Freight Trucking Market Size, Share & Industry Analysis, By Truck Type (Refrigerated Truck, Tanker, Dry Van, and Flatbed), By End User (Automobiles, Machinery, Apparels & Footwears, Pharmaceutical Products, Retail, Electronics, Petrochemicals, Agriculture, Building Materials, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

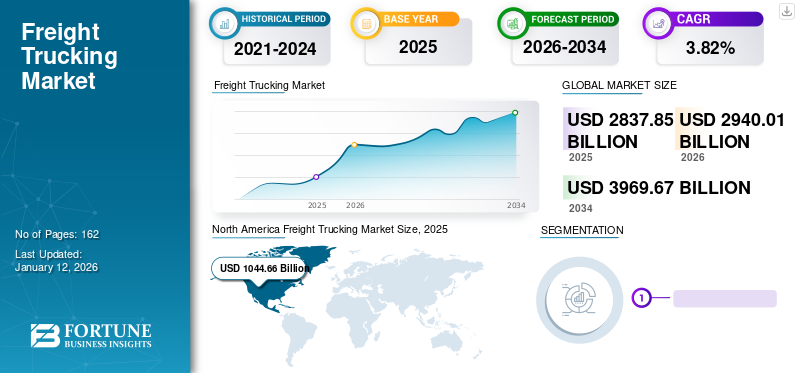

The global freight trucking market size was valued at USD 2,837.85 billion in 2025 and is projected to grow from USD 2,940.01 billion in 2026 to USD 3,969.67 billion by 2034, exhibiting a CAGR of 3.82% during the forecast period. North America dominated the global market with a share of 36.81% in 2025.

Freight trucks are large, heavy vehicles that transport goods from delivery points to end user or customer destinations and serve as connectors for other modes of transport, such as inland waterway transport, maritime transport, air transport, and rail transport. Freight trucking is an ideal option due to its flexibility in transporting cargo, large cargo, and service equipment. Road freight transport is an effective means of transportation that increases the reliability and flexibility of transport operations by transporting goods to their destinations at low cost. Freight trucking services meet the demand for goods by facilitating delivery to specific locations and facilitating access to commodity and labour markets. Growth in urbanization raised e-commerce and global trading activities, creating importance for freight trucking market forecast.

The COVID-19 pandemic profoundly affected the freight trucking market, causing disruptions in supply chains and fluctuations in demand. Lockdown measures and economic uncertainties led to reduced freight volumes and delays in deliveries. However, the pandemic also highlighted the essential role of freight trucking in maintaining the flow of goods, leading to increased demand for transportation services. As economies recover and trade resumes, the market is expected to stabilize and gradually rebound.

Freight Trucking Market Trends

Increasing Demand for Electrified Energy-efficient Trucks to Favor Market Growth

The increasing adoption of zero-emission, energy or fuel-efficient vehicles is driving the demand for freight trucking. The introduction of stricter emission standards is driving freight trucking service providers to move toward a new generation of clean energy vehicles, such as fuel-cell electric vehicles and battery electric vehicles. Additionally, rising fossil fuel prices have also created a demand for electric trucks due to limited availability.

Moreover, to supply the increasing demand for these electrified vehicles, logistics service providers are focused on partnering with companies. Nearly all the leading service providers are actively investing in the early adoption of this technology and modifying their fleets.

- For instance, in July 2023, 15 leading freight service providers partnered as part of the Government of India's Zero Emission Vehicle Emerging Markets Initiative (ZEV-EMI) and Electric Freight Accelerator for Sustainable Transportation (E-FAST) initiatives. This partnership initiated the electrification of the Indian freight trucks.

Some of the national governing institutions are also investing in electrification, considering its environmental benefits. In August 2023, Mayor Bruce Harrell and the City of Seattle's Office of Sustainability and Environment (OSE) announced a plan for local truck drivers to transition to electric trucks to improve air quality and communities adjacent to the port.

Download Free sample to learn more about this report.

Freight Trucking Market Growth Factors

Upsurge in Urbanization Created Importance for Freight Trucking

In recent years, several countries have experienced wide-scale development, with most areas being converted into urban landscapes for industries or residential zones. As more people diverted to urban areas, there was a greater need for efficient transportation of goods to and from these areas, which made it easier for trucks to traverse. This will lead to widening the freight trucking market analysis and the industry to generate more business.

According to the World Urbanization Prospects reports, 3.9 billion people live in urban areas in this century compared to 746 million in 1950. The reports further predicted that by 2050, more than 70% of the world’s population will settle in urban areas compared to 55% today. To quantify the demand of the construction sector in urban areas under strict emission regulations, companies are investing in emission-free freight trucks.

- For instance, in February 2023, CEMEX received its order for a fully electric and zero exhaust emission heavy-duty concrete mixer truck. CEMEX is an international construction materials company offering cement, ready-mix concrete, aggregates, transportation, and urbanization solutions in markets across the globe.

Owing to the increasing urbanization and growing commercial and industrial activities, emission-free freight trucks offer many potential business opportunities. They have become indispensable for the smooth functioning of goods deliveries to waste management, where freight trucking analysis plays a vital role. Thus, urbanization increased the importance of the freight trucking industry.

RESTRAINING FACTORS

Poor Road Infrastructure and Higher Logistics Costs are Restraining Market Growth

Poor road infrastructure and higher logistics costs pose significant challenges to the growth of the freight trucking market. Inadequate road conditions, including potholes, congestion, and lack of maintenance, increase vehicle wear and tear, leading to higher operating costs for trucking companies. Additionally, poor infrastructure can cause delays in delivery schedules, resulting in increased fuel consumption and decreased overall efficiency.

According to the American Society of Civil Engineers (ASCE), the United States' road infrastructure received a grade of D+ in its 2021 Infrastructure Report Card. The report highlights the urgent need for infrastructure investment to address deficiencies and improve road conditions nationwide. In 2020, the ASCE estimated that the cost of poor road conditions, including vehicle operating costs and congestion-related delays, amounted to USD 170 billion annually in the U.S.

Moreover, higher logistics costs, including fuel prices, labor expenses, and regulatory compliance, further restrain market growth. Fluctuations in fuel prices, influenced by geopolitical factors and supply chain disruptions, directly impact trucking companies' operational expenses. According to the U.S. Energy Information Administration (EIA), diesel fuel prices in the U.S. averaged USD 3.31 per gallon in December 2021, representing a significant increase compared to the previous years.

Overall, addressing poor road infrastructure and mitigating higher logistics costs are essential for fostering sustainable growth in the freight trucking market. Investments in infrastructure improvements, regulatory reforms, and technological innovations can help alleviate these challenges, enhance operational efficiency, and drive long-term prosperity in the trucking industry.

Freight Trucking Market Segmentation Analysis

By Truck Type Analysis

Dry Van Segment Dominated the Market due to its Ability to Carry Versatile Goods.

Based on truck type, the market is segmented into refrigerated trucks, tankers, dry vans, and flatbeds.

The dry van segment dominated the market with a share of 61.65% in 2026. Dry vans are versatile and can transport a wide range of goods, including consumer goods, electronics, furniture, groceries, and more. This versatility has made it a popular choice for shippers and freight forwarders, driving market growth in this area.

The U.S. market is projected to reach USD 988.25 billion by 2026.

The tanker segment continues to be the fastest growing segment and is estimated to exhibit the highest CAGR over the forecast period. Growth in industrial sectors, including chemicals, petroleum, pharmaceuticals, food products such as milk products, and others, gives rise to the requirement for tanker-type vehicles. The tanker segment plays a crucial role in driving growth in the freight trucking market by facilitating the transportation of liquid and bulk cargo. Recent news highlights advancements in tanker truck technology, including innovations in safety features and environmental sustainability. These developments aim to enhance efficiency and reliability in transporting various commodities, further contributing to the expansion and evolution of the freight trucking industry.

Refrigerated truck segment and flatbed segment types also showcased a significant growth rate in the market.

To know how our report can help streamline your business, Speak to Analyst

By End User Analysis

Increase in Agricultural Produce Boosted the Agriculture Segment's Growth

Based on the end user, the market is segmented into automobiles, machinery, apparel & footwear, pharmaceutical products, retail, electronics, petrochemicals, agriculture, building materials, and others.

The agriculture segment dominated the market with a share of 29.20% in 2026 and the segment is expected to showcase similar statistics during the forecast period. Agricultural goods require fast and timely logistics services and large quantities of some perishable fruits with limited shelf life. Most food product industries rely on different types of trucks, as some require temperature control to reach raw materials to their manufacturing units and deliver finished products to consumers without deteriorating their quality. An increase in such agricultural produce has contributed to the segmental growth of the market.

The retail sector is the fastest growing sector. With increasing globalization, international retailers are becoming increasingly competitive. International retailers opening new stores in developing countries, such as in the Asia Pacific region, face intense competition. This leads to increased economic activity and facilitates transportation between regions. Therefore, the demand for road transport services to speed up the delivery of products is increasing, thereby increasing the retail sector of the market.

Other segments, such as automobiles, machinery, apparel and footwear, pharmaceutical products, electronics, petrochemicals, building materials, and others, also have a significant growth rate in the market.

REGIONAL INSIGHTS

Based on regions, the global market is segregated into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Freight Trucking Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is anticipated to dominate the global market during the forecast period. North America dominated the global market in 2025, with a market size of USD 1044.66 billion. Owing to rising environmental concerns, green logistics solutions have been adopted in recent years. Currently, the U.S. represents one of the major logistics markets in the region, with a highly integrated road transport network that connects producers and consumers depending on the type of cargo. Average Route Guide Depth (RGD) in North America in August improved by 8% compared to August 2022. The U.S. market is projected to reach USD 988.25 billion by 2026.

- In May 2022, Maersk completed its acquisition of Pilot Freight Services, the U.S.-based international and domestic supply chain provider providing cross-border solutions in Canada and Mexico.

Asia Pacific

Asia Pacific is the fastest growing market. Rapidly growing trade between Asia and China has recovered. GEODIS, a global leader in transportation and logistics, is driving growth in Asia through strategic investments in the region's capabilities and infrastructure, thus making it the fastest-developing region in the market. The Japan market is projected to reach USD 297.88 billion by 2026, the China market is projected to reach USD 140.04 billion by 2026, and the India market is projected to reach USD 224.61 billion by 2026.

- For instance, in August 2023, GEODIS expanded its Road Network from Southeast Asia (SEA) to China, providing secure, day-definite, cost-efficient, and environmentally friendly solutions connecting Singapore, Malaysia, Thailand, Vietnam, and China.

Europe

Europe and the Rest of the World also saw market growth. This growth is due to the increased port expansion and growing e-commerce platforms in these regions, giving rise to road transportation. The UK market is projected to reach USD 81.32 billion by 2026, and the Germany market is projected to reach USD 166.36 billion by 2026.

List of Key Companies in Freight Trucking Market

Being an Official Logistics Partner and Vast Presence, Deutsche Post AG (DHL) Leads the Market

Deutsche Post AG (DHL), International is a logistics company founded by Adrian Dalsey, Larry Hillblom, and Robert Lynn in 1969. It is headquartered in Bonn, Germany. It mainly offers international express mail services, document and parcel shipping services, air, ocean, road, and rail freight, warehouse solutions, transportation management, and contract logistics. It operates in more than 200 countries and delivers 1,818,000,000 parcels per year.

DHL is an official logistics partner for various sports, arts, cultural, and fashion arenas, such as Formula 1. Moto GP, FIA World Endurance Championship, football team Manchester United, and music events of music bands - Rolling Stone. DHL has been Formula One's proud and oldest global partner for almost 40 years, bringing decades of experience to support Manchester United's logistics needs, from daily courier services to tour equipment and merchandise distribution for the Manchester United Megastore.

LIST OF KEY COMPANIES PROFILED:

- C.H. Robinson Worldwide Inc. (U.S.)

- United Parcel Service, Inc. (U.S.)

- FedEx Corporation (U.S.)

- Deutsche Post AG (DHL) (Germany)

- Kuehne+Nagel International AG. (Switzerland)

- A.P. Moller - Maersk (Denmark)

- Schenker AG (Germany)

- Nippon Express Holdings, Inc. (Japan)

- Landstar System Holdings, Inc. (U.S.)

- DSV Solutions (Denmark)

KEY INDUSTRY DEVELOPMENTS:

- February 2024, Ryder acquired dedicated fleet trucking provider Cardinal Logistics. Ryder System Inc. aims to strengthen its position as a customized dedicated contract carrier in North America.

- January 2024, RXO Launched AI-Powered Truck Check-In Technology for Warehouses and Distribution Centers. This new AI-powered check-in system for trucks arriving at warehouses and distribution centers, identifies trucks via video and extracts image and video data to streamline the check-in and security process.

- October 2023, A.P. Moller Maersk and Kodiak Robotics, Inc. launched the first commercial autonomous trucking lane between Houston and Oklahoma City. This Teaming with Kodiak will enable Maersk’s plan of innovating solutions in autonomous trucks for digitizing the supply chain.

- September 2023, UPS acquired MNX Global Logistics, a global time-critical logistics provider. MNX’s capabilities in radio-pharmaceuticals and temperature-controlled logistics. This will make UPS grow in the healthcare industry and time-critical, temperature-sensitive logistics.

- March 2023, DSV acquired two U.S.-based freight transportation and logistics service providers, S&M Moving Systems West and Global Diversity Logistics. This acquisition aimed to augment its position within the semiconductor industry, align with its new Phoenix-Mesa Gateway Airport operations and support its growing cross-border services in Latin America.

REPORT COVERAGE

The industry research report provides a structured market insights analysis. It mainly focuses on critical aspects, such as significant top-impacting factors, market scenario analysis, trends, drivers, impact analysis, types, calibre, and leading technological trends. In addition, the report offers an overview of the market growth and trends and highlights key developments in the industry. It also introduces several factors that have prejudiced the growth of the market in recent years.

An Infographic Representation of Freight Trucking Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.82% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Truck Type

By End User

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was valued at USD 2,837.85 billion in 2025.

Registering a CAGR of 3.82%, the market will display steady growth during the forecast period of 2026 to 2034.

The dry van segment led the segment in the market.

Rise in e-commerce and global trading activities is likely to drive the freight trucking market.

C.H. Robinson Worldwide Inc., United Parcel Service, Inc. (UPS), FedEx Corporation, Deutsche Post AG, Kuehne+Nagel International AG, A.P. Moller Maersk, Schenker AG, Nippon Express Holdings, Inc., Landstar System Holdings, Inc., and DSV Solutions are the major players in the global market.

North America is expected to dominate the market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic