Airport Baggage Handling System Market Size, Share & Industry Analysis, By Type (Destination-coded Vehicle (DCV), Conveyors, Sorters, Self-bag Drop (SBD)), By Mode of Operation (Automated and Manual), and Regional Forecast, 2026 – 2034

Airport Baggage Handling System Market Size

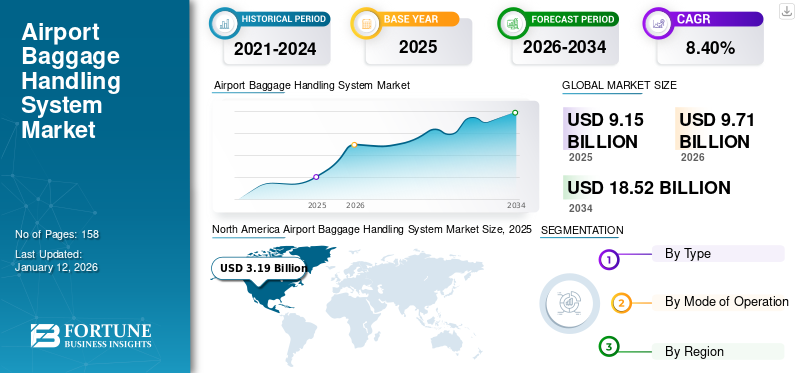

The global airport baggage handling system market size was valued at USD 9.15 billion in 2025 and is projected to grow from USD 9.71 billion in 2026 to USD 18.52 billion by 2034, exhibiting a CAGR of 8.40% during the forecast period. North America dominated the global market with a share of 34.90% in 2025.

An airport baggage handling system is a sophisticated infrastructure designed to efficiently transport, sort, and manage checked luggage or baggage within an airport terminal. It is a crucial component of airport logistics operations, ensuring passengers' bags are moved swiftly and accurately between the check-in area, the departure gates, and the aircraft, as well as between arriving aircraft and the baggage claim area. The primary goal of a BHS system is to streamline handling luggage, minimize delays and errors, and provide a seamless experience for travelers. All such factors drive market growth.

Rising investment in the new Airport and renovation of airport infrastructure across France, China, India, and Germany, which creates the demand for conveyors and destination-coded vehicles, fuels the growth of the market. In addition, the rising disposable income of the population, which, in turn, rising spending on air passenger traffic, has boosted the demand for airport baggage handling systems. A growth in tourism across both developing as well as developed economies, raising the investment in the construction of new airports, fuels market growth.

- For instance, as per the source of the International Air Transport Association, air passenger traffic across the globe increased by 55% from 2022 to 2023.

Also, major players such as Alstef Group, Daifuku Co Ltd, and Siemens AG, among others, are engaged in adopting product launches and acquisitions as key strategic moves to strengthen the market competition. For instance, in November 2024, Alstef Group signed an agreement with Zagreb International Airport based in Croatia. The agreement was made to provide baggage handling systems at airport stations. All such key developments boost the global airport baggage handling system market.

Download Free sample to learn more about this report.

The COVID-19 pandemic had a significant impact on the global market owing to a decline in passenger traveling at international and domestic airports. Additionally, halted airport infrastructure projects and supply chain disruptions affected the manufacturing of these systems, which restricted the market growth. Moreover, rising automation and touchless technologies to reduce human contact and smart baggage handling systems in airports fuel the market growth after the COVID-19 pandemic.

IMPACT OF TECHNOLOGY

Integration of Advanced Technologies in Airport Sector to Drive Market Growth

Rising adoption of technological advancements such as IoT, AI, radio frequency identification, RFID, machine learning, and robotic systems in these systems is surging in bringing automation to the baggage handling system. Tech-advanced systems enable features such as utilizing autonomous guided vehicles, an automated storage and retrieval system, and advanced tracking capabilities during checking and handling systems at international as well as domestic airports. Moreover, an advanced BHS system offers features such as real real-time tracking system, minimizing errors and delays during baggage handling solutions.

Moreover, more than 40% of airlines across the globe have adopted AI-based systems for baggage handling operations. Major players such as SITA, Alstef Group, Siemens AG, and ULMA Group, among others, are engaged in the adoption of integrating tech-advanced product portfolios into the market. For instance, in December 2024, SITA signed a collaboration with IDEMIA Public Security deals in computer vision and digital technologies. The collaboration was done to bring automation in the baggage handling solutions at airport operations.

AIRPORT BAGGAGE HANDLING SYSTEM MARKET TRENDS

Ease in Travel Restrictions and Increased Airline Operators to Boost Airport Logistics Operations

An increasing number of international and domestic air passengers worldwide, which, in turn, creates the demand for more advanced airport logistics systems. With the easing of travel restrictions, a growing number of individuals are taking trips, resulting in increased passenger numbers at airports. Moreover, stringent government regulations on baggage screening have led to investment in automated screening solutions, which are integrated with baggage handling systems to improve security and passenger experiences. All such factor drives the growth of the airport baggage handling system market.

- For instance, according to statistics by the Indian government, the Indian government planned to invest around USD 6,917.6 million in the construction of new airports across the country. All such factors are the latest trends in the available market.

MARKET DYNAMICS

Market Drivers

Rising Number of Air Passenger Traffic Globally to Trigger Market Growth

Increasing global demand for air travel raises the demand for these systems for efficient material handling and parcel sorting systems across the globe. Also, with the increasing number of air passengers globally, airports are experiencing higher volumes of baggage handling systems that need to be efficiently managed.

Moreover, major government and private investors are investing in upgrading existing airports and building new ones, which in turn is raising the demand for such systems, driving market growth. In addition, increasing concerns over security and lost luggage are pushing airports to implement advanced screening and tracking systems, which is projected to drive the global airport baggage handling system market growth.

- For instance, according to IATA, the development of global airport infrastructure is estimated to rise between USD 1.2 and USD 1.5 trillion by 2030. Also, in 2023, IATA notified 270 total projects with a combined valuation of USD 140 billion. Such a growth in the number of air passengers fuels the development of the global airport baggage handling system market.

Market Restraints

High Initial Capital Investment and Maintenance Costs to Hinder Market Growth

The cost required for sophisticated BHS systems across airports and airlines across the globe is a major challenge for numerous airports, especially in developing countries. Installing these systems at airports necessitates extensive modification to existing infrastructure, which further increases the total cost. In developing regions such as India, China, and Brazil, among others, small airports across the globe may struggle to afford these upgrades owing to the large upfront cost required to install airport baggage handling system products. The cost of installing an airport baggage handling system in small, medium, and large airports ranges from USD 2 million to USD 500 million. This cost is not bearable for small and medium-scale airports. All such factors restrict market expansion.

Market Opportunities

Technological Advancements in BHS Solutions to Provide Ample Growth Opportunities

Key players such as Alfet Group, Daifuku Co Ltd, SITA, and Siemens AG, among others, are engaged in adopting new technological advancements such as robotic systems, AI-enabled systems, and machine learning technology. Moreover, it offers features such as minimizing human mistakes, reducing operational costs, enhancing operational efficiency, maintaining precision & accuracy, and enhancing the speed of baggage processing.

Moreover, key players in the market bring technological advancements such as AI, IoT, robotics, and cloud computing to baggage handling systems, which improve efficiency and security. For instance, in March 2023, IDEMIA, a subsidiary of Advent International, introduced a new airport ALIX BHS system for baggage processing. It is an AI-enabled machine that helps automate lost luggage identification practices. It offers features such as high speed, reduced error in handling baggage at airports, maintained accuracy, and lower operating costs. All such factors drive market growth.

SEGMENTATION ANALYSIS

By Type

Conveyors to Dominate Due to High Demand for Heavy Luggage Transport

Based on type, the market is classified into Destination-coded Vehicle (DCV), conveyors, sorters, and Self-bag Drop (SBD).

The conveyors segment dominated the market share with share of 43.87% in 2026, owing to factors such as major players being engaged in providing products that are easy to manufacture and easy to install. Also, optimal speed ensures low baggage mishandling complaints that drive the demand for conveyors in the baggage handling industry.

However, the destination-coded-vehicle (DCV) segment is projected to grow with the highest growth rate, owing to this type having a high speed, 5 times that of conveyors, and being largely adopted in large airports.

Also, the sorters and self-bag drop segment is growing with potential growth, owing to the often installation of products in small as well as large airports. All such factors contribute positively to the airport baggage handling system market.

To know how our report can help streamline your business, Speak to Analyst

By Mode of Operation

Growing Implementation of Automated Handling Systems to Boost Segment Expansion

Based on the mode of operation, the market is segmented into automated and manual.

The automated segment led the market share with share of 77.55% in 2026, and the same segment is projected to grow at a substantial rate, owing to almost all airports implementing technology-efficient and high-speed automated airport baggage handling systems. The automation integration to baggage conveyor systems, ensuring correct and optimal delivery of baggage to passengers, is driving baggage handling systems.

The manual segment is projected to grow steadily during the forecast period, owing to rising demand from small and medium airports. Additionally, an increasing modernization of new airports coupled with automated conveyors is the major factor expanding the handling system market size.

AIRPORT BAGGAGE HANDLING SYSTEM MARKET REGIONAL OUTLOOK

The market covers five major regions, mainly North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America

North America Airport Baggage Handling System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2026 valuing at USD 3.38 Billion and also took the leading share in 2025 with USD USD 3.19 Billion. Increasing government investment in airport construction, strong economic growth, and increasing air passenger traffic across the region are some of the major factors that create significant demand for airport baggage handling systems. For instance, in 2023, Airports Council International revealed that the U.S. government is planning to invest around USD 151 billion in the construction of new airports from the period of 2023 to 2027. This investment includes the construction of large airports, small airports, and medium airports. All such factors drive the North American airport baggage handling system market.

The U.S. dominates the market in the region as the country has the highest number of airports in the world, which surges the demand for airport baggage handling systems. The U.S. market is projected to reach USD 2.44 billion by 2026. There is a significant surge in air passenger traffic in the U.S. due to the increasing disposable income and rise in the number of international passengers. For instance, according to the International Air Transport Association IATA, the number of air passenger traffic in the U.S. increased by 102% in February 2023, as compared to February 2019. All such aforementioned factors uplift the growth of the market. All these factors further augment the airport baggage handling system market.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The Asia Pacific region is set to grow progressively during the forecast period, owing to rising air passenger traffic and the modernization of airport infrastructure in China, Japan, India, and ASEAN countries. In addition, growth in tourism and the rising disposable income of the population surge spending on air travel. The Japan market is projected to reach USD 0.32 billion by 2026, the China market is projected to reach USD 0.95 billion by 2026, and the India market is projected to reach USD 0.4 billion by 2026.

- For instance, in 2022, the Indian government invested over USD 2 billion in the renovation of Sardar Vallabhbhai Patel International Airport, which is located in Gujarat, India.

Europe

The European market is set to grow steadily during the forecast period, owing to factors such as the strong presence of major players in the European region, such as Siemens AG, Beumer Group, Fives, Vanderlande Industries, ULMA Group, and others engaged in providing destination-coded vehicles, conveyors, sorters, and self-bag drop system in the market. Also, the rising count of airports across Germany, France, and the U.K., with a surge in air passenger traffic, needs efficient machines to handle baggage management solutions, which drives the airport baggage handling system market share. The UK market is projected to reach USD 0.36 billion by 2026, while the Germany market is projected to reach USD 0.42 billion by 2026.

Middle East & Africa

The Middle East & Africa region is projected to grow at a moderate rate owing to factors such as rapid economic growth, growth in tourism, and rising government investment in the construction of new airports and modernization of airports, which surge in the adoption of the BHS system at airports across the Middle East & Africa.

Latin America

The market in Latin America is expected to grow at a decent growth rate during the forecast period, owing to rising government investment in the aviation industry and growth in the tourism sector, which fuels the demand for such systems, driving the airport baggage handling system market.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Major Players Engaged in Adopting Product Launch, Acquisition, and Partnership as Key Strategies to Intensify Market Competition

Major players such as Alstef Group, Siemens AG, Beumer Group, and Daifuku Co. Ltd, among others, are engaged in adopting product launches, partnerships, and mergers as key developmental strategies to improve the product portfolio of the BHS system and also to improve the geographical presence of key players.

- For instance, in March 2025, Alstef Group signed an agreement with an Airport based in Costa Rica, Latin America. The basic aim of the agreement was to provide the BHS system for the Airport to enhance operational efficiency and improve the experience of air travelers.

Major Players in the Airport Baggage Handling System Market

To know how our report can help streamline your business, Speak to Analyst

List of Key Airport Baggage Handling System Companies Profiled

- Alstef Group (France)

- Beumer Group (Germany)

- China International Marine Containers (Group) Ltd. (China)

- C I MATEC LOGISTICA S A S (Colombia)

- Daifuku Co., Ltd. (Japan)

- Fives (France)

- Leonardo S.p.A (Italy)

- Siemens AG (Germany)

- Toyota Industries Corporation (Japan)

- ULMA Group (Spain)

- SITA (Switzerland)

- Babcock International (U.K.)

- Dalmec Inc (U.S.)

- Pteris Global Limited (Singapore)

- Smiths Detection Group Ltd (U.K.)

- Glidepath Limited (New Zealand)

- G&S Airport Conveyor (U.S.)

- Matrex (Saudi Arabia)

- Telair International GmbH (Germany)

- Logplan LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2024: Alstef Group launched a new XSORT cross belt sorter machine for airport baggage handling solutions. It offers features such as a low height and minimized footprint, but it requires minimal maintenance and smooth operation. It can be adjustable, and there are incline options of 5 degrees and 11 degrees angles.

- September 2024: Beumer Group planned to launch a new baggage handling system for airports at the Airports Council International (ACI), which was held in Glasgow, U.K. The product, SECTRO, offers features such as a new centralized solution, improved security, optimized operations, and enhanced passenger experience.

- November 2023: Ulma Group launched a new baggage handling system at Malaga Costa del Sol Airport in Spain. It offers features such as an enabled inspection system, is accurate, requires less space, and has low maintenance costs.

- July 2023: Alstef Group and SACO, a company involved in air cargo solutions, announced a partnership to offer an innovative air cargo handling system. The main aim of the partnership was to improve efficiency, speed, and security in air cargo handling operations.

- March 2022: Alstef Group installed a new baggage handling system for Felipe Angeles International Airport, based in Mexico. This project includes the installation, operation, and maintenance of the machine. This contract involves installing a 20 self-bag drop baggage handling system at the Airport.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, competitive analysis, types, and mode of operation segment. Besides, the report offers insights into the key performance indicators and key market indicators. Market trends and dynamics and highlights key industry developments. In addition to the factors above, the handling system market report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Growth Rate |

CAGR of 8.40% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion) |

|

|

Segmentation |

By Type

By Mode of Operation

By Region

|

|

|

Companies Profiled in the Report |

Alstef Group (France), Beumer Group (Germany), China International Marine Containers (Group) Ltd. (China), C I MATEC LOGISTICA S A S (Colombia), Daifuku Co., Ltd. (Japan), Fives (France), Leonardo S.p.A (Italy), Siemens AG (Germany), Toyota Industries Corporation (Japan), and ULMA Group (Spain) |

|

Frequently Asked Questions

The market is projected to reach USD 18.52 billion by 2034.

In 2025, the market was valued at USD 9.15 billion.

The market is projected to grow at a CAGR of 8.40% during the forecast period.

The conveyor type segment led the market.

The rising number of air passenger traffic is the key factor driving market growth.

Alstef Group, Beumer Group, China International Marine Containers (Group) Ltd., C I MATEC LOGISTICA S A S, Daifuku Co., Ltd., Fives, Leonardo S.p.A, Siemens AG, Toyota Industries Corporation, and ULMA Group are the top players in the market.

North America held the highest market share in 2025.

By mode of operation, the automated baggage system is expected to grow with a substantial CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us