Agricultural Pheromones Market Size, Share, & Industry Analysis, By Type (Sex Pheromones, Aggregation Pheromones, and Others), By Function (Mating Disruption, Detection & Monitoring, and Mass Trapping), By Application (Dispensers, Traps, and Spray Method), By Crop Type (Field Crops, Orchard Crops, Vegetables, and Others), and Regional Forecast, 2026 - 2034

KEY MARKET INSIGHTS

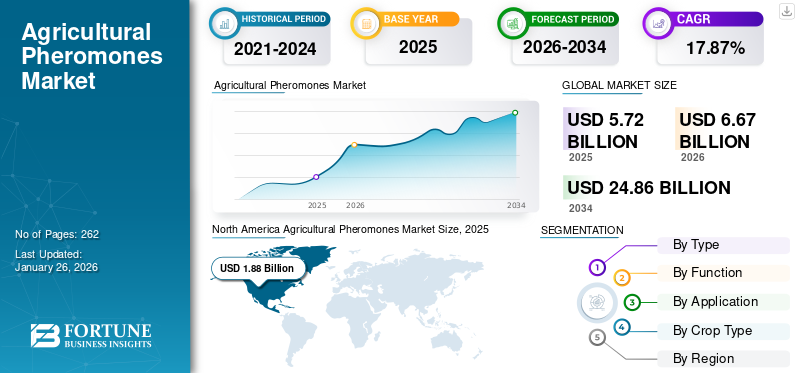

The global agricultural pheromones market size was valued at USD 5.72 billion in 2025. The market is expected to grow from USD 6.67 billion in 2026 to USD 24.86 billion by 2034, exhibiting a CAGR of 17.87% during the forecast period. North America dominated the agricultural pheromones market with a market share of 32.79% in 2025. Moreover, the agricultural pheromones market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 3.62 billion by 2032, driven by increasing adoption of integrated pest management approaches and increased governmental focus on promoting the use of sustainable agrochemicals in the country.

Agricultural pheromones are chemical signals utilized to disrupt pest behavior, monitor, and trap pests that attack crops. They play a crucial role in influencing the behavior of pests that affect crop yield. Farmers commonly use major agricultural pheromones such as sex pheromones, aggregation pheromones, and others. These pheromones are integral to the adoption of integrated pest management practices, supported by governments in various countries. Their less toxic nature in comparison to synthetic pesticides and their relatively easy application are expected to increase their demand in countries where governments aim to reduce the use of harmful chemical pesticides.

The spread of the COVID-19 virus significantly impacted global manufacturing operations and marketing strategies. Among the affected sectors, agribusiness companies emerged with substantial potential for engaging with farmers and marketers post-COVID-19. Agribusiness companies, particularly Agri Input Companies (AICs), pivoted their marketing strategies for products like pheromones, pesticides, fertilizers, and others during the pandemic. They relied on digital networks and platforms, foregoing on-ground marketing teams. Manufacturers strategically focused on establishing domestic and international sales partnerships and streamlined administration to address farmer inquiries, sustain sales momentum, and foster growth in this sector.

Global Agricultural Pheromones Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 5.72 billion

- 2026 Market Size: USD 6.67 billion

- 2034 Forecast Market Size: USD 24.86 billion

- CAGR: 17.87% from 2026–2034

Market Share:

- North America dominated the agricultural pheromones market with a 32.79% share in 2025, driven by the increasing adoption of integrated pest management approaches and strong governmental initiatives promoting sustainable agrochemicals in countries like the U.S.

- By type, sex pheromones are expected to retain the largest market share in 2025, supported by extensive research, new product launches, and widespread application in disrupting pest mating behavior.

Key Country Highlights:

- United States: Projected to reach USD 3.62 billion by 2032, fueled by integrated pest management adoption and government support for sustainable farming inputs.

- China: Government initiatives on environmental protection and sustainable agriculture are fostering strong growth in the use of pheromones.

- India: Rising regulatory restrictions on chemical pesticides and the push for organic farming practices are boosting the demand for pheromone-based crop protection.

- Brazil: Increasing popularity of pheromones, with innovations aimed at improving their affordability and efficiency for food crop production.

- Kenya: Early-stage development supported by government approvals for pheromone-based products, with rising interest in sustainable solutions for commercial horticulture and grain production.

- Europe: Second-largest region in the market, benefiting from eco-friendly pest control policies and widespread adoption of integrated pest management practices.

Agricultural Pheromones Market Trends

Increasing Focus Toward Developing Cost-Effective Pheromones to Drive Market Growth

The advancement of technology and the utilization of equipment for mass-producing and supplying insect pheromones to row crop growers can create substantial opportunities for producers to expand their consumer base. A notable example occurred in May 2022 when Saltigo, a subsidiary of the global chemicals company Lanxess, partnered with Provivi Inc. for the production of Pheron E7-E/Z9-12Ac, an insect pheromone. Leveraging expertise, Lanxess delivered a cost-effective pheromone that effectively mitigates pest risks in nuts, vines, and fruits.

In economies driven by agriculture such as China and India, increased regulatory measures restricting chemical pesticides and the rise in sustainable agricultural inputs, such as biopesticides, are anticipated to drive the demand for pheromones. Moreover, key market players' heightened investments in expanding their presence across Asian economies through innovative marketing strategies could significantly augment the agricultural pheromones market growth in the region. The increasing organic crop production has contributed to boosting the demand for sustainable and natural agri-inputs, which can be a driver for certain agricultural pheromones. The adoption of insect pheromones in organic agricultural fields to prevent insects from breeding on crops is becoming popular due to their high pest specificity and relatively less toxic nature.

Download Free sample to learn more about this report.

Agricultural Pheromones Market Growth Factors

Expanding Selection of the Integrated Pest Management Practices for Sustainable Agriculture to Bolster Market Growth

The exceptional effectiveness of pheromones against critical crop-damaging pests, in contrast to certain conventional pest control chemicals, is contributing to their popularity among growers embracing integrated pest management practices. Pheromones are gaining substantial recognition as the ideal solution for modern sustainable agriculture. Their potential to induce confusion among target pests, curbing their breeding and proliferation in crop fields while preventing adverse effects on biodiversity, is expected to enhance the appeal of these crop protection chemicals. This gradual adoption can lead to long-term pest prevention strategies in this sector. The rising concern over food security due to the growing global population is fueling the adoption of effective and eco-friendly crop production and protection inputs to prevent crop damage by insects. This will further augment the demand for pheromones in the coming years.

Proliferating Demand for High-value Horticulture Crops Globally to Drive Market Growth

The demand for high-value crops, such as fruits and vegetables, is experiencing a significant rise across various parts of the world due to the high profitability associated with their production. This surge in demand has led to an increased utilization of insect pheromones in the horticulture sector of agriculture to protect these crops from pest attacks, consequently driving market growth. For instance, according to the Agricultural and Processed Food Products Exports Development Authority (APEDA), a Government agency, the total area under horticulture in India has witnessed a steady increase, reaching around 28.88 (mh) in the year 2022-23, compared to 28.04 (mh) in the previous year.

RESTRAINING FACTORS

High Production Costs to Restrain Market Growth

The expensive nature of various insect pheromones, compared to conventional insecticides and other pesticides, poses a significant restraint to the growth of the global market. The higher cost of these products makes them an uneconomical choice for pest control in large-scale agriculture. Highly skilled laborers and professionals, such as chemical scientists, researchers, lab assistants, and expensive laboratory equipment are required in the production and maintenance of insect pheromones. Lack of availability of such skilled workforce acts as a hindrance for producers based in low-income economies where there is a lack of resources.

The production of the basic component of a formulation, which includes the pheromone itself, is quite costly. Even the least expensive pheromone component has a relatively high cost per gram. Packaging these pheromones into dispensers further adds to the final product's cost, making it challenging for small-scale farmers or growers to afford.

Agricultural Pheromones Market Segmentation Analysis

By Type Analysis

Sex Pheromones Segment Dominates Due to Extensive Research and New Product Launches

Based on type, the market is divided into sex pheromones, aggregation pheromones, and others. The sex pheromones segment has emerged as the most effective and leading type. Its substantial share is mainly attributable to the growing awareness about the pheromone applications and extensive research. Sex pheromones are either single or a complex blend of different chemicals that help to attract the opposite sex of the same species. The sex pheromones segment is projected to dominate the market with a share of 88.01% in 2026.

Aggregation pheromones have emerged as the second most prevalently used pheromone type. They are witnessing a significant rise in their usage as they attract conspecifics of both sexes, which help in preventing mass attacks by pests and insects. Furthermore, the other types of pheromones, such as alarm pheromones, are gaining significant traction among the growers in the country.

To know how our report can help streamline your business, Speak to Analyst

By Function Analysis

Mating Disruption Segment Holds Major Share as It Can Effectively Control Specific Pest Population

Based on function, the market is divided into mating disruption, detection & monitoring, and mass trapping. The mating disruption segment accounts for the highest market share and has emerged as the most effective approach in recent years for pest control. It works by disrupting the chemical communication by the organisms and preventing their mating by dispensing synthetic sex pheromone, which affects the organism’s reproduction. Many scientists have proven its effectiveness with various studies and deriving fruitful results that help in significantly lowering the pest population. Mating disruption is an important tool in the IPM system that can help attain sustainability along with safety and food security. However, more efforts are needed to promote this technology. The mating disruption segment is projected to dominate the market with a share of 60.57% in 2026.

The detection & monitoring segment is experiencing steady growth in this sector as it helps to monitor pest infestations in crops. The mass trapping method has also proven effective when used as a standalone method or in combination with other approaches. There has been a significant reduction in pest population as well as pest damage by using this approach.

By Application Analysis

Dispensers Segment to Witness Expansion Due to Their Enhanced Applicability

Based on application, the market is divided into dispensers, traps, and spray method. The dispensers segment is the dominating segment among various applications, and it is anticipated to remain in a prominent position, expanding with a notable double-digit CAGR of 17.18% during the forecast period. Dispensers are the most preferable application mode in a sustainable pheromone-based strategy in Integrated Pest Management (IPM). It uses a simple diffusion technique to release pheromones into the surrounding environment, gives more benefit than spray, and produces a concentration of pheromones in a limited area. Thus, it is commonly used to disrupt the mating patterns of insect pests. The dispensers segment is expected to lead the market, contributing 43.93% globally in 2026.

Traps are another popular application largely utilized in crop management. These traps can be used to monitor targeted pests in agricultural areas by using specific pheromones. It efficiently captures and retains insects and is cost-effective. Therefore, the demand for trap applications is likely to flourish, due to which it is expected to register the fastest growth in the agricultural pheromones sector during the forecast period.

By Crop Type Analysis

Orchard Crops Accounts for Highest Market Share as Production of Fruits and Vegetables is Increasing Globally

By crop type, the market is classified into field crops, orchard crops, vegetables, and others. The orchard crops segment accounts for the highest market share as the cultivation of horticulture crops such as fruits and vegetables is increasing globally. Companies such Rusell IPM, Suterra LLC and others are working on developing innovative crop-specific sex pheromones. As per the Food and Agriculture Organization (FAO), every year, nearly 20-30% of the crop yields are wasted due to pest attacks. The orchard crops segment will account for 46.18% market share in 2026.

Field crops, such as cotton, rice, soybeans, and wheat, are also prone to several pests, and to eradicate those, the utilization of pheromones has increased as they have proven effective against these crops as well.

The demand for various vegetables is growing globally due to the increasing adoption of vegan and vegetarian diets among consumers. The use of pheromones for crops such as cucumber, tomato, potatoes, and others is increasing rapidly to protect the vegetables against pest attacks.

REGIONAL INSIGHTS

Geographically, the market is studied across the regions, including North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Agricultural Pheromones Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American agricultural pheromones market reached USD 1.88 billion in 2025, making it a major region in the global market. The use of insect pheromones in North American agriculture is expanding at an impressive rate due to several reasons. Key food-producing countries in North America are increasingly adopting integrated pest management approaches, driving market growth. Additionally, there is a growing governmental focus on the use of sustainable agrochemicals in the region to produce and protect crops. The U.S. market is estimated at USD 1.24 billion by 2026.

Europe

To know how our report can help streamline your business, Speak to Analyst

Europe ranks as the second-leading region in the market. Pheromones are gaining wider recognition as next-generation pest control tools in the region, working in harmony with nature. Their increased use in stems is from their high effectiveness and the promotion and adoption of sustainable agrochemical strategies across different European countries. The region's high awareness of modern pest control practices and the growing adoption of integrated pest management approaches in agriculture present significant opportunities for agricultural pheromone market growth, supporting a clean and green economy. The UK market is expected to reach USD 0.06 billion by 2026, while the Germany market is anticipated to account for USD 0.23 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to be the fastest-growing region during the forecast period. China, followed by India, is expected to dominate this market due to their potential to become global leaders in innovative agri-inputs. The Chinese government's emphasis on environmental protection is projected to create untapped opportunities for agricultural pheromones in the coming years. The Japan market is forecast to attain USD 0.09 billion by 2026, the China market is set to reach USD 1.05 billion by 2026, and the India market is anticipated to achieve USD 0.26 billion by 2026.

Rest of The World

The demand for agricultural type of pheromones is swiftly rising across South America. Brazil is witnessing a surge in the popularity of these pheromones, with industry players focusing on innovation to enhance the effectiveness, affordability, and ease of application of pheromones. Collaborations between industry pioneers and private food crop-producing companies aim to develop environmentally safe semiochemical and pheromone-based insect controls.

The Middle East & Africa market is still in its early stages of development. Kenya is utilizing pheromones to safeguard their crops. For instance, in 2021, Pherogen SPOFR obtained approval from Kenya’s Pest Control Products Board, and pheromone manufacturer Provivi is slated to commercially launch the product in Kenya. Key operating companies in the region are establishing a strong foundation amid a transformative shift in farming practices, leading to an increased demand for more effective agricultural inputs in commercial horticultural crops and grains.

List of Key Companies in Agricultural Pheromones Market

Emphasis on Innovation of Sustainable Crop Protection Solutions to Strengthen Market Presence

The market is fragmented, with various small and large players vying for market share. Key players such as BASF SE, Gowan Company, Russell IPM, Suterra LLC, and Provivi Inc. hold a significant proportion of the total global agricultural pheromones market share. These players are focusing on developing efficient, organic, and sustainable crop protection solutions to reduce the reliance on harmful synthetic pesticides. Additionally, industry pioneers are actively pursuing regulatory approvals to expand into overseas markets.

LIST OF KEY COMPANIES PROFILED:

- Russell IPM (U.K.)

- Shin-Etsu Chemical Company (Japan)

- Isagro S.p.A. (Italy)

- Biobest Group (Belgium)

- SEDQ Healthy Crops SL (Spain)

- ISCA Global (U.S.)

- Suterra LLC (U.S.)

- Provivi, Inc. (U.S.)

- Koppert Biological Systems (Netherlands)

- Pacific Biocontrol Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Russell IPM manufactured an easy-to-use, affordable, and efficient mating disruption solution, DISMATE YSB, for controlling the growth of “rice stem borer.” The newly launched product was proven highly efficient in reducing the growth of “rice stem borer,” and thus, achieved nearly 90% control in trials.

- May 2023: Biobest Group NV, one of the pioneers in the global biological market, announced its letter of intent to acquire an American-based manufacturer, BioWorks Inc.

- January 2023: Bayer entered into a partnership with M2i Group to supply farmers with pheromone-based biological crop protection products targeted toward Lepidoptera pests in crops that include stone and pome fruits, tomatoes, and grapes.

- May 2022: BASF acquired Italian company Horta S.r.l., which specializes in digital farming solutions. The company developed innovative agronomic Decision Support Systems (DSS), which is used for crops, such as grapes, tomatoes, cereals, and olives.

- March 2022: Provivi introduced its latest pheromone-based crop protection solutions, named Nelvium, by collaborating with Syngenta Crop Protection, one of the world’s leading agriculture companies, across Indonesia.

REPORT COVERAGE

The report provides qualitative and quantitative insights, market intelligence on this market, and a detailed analysis of the size and growth rate for all possible segments in the market. The report also provides an elaborative research-based analysis of the market dynamics and its competitive landscape. Numerous key insights provided in the report include the overview of related markets, share analysis, recent industry developments such as mergers & acquisitions, supply chain analysis, regulatory scenario in key countries, key industry trends, and market outlook.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 17.87% from 2026 to 2034 |

|

Segmentation |

By Type

By Function

By Application

By Crop Type

Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 5.72 billion in 2025.

Recording a CAGR of 17.87%, the market is expected to register significant growth during the forecast period of 2026-2034.

Based on type, the sex pheromones segment leads the market.

Expanding the selection of integrated pest management practices for sustainable agriculture drives market growth.

Suttera LLC, SEDQ Healthy Crops SL, Provivi, Inc., Isagro S.p.A., and Russell IPM are the key players in the market.

North America held the dominant market with a share of 32.79% in 2025.

The dispenser is the most preferred mode of application and is the leading market segment during the forecast period.

Development of cost-effective agriculture pheromones are the key trends driving market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us