Biopesticides Market Size, Share & Industry Analysis, By Type (Bioinsecticide, Biofungicide, Bionematicide, & Others), By Source (Microbials & Biochemicals), By Mode of Application (Foliar Application, Seed Treatment, Soil Application), By Form ( Liquid & Dry), By Crop (Cereals, Oilseeds, Fruits & Vegetables {Fruits & Vegetables}, Pulses, Fiber Crops, Turf and Ornamentals & Others), By Distribution Channel (Government Procurement / Subsidies, Direct Sales, Retail Stores / Agro-Dealers, Online / E-commerce Platforms & Cooperatives / Farmer Organizations) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

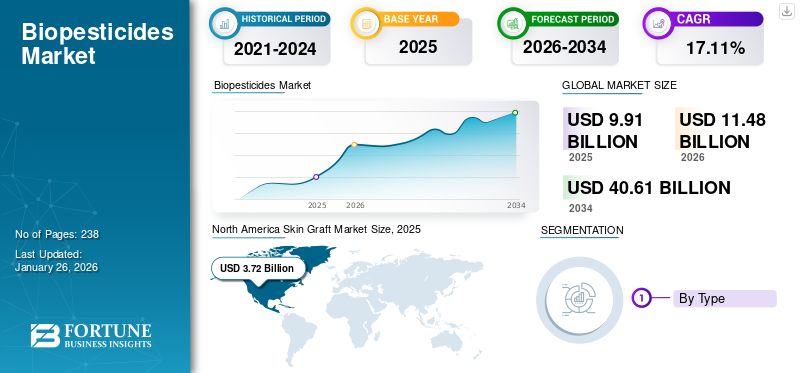

The global biopesticides market size was valued at USD 9.91 billion in 2025. The market is projected to grow from USD 11.48 billion in 2026 to USD 40.61 billion by 2034, exhibiting a CAGR of 17.11% during the forecast period. North America dominated the biopesticides market with a market share of 37.56% in 2025.

Biopesticides are a type of pesticide produced from natural materials such as plants, animals, bacteria, and certain minerals used to control agricultural pests and pathogens. The market is expected to grow significantly in the coming years, fueled by growing awareness about the downsides of conventional pesticides and a surge in demand for sustainable agricultural practices. Moreover, the growing government initiatives to support research and development activities would further fuel the market growth.

Furthermore, the market encompasses several major players including Syngenta AG, Bayer AG, BASF SE, and Bioceres S.A. among others. Diversification of product lines, and expansion of distribution channel have supported the growth of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Ever-rising Demand for Organic Food to Play a Crucial Role in Product Demand

Organic farming is increasingly advocated as an ideal alternative to conventional techniques to reduce the overall impact on the environment. The promising growth trajectory of organic agriculture practices is expected to benefit the future growth of bio-based pesticides with a stronger demand for organic and natural plant protection products. As per data provided by the Economic Research Survey, retail sales of organic food products in the U.S. was USD 65.4 billion in 2024. The strong emphasis of governments and other stakeholders on the organic and sustainable mode of farming has increased the adoption of the product.

MARKET RESTRAINTS

Limited Shelf Life and High Costs Associated with Product May Hamper Market Growth

Although the product is considered to be safer for crops and environment, it has a short or limited shelf life and a high risk of contamination. Moreover, the high maintenance requirements for some products, coupled with their high application costs as opposed to several traditional pesticides, are expected to emerge as significant obstacles to the market growth. Furthermore, the high costs of the product restrict small or marginal farmers from implementing these methods in farming practices. In addition, the application costs of the product are further increased by the additional labor costs required for its application, which is limiting the growth of the market.

MARKET OPPORTUNITIES

Growing Demand for Specialty Crops to Create Opportunity for Market Expansion

Globally, the demand for specialty crops is increasing among consumers. Horticulture crops such as berries, tree fruits, and others are growing in demand among health-conscious consumers. Therefore, to enhance the yield of these crops and protect them from pests, specialized agricultural inputs are required. Such crops are highly susceptible to climate change, and some countries follow strict residue requirements and check imported fruits stringently. Hence, companies have the opportunity to develop products specifically suited for use in such crops.

- According to data provided by the U.S. Department of Agriculture, the U.S. exported USD 13.53 billion of fruits and vegetables in 2024.

BIOPESTICIDES MARKET TRENDS

Rising Government Support and Initiatives to Fuel Market Growth

Governments across the globe are increasingly acknowledging the negative impact of conventional pesticides. Biopesticides, with their natural origins and targeted action, offer a more sustainable alternative aligning with government goals for environmental protection. The product is safer compared to other conventional pesticides, and thus, in many countries, its registration requires less data and time. For instance, in India, the Central Insecticide Control Board and Registration Committee have developed simplified rules for the registration of biopesticides compared to chemical pesticides registrations in order to promote the use of biopesticides products in agriculture.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Nitrogen Fixing Fertilizers to be Sought-after Owing to the Ability to Generate Higher Yield

Based on type, the market is segmented into biofungicide, bioinsecticide, bionematicide, and others.

The bioinsecticides segment is expected to hold a major share of the global market in 2026 with47.39%. As compared to conventional insecticides, new product development and time associated to develop bioinsecticides is less, which provides an economic advantage to the manufacturers. Thus, this benefit coupled with the effectiveness of controlling pests supports the growth of bioinsecticides segment.

To know how our report can help streamline your business, Speak to Analyst

By Source

Microbials Dominates the Segment Owing to High Efficacy in Crop Production

Based on source, the market is segmented into microbials and biochemicals.

The microbial segment is expected to hold a dominating biopesticides market share of 61.67% in 2026. In 2025, the segment is anticipated to dominate with 61.15% share. Microbials have proven their ability to enhance the uptake of nutrients while boosting the development of residential microbiota of plants. Moreover, these pesticides are sustainable, and environmentally friendly alternatives to chemical pesticides.

Biochemicals segment is expected to grow at a CAGR of 15.20% over the forecast period. High production costs makes these product expensive leading to lower acceptance in comparison to microbial products.

By Mode of Application

Foliar Application Segment to Hold Larger Revenue Chunk Due to its Sufficient Potency to Increase Plant Growth and Productivity

Based on mode of application, the market is segmented into foliar application, soil application, seed treatment, and others.

The foliar application segment is expected to secure a larger revenue share in the global market with strong growth projections during the forecast period. The application of the product through this method can result in quick seedling growth after germination. The segment held a share of 81.36% in 2026.

Seed treatment is set to flourish with a growth rate of 16.97% across the forecast period. The product utilized for seed treatment is gaining popularity among cultivators owing to the rising awareness of microbe-based agri-based product treatment for improving the seed quality and reinstating the microbial variety.

To know how our report can help streamline your business, Speak to Analyst

By Crop

Fruits & Vegetables Segment to Exhibit a Majority Share Attributed to Rising Demand for Organic Products

Based on crop, the market is segmented into cereals, oilseeds, fruits & vegetables, and others.

The fruits & vegetables segment is expected to hold a majority share in the global market during the forecast period. The ever-growing popularity of organic products among consumers propels the demand for fruits & vegetables in the market. Moreover, fruits & vegetables are often more susceptible to pest damage compared to other crops, necessitating safe pest controlled solutions. The segment is set to hold 44.58% share in 2025.

In addition, cereals are projected to grow at a CAGR of 17.47% during the study period.

By Form

Liquid Segment to Dominate Due to Easier Applicability

Based on form, the market is segmented into liquid and dry.

The liquid segment is expected to retain its dominance during the forecast period in the market. Liquids can be applied on the fields directly or mixed with other agricultural inputs and then applied on the crops or soil. It can penetrate the soil more easily thus helping easier pest control. Furthermore, the segment is set to hold 55.7% share in 2025.

In addition, dry form is projected to grow at a CAGR of 16.8% during the study period.

By Distribution Channel

Government procurement to Lead Due to Increase in Bulk Purchase

Based on distribution channel, the market is segmented into government procurement / subsidies, direct sales, retail stores / agro-dealers, online / e-commerce platforms and cooperatives / farmer organizations.

The government procurement segment is expected to retain its dominance during the forecast period in the global market. Government is promoting agricultural practices and directly supports its farmers by distributing such products to them at free or at a limited price. It also helps companies to sell its products to the government at bulk volume. This channel is set to hold 27.76% share in 2025.

In addition, direct sales are projected to grow at a CAGR of 16.51% during the study period.

Biopesticides Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, South America, and Middle East & Africa.

North America

North America Skin Graft Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2025 valuing at USD 3.72 billion and also took the leading share in 2026 with USD 4.3 billion revenue share. Consumers in the region are increasingly opting for organic food, seeking healthier options and minimizing their exposure to chemical residues. This trend has been propelling the demand for natural pest control alternatives, fueling the market growth in the region. Tightening rules and regulations regarding the usage of synthetic crop protection chemicals for environmental protection from hazardous implications are also driving the regional market growth. By 2026, the U.S. market is estimated to reach USD 3.61 billion.

- For instance, in May 2025, Super Growers, a U.S. based company, launched Omnicide IPM, a nano-emulsion technology based next generation biopesticide in the market. The product helps in pest, fungal and sport control.

Europe

Europe is anticipated to witness a notable growth in the coming years. The Europe held the dominant share in 2025 valuing at USD 2.69 billion and also took the leading share in 2026 with a revenue of USD 3.11 billion. A huge population of organic food consumers and tightening regulatory restrictions related to the use of synthetic pesticides are some of the major factors boosting the market growth across the region. During the forecast period, European region is projected to record a growth rate of 16.44%, which is the second highest amongst all the regions and touch the valuation of USD 2.69 billion in 2025. Consumption of organic produce is one of the key factor that drives the demand for biopesticides in the region. Backed by these factors, countries including Germany anticipates to record the valuation of USD 0.63 billion in 2026, France to record USD 0.46 billion, and Italy to record USD 0.27 billion in 2025.

Asia Pacific

After Europe, the market in Asia Pacific is estimated to reach USD 2.34 billion in 2026 and secure the position of third-largest region in the market. This regional market growth is expected to be driven by a growing investment by governments and key players in R&D to develop effective and environmentally friendly pesticides that can help increase yields and improve resilience. Across this region, China and Japan are estimated to reach USD 1.28 billion and USD 0.18 billion respectively in 2026.

South America and Middle East & Africa

Over the forecast period, South America and Middle East & Africa regions would witness a moderate growth in the marketspace. South America market in 2025 is set to record USD 1.35 billion as its valuation. Lack of technical expertise and limited availability of the product are major restraints hindering the biopesticides market growth in the region. In Middle East & Africa, Israel is set to grow at a CAGR of 16.24% during the forecast period.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies Focus on Merger and Acquisitions and Collaboration to Compete at a Global Level

Biopesticide products are essential components in modern integrated pest management concepts to achieve the required level of crop protection from pests and diseases without causing damage to the environment and human health. The increasing demand for these products is gravitating key market players to diversify their product portfolio and distribution network to increase market reach and consumer base. Moreover, mergers, acquisitions and collaboration are the key strategies adopted by companies including Marrone Bio Innovations to compete in the global market.

LIST OF KEY BIOPESTICIDES COMPANIES PROFILED

- BASF SE (Germany)

- Syngenta AG (Switzerland)

- Bayer AG (Germany)

- Bioceres S.A. (Argentina)

- Novozymes (Denmark)

- Koppert Biological Systems (Netherlands)

- Floridienne SA (Belgium)

- Gowan Group (Ireland)

- Sumitomo Chemical Co., Ltd. (Japan)

- Certis USA LLC. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Sumitomo Chemical launched new biopesticide named Sumifly in the European market. The product is composed of spores of entomopathogenic fungus Isaria fumosorosea which is effective against various whiteflies and thrips at all life stages.

- June 2025: ICAR-Indian Institute of Spices Research (ICAR-IISR) announced the commercial rollout of new biopesticide product which helps to manage pest in cardamom. The product is manufactured using naturally occurring fungus Lecanicillium psalliotae.

- August 2024: BioConsortia launched new biofungicide/bactericide named Amara which received registration from the Environmental Protection Agency (EPA). This product is suitable for high value fruit and vegetables.

- January 2024: UPL Limited, an Indian multinational company, launched a bioinsecticide, Tackler. The new product helps control pests in various crops and is made from the fungus Beauveria bassiana.

- January 2024: Simbiose, a Brazilian company, announced the launch of fungicide Frontier Control (Bacillus velezensis). The new product is a microbiological fungicide with a concentrated suspension (S.C.) formulation and is used for ground application.

- October 2023: Vestaron Corporation, a U.S.-based bioinsecticides company, raised USD 10 million in funding for new biopesticide R&D plans.

- September 2023: Croda International plc., a British speciality chemicals company, launched a new biopesticide, Atlox BS-50. The new product is a ready-to-use powder for spore-forming microbes and meets the demand for biopesticides.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17.11% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Biofungicides · Bioinsecticides · Bionematicides · Others |

|

By Source · Microbials · Biochemicals |

|

|

By Mode of Application · Foliar Application · Soil Application · Seed Treatment · Others |

|

|

By Form · Liquid · Dry |

|

|

By Crop Type · Cereals · Oilseeds · Fruits & Vegetables o Fruits o Vegetables · Pulses · Fiber Crops · Turf and Ornamental · Others |

|

|

By Distribution Channel · Government Procurement / Subsidies · Direct Sales · Retail Stores / Agro-Dealers · Online / E-commerce Platforms · Cooperatives / Farmer Organizations |

|

|

By Geography · North America (By Type, Source, Mode of Application, Crop Type, Form, Distribution Channel, and Country) o U.S. (By Mode of Application ) o Canada (By Mode of Application ) o Mexico (By Mode of Application ) · Europe (By Type, Source, Mode of Application, Crop Type, Form, Distribution Channel, and Country/Sub-region) o Germany (By Mode of Application ) o U.K. (By Mode of Application) o France (By Mode of Application ) o Spain (By Mode of Application) o Italy (By Mode of Application ) o Russia (By Mode of Application ) o Rest of Europe (By Mode of Application ) · Asia Pacific (By Type, Source, Mode of Application, Crop Type, Form, Distribution Channel, and Country/Sub-region) o China (By Mode of Application ) o Japan (By Mode of Application ) o India (By Mode of Application ) o Australia (By Mode of Application ) o Rest of Asia Pacific (By Mode of Application ) · South America (By Type, Source, Mode of Application, Crop Type, Form, Distribution Channel , and Country/Sub-region) o Brazil (By Mode of Application ) o Argentina (By Mode of Application ) o Rest of Latin America (By Mode of Application ) · Middle East & Africa (By Type, Source, Mode of Application, Crop Type, Form, Distribution Channel, and Country/Sub-region) o Israel (By Mode of Application ) o South Africa (By Mode of Application ) · Rest of the Middle East & Africa (By Mode of Application ) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 9.91 billion in 2025 and is projected to reach USD 40.61 billion by 2034.

In 2025, the market value stood at USD 3.72 billion.

The market is expected to exhibit a CAGR of 17.11% during the forecast period of 2026-2034.

Bioinsecticides is expected to be the leading type in the market during the forecast period.

The intensifying demand for organic food is predicted to drive the growth of the global market.

Syngenta AG, Bayer AG, BASF SE, and Bioceres S.A. are some of the top players in the market.

North America dominated the biopesticides market with a market share of 37.56% in 2025.

The rising government support and initiatives is an emerging trend in the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us