Dark Fiber Market Size, Share & Growth Analysis Report, By Fiber Type (Plastic and Glass), By Technology (DWDM and Mobile Backhaul), By Service (Single-mode and Multimode), By Application (Telecom, Automobile, Industrial Automation & Control, Aerospace & Defense, Data Centers, and Others (Government)), and Regional Forecast, 2026–2034

Dark Fiber Market Size & Growth

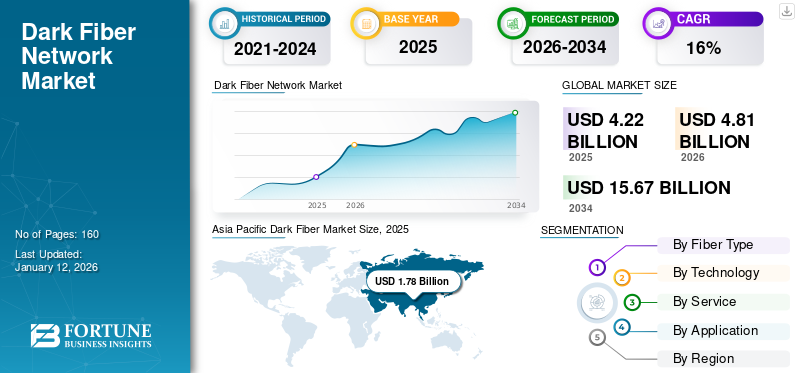

The global dark fiber market size was valued at USD 4.22 billion in 2025 and is projected to grow from USD 4.81 billion in 2026 to USD 15.67 billion by 2033, exhibiting a CAGR of 15.90% during the forecast period. Asia Pacific dominated the dark fiber market with a market share of 42.10% in 2025.

The global connectivity landscape is the backbone of every telecom and information technology. Dark fibers, also termed as un-lit fibers or unused fiber optic cables, or optical fibers that are not in service or any internet traffic flowing through it. The un-lit fiber is a technological advancement that offers ultra-high speed and scaling of the existing optical communication network infrastructure for optimizing business performance. It offers ten times faster speed than the standard optical fiber cables and carries much more data with lower latency and higher security than fiber optic cables of the same diameter. The network and IT internet line service providers are constantly trying to use innovative fiber optics to optimize the Optical Distribution Network (ODN) efficiency and minimize the Operations and Maintenance (O&M) costs.

5G is a significant market driver as it takes the optical fiber connectivity to the next level due to rising consumer base and demand for low latency. These consumer demands are expected to play an essential role in extending the possibilities of using fiber cables for mobile backhaul and the network multiplexing infrastructure.

The study shows that the COVID-19 pandemic significantly impacted the adoption of fiber optic networks. Disturbed supply chain networks and lockdowns implemented by majority of the nations across the globe caused a negative impact on the manufacturing of IT and network-based products. These stringent regulations and guidelines were introduced for a short time. However, the market has revoked from the supply-chain restrictions with systematic approach and methods to resume the import and export of dark fibers. Network suppliers are also struggling on providing internet services from internet service providers to consumers, which eventually resolved through a distributed network of lease operators and internet service providers that help regained business strength. This factor has helped the market recover from the pandemic.

Dark Fiber Market Trends Insights

Integration of Optic Fiber by Businesses to Propel Market Growth

Fast-growing businesses demand high-speed internet connections and higher bandwidth. As a result, consumers and businesses are shifting from standard copper or traditional internet cables to optical fiber ones. Bigger organizations in the industry are integrating optical fiber devices and components with their installed Voice over IP (VoIP) telephony to enhance their business communications. Also, the integration of dark fiber networks with the internet services in organizations creates a more efficient working environment with faster internet speed. Unlike the standard copper internet cables, optical fiber cables are resistant to harsh climatic conditions. In addition to this, dark optical fibers eliminate unexpected internet downtimes as this might cost users time and money. Besides, complex and robust internet connections demanding higher bandwidth and lower down time are increasingly using un-lit fibers which can help companies accelerate operational productivity, enhance server utilization, and decrease packet loss in networks. Thus, the growing use of optical fiber in business verticals is anticipated to reshape the market’s outlook, while boosting the global dark fiber market growth during the forecast period.

Download Free sample to learn more about this report.

Dark Fiber Market Growth Factors Insights

Expansion of Data Centers and Cloud Computing for Better Connectivity to Drive Product Demand

The expansion of data centers in Asia Pacific owing to the rising penetration of internet in rural areas. The growing demand for cloud computing and data centers in the region’s emerging information technology hubs, such as India, Singapore, and Japan have driven the need for un-lit fibers for higher bandwidth. Dark fiber optics are considered the ideal solution for data centers as they deliver a secure and reliable connection for data transactions and security. Another major application of un-lit fibers is cloud computing that requires a low latency network to transmit data from multiple access points across the internet. At a worksite, in a software production environment, the un-lit fiber connectivity helps with efficient data transmission across multiple data servers, which will extend the demand for un-lit fibers in the long term. The organizations operating in the field of information technology and providing services, such as cloud computing and data analytics are seeking optical fiber service providers owing to its unlimited speed, superior performance, and enhanced security. Thus, growing investment in Video-on-Demand (VoD) services for video streaming and the need for higher bandwidth and enhanced connectivity in data centers and cloud computing are the potential market trends shaping the dark fiber market size.

RESTRAINING FACTORS INSIGHTS

Lack of Investments to Hinder Market Growth

The fiber connection installation and maintenance services are quite costly for the Internet Service Providers (ISPs). Therefore, un-lit fibers are a revenue driver for ISPs as they provide several benefits compared to the traditional coaxial cables and Digital Subscriber Line (DSL). However, the un-lit fiber technology demands a huge capital investment which majority of internet service providers finds difficult to accomodate and could be a potential restraint to the market growth. Though, owing to the higher maintenance, service limitation, and operational cost by optical fibers, majority of the small-scale information technology companies and governments are investing less in the dark fiber infrastructure. Additionally, multifaceted laws are discouraging countries from investing in optical fibers, which is providing opportunities for private businesses.

- For instance, as per Broadband Now, even the fiber optic connection is considered as faster, internet service providers are unable to provide internet services to the home because of limited service availability. In March 2020, Chicago had only 21% fiber availability, while Dallas had about 61% availability, which is considered the highest compared to other major cities in the U.S.

Dark Fiber Market Segmentation Analysis

By Fiber Type Insights

To know how our report can help streamline your business, Speak to Analyst

High Transmitting Capabilties to Bolster Glass Fiber Demand

Based on fiber type, the market is classified into two major types - glass and plastic fiber.

The glass fiber type segment is expected to hold the largest dark fiber market share of 70.49% in 2026, owing to its high transmitting capabilities without packet loss.

In contrast, the plastic fiber type segment is exhibiting the highest CAGR due to better flexibility in long range, greater operational life, and low cost of investment.

By Technology Insights

Product Applications to Rise in Mobile Backhaul Technology Due to Growing Use of Mobile Connections

Based on technology, the market is classified into Dense Wavelength Digital Multiplexing (DWDM) and mobile backhaul.

The mobile backhaul segment is estimated to dominate the market with a share of 60.54% in 2026, owing to the rising adoption of mobile connections and the high demand for 5G data from mobile internet service providers.

The DWDM technology segment is also showing the highest CAGR due to the rising global demand for lag-free internet services from data centers, server operators, and data & cyber security businesses.

By Service Insights

Growing Adoption of Multimode Network Services to Boost the Market Growth

Based on service, the market is segmented into single mode fiber and multimode fiber.

The multimode fiber segment is expanding, recording the highest CAGR owing to low cost of operations, installation, and maintenance.

Compared to this, the single mode fiber segment is demonstrating the highest CAGR owing to its growing adoption in the 5G network for Fiber to the Home (FTTH) and (Fiber to the X (FTTX) businesses.

By Application Insights

Dominant Application in Telecommunication for Seamless Connectivity to Support Market

By application, the market is bifurcated into telecom, automobile, industrial automation & control, aerospace & defense, data centers, and others (government).

The telecommunication application segment is anticipated to lead the market with the highest CAGR owing to rising demand for higher internet bandwidth with low latency.

The use of optical fiber connectivity is the crucial element driving the demand for essential services across the telecommunications industry as it offers low internet tampering and higher bandwidths for transmitting data of large gigabytes. The un-lit fiber connectivity is essential for the SONAR and seismic waves identification systems in aircraft, submarines, automobiles, and in various location devices in different industrial automation and control instruments. Similarly, data centers and large government corporations have started utilizing the capabilities of fiber connections in their systems to enhance the security of data transmission through optical fiber capabilities. This will offer benefits to both the business owners and government firms in the long term.

REGIONAL INSIGHTS

Asia Pacific Dark Fiber Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The global dark fiber market is studied across five major regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific dominated the market with a valuation of USD 1.78 billion in 2025 and USD 2.06 billion in 2026, owing to rising internet penetration in urban and rural areas and high youth population. The region is witnessing technological transformation, which provides immense opportunities for the internet service providers owing to the growing adoption of technologies, such as 5G connectivity and mobile backhaul.

In the past two decades, China has invested in major technological advancements across the information technology and telecom sectors. Telecom companies in China have used advanced fiber optic cables in majority of the telecom applications, which has boosted the network infrastructure throughout the country. Chinese authorities and technology companies are utilizing the optical fiber systems in almost every area, including power grids, highways, pipelines, airports, railways, data centers, multi-channel television broadcast systems, and long distance communications. Additionally, surge in the adoption of advanced 5G network is expected to fuel the demand for this type of optic fibers in mobile backhaul technology. Thus, network advancements and 5G infrastructure investments to exhibit the highest CAGR growth for developing country such as India and further supporting the economies of Japan, South Korea, and other Asian Countries. The Japan market is projected to reach USD 0.37 billion by 2026, the China market is projected to reach USD 0.76 billion by 2026, and the India market is projected to reach USD 0.25 billion by 2026.

In North America, the growing demand for low-latency network and higher bandwidth has encouraged companies to invest in low traffic un-lit fiber technology for both fixed telephone and mobile services. Also, prominent dark fiber manufacturers operating in the U.S. are expanding their global reach through collaborations with local subsidiaries in other nations. The U.S. market is projected to reach USD 0.73 billion by 2026.

In Europe, the growing need for bandwidth with higher frequency for better communication and lag-free data services has increased the dominance of the un-lit fiber technology. Additionally, the FTTH Council Europe is constantly increasing the availability of high-speed internet services to businesses and consumers, which is supporting the regional market’s growth. The UK market is projected to reach USD 0.34 billion by 2026, while the Germany market is projected to reach USD 0.15 billion by 2026.

Furthermore, growing initiatives by countries in the Middle East & Africa to fast track the internet penetration in their regions is supplementing the growth of the market.

Also, rising investments by South American countries to boost their network efficiencies and provide low-latency internet to their government and private entities is driving the demand for un-lit fibers in the region.

Dark Fiber Market Key Companies Insights

Strategic Collaborations and Joint Ventures to Help Key Players Expand Their Business Potential

The key players operating in the dark fiber market are concentrating on solidifying their consumer base by introducing advanced solutions and unique plans. They are expanding their business capital through collaborations and partnerships. Since the demand for un-lit fiber varies from business to business, these key players are focusing on providing cost-effective and customized solutions to align to the network requirements of their customers. However, since dark fiber is a newer fiber technology in comparison to the standard broadband services, many businesses are leveraging the benefit of higher returns through their initial investment in fiber. Thus, endless benefits for businesses and technology giants through the implementation of this type of optic fiber will expand the market share of key companies during the forecast period.

List of Key Companies Profiled

- AT&T (U.S.)

- CenturyLink (U.S.)

- Comcast Corporation (U.S.)

- Lumen Technologies (U.S.)

- Zayo Group (U.S.)

- Colt Technology Services Group Limited (U.K.)

- Cogent Communications (U.S.)

- EXA Infrastructure (U.K.)

- Windstream Communications (U.S.)

- Telstra Group (U.S.)

- euNetworks (U.K.)

KEY INDUSTRY DEVELOPMENTS

- November 2023: Lumen technologies, a technology leader, closed an approximately USD 110 million contract with the U.S. Defense Information System Agency (DISA). The contract will operate and maintain DISA’s fiber backbone that includes dark fiber, colocation facilities, diverse end-to-end network infrastructure, new fiber builds, and system updates.

- October 2023: Fluxys Belgium and gasLINE signed an infrastructure co-operation agreement that will work to expand the fiber optic network to western Europe. The company has a strong dark fiber network in Belgium and Germany and the plan is to expand the network to neighbouring countries.

- July 2023: Uniti Group Inc. signed a contract with a global internet service provider for long-term offering of a long-range dark fiber network across two important U.S. routes that work on 12 cities covering Southeast and Midwest, encompassing 7,000 miles of fiber strands.

- April 2023: euNetworks completed the acquisition of the dark fiber business of Begian Utility Company. The acquisition will help euNetworks expand its business to Belgium while maintaining and delivering scalable and unique network routes.

- April 2023: Zayo Group Holdings Inc., a global communication infrastructure, announced the series expansion of its network and services. The expansion includes enhanced network protection, on-demand services, and growth of its long-haul dark fiber and 400G-enabled routes.

REPORT COVERAGE

An Infographic Representation of Dark Fiber Network Market

To get information on various segments, share your queries with us

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends, porter’s five forces analysis, and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.90% from 2025 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Fiber Type

By Technology

By Service

By Application

By Region

|

Frequently Asked Questions

The dark fiber market is projected to reach a valuation of USD 15.67 billion by 2034.

In 2025, the market was valued at USD 4.22 billion.

The market is projected to record a CAGR of 15.90% during the forecast period.

The Dense Wavelength Digital Multiplexing (DWDM) segment is expected have the highest CAGR.

Expansion of data centers and cloud computing for better connectivity are the key factors driving the market growth.

AT&T, CenturyLink (Lumen Technologies), Comcast Corporation, Lumen Technologies, Zayo Group, Colt Technology Services Group Limited, Cogent Communications, EXA Infrastructure, Windstream Communications, Telstra Group, and euNetworks are the top players in the market.

Asia Pacific is expected to hold the highest market share.

By application, the telecom segment is expected to record a significant CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic