastewater Treatment, Pulp & Paper, Construction, Textiles & Leather, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global aluminum sulfate market size was USD 2.12 billion in 2025. The market is projected to grow from USD 2.22 billion in 2026 to USD 3.14 billion by 2034 at a CAGR of 4.5% during the 2026-2034 period. Asia Pacific dominated the global market with a market share of 36.79% in 2025.

Aluminum sulfate is an inorganic aluminum salt, typically expressed as Al₂(SO₄)₃ and commonly known as alum. It is produced by reacting aluminum hydroxide or bauxite with sulfuric acid. It is widely used as a coagulant and pH-control agent, supplied in solid or liquid form, and valued for its ability to aggregate suspended particles and impurities. Its largest and most critical application is municipal and industrial water and wastewater treatment, where it enables clarification and contaminant removal. The major demand driver for aluminum sulfate is the expansion and modernization of global water infrastructure, particularly in emerging economies that are experiencing rapid urbanization, population growth, and increasingly stringent water quality regulations. Chemtrade Logistics, Kemira Oyj, USALCO, Feralco AB, and Nippon Light Metal Company, Ltd. are the key players operating in the market.

ALUMINUM SULFATE MARKET TRENDS

Water Infrastructure Keeps Alum Relevant in a Changing Coagulants Market

Aluminum sulfate continues to benefit from its crucial role in municipal water and wastewater treatment, which accounts for the majority of global demand. While alternative coagulants such as polyaluminum chloride and ferric salts are gaining traction in high-performance applications, aluminum sulfate remains the preferred choice in cost-sensitive regions due to its low price, established regulatory acceptance, and proven effectiveness. Another notable trend is the shift toward liquid alum in developed markets, driven by the need to meet handling efficiency and safety requirements. Regionally, the Asia Pacific and the Middle East & Africa are emerging as growth centers, supported by urbanization and infrastructure expansion.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Global Push for Clean Water Infrastructure to Sustain and Drive Market Growth

One of the most important demand drivers for aluminum sulfate is the expansion and modernization of potable water and wastewater treatment infrastructure worldwide. Rapid urbanization, population growth, and increasingly stringent water quality regulations are compelling governments to invest heavily in drinking water clarification, sewage treatment, and industrial effluent management. Emerging economies in Asia, Africa, and Latin America heavily rely on aluminum sulfate due to its affordability and wide availability. In developed regions, replacement of aging infrastructure and stricter discharge standards continue to support stable demand. As water security becomes a policy priority, alum consumption is expected to increase, driving aluminum sulfate market growth in tandem.

MARKET RESTRAINTS

Substitution Pressure and Environmental Scrutiny Likely to Limit Market Growth

Despite its widespread use, aluminum sulfate faces growing restraint from substitution by higher-efficiency coagulants, particularly polyaluminum chloride and ferric-based products. These alternatives offer better performance at lower dosages and generate less sludge, making them attractive in advanced treatment plants. Additionally, environmental and health scrutiny related to residual aluminum levels in treated water has prompted some utilities to diversify chemical usage. In mature markets such as Europe and North America, declining demand from the pulp and paper industry further limits volume growth. Together, substitution and regulatory risk are likely to constrain market expansion.

MARKET OPPORTUNITIES

Emerging Markets and Wastewater Reuse Open New Demand Avenues

Significant growth opportunities exist in emerging markets, where access to clean water remains uneven, and infrastructure investment is accelerating. Africa, South Asia, and parts of the Middle East are expanding municipal treatment capacity, creating sustained demand for aluminum sulfate. Additionally, the global push toward industrial wastewater reuse and circular water systems is increasing chemical consumption in secondary and tertiary treatment processes. Aluminum sulfate also benefits from its versatility across multiple industries, including construction, textiles, and mining. Producers that invest in regional manufacturing, logistics efficiency, and bundled water-chemicals portfolios are well-positioned to capture increasing demand.

MARKET CHALLENGES

Margin Pressure in a Regional, Logistics-Driven Commodity Nature to Create Market Challenges

The aluminum sulfate industry faces persistent challenges from low product differentiation and intense price competition. High transportation costs limit long-distance trade, forcing producers to compete in localized markets where price, reliability, and logistics are the primary factors influencing purchasing decisions. Volatility in key inputs such as sulfuric acid, energy, and freight further pressures margins. Additionally, producers must balance compliance costs related to water treatment regulations while competing against alternative coagulants. In this environment, sustaining profitability requires operational efficiency, feedstock integration, proximity to customers, and the ability to offer value-added services rather than relying solely on volume growth.

SEGMENTATION ANALYSIS

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Expansion and Upgrading of Municipal Treatment Infrastructure Boosts Water & Wastewater Treatment Growth

Based on the end-use industry, the market is segmented into water & wastewater treatment, pulp & paper, construction, textiles & leather, and others.

The water & wastewater treatment segment is anticipated to hold the dominant aluminum sulfate market share during the forecast period. The primary factor driving aluminum sulfate demand in water and wastewater treatment is the global expansion and upgrading of municipal treatment infrastructure to meet stricter water quality and discharge standards. Rapid urbanization, population growth, and rising industrial effluent volumes are forcing governments to invest in cost-effective clarification and phosphorus removal solutions. Aluminum sulfate remains the preferred coagulant in many regions due to its low cost, regulatory familiarity, and proven performance, especially in emerging markets where affordability and operational simplicity are critical.

Demand in the textile and leather segment is driven by the geographic concentration of textile manufacturing and dyeing operations in emerging economies, particularly Asia and parts of Africa. The product is widely used as a mordant and dye-fixing agent, enabling consistent color and facilitating wastewater clarification at a low cost. As global apparel supply chains expand their capacity in cost-competitive regions and environmental norms tighten around effluent treatment, product consumption rises due to its dual role in enhancing processing efficiency and ensuring wastewater compliance.

ALUMINUM SULFATE MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Aluminum Sulfate Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region is expected to dominate the market during the forecast period. Demand is driven by water and wastewater treatment, fueled by rapid urbanization, industrial expansion, and large-scale investments in municipal infrastructure. Cost sensitivity and wide regulatory acceptance make aluminum sulfate the preferred coagulant in many countries. Textiles and leather act as a strong secondary driver due to the region’s dominance in global dyeing and tanning activities, while pulp and paper also contribute through packaging demand. Together, these applications reinforce sustained multi-sector demand growth.

Japan Aluminum Sulfate Market

Japan’s aluminum sulfate market is projected to reach approximately USD 0.06 billion in 2025, equivalent to around 2.8% of global aluminum sulfate sales.

China Aluminum Sulfate Market

China’s market can be analytically approximated at around USD 0.38 billion in 2025, accounting for roughly 17.9% of global aluminum sulfate sales.

India Aluminum Sulfate Market

India’s aluminum sulfate market is projected to reach approximately USD 0.16 billion in 2025, equivalent to around 7.5% of global aluminum sulfate sales.

North America

In North America, product demand is primarily driven by water and wastewater treatment, supported by aging municipal infrastructure, strict drinking water regulations, and high per-capita water chemical consumption. Replacement of legacy treatment systems and growing focus on phosphorus removal sustain stable alum usage. Pulp and paper remains a secondary but relevant driver, particularly in packaging and tissue grades, while construction contributes marginally through specialty cement and admixtures.

U.S. Aluminum Sulfate Market

The U.S.’s aluminum sulfate market is projected to be one of the largest worldwide, with 2025 revenues estimated at around USD 0.47 billion, representing roughly 22.2% of global aluminum sulfate sales.

Europe

Europe’s product demand is driven mainly by water and wastewater treatment, supported by stringent environmental regulations and compliance with EU water quality directives. Continuous upgrades to municipal and industrial treatment facilities sustain baseline demand despite market maturity. Pulp and paper provide secondary support, especially in specialty and recycled paper segments, although long-term growth is limited.

U.K. Aluminum Sulfate Market

The U.K.’s aluminum sulfate market is projected to reach approximately USD 0.07 billion in 2025, equivalent to around 3.3% of global aluminum sulfate sales.

Germany Aluminum Sulfate Market

Germany’s aluminum sulfate market is projected to reach approximately USD 0.09 billion in 2025, equivalent to around 4.2% of global aluminum sulfate sales.

Latin America

In Latin America, product demand is primarily driven by water and wastewater treatment, as governments invest in expanding access to clean drinking water and improving urban sanitation systems. Infrastructure catch-up and regulatory tightening support steady growth. Construction provides a meaningful secondary contribution through the use of cement additives and infrastructure projects, while the pulp and paper sector supports demand in countries with strong pulp production, such as Brazil and Chile.

Brazil Aluminum Sulfate Market

Brazil’s aluminum sulfate market is projected to reach approximately USD 0.07 billion in 2025, equivalent to around 3.3% of global aluminum sulfate sales.

Middle East & Africa

In the Middle East & Africa, product demand is driven predominantly by water and wastewater treatment, reflecting acute water scarcity, population growth, and investment in municipal treatment capacity. In Africa, expanding access to safe drinking water is the key driver, while in the Middle East, industrial and municipal treatment supports demand. Construction plays a secondary role through infrastructure development and specialty cement applications.

Saudi Arabia Aluminum Sulfate Market

Saudi Arabia’s aluminum sulfate market is projected to reach approximately USD 0.03 billion in 2025, equivalent to around 1.4% of global aluminum sulfate sales.

COMPETITIVE LANDSCAPE

Key Industry Players

Competition Driven by Logistics Efficiency by Key Players Leads to a Competitive Market

The global aluminum sulfate industry is fragmented and regionally structured, with competition driven by logistics efficiency, regulatory compliance, and proximity to municipal water treatment customers rather than product differentiation. Demand is anchored in water and wastewater treatment, making long-term utility contracts strategically critical. The competitive landscape is led by Chemtrade Logistics, Kemira Oyj, USALCO, Feralco AB, and Nippon Light Metal Company, which together dominate regulated markets in North America, Europe, and the Asia Pacific. Smaller regional producers compete on cost and location, while substitution by PAC and ferric salts shapes strategic positioning.

LIST OF KEY ALUMINUM SULFATE COMPANIES PROFILED

- Chemtrade Logistics (Canada)

- USALCO (U.S.)

- Kemira Oyj (Finland)

- Affinity Chemical (U.S.)

- Nippon Light Metal Company, Ltd. (Japan)

- GAC Chemical Corporation (U.S.)

- Feralco AB (Sweden)

- Coogee (Australia)

- Vinipul Inorganics Pvt. Ltd. (India)

- Saf Sulphur Factory (Saudi Arabia)

- Other Key Players

KEY INDUSTRY DEVELOPMENTS

- May 2025 - Chemtrade announced the acquisition of aluminum sulfate water treatment chemical businesses in Florida, New York, and California from subsidiaries of Thatcher Group Inc. for USD 30 million. The acquisition strengthens Chemtrade’s U.S. water treatment platform and aligns with its strategy of pursuing targeted investments.

- November 2021 - USALCO has completed a merger with G2O Technologies, creating one of North America’s leading water treatment chemical producers with 27 sites spanning California to Puerto Rico. Backed by H.I.G. Capital, the combined company expands its in-house logistics and product portfolio, including aluminum and iron salts, polymers, and specialty formulations.

- May 2021 - Feralco acquired Venator Materials’ Wasserchemie business in Germany, which produces water treatment chemicals, including aluminum sulfate. The deal expanded Feralco’s alum and inorganic coagulant portfolio in Europe, strengthening its position in the municipal water treatment market.

REPORT COVERAGE

The global market report provides a detailed analysis of the market. It focuses on key aspects such as profiles of leading companies, product types, and leading applications of the product. Besides this, it offers insights into the analysis of key market trends and highlights key industry developments. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Volume (Kiloton); Value (USD Billion) |

|

Growth Rate |

CAGR of 4.5% during 2026-2034 |

|

Segmentation |

By End-use Industry, and By Region |

|

By End-use Industry |

· Water & Wastewater Treatment · Pulp & Paper · Construction · Textiles & Leather · Others |

|

By Region |

North America (By End-use Industry, By Country)

Europe (By End-use Industry, By Country)

Asia Pacific (By End-use Industry, By Country)

Latin America (By End-use Industry, By Country)

Middle East & Africa (By End-use Industry, By Country)

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 2.12 billion in 2025 and is projected to record a valuation of USD 3.14 billion by 2034.

In 2025, Asia Pacific stood at USD 0.78 billion.

Registering a CAGR of 4.5%, the market will exhibit steady growth during the forecast period of 2026-2034.

The water & wastewater treatment application is expected to lead this market during the forecast period.

Global push for clean water infrastructure to sustain and drive market growth.

Chemtrade Logistics, Kemira Oyj, USALCO, Feralco AB, and Nippon Light Metal Company are the major players operating in the market.

Asia Pacific dominated the market in terms of share in 2025.

Global expansion and modernization of water treatment infrastructure to drive wider adoption.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us