Europe Medical Devices Market Size, Share & Industry Analysis, By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging Devices, In-vitro Diagnostics (IVD), Minimally Invasive Surgery Devices, Wound Management, Diabetes Care Devices, Ophthalmic Devices, Nephrology Devices, General Surgery, Dental Devices, and Others), By End-User (Hospitals & Ambulatory Surgery Centers (ASCs), Clinics, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

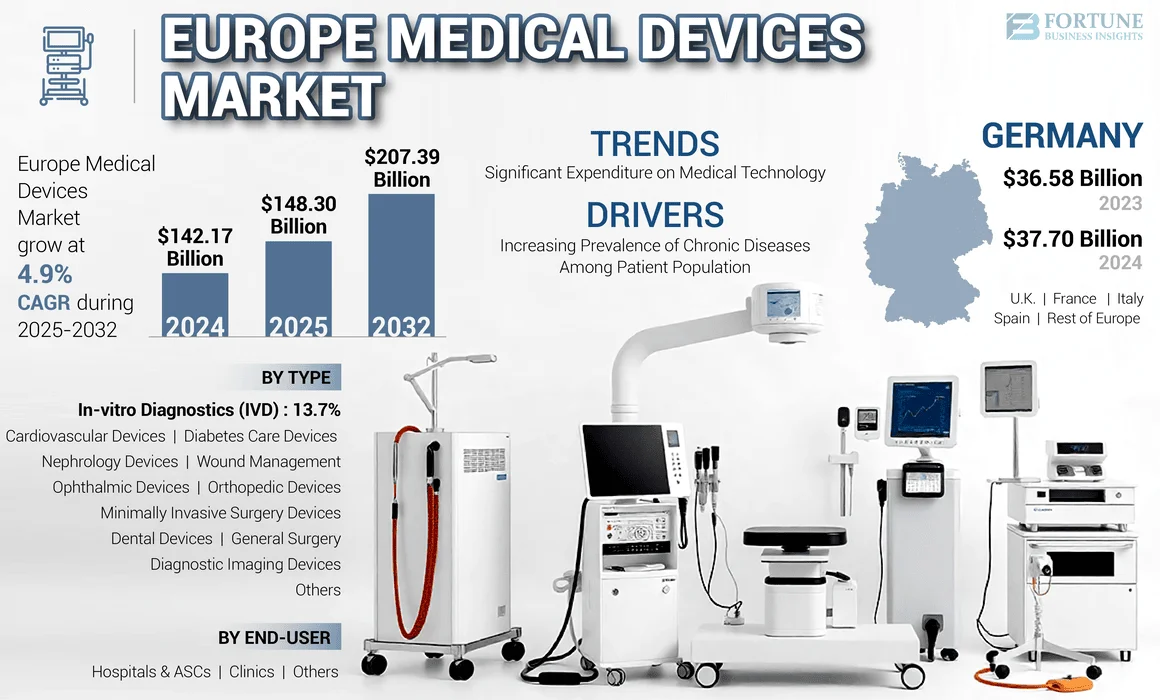

The Europe medical devices market size was USD 142.17 billion in 2024. The market is expected to grow from USD 148.30 billion in 2025 to USD 207.39 billion by 2032, exhibiting a CAGR of 4.9% during the forecast period.

Medical devices refer to instruments used for the prevention, diagnosis, and treatment of disease conditions among the patient population. The European medical device market is competitive due to increasing small and medium-sized enterprises, supportive regulatory framework, development of innovative products, and rising adoption of these devices. For instance, according to the European Commission, currently, there are over 500,000 types of medical devices and in-vitro diagnostics (IVDs) in the European market. These factors highlight a need for a smooth framework ensuring the flawless functioning of the internal market, and which is increasingly focused on product diversification.

Key players, including Abbott, Medtronic, Siemens Healthineers AG, are prioritizing research and development activities to introduce technologically advanced products to the market.

MARKET DYNAMICS

Market Drivers

Increasing Prevalence of Chronic Diseases Among Patient Population to Boost Market Growth

Increasing adoption of sedentary lifestyles and health-damaging behaviors, including tobacco use, lack of physical activity, poor eating habits, and excessive alcohol use, has rapidly increased lifestyle diseases such as diabetes, hypertension, and cardiac disorders. These chronic diseases exert an enormous economic burden on the healthcare systems of a country.

- For instance, according to the 2024 data provided by the World Health Organization (WHO), about 64.0 million adults and around 300,000 children and adolescents are estimated to be living with diabetes in the European region.

Growing prevalence is further leading to the increasing cost burden of chronic and lifestyle diseases, prompting government, healthcare agencies, and healthcare providers to emphasize timely and routine diagnosis, and early treatment. Thus, several healthcare agencies and key players have actively promoted routine diagnosis and treatment through various campaigns and awareness programs.

- For instance, in September 2024, the European Cancer Organization (ECO), collaborated with the Make Sense Campaign to raise awareness for better access to cancer care across Europe. Increasing awareness about cancer care is expected to increase the demand for these devices to diagnose cancer among the patient population.

Increasing health initiatives have contributed to growing awareness among the general population toward devices and products for diagnosing and treating chronic disorders. This, along with manufacturers introducing devices with various advanced capabilities such as artificial intelligence, 3D imaging, and wearable heart rate trackers. These innovations have significantly increased demand for these devices among the general and patient population, thereby supporting the growth of the Europe medical devices market.

MARKET RESTRAINTS

Slow Translation of Research into Clinical Practice May Delay Product Adoption and Limit Market Growth

There is a rising focus on innovation and the development of new products among prominent players in the market. However, European medical professionals often rely on conventional methods owing to strict regulations, multiple review layers, among others, for advanced devices. Artificial intelligence has become a significant part of medical technology. However, its approval guidelines are still unclear and limit medical professional’s access to innovative AI-powered products, causing delays in healthcare delivery at the patient level.

- For instance, according to an article published in December 2022 by Rijnstate Hospital, Netherlands, Europe's health professionals are ready to adopt efficient AI solutions. However, owing to the slow translation of research activity into clinical practice, they are not yet implemented in clinical practice. Additionally, many AI tools lack the necessary regulatory approvals and cannot be used clinically. The current regulation also restricts hospital data access for AI learning purposes. Once the access is granted, the database may become locked, creating a major contradiction that must be addressed.

This, along with certain factors such as persistent quality problems, software issues, mislabeling of devices, among others, present health risks to consumers and healthcare professionals. These issues often lead to product recalls, further limiting the adoption rate for these products in the market.

- For instance, in October 2024, Medtronic recalled Minimed 600 series or 700 series insulin pumps, including 630G, 670G, 770G, and 780G insulin pumps, due to the risk of shorter than expected battery life.

- In May 2024, Johnson & Johnson Services, Inc., recalled MEGADYNE MEGA SOFT Pediatric Patient Return Electrodes owing to reported cases of burn injuries among patients.

MARKET OPPORTUNITIES

Investments in R&D and Showcasing of Devices in Conferences to Present Lucrative Opportunities

Medical device manufacturers are shifting their strategies from incremental innovation toward breakthrough technologies, with a significant focus on research and development investments, expected to boost the growth of the market.

- For instance, in November 2024, Abbott established a new state-of-the-art manufacturing facility in Kilkenny, Ireland, with an aim to expand its geographical presence. The company is investing in expanding manufacturing and R&D capabilities across its diagnostic imaging and laboratory diagnostics portfolios.

Increasing investments in research activities for the development of novel devices are leading to increasing advantages offered to consumers along with improved accessibility. This is expected to fill the gap and the growing unmet need for efficient products.

Market players are also focusing on showcasing their product portfolios at national and international conferences to expand their geographical presence. This creates new opportunities in the underpenetrated and untapped markets, driving demand for innovative products.

- For instance, in April 2024, Johnson & Johnson Services, Inc., attended the 31st International Meeting on Advanced Spine Techniques (IMAST) to showcase the latest technological advancements across its comprehensive spine portfolio. This initiative helped the company increase its brand presence and market reach.

MARKET CHALLENGES

Inadequate Reimbursement Policies in Emerging Countries to Limit Market Growth

The availability of adequate reimbursement policies has been a crucial factor in the adoption of these devices among healthcare providers. However, limited reimbursement policies, especially in emerging countries such as Poland, Netherlands, and Serbia, have led to reduced adoption rate for these products in the market.

- For instance, according to 2023 data published by the Organization for Economic Co-operation and Development (OECD), it was reported that about 20% of patients pay out-of-pocket expenses in Poland.

However, healthcare agencies and governing bodies in emerging European countries are now focusing on realigning reimbursement policies to promote the use of these devices for various conditions, including cardiovascular and neurovascular disorders.

Other Prominent Challenges

- Supply Chain Disruptions – The COVID-19 pandemic increased vulnerabilities in the medical device supply chain, leading to shortages and delays. Ensuring a resilient supply chain remains a critical challenge in the market.

- Cybersecurity Risks – As these devices become more interconnected, they are increasingly susceptible to cyber threats, posing risks to patient data security and device functionality.

- Regulatory Hurdles – The stringent regulatory environment in Europe presents challenges, especially for new market entrants. The Medical Device Regulation (MDR) and In-vitro Diagnostic Regulation (IVDR) have introduced more rigorous requirements, impacting time-to-market and compliance costs for manufacturers.

EUROPE MEDICAL DEVICES MARKET TRENDS

Significant Expenditure on Medical Technology to Boost Market Prospects

There is an increasing trend toward the development of novel medical devices such as pacemakers, resulting in a huge amount of investment in the medical technology sector. For instance, according to 2023 data published by the Office for National Statistics, approximately 10.9% of GDP is spent on the healthcare system in the U.K. However, the expenditure varies significantly across European countries, ranging from 5% to 12% of total healthcare expenditure.

The rising healthcare expenditure is driving innovation in these devices, leading to a growing number of patent applications. According to 2023 data published by MedTech Europe, more than 15,900 patent applications were filed with the European Patent Office (EPO) in the field of medical technology, representing a 1.3% increase in patent applications compared to the previous year.

- Additionally, according to the same source, medical technology accounts for 8.1% of the total number of applications, the 2nd highest among all industrial sectors in Europe.

Therefore, increasing healthcare expenditure is encouraging key players to develop and introduce novel products, which is expected to propel the Europe medical devices market growth during the forecast period.

Other Prominent Trends

- Home Healthcare - There is a growing trend toward home-based healthcare solutions, including wearable devices and telemedicine platforms, enabling patients to manage their health conditions remotely.

- Aging Population - Europe's aging demographic is driving demand for medical devices, particularly those related to chronic disease management and elderly care.

Download Free sample to learn more about this report.

IMPACT OF COVID-19 ON THE MARKET

The market experienced a slight positive impact during the COVID-19 pandemic, as major market players reported revenue growth during the period.

The growing prevalence of COVID-19 among patients resulted in a major increase in the volume of molecular diagnostic procedures, which contributed to a significant rise in demand for POC and lab-based molecular tests related to COVID-19 diagnosis. Additionally, the growing demand for healthcare products such as ventilators, diagnostic devices further contributed to the growth in the market during the COVID-19 pandemic.

- For instance, according to the statistics published by the World Health Organization (WHO), about 4.5 million COVID-19 cases were reported in 2020 from February to September in Europe.

Additionally, increased risk of coronavirus infection shifted the focus toward home healthcare devices, such as continuous glucose monitoring devices, and others among the patient population. Several medical organizations and market players are actively taking initiatives to fulfill the unmet need of patients from conditions such as diabetes, particularly those in experiencing financial hardships during the pandemic.

Trade Protectionism

Europe generally promotes free trade; however, certain regulations and standards can act as trade barriers, especially among non-European manufacturers. The Medical Devices Regulation (MDR) and In-Vitro Diagnostics Regulation (IVDR) have increased compliance requirements, which can present challenges among the international market players in Europe.

SEGMENTATION ANALYSIS

By Type

IVD Segment Dominated the Market Due to Increasing Number of Product Launches

On the basis of type, the market is sub-segmented into orthopedic devices, cardiovascular devices, diagnostic imaging devices, In-vitro Diagnostics (IVD), minimally invasive surgery devices, wound management, diabetes care devices, ophthalmic devices, nephrology devices, general surgery, dental devices, and others.

The IVD segment dominated the market in 2024. The increasing awareness regarding Point-Of-Care (POC) diagnostics, rising use of infectious disease testing and nucleic acid testing systems, and the launch of technologically advanced products with greater accuracy are key drivers of segment growth. This, along with the growing focus of key players toward the establishment of new R&D facilities to develop and introduce novel IVD products, is also expected to support the growth of the segment.

- In July 2024, Siemens Healthineers AG launched the next-generation point-of-care Atellica DCA Analyser in the U.K., strengthening its product portfolio.

The orthopedic devices segment held the third-largest market share in 2024 and is expected to grow at a significant CAGR throughout the forecast period. The presence of potential manufacturers, increase in the number of orthopedic surgeries, introduction of advanced orthopedic devices, and expansion initiatives by market players in European countries such as Germany, France, and others are responsible for the growth of this segment.

The cardiovascular devices segment is also expected to grow with a considerable CAGR during the forecast period. The growth is primarily due to the increasing prevalence of heart disease, greater adoption of new technologies, such as robotic cardiac surgeries. According to 2023 data provided by the U.K. Government, 1.9 million people in the U.K. are living with coronary heart disease. The growing prevalence of cardiovascular diseases is further increasing the demand for cardiovascular devices.

The wound management segment accounted for a notable market share in 2024. The rise in the number of key players engaged in introducing advanced devices such as Negative Pressure Wound Therapy (NPWT), and advanced dressing for the treatment of chronic and acute wounds is expected to increase the adoption of wound care products in Europe.

- In May 2022, Winner Medical launched multiple wound care solutions including Transparent Film Dressing, Bordered Silicone Foam Dressing with SAF, Antibiosis Series Products, and with its CMC dressing, in France.

The diabetes care, dental, and ophthalmics segment is also expected to grow during the forecast period. The growth is due to the growing prevalence of these conditions among the patient population resulting in the growing number of patient admissions in the healthcare settings. This, along with the growing number of key players focusing on receiving product approvals, is likely to boost the growth of these segments in the market.

To know how our report can help streamline your business, Speak to Analyst

By End-User

Hospitals & ASCs Segment Dominated the Market Due to Increasing Number of Hospitals

On the basis of end-user, the market is trifurcated into Hospitals & Ambulatory Surgery Centers (ASCs), clinics, and others.

The hospitals & ASCs segment dominated the market in 2024 due to the rising number of healthcare settings, such as hospitals and ambulatory surgical centers. The growing adoption of these devices in European countries, along with the rising number of hospitalization rates of patients suffering from chronic diseases, and the rising number of patients for surgical procedures, are some of the additional factors responsible for the dominance of the hospitals & ASCs segment in 2024.

- For instance, as per the data published by the British Heart Foundation in January 2024, nearly 100,000 hospital admissions take place each year due to heart attacks in the U.K., equating to about 290 admissions each day.

The clinics segment is also expected to grow at a considerable rate during the forecast period. The growth is due to an increasing preferential shift toward clinics owing to certain factors such as shorter waiting times in the clinics. Additionally, the increasing number of clinics and other healthcare facilities offering chronic disorder treatment is expected to increase the demand and adoption of medical devices, further driving segment growth.

MEDICAL DEVICES MARKET COUNTRY OUTLOOK

Germany Dominated the Market Due to Increasing Strategic Initiatives Among Key Players

On the basis of country/sub-region, the market is segmented into Germany, the U.K., France, Italy, Spain and the rest of Europe.

Germany dominated and generated a revenue of USD 37.70 billion in 2024. The growing prevalence of chronic diseases and diagnostic procedures, along with an increasing number of collaborations among key players to establish new R&D centers in Germany are expected to support the growth in the market.

- In October 2024, GE Healthcare collaborated with University Medicine Essen (UME) to establish a new Theranostics Center of Excellence. The center included the latest technologies and solutions to support clinical practice and advanced research of more personalized approaches to cancer care in Germany and worldwide. This helped the company to increase its brand presence.

The U.K held a considerable market share in 2024 owing to increasing healthcare expenditure and the adoption of home healthcare solutions. This, along with a higher number of multi-national companies, including many of the leading U.S. manufacturers that have subsidiaries and head offices in the U.K., is also expected to support the growth of the market. The strong presence of manufacturers, along with the presence of a large patient population suffering from chronic disorders are key factors boosting patient adoption of medical devices, thereby supporting the market expansion.

Rest of Europe is also expected to witness considerable growth during the forecast period. Various factors, such as the increasing geriatric population, growing demand for home care devices, improving reimbursement system for hospitals and ambulatory care, and increasing focus toward new manufacturing facilities among key players in these countries, including Poland, Ireland, Netherlands, and others are primarily responsible for the dominance of the country.

- In November 2024, Medtronic established a new state-of-the-art manufacturing facility in Ireland with an aim to expand its geographical presence.

COMPETITIVE LANDSCAPE

Key Industry Players

Increasing Number of Product Approvals to Support Dominance Among Key Players

A growing focus on research and development activities to develop and introduce innovative devices among key players, such as Medtronic, is likely to support the growth of the company in the market. This, along with a growing focus on receiving approvals for new devices is likely to boost the Europe medical devices market share.

- In January 2025, Medtronic received CE mark approval for its Harmony transcatheter pulmonary valve, a minimally invasive alternative to open-heart surgery for congenital heart disease patients, to strengthen its product portfolio.

Additionally, Johnson & Johnson Services, Inc. is also expected to expand its market presence owing to its strategic acquisitions and collaborations. In November 2024, Johnson & Johnson Services, Inc., collaborated with Responsive Arthroscopy Inc., an innovative medical device company, to strengthen its sports platform.

Furthermore, Abbott and Siemens Healthineers AG are some of the major players in the European medical device industry. The growing focus of these players toward the establishment of manufacturing facilities to develop novel devices is likely to support the growth of these companies in the market.

Other prominent players in the market are Koninklijke Philips N.V., Stryker, F. Hoffmann-La Roche AG, GE Healthcare, BD, and Boston Scientific Corporation. A significant rise in the prevalence of chronic diseases and favorable reimbursement scenario for high-end instruments is projected to propel the number of emerging players in the market by 2032.

LIST OF KEY MEDICAL DEVICES COMPANIES IN EUROPE

- Koninklijke Philips N.V. (Netherlands)

- Fresenius Medical Care AG (Germany)

- Siemens Healthcare AG (Germany)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- BD (U.S.)

- GE Healthcare (U.S.)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- Medtronic (Ireland)

- Stryker (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Siemens Healthineers AG launched a new ACUSON Sequoia 3.5, an ultrasound system integrated with AI with an aim to strengthen its product portfolio in the U.K.

- December 2024: Koninklijke Philips N.V. partnered with Sim&Cure, a provider of advanced digital solutions for neurovascular therapy, to drive innovation in neurovascular therapy.

- December 2024: F. Hoffmann-La Roche Ltd. received CE approval for its cobas 6800/8800 systems 2.0 to enhance throughput, flexibility and enable sample prioritization in healthcare settings. This approval helped the company to increase its product offerings.

- February 2024: Johnson & Johnson Services, Inc., received CE approval for the VARIPULSE Pulsed Field Ablation Platform with an aim to strengthen its product offerings.

- February 2024: Koninklijke Philips N.V. launched the Philips CT 5300 system equipped with advanced AI capabilities, for diagnosis, interventional procedures, and screening at ECR. This helped the company strengthen its product portfolio.

REPORT COVERAGE

The Europe medical devices market research report provides qualitative and quantitative insights into the market and a detailed analysis of the European market size & growth rate for all possible segments in the market. Along with the market size, forecast, the research report elaborates on the market dynamics and competitive landscape. Various key insights presented in the report are an overview of the number of procedures, an overview of price analysis of types of products, an overview of the regulatory scenario by key countries, new product launches, key industry developments, such as mergers, acquisitions, partnerships, and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.9% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End-User

|

|

|

By Country/ Sub-Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 142.17 billion in 2024 and is projected to reach USD 207.39 billion by 2032.

Growing at a CAGR of 4.9%, the market will exhibit steady growth during the forecast period (2025-2032).

Germany dominated the market in 2024 by holding the largest share.

In 2024, Germany was valued at USD 37.70 billion.

Rising medical technology expenditure and the number of SMEs introducing innovative products are the major factors driving market growth.

Koninklijke Philips N.V, Fresenius Medical Care AG & Co. KgaA, Siemens Healthcare GmbH, and B. Braun SE are the major players in the Europe market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us